Hello and happy Friday!

Markets delivered a sobering lesson this week that correlation converges to one when true risk-off conditions emerge.

This week's report dissects the breakdown with 14 detailed charts covering collapsing ETF flows, cleared liquidation clusters, and the simultaneous failure of crypto, tech stocks, and traditional hedges.

The crypto section breaks down Bitcoin, Ethereum, and Solana, delivering long and short trading setups, with exact entry points, targets, and invalidation zones, to help you navigate this market environment with confidence.

Here's what we'll cover today:

🌍 Market Recap & Macro Overview: Why did Bitcoin fall hardest when investors needed safety most? And what does a "bear steepening" bond market mean for every risk asset you own?

📈 Bitcoin (BTC) Breakdown: Where does $57B in vanished ETF capital go next? Plus: the liquidation clusters that reveal Bitcoin's most likely path forward.

📊 Ethereum (ETH) Outlook: Is the BTC pair signaling capitulation or consolidation? What the leverage map down to $1,230 tells us about downside risk.

🚀 Solana (SOL) Analysis: Can SOL hold critical support after erasing all 2025 gains? The answer lies in two key levels and what happened at $67.

Let's dive in 👇

🌍 Market Recap & Macro Overview:

Bitcoin has collapsed nearly 50% from its October peak, briefly touching $60,000 this morning after falling below $70,000 for the first time in 15 months. This wipes out the entire post-election rally and marks Bitcoin's steepest decline since the 2021 bear market correction. The selloff destroys the narrative that Bitcoin serves as "digital gold“, instead, it's trading in lockstep with US software stocks, showing a 0.73 correlation with the iShares Expanded Tech Software ETF, falling hardest precisely when investors need safety most.

Bitcoin Is Down Almost 50% From Its Peak (Source: Bloomberg)

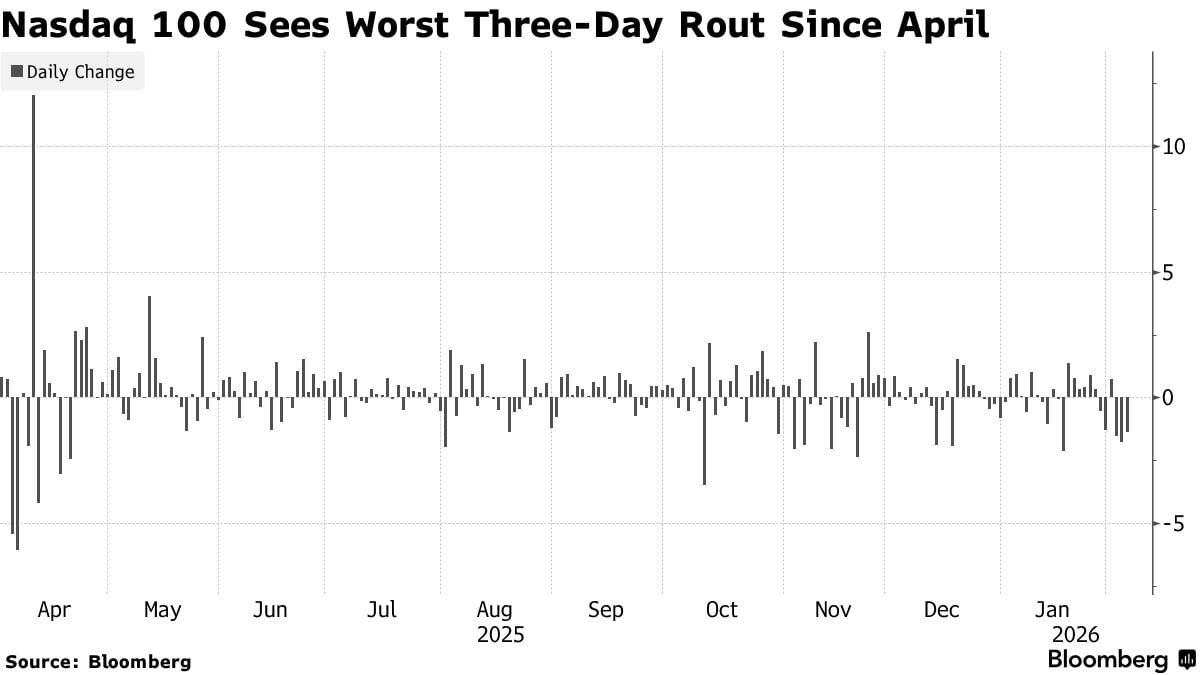

The pain extends across risk assets, with the Nasdaq 100 posting its worst three-day decline since April. Tech stocks are cratering on dual fears: AI displacement of traditional software businesses and weakening economic data. The selloff's breadth is what matters most, this isn't sector rotation, it's a broad reassessment of growth stock valuations as the multi-year tech rally shows signs of exhaustion.

Nasdaq 100 Sees Worst Three-Day Rout Since April (Source: Bloomberg)

Get the Edge Most Retail Traders Don’t Have

Become a paying subscriber of Sandman Research to get this post and all subscriber-only insights, trade setups, and macro intelligence used by top crypto traders.

Upgrade Now → Get Full AccessA subscription gets you:

- Clear Trade Setups for BTC & Altcoins: Step-by-step guidance with entry, stop, and take-profit levels so you can act confidently during market swings.

- Macro & Market Intelligence: Understand which macro events and liquidity shifts are moving crypto, so you’re never caught off guard by volatility.

- Exclusive ETF & On-Chain Flow Analysis: See capital movements and liquidation clusters before the crowd, giving you an edge in timing entries and exits.

- Altcoin & Sector Insights: Identify early rotation opportunities in high-potential sectors like AI-focused altcoins, without wasting time on dead projects.

- Actionable, Risk-Aware Playbooks: Convert research into actual trades with structured setups, technical breakdowns, and scenario-based strategies.