Hello and happy Monday!

Markets closed last week at a pivotal crossroads. Inflation cooled, bond yields dropped to multi-year lows, and rate-cut expectations accelerated, but equities struggled to rally, and crypto sentiment deteriorated further into capitulation territory.

Why are equities failing to respond to disinflation? And what does deepening fear mean for Bitcoin and altcoins? This report breaks it all down with 11 key charts, actionable trade setups, and the scenarios most likely to shape market direction in the days ahead.

Here’s what we’ll cover today:

📈 Market Review: CPI surprises to the downside, collapsing yields, shifting Fed-cut expectations, AI capex anxiety in equities, and Bitcoin’s fragile CPI-driven rally.

🔍 Current Market Conditions: Crypto sentiment sinks deeper into extreme fear as ETF flows stall. Is this capitulation or another leg lower in disguise?

👀 Key Events Ahead: Durable Goods, Fed Minutes, PCE inflation, heavy Fed speaker risk, and major earnings, why Friday’s PCE print could define the macro narrative into March.

📊 Technical Analysis: Bitcoin’s key $65,500–$72,000 range, expanding liquidation clusters from $44K to $120K, and clearly defined bullish and bearish scenarios.

🚀 Altcoin Insights: TOTAL3 stuck in a tight range, ETH/BTC prints fresh lows, and why capital continues rotating into Bitcoin instead of the broader altcoin market.

Let’s dive in 👇

Stop overpaying to swap crypto.

The exchange you're using? Probably charging you more than you need to pay.

CoW Swap compares prices across every major exchange in real time. Gets you the best deal automatically. You just swap like normal.

No extra work. Better prices.

📈 Market Review:

Friday's CPI print was the week's defining moment, headline inflation came in at 2.4%, below expectations, and the bond market moved fast. The 2-year Treasury yield dropped to its lowest level since 2022, continuing a multi-year decline from the 5%-plus peaks of 2023 and 2024. The message from fixed income is clear: the tightening cycle is firmly in the rearview mirror.

Treasury Two-Year Yield Hits Lowest Since 2022 on CPI (Source: Bloomberg)

Rate-cut pricing shifted accordingly, with traders now putting real odds on a first Fed cut in June, a scenario that seemed premature just weeks ago. Markets are pricing more than one full cut by July 2026, and each soft inflation print has pulled that timeline forward. The Fed may end up behind the curve on easing just as it once was on tightening.

June Rate Cut Back in Play (Source: Bloomberg)

Equities didn't share the enthusiasm. The S&P 500 fell for a second straight week, closing at 6,836, roughly 2% off its all-time high, as AI spending anxiety overshadowed the macro relief. Alphabet's $185 billion capex announcement for 2026 spooked investors rather than impressing them, and the index remains unable to hold above 7,000. Good inflation data isn't enough while the market is rethinking the AI investment thesis.

Stocks Fall for Second Week (Source: Bloomberg)

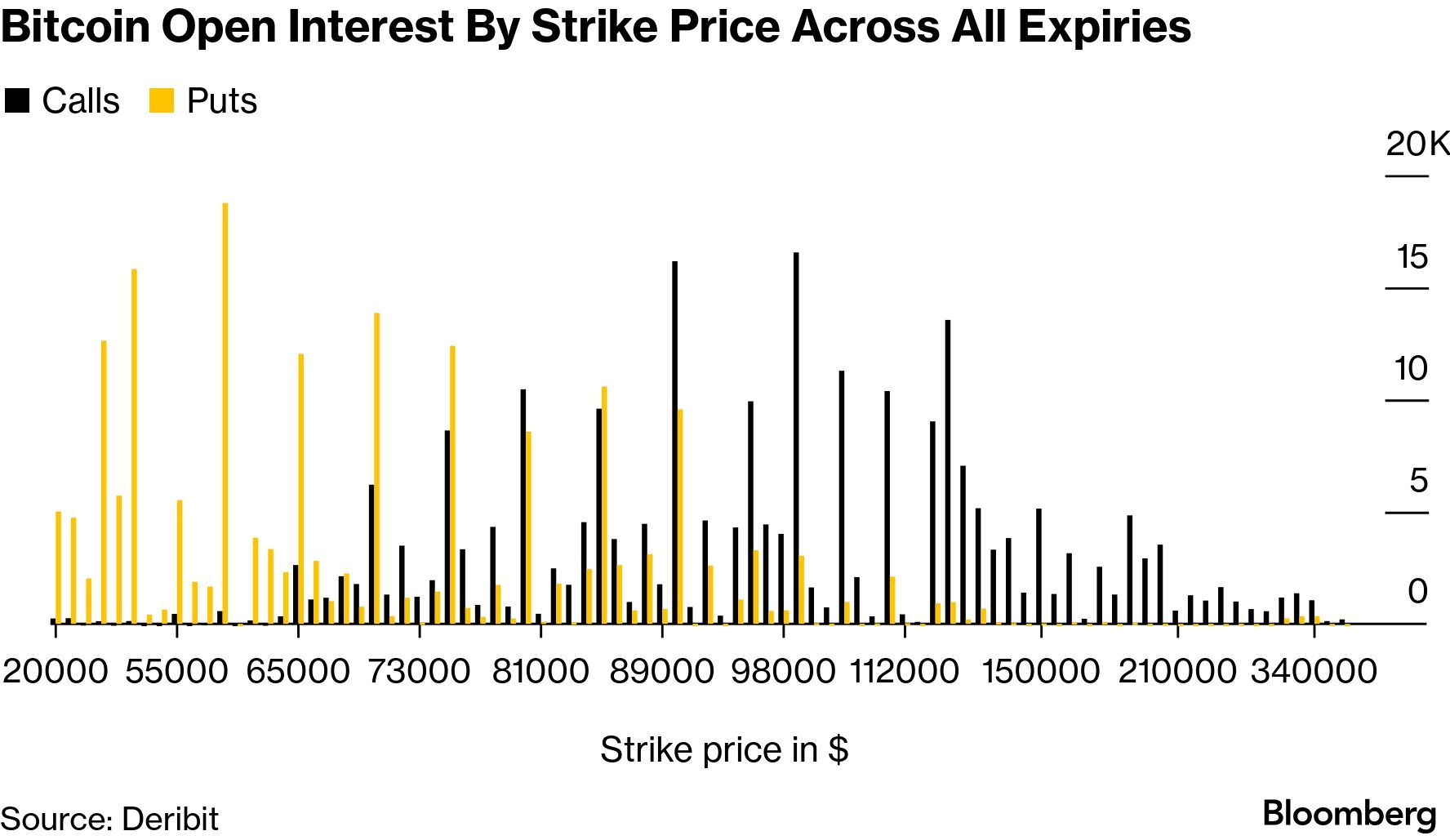

Bitcoin’s options positioning is telling. Heavy put concentration at lower strikes reflects hedging from trapped holders, while significant call open interest clusters around $89,000–$98,000 suggest many are still positioned for a recovery. Friday's CPI rally helped it reclaim $70,000 briefly before it gave up the gains, a reminder that rate sensitivity cuts both ways, and that without a sustained shift in macro momentum, relief rallies remain fragile.

Bitcoin Open Interest By Strike Price Across All Expiries (Source: Bloomberg)

The macro backdrop is turning more supportive across the board, but equities face a growth narrative headwind that softer inflation alone can't fix. Watch the June Fed meeting, it's becoming the most important date on the calendar.

You're overpaying for crypto.

Every exchange has different prices for the same crypto. Most people stick with one and pay whatever it costs.

CoW Swap checks them all automatically. Finds the best price. Executes your trade. Takes 30 seconds.

Stop leaving money on the table.

🔍 Current Market Conditions:

Bitcoin sentiment has deteriorated further since last week, with the Crypto Fear & Greed Index sliding from 13 to 9, deepening into extreme fear territory and signaling that capitulation psychology is intensifying rather than finding a bottom. The modest stabilization many had hoped for simply has not materialized, and at these sentiment levels, the market remains highly susceptible to further downside on any negative catalyst.

Crypto Fear and Greed Index (Source: Coinglass)

ETF flows told a similar story. Monday and Tuesday saw inflows, but Wednesday and Thursday both flipped back to outflows, and Friday's positive reading was a negligible $15 million, a stark contrast to the $330 million in dip-buying recorded the prior Friday. With US spot Bitcoin ETFs collectively holding $93 billion in AUM, even modest net outflows carry real weight as a signal of where large allocators stand.

Bitcoin ETF Net Flow (Source: CoinMarketCap)

The takeaway is straightforward: sentiment is pressing toward historically extreme lows, ETF momentum has stalled, and there is no sustained streak of inflows to suggest institutional conviction is returning. Until the Fear & Greed Index stabilizes and ETF flows turn consistently positive, the path of least resistance remains downward.

Stop overpaying to swap crypto.

The exchange you're using? Probably charging you more than you need to pay.

CoW Swap compares prices across every major exchange in real time. Gets you the best deal automatically. You just swap like normal.

No extra work. Better prices.

👀 Key Events Ahead:

With US markets closed Monday for Presidents' Day, attention turns quickly to Wednesday, where two important releases land in tandem. December Durable Goods Orders will offer a read on business investment and industrial demand, while the Fed Meeting Minutes will reveal how policymakers were thinking about inflation and rate cuts heading into this year, particularly relevant given the mixed signals from recent CPI and jobs data.

United States Core PCE Price Index YoY (Source: US Bureau of Economic Analysis)

Friday is the week's main event. December PCE inflation, the Fed's preferred inflation gauge, will either reinforce or complicate the disinflationary narrative that markets have been banking on. A cooler reading would support the case for rate cuts in the second half of the year and provide a potential tailwind for both equities and crypto. A hotter print would do the opposite, pushing rate-cut expectations further out and adding pressure to already fragile risk sentiment.

Layered on top of all this, ten Fed speaker events are scheduled throughout the week alongside earnings from roughly 15% of S&P 500 companies, a combination that virtually guarantees headline risk on multiple fronts. With sentiment already stretched and markets navigating AI volatility, crypto weakness, and Japan's bond market in recovery mode, the bar for a clean week is low. PCE on Friday is the number to watch, it will set the tone heading into March.

🚨 Every week, we produce multiple in-depth reports, our Monday Market Report is the only free piece.

Upgrade to Full Research Access and get:

Complete market coverage across crypto, equities, and macro trends

Deep-dive analysis with 26+ extra charts each week

Long & short trading setups for Bitcoin and select altcoins

Exclusive insights trusted by top investors

Make smarter trades, optimize your portfolio, and grow and protect your capital. Upgrade today, your future self will thank you.

📊 Technical Analysis:

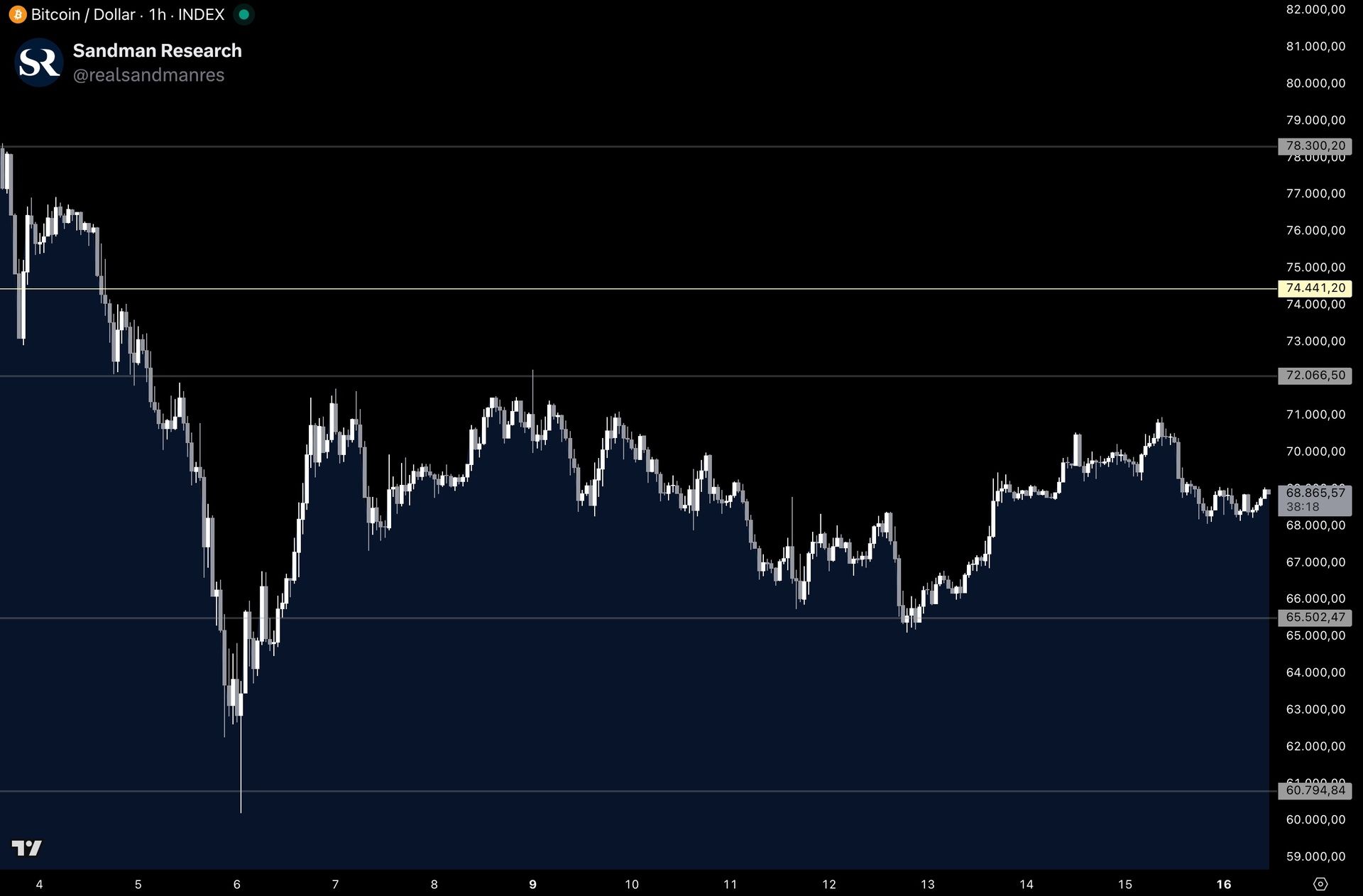

Bitcoin bounced off the $65,500 technical level on Thursday and rallied as high as $70,900 over the weekend before pulling back, and is currently trading at $68,900, squarely between the two key levels of $65,500 to the downside and $72,000 to the upside, with no clear directional bias yet.

Bitcoin Price Chart (Source: Tradingview)

The three-month liquidation heatmap reinforces this picture. Downside liquidation clusters are building below the recent $60,000 lows and extend all the way to $44,000, meaning a breakdown could accelerate quickly as leveraged longs get flushed. To the upside, the most significant liquidity sits above the January highs at $100,000, spreading to $120,000 with a major concentration at $109,700, a level that would act as a magnet if bullish momentum returns.

Bitcoin Liquidation Heatmap (Source: Coinglass)

Bullish Scenario: Bitcoin holds $65,500, and long setups become attractive on a successful bullish retest of that level, targeting $72,000, with invalidation on a loss of $65,500. A clean reclaim of $72,000 opens additional long opportunities on a bullish retest, targeting $74,400 and $78,300.

Bearish Scenario: Bitcoin fails to reclaim $72,000 and faces rejection there. Short setups may form on a confirmed bearish retest, targeting $65,500, with invalidation on a reclaim of that level. A break below $65,500 opens further downside, with additional short opportunities targeting $60,700 and $58,300 on a bearish retest, invalidated on a reclaim of the broken level.

🚀 Altcoin Insights:

TOTAL3 traded higher over the weekend, after bouncing off the 695B technical level on Friday, the metric climbed higher to 740B where it faced rejection on Sunday morning. From there, it headed lower again and is currently sitting right inbetween the two major levels of 743B on the upside acting as resistance, and 695B on the downside acting as support.

TOTAL3 (Source: Tradingview)

ETH/BTC also showed notable developments, as it formed a fresh lower low within the current bearish trend by extending lower on late Sunday by falling to 0.02827 after facing clear rejection at the 0.0299 technical level under which it has been trading for the past weeks. Ethereum continues underperforming Bitcoin without a notable shift in relative strength.

Ethereum / Bitcoin (Source: Tradingview)

Investor Implications: The altcoin market remains in a fragile, range-bound state with no clear directional conviction, TOTAL3 is pinned between 695B and 743B, and until one of those levels breaks decisively, the path of least resistance is sideways. ETH/BTC compounds the caution, printing fresh lower lows and facing clear rejection at 0.0299, confirming that capital within crypto continues rotating toward Bitcoin rather than spreading into the broader ecosystem. Until TOTAL3 clears 743B and ETH/BTC shows genuine signs of stabilization, investors are best served staying selective and avoiding the temptation to chase altcoin bounces within what remains a bearish trend structure.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.