Smart starts here.

You don't have to read everything — just the right thing. 1440's daily newsletter distills the day's biggest stories from 100+ sources into one quick, 5-minute read. It's the fastest way to stay sharp, sound informed, and actually understand what's happening in the world. Join 4.5 million readers who start their day the smart way.

Hello and happy Friday!

Crypto hedge funds are hoarding cash, equities are stuck in a tight range, and macro liquidity signals are quietly tightening. When institutional investors build dry powder like this, it rarely lasts long, either a sharp rally or another leg lower usually follows.

This week’s report breaks down the growing hesitation with 14 detailed charts covering crypto fund cash balances, the dollar rebound, equity range dynamics, and Japan’s bond market signal. The crypto section dissects Bitcoin, Ethereum, and Solana, delivering long and short trading setups with precise entry points, targets, and invalidation zones.

Here’s what we’ll cover today:

🌍 Market Recap & Macro Overview: Why crypto funds are hoarding cash, what US data means for rate cuts, how Japan’s bond market could impact global liquidity, and why equities remain stuck.

📈 Bitcoin (BTC) Breakdown: What persistent ETF outflows, rangebound price action, and liquidation clusters mean for BTC’s next move, and why $65,500 remains the key battleground.

📊 Ethereum (ETH) Outlook: Is ETH consolidating or preparing for another leg lower? What ETF flows, the BTC pair, and leverage maps signal about risk and opportunity.

🚀 Solana (SOL) Analysis: Can SOL defend $78 and reverse its downtrend, or does a breakdown open the path toward $66? The critical levels and scenarios to watch next.

Let’s dive in 👇

If You Could Be Earlier Than 85% of the Market?

Most read the move after it runs. The top 250K start before the bell.

Elite Trade Club turns noise into a five-minute plan—what’s moving, why it matters, and the stocks to watch now. Miss it and you chase.

Catch it and you decide.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

🌍 Market Recap & Macro Overview:

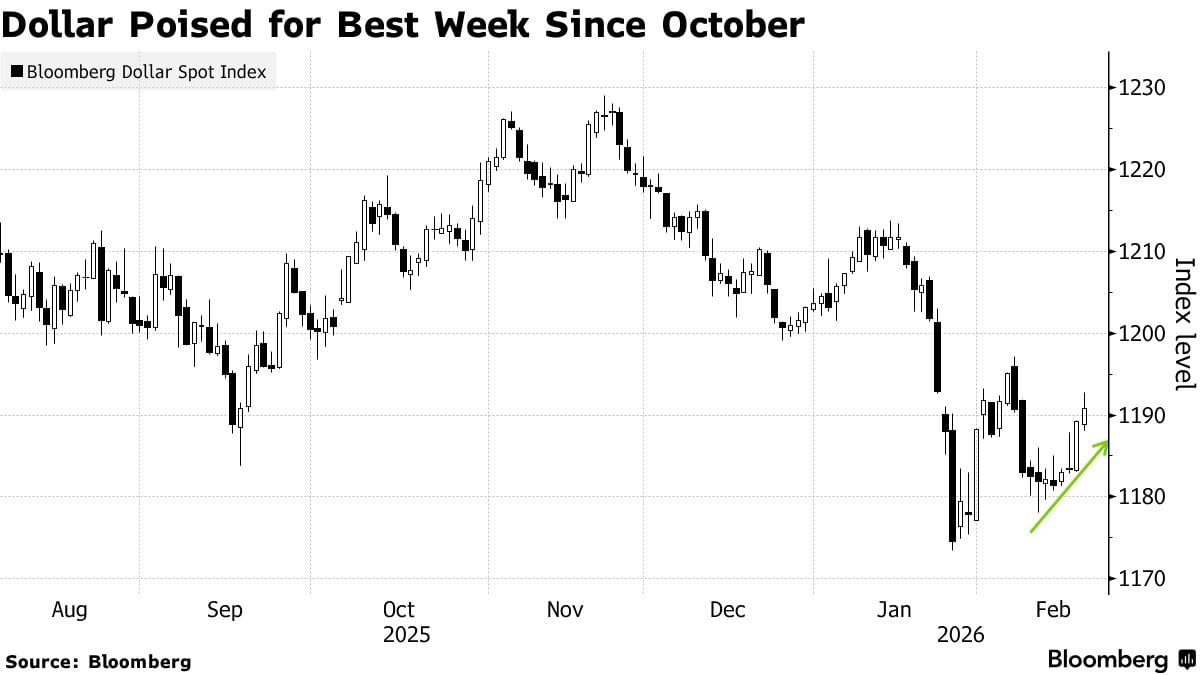

The dollar is closing out its best week since October, with the Bloomberg Dollar Spot Index bouncing sharply off recent lows near 1,180. Stronger-than-expected US economic data, including a surge in industrial production and a surprise drop in jobless claims, reminded markets that the Fed has little reason to rush rate cuts. The stronger dollar continues tightening financial conditions globally, creating headwinds for commodities, emerging markets, and risk assets broadly.

Dollar Poised for Best Week Since October (Source: Bloomberg)

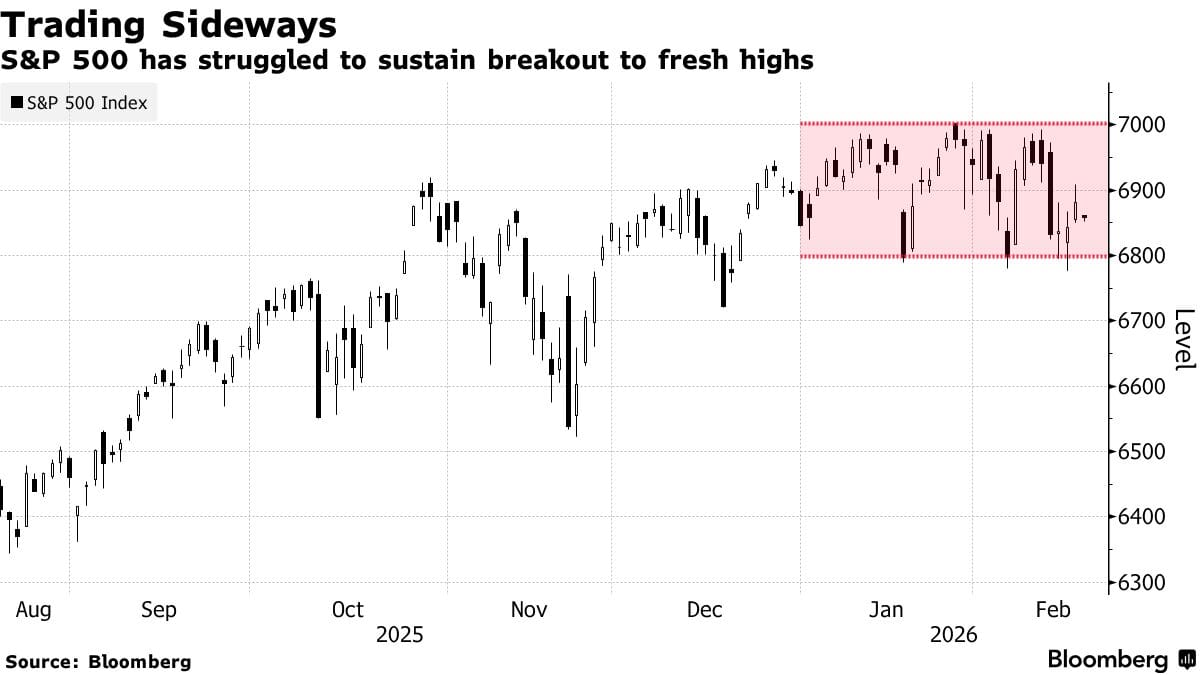

That caution is clearly visible in US equities, where the S&P 500 has spent the last six weeks trapped between 6,800 and 7,000, unable to hold a breakout above the key psychological level. Sellers keep showing up near the top of the range, and buyers keep defending the bottom, a standoff that reflects genuine uncertainty about valuations and Fed policy. Until one side blinks, this sideways grind is the path of least resistance.

Trading Sideways (Source: Bloomberg)

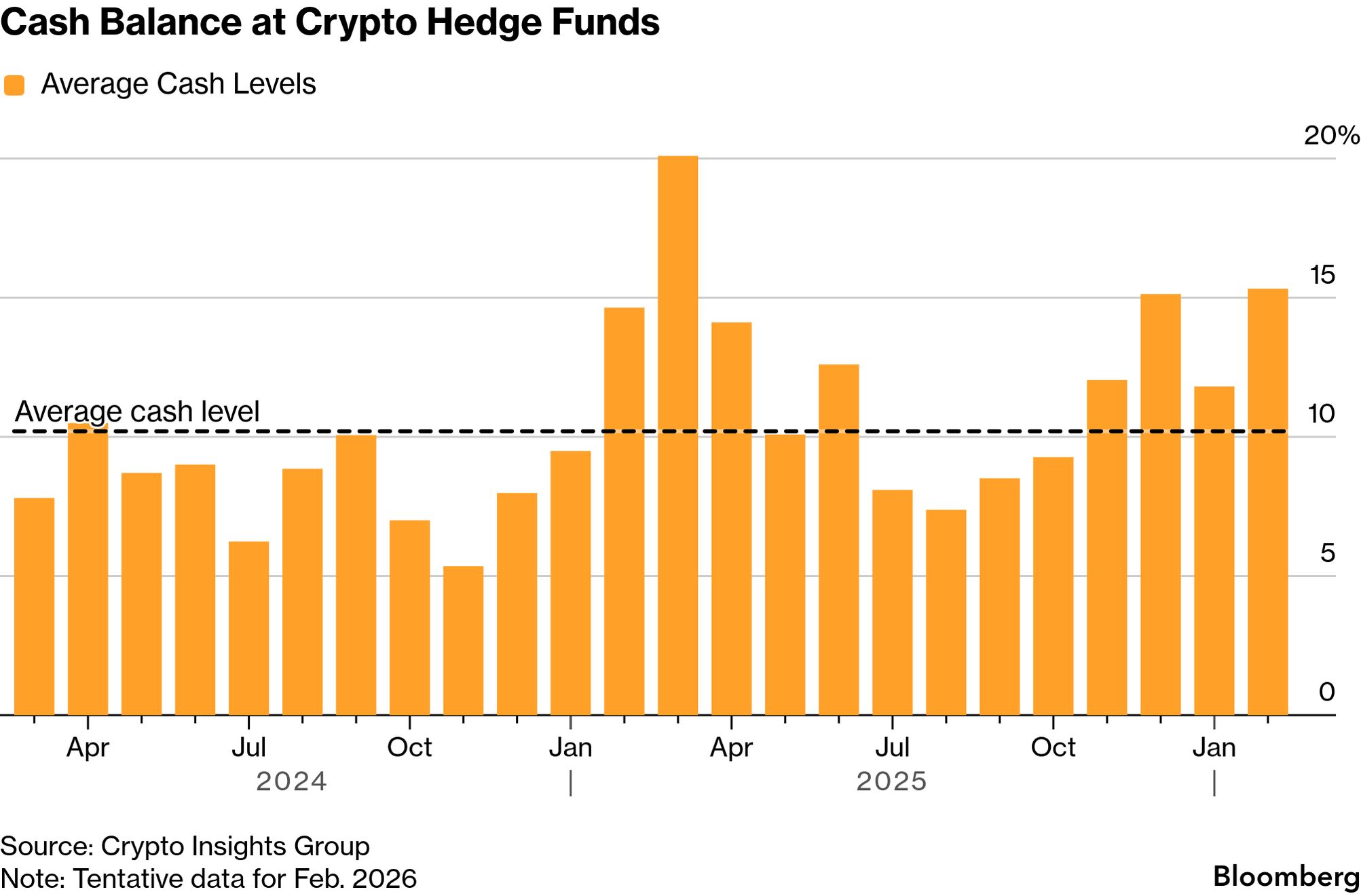

Crypto hedge funds are sending a similar message. Their average cash balances have climbed back to roughly 14–15%, well above the long-run average of 10%, meaning institutional players in digital assets are sitting on dry powder rather than deploying it. History suggests these elevated cash levels resolve one of two ways: either a catalyst arrives, funds deploy aggressively, and prices rally sharply, or the caution proves prescient and prices drift lower first. Either way, it signals the smart money isn't convinced this is the time to buy.

Cash Balance at Crypto Hedge Funds (Source: Bloomberg)

Meanwhile, Japan's bond market is sending a signal worth paying attention to. The spread between 5-year and 30-year Japanese government bond yields has collapsed to around 160 basis points, as the Bank of Japan presses ahead with rate normalization, a largely healthy development after decades of near-zero rates. The risk, however, lies in the side effects: rising short-term Japanese yields erode the profitability of the yen carry trade, and when that trade unwinds it can hit global equities and FX markets hard and fast, as investors got a sharp reminder in August 2024.

Japan’s 5/30-Year Yield Curve Flattens (Source: Bloomberg)

The big picture this week is one of coordinated hesitation. A dollar catching a bid, stocks unable to break higher, crypto funds hoarding cash, and Japan's bond market quietly tightening global liquidity. The common thread is a world still waiting for clarity on where rates are headed, and until that clarity arrives, the path for risk assets remains narrow.

The decision is yours

Confusing, jargon-packed, and time-consuming. Or quick, direct, and actually enjoyable.

Easy choice.

There’s a reason over 4 million professionals read Morning Brew instead of traditional business media. The facts hit harder, it’s built to be skimmed, and for once, business news is something you actually look forward to reading.

Try Morning Brew’s newsletter for free and realize just how good business news can be.

📈 Bitcoin (BTC) Breakdown:

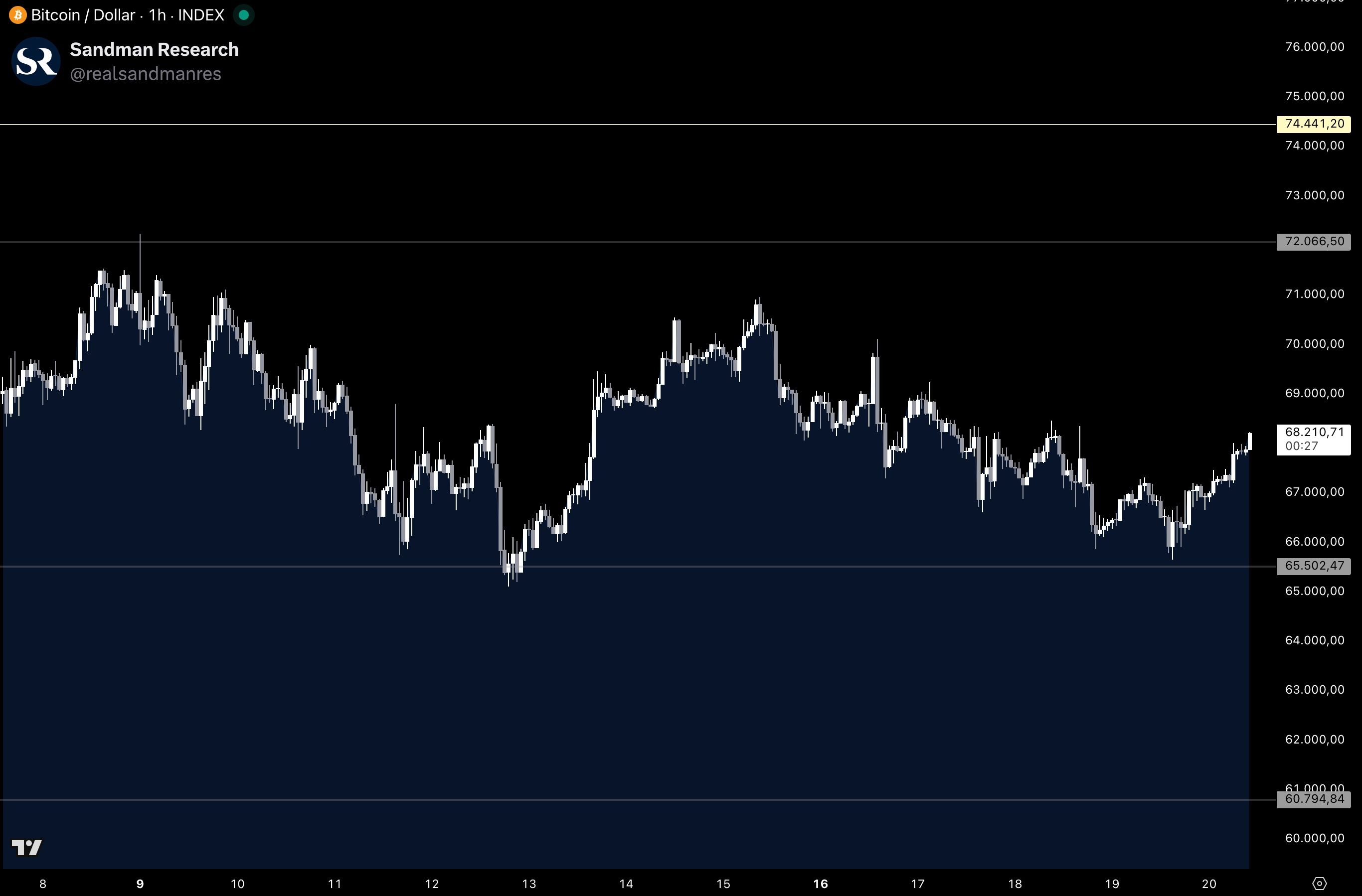

Bitcoin trended lower throughout the week, forming lower highs and lower lows until finding support at our technical level of $65,500 on Thursday, before bouncing back to $68,100. BTC remains rangebound between $65,500 and $72,000.

Bitcoin Price Chart (Source: Tradingview)

Get the Edge Most Retail Traders Don’t Have

Become a paying subscriber of Sandman Research to get this post and all subscriber-only insights, trade setups, and macro intelligence used by top crypto traders.

Upgrade Now → Get Full AccessA subscription gets you:

- Clear Trade Setups for BTC & Altcoins: Step-by-step guidance with entry, stop, and take-profit levels so you can act confidently during market swings.

- Macro & Market Intelligence: Understand which macro events and liquidity shifts are moving crypto, so you’re never caught off guard by volatility.

- Exclusive ETF & On-Chain Flow Analysis: See capital movements and liquidation clusters before the crowd, giving you an edge in timing entries and exits.

- Altcoin & Sector Insights: Identify early rotation opportunities in high-potential sectors like AI-focused altcoins, without wasting time on dead projects.

- Actionable, Risk-Aware Playbooks: Convert research into actual trades with structured setups, technical breakdowns, and scenario-based strategies.