Stop overpaying to swap crypto.

The exchange you're using? Probably charging you more than you need to pay.

CoW Swap compares prices across every major exchange in real time. Gets you the best deal automatically. You just swap like normal.

No extra work. Better prices.

Hello and happy Wednesday!

The U.S. dollar is staging a comeback, and that shift is rippling across global markets. A stronger dollar is already weighing on equities and crypto, tightening financial conditions and reinforcing a broader risk-off regime driven by persistent policy uncertainty and growth concerns.

Inside today’s report, we break down the key macro, crypto, and relative strength signals defining market structure right now. You’ll find 12 charts including Bitcoin long and short trading setups, plus a special coin of the week with actionable trades and risk guidance.

Here’s what’s in today’s report:

📅 Macro Review: A deep dive into the dollar’s rebound, policy-driven equity underperformance, and why tightening financial conditions are pressuring risk assets across the board.

📊 Crypto Market Overview: Clear technical analysis of Bitcoin, TOTAL3, and OTHERS, with defined bullish and bearish scenarios as price trades near key support and resistance levels.

🔍 Bitcoin vs. Altcoins: An assessment of Bitcoin and OTHERS dominance and what current capital flow dynamics reveal about relative strength across crypto.

📈 Key Reversal Signals: A focused look at OTHERS/BTC and ETH/BTC, highlighting the exact levels that would confirm either improving altcoin breadth or renewed underperformance.

🚀 Chart of the Week: A tactical technical breakdown of ???, outlining precise long and short scenarios, key levels, and risk management considerations within a still-challenging altcoin environment.

Let’s dive in 👇

Stop overpaying to swap crypto.

The exchange you're using? Probably charging you more than you need to pay.

CoW Swap compares prices across every major exchange in real time. Gets you the best deal automatically. You just swap like normal.

No extra work. Better prices.

📅 Macro Review:

The U.S. dollar staged a comeback. After sliding sharply from around 1,220 to 1,180 on the Bloomberg Dollar Spot Index, pressured by tariff uncertainty and slowing growth fears, options markets are now betting the rebound has legs, with one-week risk reversals flipping in favor of dollar strength. A rising dollar historically acts as a brake on risk assets, tightening financial conditions globally and making alternatives like equities and crypto even less attractive.

Options Pricing Points to Dollar Extending Rebound (Source: Bloomberg)

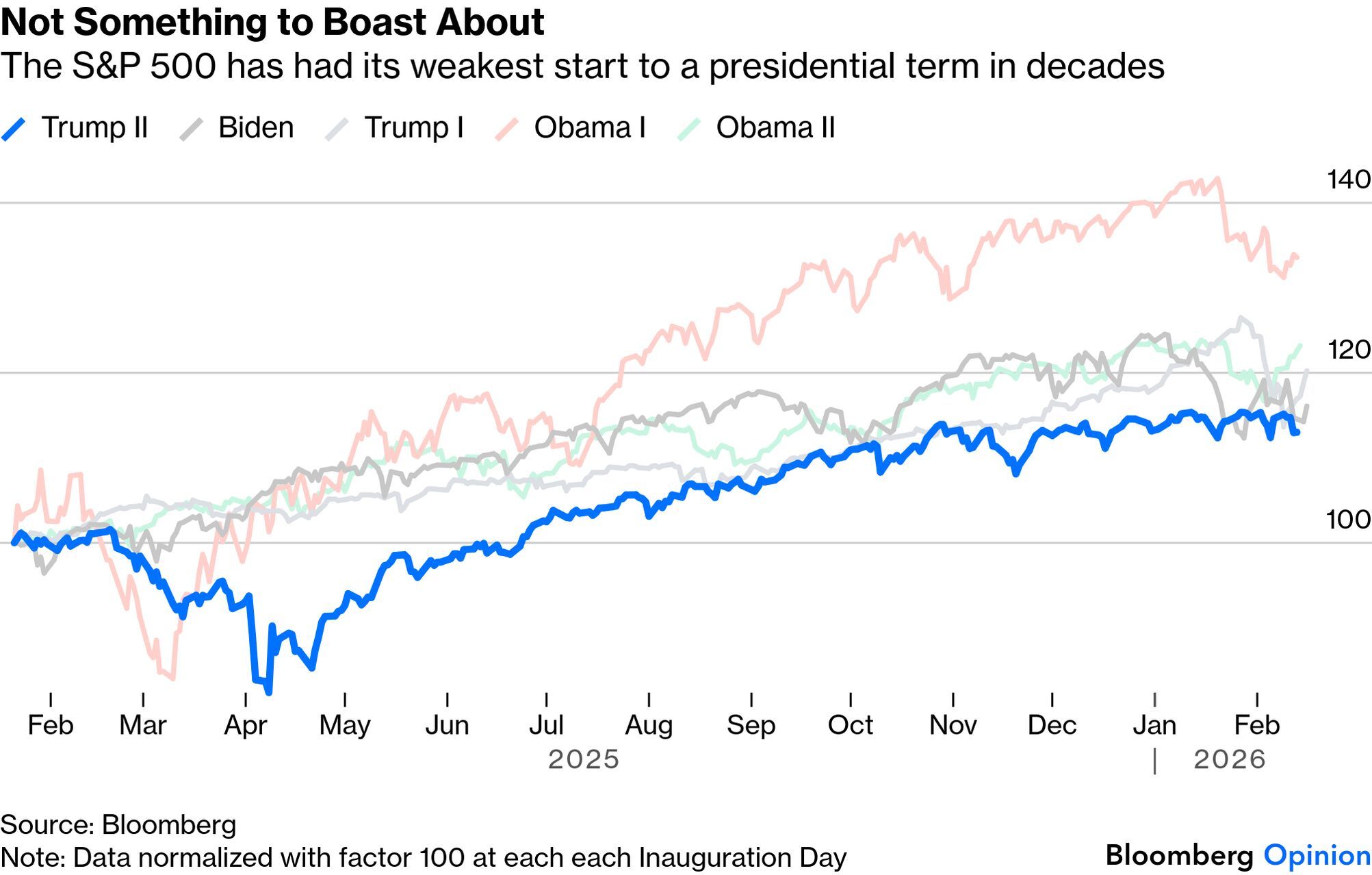

That pressure is already showing up in stocks. The S&P 500 has had its weakest start to a presidential term in decades, trailing every comparable period shown, Biden, Trump I, and both Obama terms, by a wide margin. The culprit is familiar: persistent tariff uncertainty and a policy environment that has made it difficult for markets to price in a clear growth trajectory, reminding investors that political risk has a very real cost.

Not Something to Boast About (Source: Bloomberg)

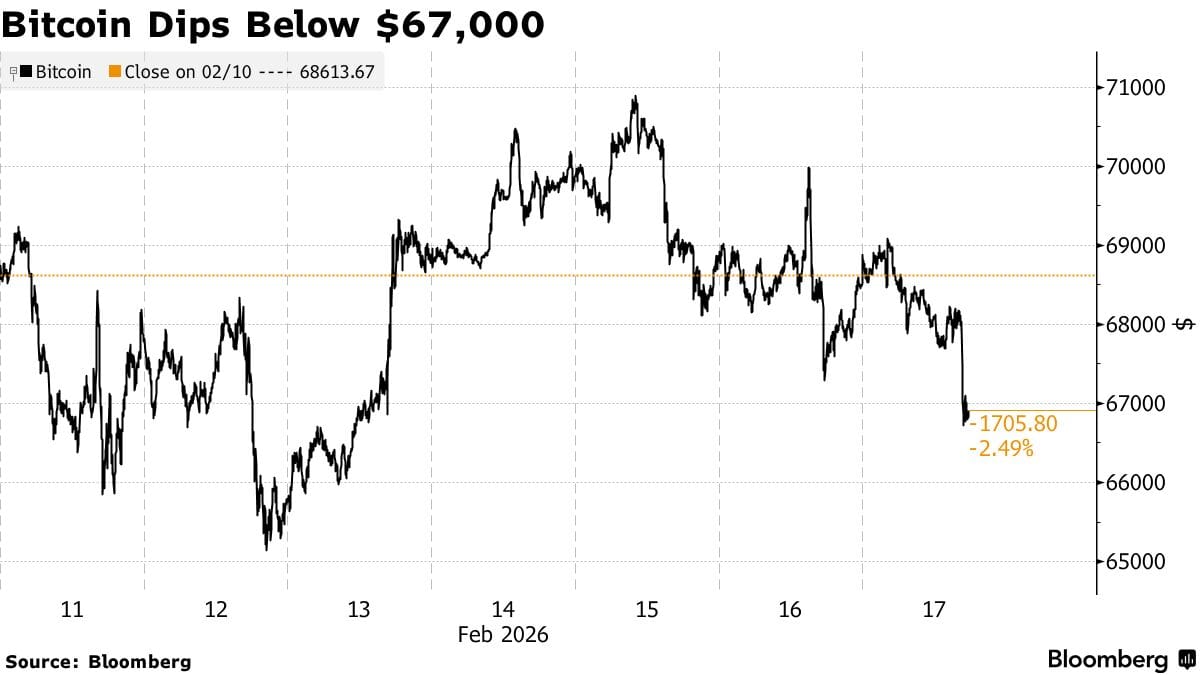

Nowhere is that cost more visible than in Bitcoin, which slipped below $67,000 on Tuesday. What makes the move notable is its institutional dimension, ETF flows, which were strongly positive this time last year, have turned negative, signaling that large players are continuously stepping back rather than buying the dip.

Bitcoin Dips Below $67,000 (Source: Bloomberg)

Pulling back further, Bitcoin has now logged four consecutive weekly losses, a sustained streak that points to something more than routine consolidation. The coin has broken below its 200-week moving average for the first time since early 2022, and each attempted bounce has so far been met with fresh selling, a pattern that suggests the market structure has genuinely shifted.

Bitcoin Posts Fourth Straight Weekly Loss (Source: Bloomberg)

The takeaway is straightforward: dollar strength, equity underperformance, and crypto weakness are not isolated, they are three expressions of the same underlying anxiety about U.S. policy and global growth. Until there is meaningful stabilization in risk appetite, the path of least resistance across crypto remains lower.

You're overpaying for crypto.

Every exchange has different prices for the same crypto. Most people stick with one and pay whatever it costs.

CoW Swap checks them all automatically. Finds the best price. Executes your trade. Takes 30 seconds.

Stop leaving money on the table.

📊 Crypto Market Overview:

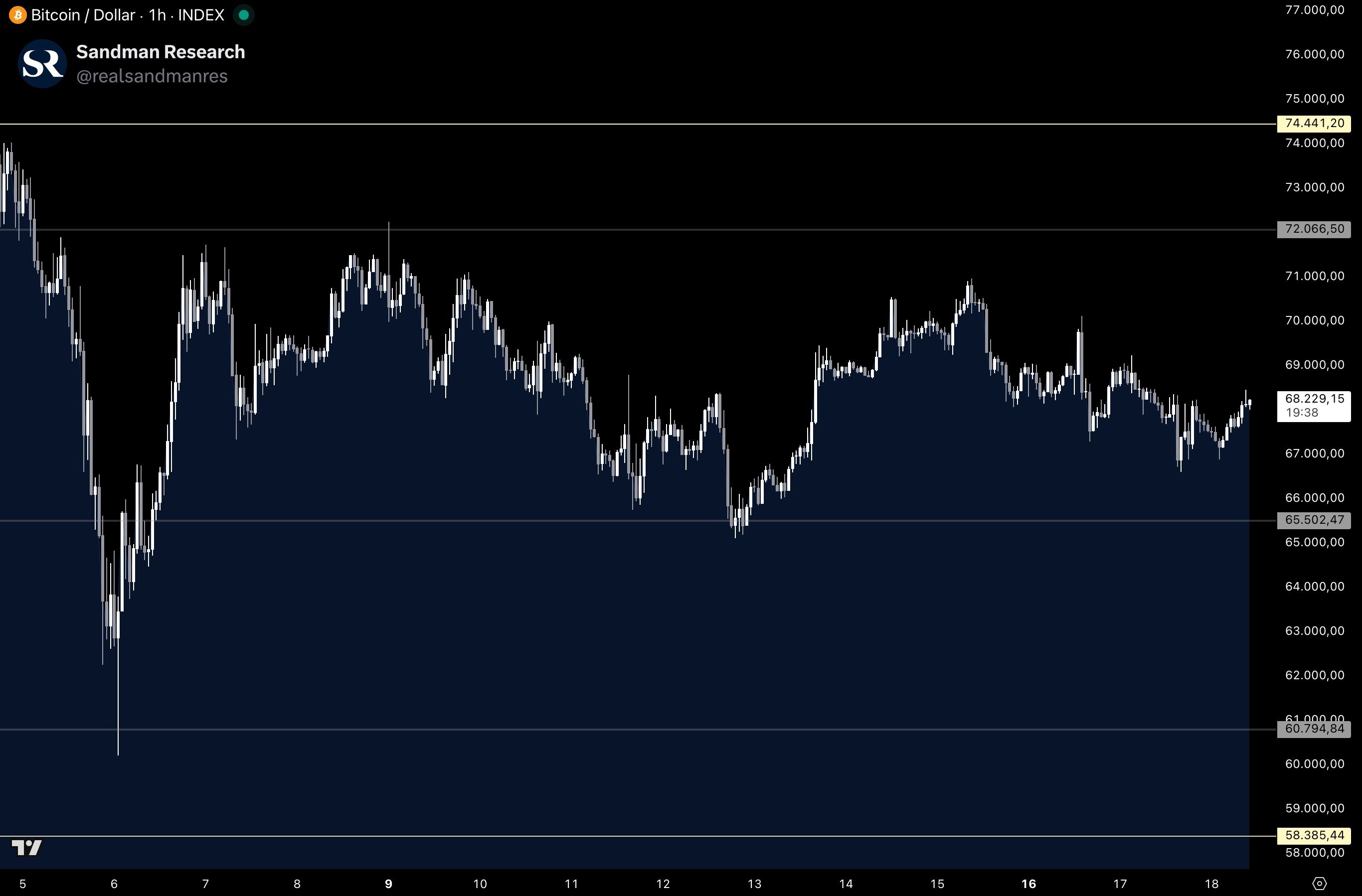

Bitcoin continues trading lower after facing rejection on Sunday, with price forming clear lower highs and lower lows, including a dip below $67,000 on Tuesday. BTC has since recovered and is currently trading around $68,200, with $72,000 as the key level to watch on the upside and $65,500 on the downside.

Bitcoin Price Chart (Source: Tradingview)

Get the Edge Most Retail Traders Don’t Have

Become a paying subscriber of Sandman Research to get this post and all subscriber-only insights, trade setups, and macro intelligence used by top crypto traders.

Upgrade Now → Get Full AccessA subscription gets you:

- Clear Trade Setups for BTC & Altcoins: Step-by-step guidance with entry, stop, and take-profit levels so you can act confidently during market swings.

- Macro & Market Intelligence: Understand which macro events and liquidity shifts are moving crypto, so you’re never caught off guard by volatility.

- Exclusive ETF & On-Chain Flow Analysis: See capital movements and liquidation clusters before the crowd, giving you an edge in timing entries and exits.

- Altcoin & Sector Insights: Identify early rotation opportunities in high-potential sectors like AI-focused altcoins, without wasting time on dead projects.

- Actionable, Risk-Aware Playbooks: Convert research into actual trades with structured setups, technical breakdowns, and scenario-based strategies.