Hello and happy Monday!

Markets were hit with a sharp reality check to close last week. A sudden shift in expectations sparked forced liquidations across asset classes, sending Bitcoin below $75,000, triggering one of the most violent corrections in precious metals in decades, and rippling through global equities as risk appetite abruptly flipped to risk-off.

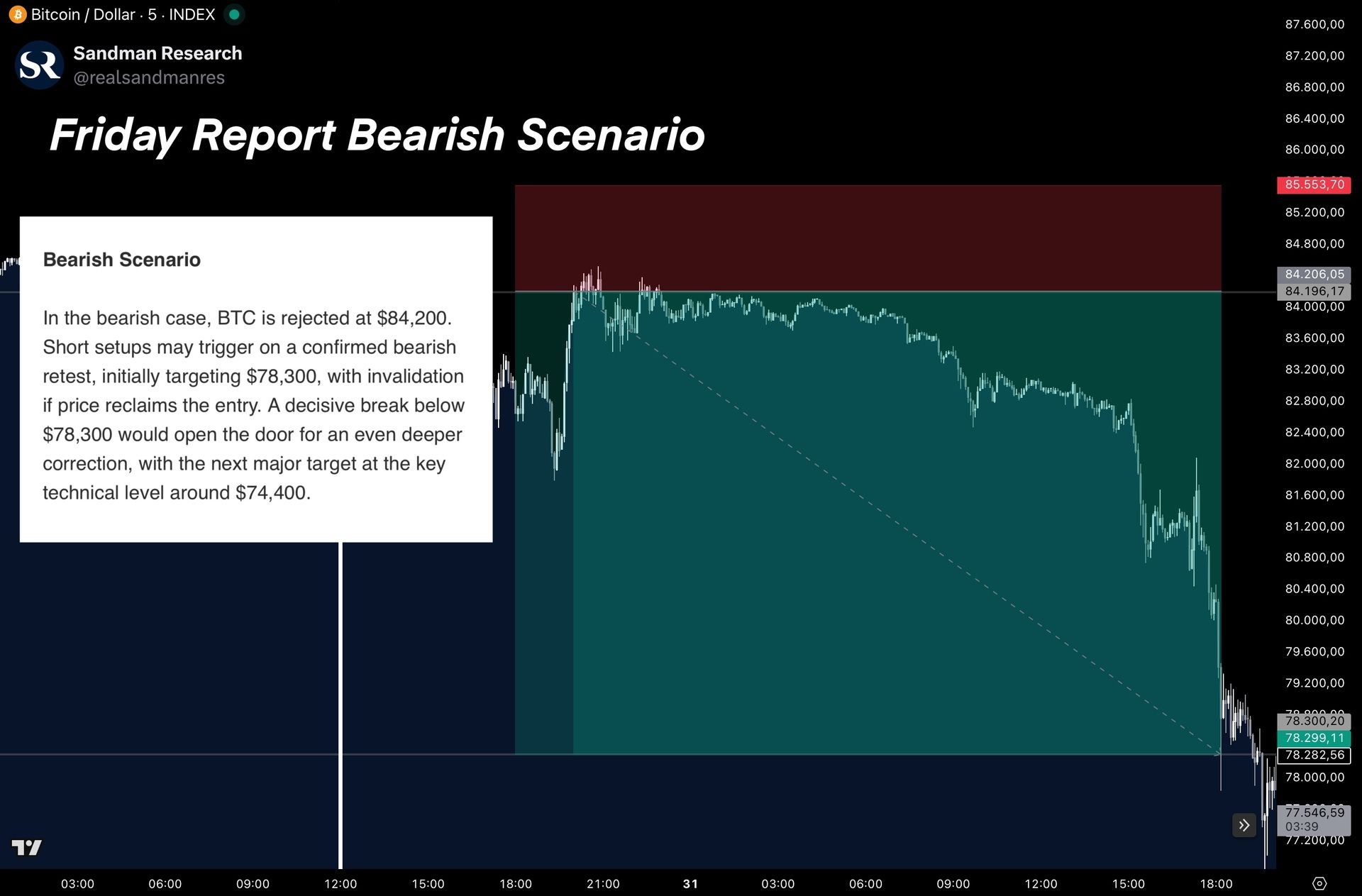

Despite the chaos, our full research members were able to capitalize on Bitcoin’s sell-off, capturing a 7% move from 84,200 to 78,300, as outlined in Friday’s crypto report.

How far does this unwind still have to go? What does it signal about Fed credibility and market positioning? And which levels now matter most for Bitcoin, altcoins, and broader risk assets? This report breaks it all down with 14 key charts, actionable trade setups, and the scenarios most likely to shape market direction in the days ahead.

Here’s what we’ll cover today:

📈 Market Review: Violent reversals across crypto, commodities, and equities. We analyze how crowded positioning turned a policy headline into a global liquidation event.

🔍 Current Market Conditions: Bitcoin sentiment sinks deeper into extreme fear as price revisits April lows and ETF outflows accelerate. Is this a late-stage capitulation phase?

👀 Key Events Ahead: A data- and earnings-heavy week puts the labor market and Big Tech firmly in focus. We outline the catalysts that could either stabilize markets, or extend the risk-off move.

📊 Technical Analysis: Key Bitcoin levels, liquidation clusters, and clearly defined bullish and bearish trading scenarios. Where reactions matter most and how to manage risk after a sharp volatility expansion.

🚀 Altcoin Insights: TOTAL3 and ETH/BTC break critical support levels. We explain where downside risks accelerate, what levels must be reclaimed to change the trend, and how positioning remains essential.

Let’s dive in 👇

The Gold standard for AI news

AI will eliminate 300 million jobs in the next 5 years.

Yours doesn't have to be one of them.

Here's how to future-proof your career:

Join the Superhuman AI newsletter - read by 1M+ professionals

Learn AI skills in 3 mins a day

Become the AI expert on your team

📈 Market Review:

Asset managers piled into bearish dollar bets just before President Trump's Friday nomination of Kevin Warsh as the next Fed chair sparked the dollar's sharpest single-day rally since May. The timing couldn't have been worse for institutions that had wagered $8.3 billion against the greenback. Markets interpreted Warsh, a former Fed governor with Wall Street credentials, as a signal that Fed independence might be preserved despite Trump's relentless pressure for rate cuts, immediately reversing what had become an overcrowded trade.

Asset Managers Boost Bearish Dollar Bets (Source: Bloomberg)

Bitcoin crashed below $75,000, its lowest level since April, as the cryptocurrency shed 40% from its 2025 peak above $125,000. The sell-off reflects a toxic mix of leveraged liquidations, weakening ETF demand with outflows exceeding $800 million in recent days, and persistent selling from long-term holders dumping roughly 12,000 BTC daily. What started as a Trump-friendly political trade has morphed into classic risk-off behavior, with Bitcoin moving in lockstep with precious metals and growth stocks as investors reassess inflated valuations across speculative assets.

Bitcoin Fell to its Lowest Since April (Source: Bloomberg)

Precious metals experienced their most violent correction in decades after the Warsh announcement, with silver plummeting 31% on Friday, its worst day since March 1980, while gold tumbled 11% from record highs above $5,600 per ounce. The carnage continued into Monday as silver dropped another 12% and gold shed 5%, with the metals extending their collapse as the strengthening dollar and shifting Fed expectations unwound what had become a dangerously leveraged momentum trade.

Gold, Silver Extend Fall After Market Rout (Source: Bloomberg)

Korean stocks suffered their worst day since November, with the Kospi crashing over 5% to close at 4,949 on concerns about AI spending sustainability and global growth. Heavyweight semiconductor stocks Samsung and SK Hynix, which had driven Korea's world-beating rally to record highs above 5,200 just days earlier, each fell more than 4% as the tech-driven momentum abruptly reversed. The decline triggered a circuit breaker halt when Kospi 200 futures dropped 5%, reflecting broader risk-off sentiment rippling through Asian markets.

Korean Stocks Decline Most Since April Selloff (Source: Bloomberg)

These violent moves reveal a market that had positioned for continued dollar weakness and unchecked asset inflation, only to face a sharp reality check when the Warsh nomination suggested the Fed might retain more credibility than feared. The magnitude of the reversals, from currencies to crypto to commodities, points to stretched positioning that turned modest corrections into forced liquidations across global markets.

🔍 Current Market Conditions:

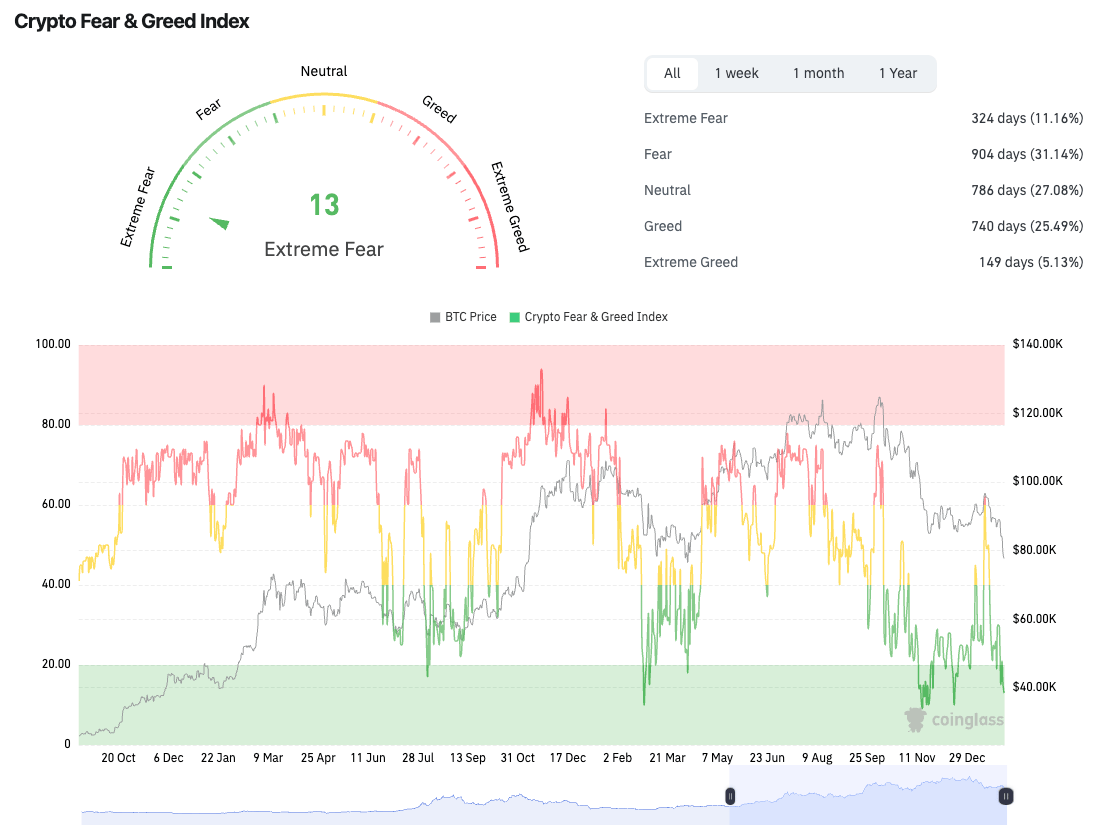

Bitcoin sentiment has deteriorated further, deepening the risk-off backdrop rather than stabilizing. The Crypto Fear & Greed Index has slipped deeper into extreme fear, now reading 13, as Bitcoin revisited the April lows. This marks a clear breakdown in confidence and reinforces the view that recent upside attempts failed to transition into a sustainable recovery phase.

Crypto Fear and Greed Index (Source: Coinglass)

ETF flows strongly confirm this renewed weakness. US spot Bitcoin ETFs recorded net outflows across nearly the entire past week, with only Monday posting modest inflows of roughly $6 million, an amount too small to carry any signaling value. The selling pressure accelerated into the end of the week, with $817 million in net outflows on Thursday followed by another $509 million on Friday, pointing to active and sustained institutional de-risking rather than passive consolidation.

Bitcoin ETF Net Flow (Source: CoinMarketCap)

The takeaway for investors remains defensive. Both sentiment and capital flows are not just weak, but continuing to deteriorate in tandem. For conditions to improve, the market would need to see a clear inflection in ETF flows alongside stabilization in sentiment indicators. Until that happens, the balance of risks favors further downside probing of lower support zones rather than an immediate resumption of the broader uptrend, with this week’s macro developments remaining a critical catalyst.

👀 Key Events Ahead:

Markets enter the week with a heavy focus on the labor market and earnings, with macro data taking center stage rather than policy signaling. Monday’s January ISM Manufacturing PMI will set the tone early, offering insight into whether recent growth concerns are spilling over into industrial activity. A weaker print would reinforce slowdown narratives, while resilience could help stabilize risk sentiment.

United States ISM Manufacturing PMI (Source: TradingEconomics)

Attention then shifts to the labor market. Tuesday’s December JOLTS Job Openings will be closely watched for signs of cooling in labor demand, a key variable for Fed policy expectations. A continued decline in openings would support the case that labor market tightness is easing, while a rebound could complicate the disinflation narrative.

United States Job Openings (Source: TradingEconomics)

Midweek and late-week earnings add another layer of risk. Alphabet reports on Wednesday, followed by Amazon on Thursday, making Big Tech guidance a critical driver for broader equity sentiment. With valuations elevated, markets are likely to react more to forward-looking commentary than headline results, particularly around cloud demand, AI investment, and consumer spending trends.

United States Initial Jobless Claims (Source: TradingEconomics)

Thursday also brings Initial Jobless Claims, offering a timely check on labor market stress. Friday’s January Jobs Report is the main macro event of the week, with markets focused on wage growth and employment momentum rather than the headline payroll number alone. Any surprise strength could push rate-cut expectations further out, while clear signs of cooling would likely support risk assets.

United States Non Farm Payrolls (Source: TradingEconomics)

Investor Implications:

This is a data- and earnings-driven volatility week. Labor market signals will shape rate expectations, while Big Tech earnings will influence risk appetite. Strong jobs data combined with cautious earnings guidance could pressure risk assets, whereas cooling labor data and resilient earnings would support stabilization. Expect volatility around Friday’s jobs report and key earnings releases, and prioritize confirmation over early positioning.

🚨 Every week, we produce multiple in-depth reports, our Monday Market Report is the only free piece.

Upgrade to Full Research Access and get:

Complete market coverage across crypto, equities, and macro trends

Deep-dive analysis with 26+ extra charts each week

Long & short trading setups for Bitcoin and select altcoins

Exclusive insights trusted by top investors

Make smarter trades, optimize your portfolio, and grow and protect your capital. Upgrade today, your future self will thank you.

📊 Technical Analysis:

Bitcoin sold off heavily over the weekend. On Friday, BTC faced rejection at the 84,200 technical level and fell to the next lower support at 78,300. Price held there until Sunday, when it sold off further, briefly touching 74,400 before recovering to currently sit between the 78,300 and 74,400 key levels.

Bitcoin Price Chart (Source: Tradingview)

The two-week Bitcoin liquidation heatmap continues to show a higher concentration of leverage to the upside. Notable liquidation clusters sit around 90,000 and extend up toward 96,000. On the downside, remaining liquidation clusters sit just below recent lows near 74,300, although they are minimal in volume. While the heatmap would suggest a recovery is imminent, recent weeks have shown that such a picture does not guarantee a reversal, as price continued breaking lower despite limited downside leverage.

Bitcoin Liquidation Heatmap (Source: Coinglass)

Bullish Scenario: In the bullish case, Bitcoin shows early-week strength and reclaims the 78,300 level. Long setups become attractive after a successful bullish reclaim and retest, targeting 84,200, with invalidation on a loss of 78,300. A clean reclaim of 84,200 could open additional long opportunities on a bullish retest, targeting a move toward 88,800. Alternatively, if price first retests 74,400 and finds true support, long opportunities could also arise there, targeting 78,300.

Bearish Scenario: In the bearish case, Bitcoin fails to reclaim 78,300 and is rejected at that level. Short setups may form on a confirmed bearish retest, targeting 74,400, with invalidation on a reclaim of the level. If 74,400 breaks, downside opens further, with Bitcoin likely seeking a fresh lower low within the broader structure. Additional short opportunities could emerge on a bearish retest, targeting 72,000, with invalidation on a reclaim of the broken level.

🚀 Altcoin Insights:

TOTAL3 also saw a sharp sell-off starting Thursday, after facing rejection at the 847B technical level. Price initially held above the 816B technical level but ultimately broke below it on Friday and continued lower. Over the weekend, TOTAL3 reached the next lower technical level at 743B, where it has been holding since. If 743B fails to hold, the next lower technical level sits at 695B.

TOTAL3 (Source: Tradingview)

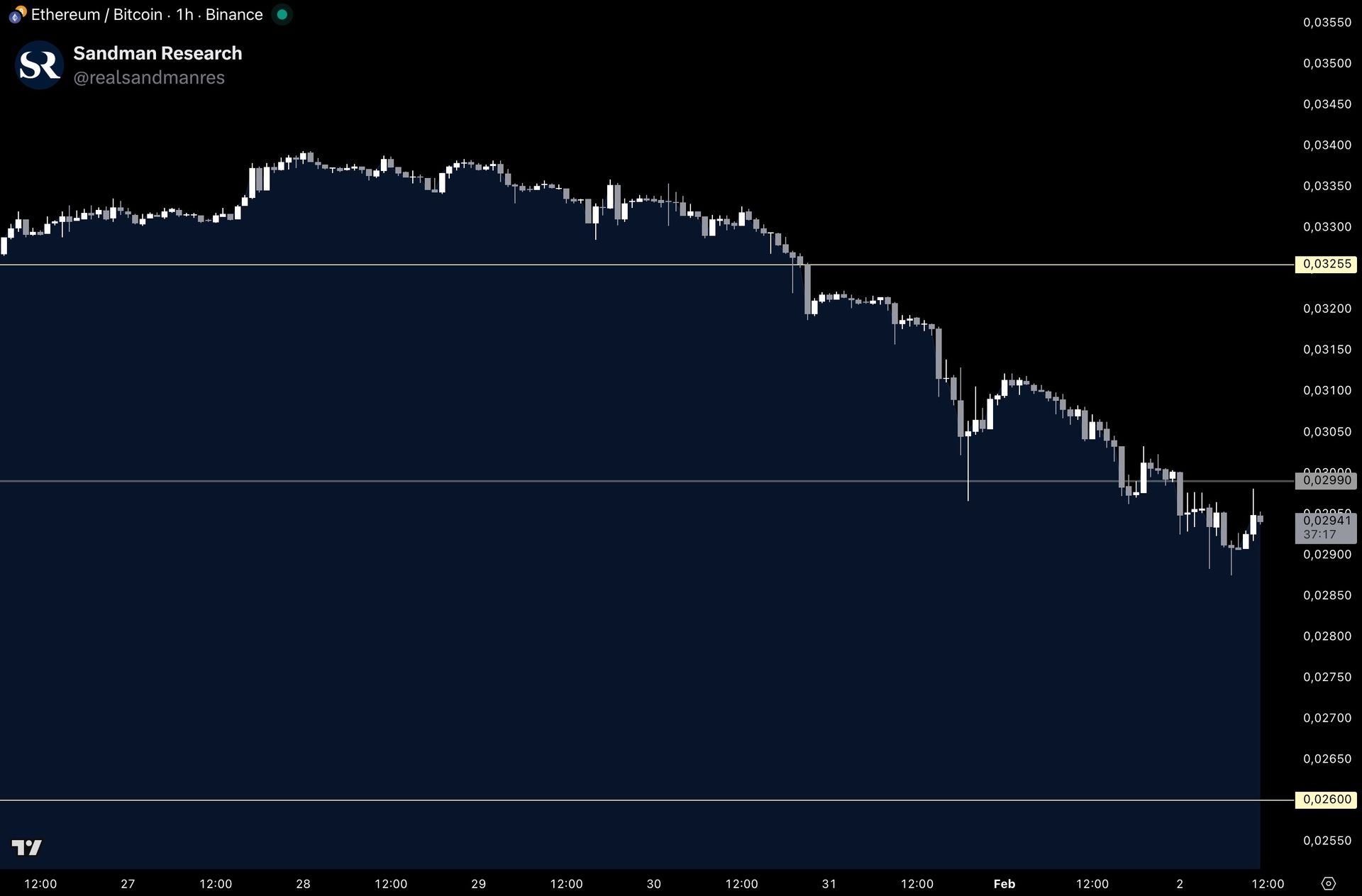

ETH/BTC also showed notable developments, as for the first time this cycle it broke back below the 0.03255 technical level, which had held as support ever since it was reclaimed in August. This move forms a fresh lower low within the broader trend for Ethereum on its Bitcoin pair. Notably, ETH/BTC also fell below the next lower technical support at 0.0299. If this level cannot be reclaimed quickly, the next lower technical support lies at 0.026.

Ethereum / Bitcoin (Source: Tradingview)

Investor Implications: The altcoin market is showing clear signs of structural breakdown, as altcoins are underperforming even as Bitcoin struggles. This deterioration suggests capital is rotating out of altcoins entirely rather than seeking alternatives to Bitcoin weakness, with ETH/BTC potentially heading toward 0.026 if 0.0299 fails to hold. Until TOTAL3 reclaims 816B and ETH/BTC stabilizes above 0.03255, the technical picture favors continued altcoin underperformance, making defensive positioning and strict risk management essential until clearer signs of accumulation emerge.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.