Hello and happy Monday!

Markets entered a decisive inflection point to close last week. The AI narrative fractured, Bitcoin went through a violent leverage unwind, and global liquidity dynamics continued to diverge across regions and asset classes.

How durable is this AI divergence? Can market leadership finally broaden beyond megacap tech? And what does it all mean for Bitcoin and Crypto? This report breaks it all down with key charts, actionable trade setups, and the scenarios most likely to shape market direction in the days ahead.

Here’s what we’ll cover today:

📈 Market Review: AI hardware winners vs software losers, Bitcoin’s leverage unwind, China’s liquidity surge, and why Big Tech dominance may be peaking.

🔍 Current Market Conditions: Bitcoin sentiment sinks to extreme fear as ETF flows remain fragile. Is this capitulation or just another leg lower?

👀 Key Events Ahead: A CPI-heavy macro week with critical labor and retail data. We outline what could stabilize markets, or trigger another volatility spike.

📊 Technical Analysis: Key Bitcoin levels, liquidation dynamics, and clearly defined bullish and bearish scenarios as volatility compresses after the crash.

🚀 Altcoin Insights: TOTAL3 remains in a bearish structure and ETH/BTC prints new lows. We explain why altcoins continue to underperform and what must change to reverse the trend.

Let’s dive in 👇

Stop overpaying to swap crypto.

The exchange you're using? Probably charging you more than you need to pay.

CoW Swap compares prices across every major exchange in real time. Gets you the best deal automatically. You just swap like normal.

No extra work. Better prices.

📈 Market Review:

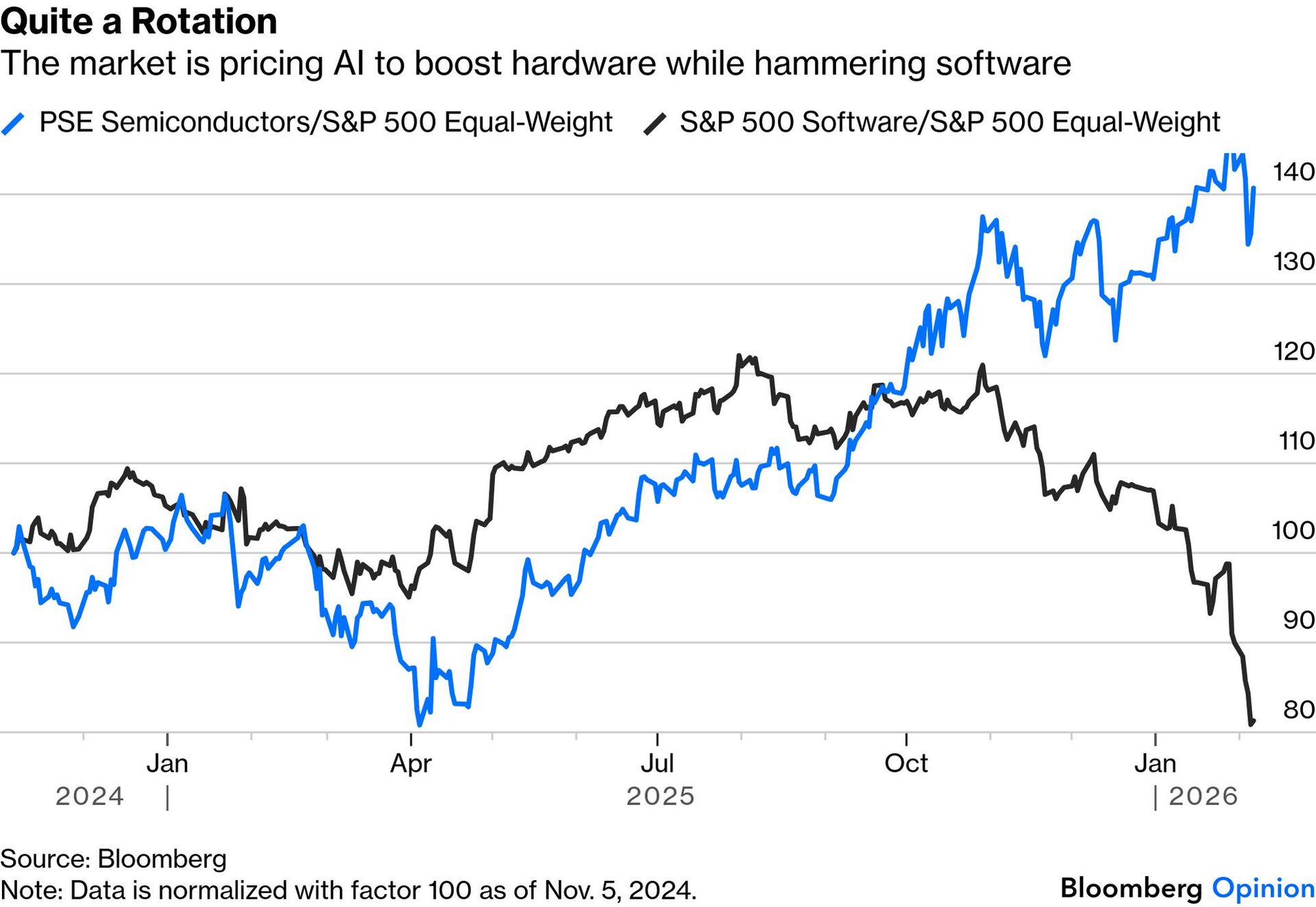

The market is experiencing a split in AI-related stocks. Semiconductor companies have surged as investors bet on the picks-and-shovels providers building AI infrastructure, while software stocks have collapsed amid fears that AI agents could replace traditional software products. This divergence intensified after Anthropic released legal automation tools, triggering a $1 trillion selloff across software companies as investors questioned which business models will survive the AI revolution.

Quite a Rotation (Source: Bloomberg)

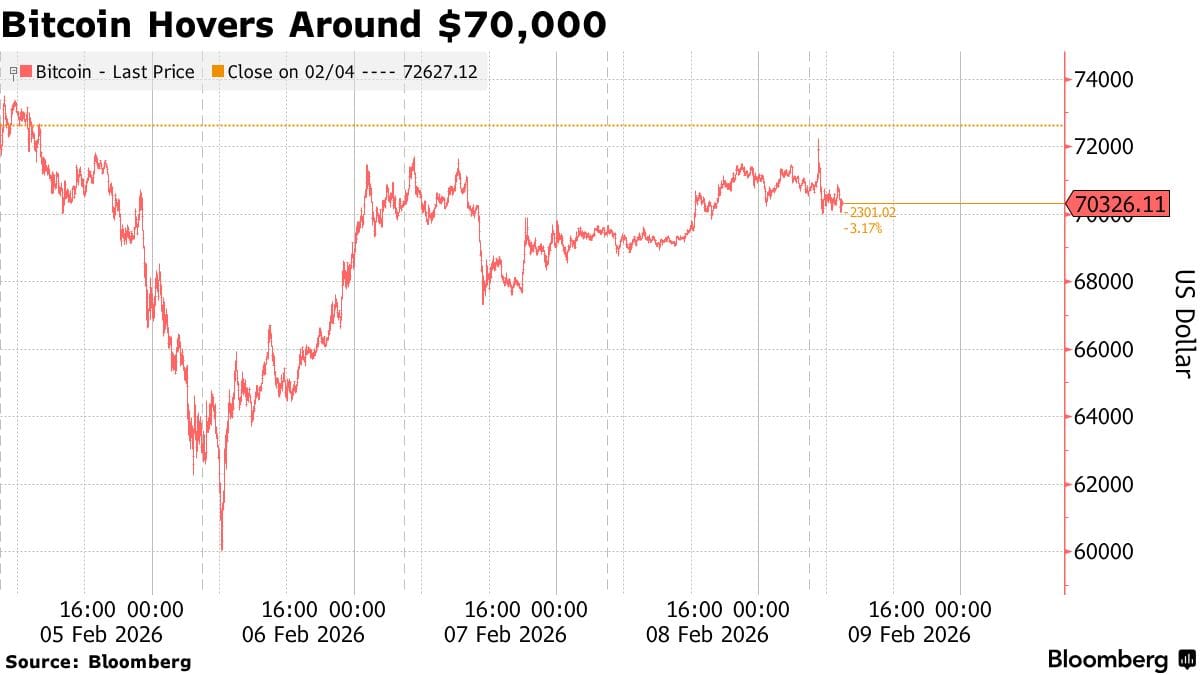

Bitcoin's violent swing below $70,000 last week, including a Thursday crash toward $60,000 before a Friday rebound, reflects the unraveling of leveraged speculation and ETF-driven momentum. The 52% decline from October's $126,000 peak mirrors the liquidation cascades seen during previous crypto winters, where overleveraged positions force selling that feeds on itself. With institutional flows reversing sharply and $3 billion fleeing Bitcoin ETFs, the cryptocurrency continues to behave like a high-beta tech stock.

Bitcoin Hovers Around $70,000 (Source: Bloomberg)

China's overnight repo market has reached record trading volumes of 8.24 trillion yuan, reflecting the scale of short-term liquidity operations in the country's financial system. These elevated volumes come as Beijing maintains aggressive monetary support through trillion-yuan reverse repo operations and other liquidity injections, helping sustain the recent equity rally that pushed the CSI 300 to four-year highs with daily stock trading volumes exceeding 3 trillion yuan.

China’s Overnight Repo Trading Volume Hits Record High (Source: Bloomberg)

Analyst estimates show the profit gap between Big Tech and the rest of the market is expected to narrow through late 2026. Forecasts project the Magnificent Seven's earnings growth will moderate from over 30% to around 15%, while the remaining 493 S&P companies are expected to accelerate toward that same rate. Since these seven stocks represent 35% of the index, concentration not seen since the dot-com era, whether this convergence materializes could determine if market leadership finally broadens beyond megacap tech.

Big Tech, Rest of S&P 500 Expected to Narrow Profit Gap (Source: Bloomberg)

The past week shows how quickly market narratives are being tested: AI is creating hardware winners while threatening software losers, Bitcoin remains trapped in boom-bust cycles, China continues pumping liquidity to support its markets, and analysts expect Big Tech's earnings dominance to fade. For investors, this means 2026 will be about separating AI hype from real profits and watching whether the rest of the market can actually deliver the growth that analysts are penciling in.

You're overpaying for crypto.

Every exchange has different prices for the same crypto. Most people stick with one and pay whatever it costs.

CoW Swap checks them all automatically. Finds the best price. Executes your trade. Takes 30 seconds.

Stop leaving money on the table.

🔍 Current Market Conditions:

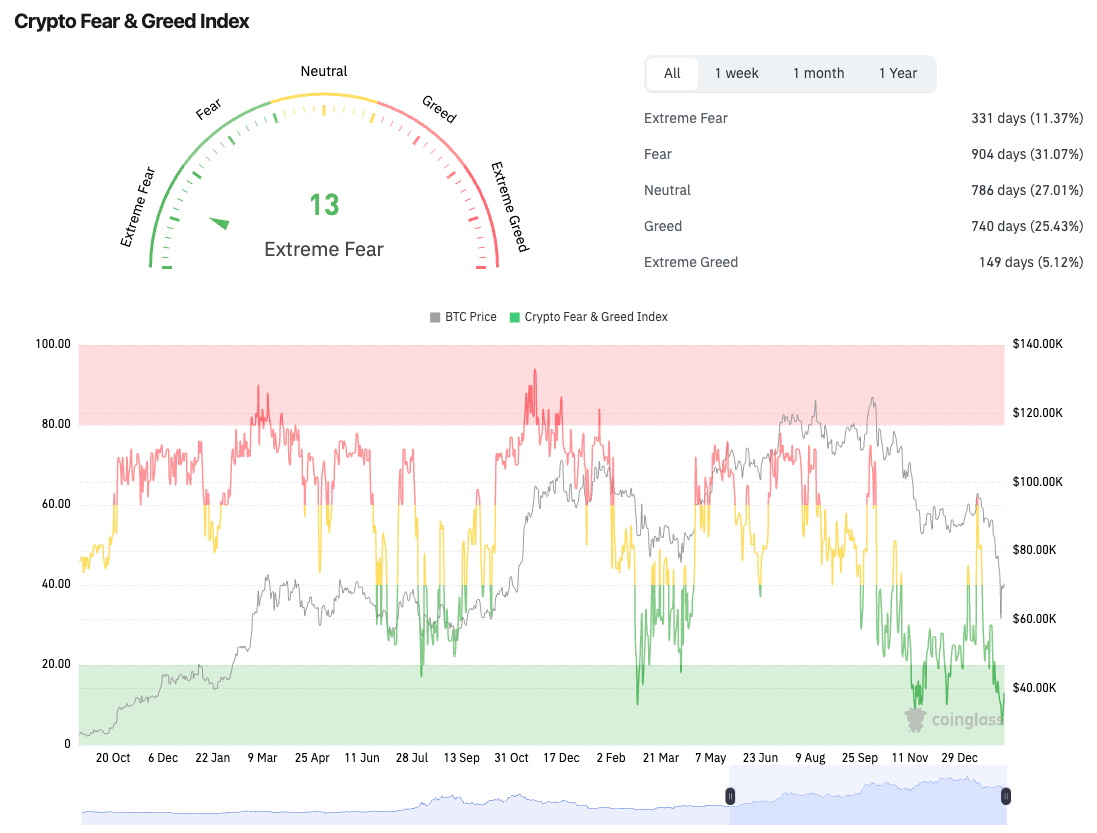

Bitcoin sentiment is getting worse, reinforcing a pronounced risk-off environment. The Crypto Fear & Greed Index has dropped further into extreme fear territory, now printing 13, reflecting broad capitulation-like psychology as Bitcoin traded to new local lows. This signals that market confidence has continued to erode rather than stabilize.

Crypto Fear and Greed Index (Source: Coinglass)

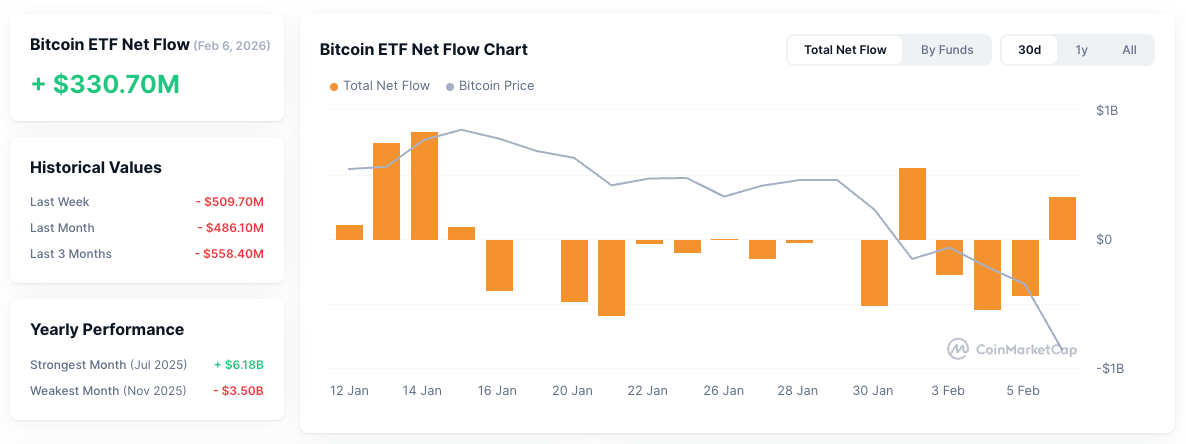

ETF flows show early signs of two-way activity but remain net fragile. US spot Bitcoin ETFs recorded inflows on Monday and Friday, while the remaining sessions of the week saw net outflows. Notably, $330 million flowed into ETFs on Friday, pointing to selective dip-buying interest, though not yet strong enough to suggest a sustained shift in institutional positioning.

Bitcoin ETF Net Flow (Source: CoinMarketCap)

The broader takeaway remains cautious. Sentiment continues to trend lower, while capital flows show only tentative signs of stabilization. A durable improvement would require a consistent streak of ETF inflows alongside a recovery in sentiment metrics. Until such confirmation emerges, the market remains vulnerable to further downside, with upcoming macro catalysts likely to dictate near-term direction.

Stop overpaying to swap crypto.

The exchange you're using? Probably charging you more than you need to pay.

CoW Swap compares prices across every major exchange in real time. Gets you the best deal automatically. You just swap like normal.

No extra work. Better prices.

👀 Key Events Ahead:

Markets face a data-heavy week building toward Friday's January CPI release, the most critical event for Fed policy and risk sentiment.

Monday's December Retail Sales opens the week, showing whether consumer spending held up into year-end. Wednesday brings the January Jobs Report, offering insight into employment momentum and wage growth. Thursday adds Initial Jobless Claims and January Existing Home Sales data, rounding out the labor and housing picture before Friday's main event.

Friday's CPI is what matters most. A hotter-than-expected reading could reignite sticky inflation fears and push rate-cut expectations further out, pressuring risk assets. Cooler data would reinforce the disinflationary trend and likely support both equities and crypto.

United States CPI Inflation Rate (Source: U.S Bureau of Labor Statistics)

Five Fed speaker events are scheduled throughout the week, though the hard data will carry more weight than commentary. Additional government shutdown-related data may also create noise in the numbers.

Investor Implications: This week builds toward Friday's CPI, which will dictate near-term direction for both rate expectations and risk sentiment. Hot inflation with strong jobs data would pressure risk assets, while cooling inflation and softening labor data would support stabilization. Expect volatility to accelerate as the week progresses, with Friday likely triggering the sharpest moves. Wait for confirmation before taking aggressive positions.

🚨 Every week, we produce multiple in-depth reports, our Monday Market Report is the only free piece.

Upgrade to Full Research Access and get:

Complete market coverage across crypto, equities, and macro trends

Deep-dive analysis with 26+ extra charts each week

Long & short trading setups for Bitcoin and select altcoins

Exclusive insights trusted by top investors

Make smarter trades, optimize your portfolio, and grow and protect your capital. Upgrade today, your future self will thank you.

📊 Technical Analysis:

Bitcoin stabilized over the weekend and hovered around $70,000 after forming a fresh low on Friday morning by touching $60,200. Notably, price found support around our technical level and moved higher, reclaiming $65,500 before reaching the next technical target at $72,000 late Sunday night. From there, price pulled back and is now trading at $69,400.

Bitcoin Price Chart (Source: Tradingview)

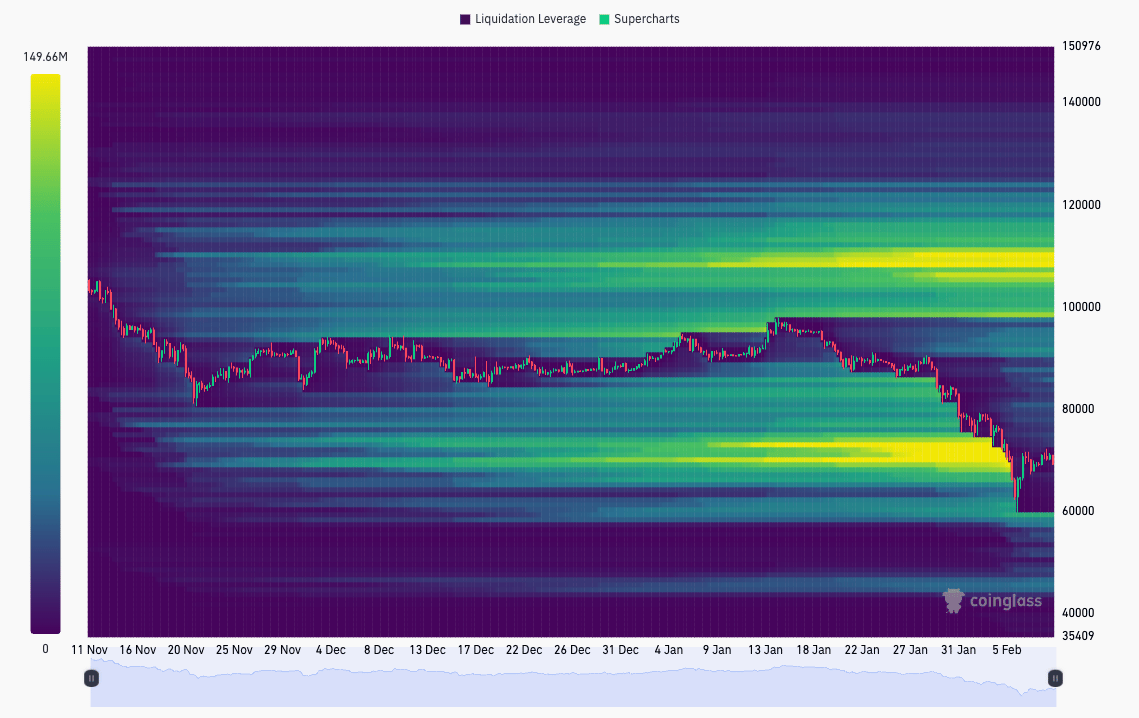

Looking at the current three-month Bitcoin liquidation heatmap, last week's downside leverage has been completely wiped out by the crash to $60,000. The chart now shows very little liquidation activity near current prices, meaning most overleveraged positions, both longs and shorts, have already been forced to close during the recent volatility. The remaining clusters sit far above at $100,000 and higher, representing traders who bought near the peaks and are now underwater. This cleared-out heatmap tells us two things: first, there's less risk of another immediate cascade lower since weak hands have already been shaken out, but second, there's also less fuel for a sharp bounce higher since there aren't many shorts left to squeeze.

Bitcoin Liquidation Heatmap (Source: Coinglass)

Bullish Scenario: In the bullish case, Bitcoin shows early-week strength and holds the $65,500 level. Long setups become attractive after a successful bullish retest, targeting $72,000 again, with invalidation on a loss of $65,500. A clean reclaim of $72,000 could open additional long opportunities on a bullish retest, targeting a move toward $74,400 and $78,300.

Bearish Scenario: In the bearish case, Bitcoin fails to reclaim $72,000 and gets rejected at that level. Short setups may form on a confirmed bearish retest, targeting $65,500, with invalidation on a reclaim of the level. If $65,500 breaks, downside opens further. Additional short opportunities could emerge on a bearish retest, targeting $60,700 and $58,300, with invalidation on a reclaim of the broken level.

🚀 Altcoin Insights:

TOTAL3 also bottomed on Friday morning, wicking down to $640B, from where it quickly rebounded and moved higher again, reclaiming $695B and pushing back to $720B, which it reached on Friday afternoon. From there, TOTAL3 traded mostly sideways and is now closing in on the $695B technical level again, potentially looking to retest it. Notably, TOTAL3 remains in a clear bearish structure and has not yet formed any higher highs that would signal a trend shift.

TOTAL3 (Source: Tradingview)

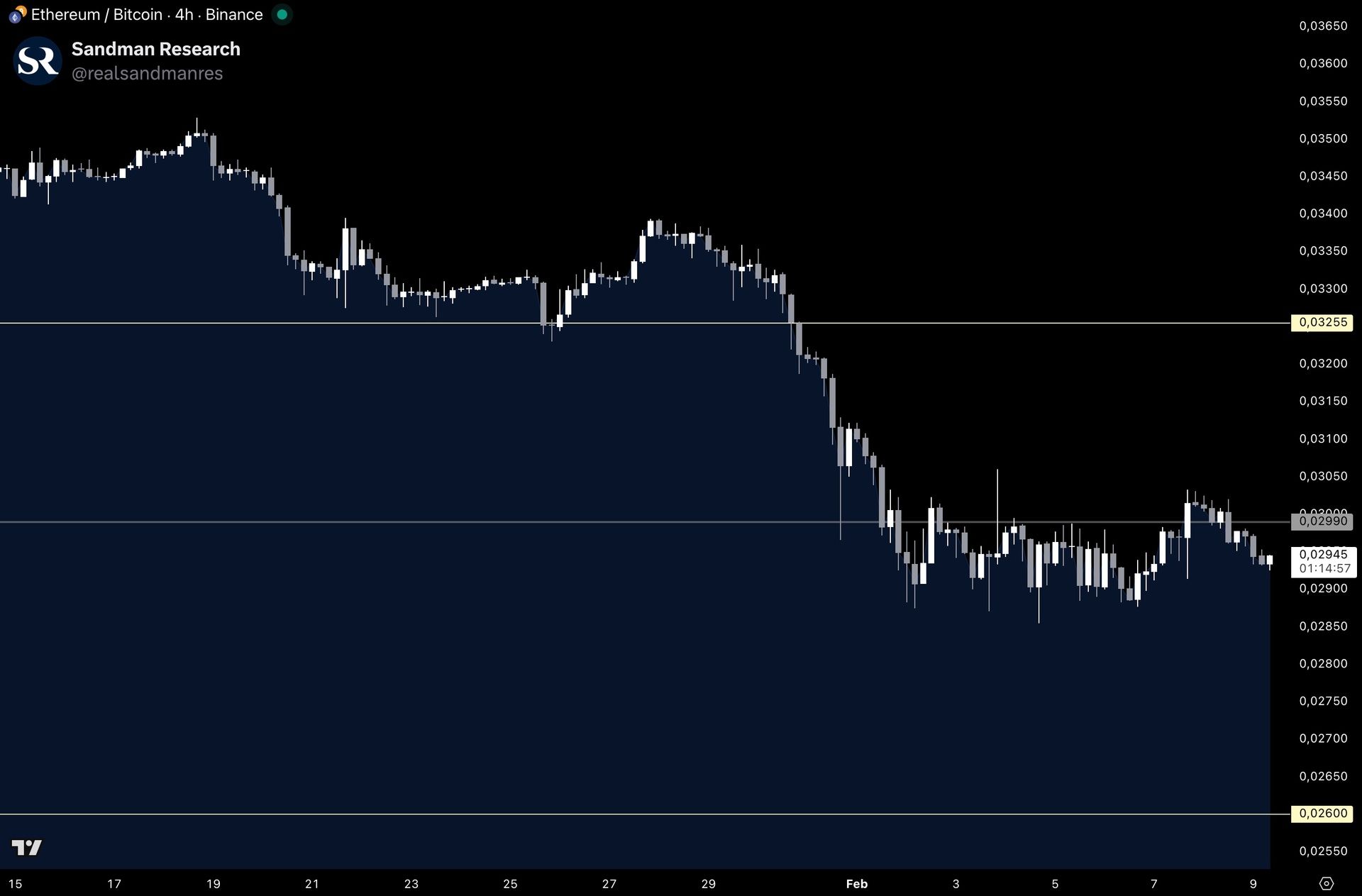

ETH/BTC diverged from Bitcoin and TOTAL3’s developments, as it has been trading sideways below the 0.029 technical level, another support line that has been lost for now. With this move lower, ETH/BTC formed a fresh lower low within the ongoing bearish trend that has been in place since topping out in August last year. This means that, with small exceptions, Ethereum has been underperforming Bitcoin since then, making it the weaker asset to hold.

Ethereum / Bitcoin (Source: Tradingview)

Investor Implications: Altcoins remain in a fragile regime. TOTAL3’s rebound looks corrective rather than structural, with no higher highs formed and a potential retest of $695B ahead. ETH/BTC continues to print lower lows below 0.029, confirming ongoing Ethereum and broader altcoin underperformance versus Bitcoin. Until TOTAL3 reclaims $720B+ and ETH/BTC stabilizes, the setup favors defensive positioning and reduced high-beta altcoin exposure.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.