Hello and happy Wednesday!

Markets saw a sharp shift in sentiment this week as Bitcoin dropped over 10%, falling from 98,000 to below 88,000 amid a broader risk-off move.

Inside today’s report, 12 charts highlight critical market patterns and key inflection points, helping you spot opportunities before they unfold. From dominance trends to technical reversals and one standout altcoin setup, the “Chart of the Week”. The analysis is designed to provide executable insights you can put into action this week.

Here’s what’s in today’s report:

📅 Macro Review: A deep dive into the global risk-off move, covering equity market selloffs, bond market stress, surging volatility, and why capital is flowing into gold instead of US Treasuries, signaling a potential regime shift in global markets.

📊 Crypto Market Overview: Detailed analysis of Bitcoin’s breakdown below key levels, current market structure, and clearly defined bullish and bearish scenarios to help navigate heightened volatility.

🔍 Bitcoin vs. Altcoins: Examination of dominance trends and capital concentration, highlighting why Bitcoin continues to outperform and why altcoin exposure remains structurally challenged.

📈 Key Reversal Signals: Technical assessment of ETH/BTC and OTHERS/BTC, identifying the precise levels that would signal either stabilization or further relative weakness in altcoins.

🚀 Chart of the Week: A focused technical breakdown of a standout coin, outlining clear long and short trading setups, key invalidation levels, and risk management considerations in a broader bearish environment.

Let’s dive in 👇

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

📅 Macro Review:

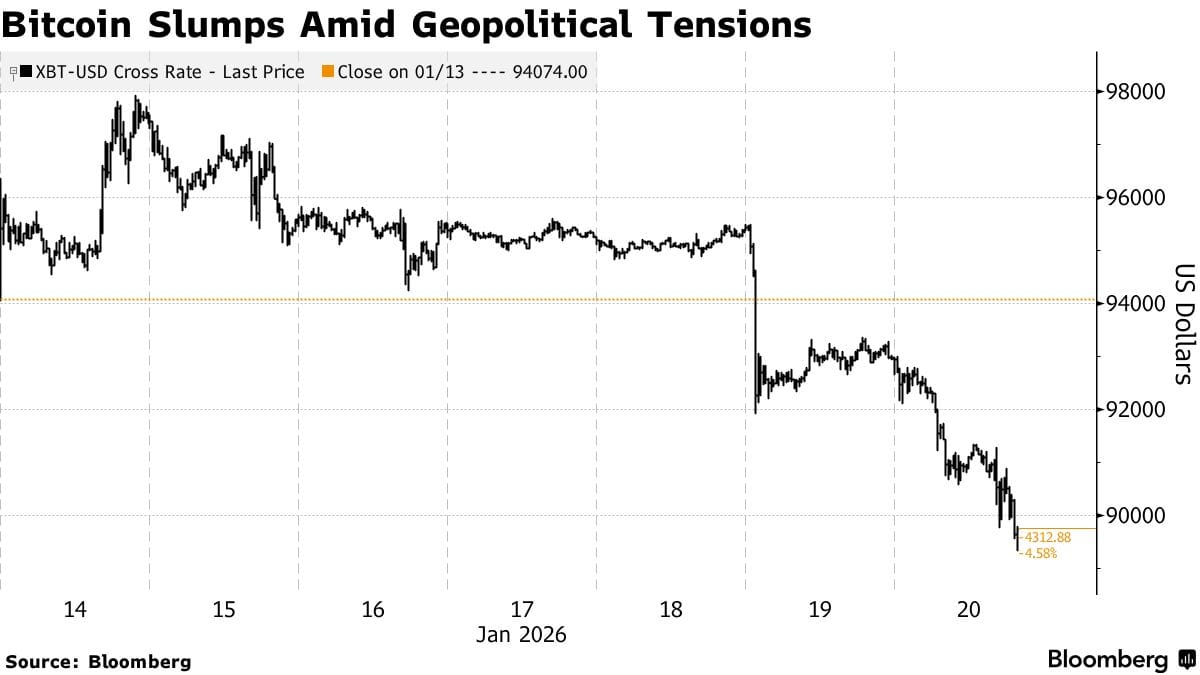

Bitcoin plunged from $98,000 to below $88,000, a 10% drop, as it tracked broader risk-off sentiment. The selloff intensified when over $763 million in leveraged positions were liquidated within 12 hours. While gold surged to record highs, Bitcoin's collapse definitively undermined the "digital gold" narrative during genuine geopolitical stress.

Bitcoin Slumps Amid Geopolitical Tension (Source: Bloomberg)

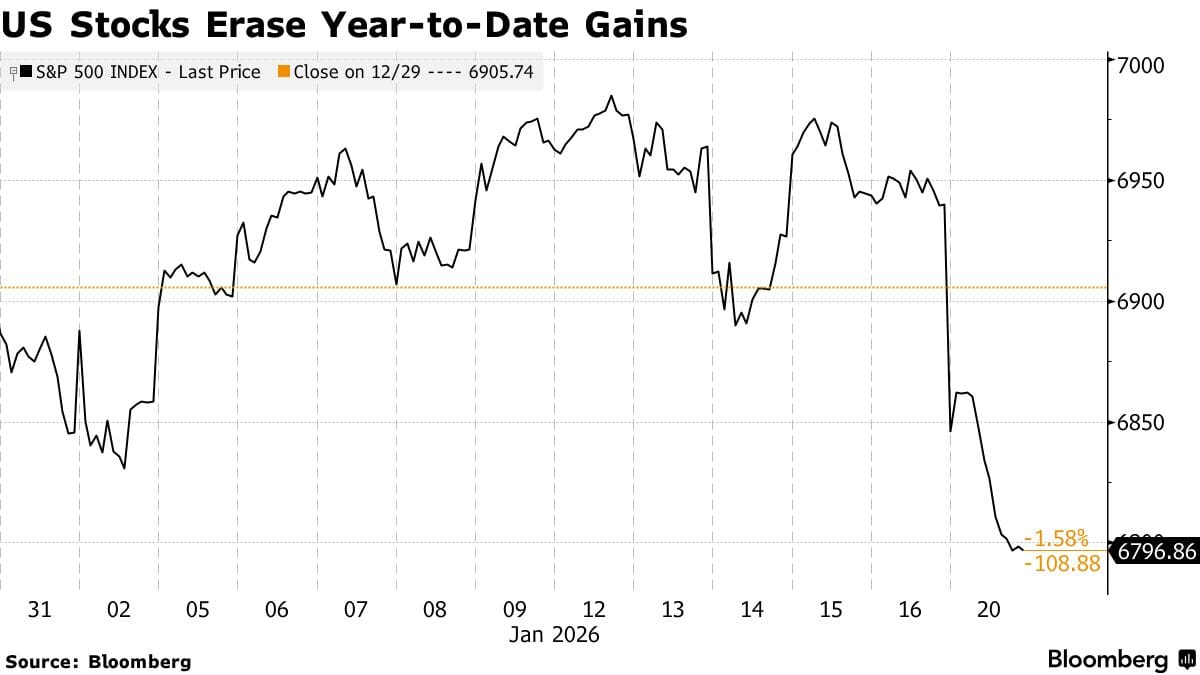

The S&P 500 dropped 2.1% to erase its entire year-to-date gain, while the Nasdaq fell 2.4% and the Dow plunged 870 points in what traders called a "fear trade." The VIX spiked to 20.99, its highest since mid-November. Mega-cap tech stocks led the decline as investors reassessed valuations amid policy uncertainty.

US Stocks Erase Year-to-Date Gains (Source: Bloomberg)

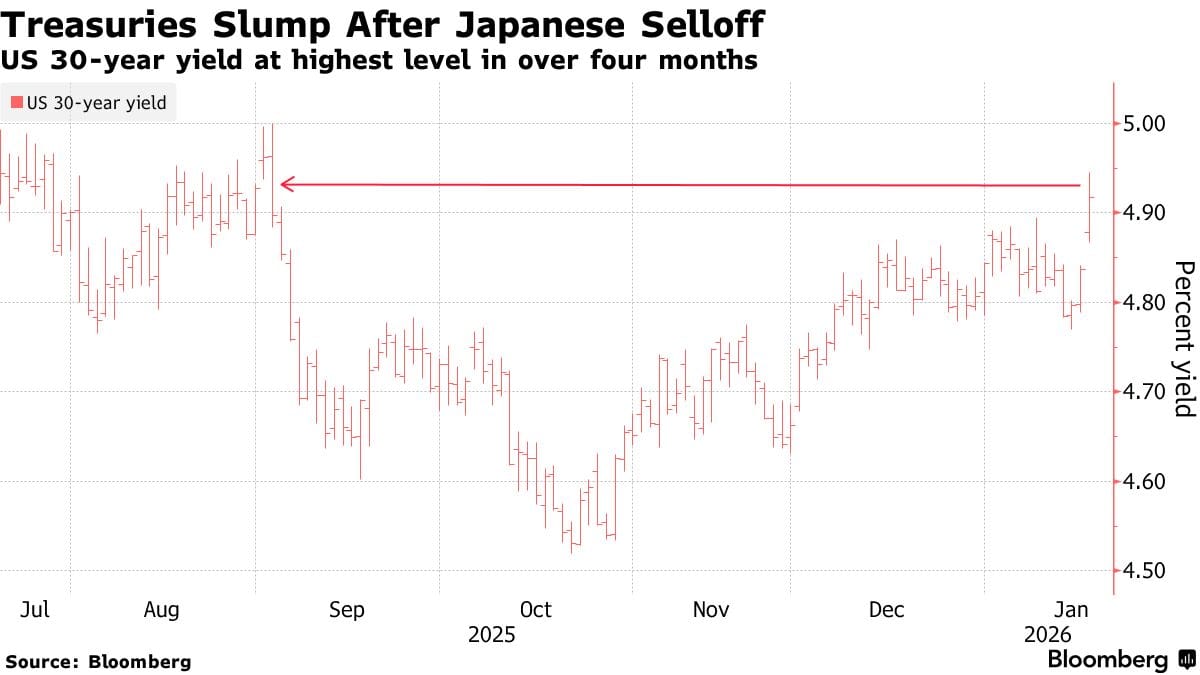

Japan's 30-year bond yields surged 38 basis points in two days, the largest move since April's tariff chaos. As the largest foreign holder of US Treasuries with $1.2 trillion, Japan's bond turmoil pushed the US 30-year yield to 4.95%, a four-month high. This contagion threatens borrowing costs across the American economy, from mortgage rates to corporate debt financing, while also raising the specter that Japan, and potentially other foreign holders, may need to liquidate US Treasury holdings to stabilize their own bond markets.

Treasuries Slump After Japanese Selloff (Source: Bloomberg)

Gold surged to a new all-time high as investors sought safety. Crucially, capital flowed into gold rather than US Treasuries, a historic shift as investors questioned whether US assets still deserve safe-haven status when Washington itself is the source of uncertainty. This decoupling represents a fundamental change in global capital flows.

These 48 hours exposed critical flaws in portfolio construction for both crypto and macro investors. Bitcoin's 10% collapse while gold hit record highs definitively proves crypto remains a leveraged liquidity bet, not a geopolitical hedge. For macro investors, the simultaneous selloff across US stocks, bonds, and the dollar signals a regime change where traditional correlations break down and Washington itself becomes the primary risk factor.

Get the Edge Most Retail Traders Don’t Have

Become a paying subscriber of Sandman Research to get this post and all subscriber-only insights, trade setups, and macro intelligence used by top crypto traders.

Upgrade Now → Get Full AccessA subscription gets you:

- Clear Trade Setups for BTC & Altcoins: Step-by-step guidance with entry, stop, and take-profit levels so you can act confidently during market swings.

- Macro & Market Intelligence: Understand which macro events and liquidity shifts are moving crypto, so you’re never caught off guard by volatility.

- Exclusive ETF & On-Chain Flow Analysis: See capital movements and liquidation clusters before the crowd, giving you an edge in timing entries and exits.

- Altcoin & Sector Insights: Identify early rotation opportunities in high-potential sectors like AI-focused altcoins, without wasting time on dead projects.

- Actionable, Risk-Aware Playbooks: Convert research into actual trades with structured setups, technical breakdowns, and scenario-based strategies.