Fuel your business brain. No caffeine needed.

Consider this your wake-up call.

Morning Brew}} is the free daily newsletter that powers you up with business news you’ll actually enjoy reading. It’s already trusted by over 4 million people who like their news with a bit more personality, pizazz — and a few games thrown in. Some even come for the crosswords and quizzes, but leave knowing more about the business world than they expected.

Quick, witty, and delivered first thing in the morning, Morning Brew takes less time to read than brewing your coffee — and gives your business brain the boost it needs to stay sharp and in the know.

Hello and happy Monday!

As markets open the final trading days of the year, risk appetite remains surprisingly resilient across global assets.

With liquidity thin and positioning stretched in several areas, the coming days may prove decisive for how capital rotates as we head into 2026.

Here’s what we’ll cover today:

📈 Market Review: Bitcoin briefly reclaimed $90,000, but key resistance remains unresolved. Global equities continue to print new all-time highs. Silver’s parabolic move, however, raises growing concerns around positioning and near-term volatility.

🔍 Current Market Conditions: Crypto sentiment remains deeply depressed, with Fear & Greed stuck near extreme fear and ETF flows continuing to show persistent outflows.

👀 Key Events Ahead: Housing data, Fed Meeting Minutes, labor market signals, China’s silver export restrictions, and manufacturing PMI data could all drive outsized reactions across equities, commodities, and crypto.

📊 Technical Analysis: Bitcoin is once again testing the critical 88,800–90,000 resistance zone after a brief breakout attempt. Liquidation data shows downside risk open toward the mid-$80,000s if support fails.

🚀 Altcoin Insights: Altcoins showed tentative strength as TOTAL3 tagged key resistance before rejecting, while ETH/BTC continues to consolidate above long-term support without follow-through.

Let’s dive in 👇

📈 Market Review:

Bitcoin broke above $90,000 early this morning, gaining 2.8% after a quiet Christmas consolidation around $87,500. Failure to maintain these gains would likely send price back toward support in the mid-$80,000s. We will take a detailed look at the technical structure throughout this report and outline potential trade scenarios for both bullish and bearish outcomes later on.

Bitcoin Tops $90,000 After Quiet Christmas (Source: Bloomberg)

Global equities continue their remarkable ascent, with the MSCI All Country World Index pushing to fresh all-time highs in December. After a brief correction in spring, the index has climbed steadily throughout the second half of 2025, supported by resilient corporate earnings and moderating inflation expectations. The rally’s broad-based participation across both developed and emerging markets signals genuine investor confidence, though the key challenge now lies in balancing exposure to elevated valuations against the risk of missing further upside in this momentum-driven environment.

Global Stocks Extend Their Record-Breaking Rally (Source: Bloomberg)

The U.S. dollar posted its worst weekly decline since June, falling 0.8% as investors reassessed Fed policy expectations and reduced defensive positioning. This pullback after months of dollar strength has acted as a tailwind for risk assets, particularly commodities and emerging market currencies. Historically, periods of dollar weakness have supported equity and alternative asset rallies by fueling the “debasement trade,” where investors rotate into hard assets such as gold, silver, and Bitcoin to hedge against currency erosion and rising sovereign debt burdens.

The Dollar Capped its Worst Week Since June (Source: Bloomberg)

Silver is trading near the critical $80 per ounce level after briefly touching record highs and pulling back. The setup remains increasingly fragile: Friday’s trading volume in SLV surged to a record $9.6 billion during low-liquidity holiday conditions, pointing to signs of retail-driven euphoria, while COMEX warehouse inventories remain near all-time highs, offering little evidence of near-term physical scarcity. While the long-term bull case rests on inelastic solar demand, unlikely to break before prices approach $134 per ounce, and copper substitution requiring at least four years to scale, investors should expect heightened volatility as tax selling, profit-taking, and mean reversion introduce potential downside risk in the months ahead.

Silver Trades Near $80 an Ounce (Source: Bloomberg)

The synchronized rally across most asset classes highlights strong risk appetite heading into year-end, but positioning risks are becoming increasingly visible, from Bitcoin’s unresolved technical resistance to silver’s euphoric volume dynamics. Silver’s parabolic advance is currently absorbing a significant share of speculative liquidity, which could rotate back into Bitcoin once commodities cool, a pattern observed in prior cycles where retail capital moves from metals into crypto. Dollar weakness remains the common thread underpinning this environment, and a healthy correction in commodities could ultimately act as a catalyst for crypto’s next leg higher as capital searches for the next asymmetric opportunity.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

🔍 Current Market Conditions:

The Crypto Fear & Greed Index remains near extreme fear, currently at 25. Notably, 46 days have now passed since the index first entered extreme fear, and it has yet to recover back to neutral territory, highlighting persistently low investor confidence and depressed market sentiment. So far, there is no meaningful shift in price action, momentum, or sentiment that would suggest a major trend reversal is imminent. While conditions like these often develop during or near market bottoms, clear confirmation is still needed.

Crypto Fear and Greed Index (Source: Coinglass)

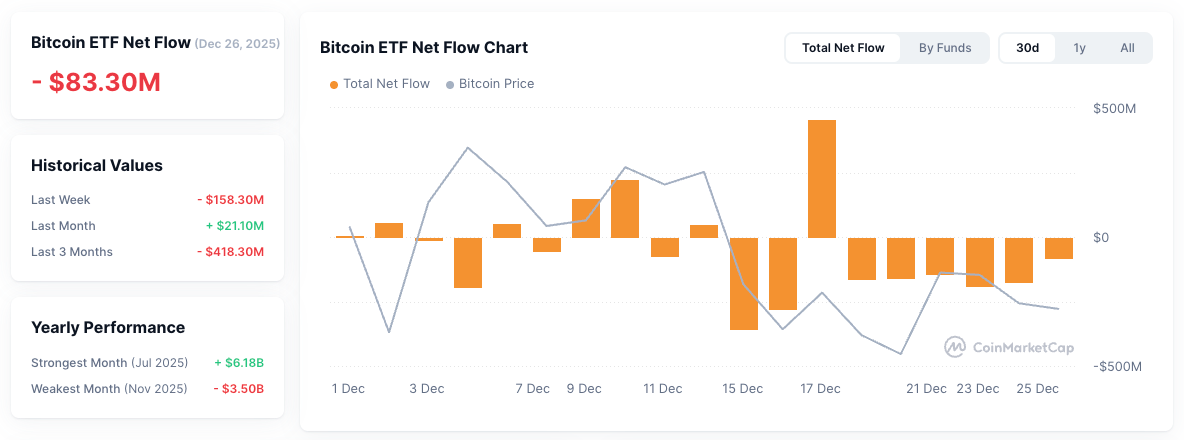

ETF flows over the past week reinforce this picture, as every trading session recorded net outflows from Bitcoin spot ETFs, totaling roughly $446 million leaving the asset. With the recent rally in silver and broader commodities absorbing liquidity, the lack of inflows into alternative assets like Bitcoin is not surprising, as discussed previously on X. Nevertheless, Bitcoin and the broader crypto market remain highly dependent on renewed institutional participation to regain sustained upside momentum.

Bitcoin ETF Net Flow (Source: CoinMarketCap)

Until sentiment stabilizes and ETF flows turn decisively positive, the broader crypto market is likely to remain range-bound and vulnerable to further downside.

👀 Key Events Ahead:

Monday brings November Pending Home Sales, offering an updated read on housing demand and interest-rate sensitivity. Continued weakness would reinforce the view that higher rates are still constraining activity, while a surprise rebound could signal resilience in rate-sensitive sectors.

On Tuesday, markets will focus on the release of the Fed Meeting Minutes, which should provide deeper insight into policymakers’ confidence around inflation, growth, and the timing of potential rate cuts. Any hint of caution or pushback against easing expectations could pressure risk assets, while a more dovish tone would support sentiment.

Wednesday’s Initial Jobless Claims will be closely watched for signs of softening in the labor market. A sustained uptick would strengthen the disinflation narrative and support expectations for easier financial conditions.

Thursday marks the start of China’s silver export restrictions, a development with implications for commodity markets and global supply chains, while U.S. equity markets remain closed for New Year’s Day, further reducing liquidity.

The week concludes Friday with December S&P Global Manufacturing PMI data, providing a final snapshot of year-end industrial momentum. With volumes still subdued, even modest surprises could have an outsized impact across equities, commodities, and crypto markets.

🔒 Important Update for the New Year

The Monday Market Report will remain free. Starting in the new year, Wednesday and Friday reports will move fully private and be available exclusively to paid subscribers.

Full Research Access gives you complete market coverage, deep-dive analysis, and exclusive insights trusted by top investors, for the best price currently.

Make smarter trades, improve portfolio decisions, and stay ahead of the crowd. Upgrade now, your future self will thank you.

📊 Technical Analysis:

Early this morning, Bitcoin broke above the key 88,800 technical level and briefly tapped 90,000 before pulling back again. Price is currently trading below the level, clearly confirming how strong the area between 88,000 and 90,000 continues to act as resistance and how sellers remain active in that zone. The next lower support and potential bounce area, should price move lower from here, sits at the 84,200 technical level.

Bitcoin Price Chart (Source: Tradingview)

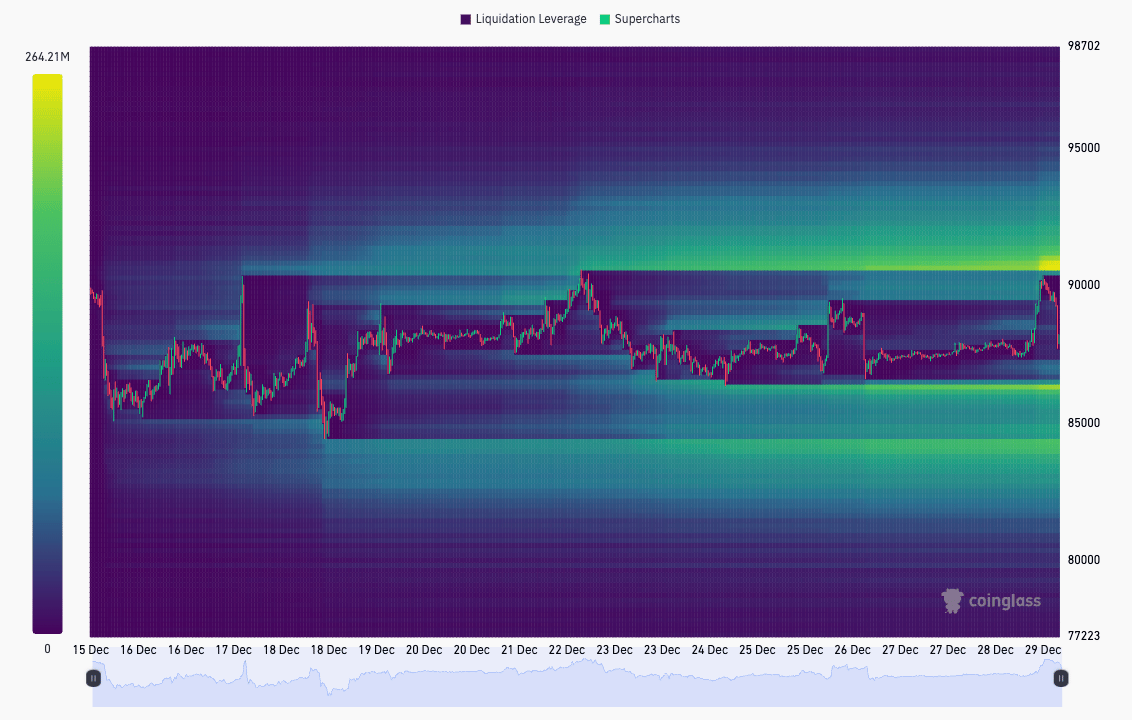

The two-week Bitcoin liquidation heatmap supports this view. A major cluster of leveraged liquidations on the upside sits just above 90,000, extending toward 95,000. Depending on how equities start the week and whether we see constructive flows into U.S. Bitcoin ETFs again, price could be drawn toward these liquidity levels, allowing BTC to grind higher. On the downside, liquidity remains spread from 86,000 down to 80,000, keeping the possibility of a correction into the mid-80,000s firmly on the table.

Bitcoin Liquidation Heatmap (Source: Coinglass)

Bullish Scenario:

In the bullish case, Bitcoin starts the week with strength and continues higher, reclaiming the 88,800 technical level and pushing toward 92,000. Long setups become attractive on a successful retest of 88,800, targeting 92,000, with invalidation if price loses 88,800 again. If BTC first retests 84,200, long opportunities emerge on a successful bullish retest, targeting a move back toward 88,800.

Bearish Scenario:

In the bearish case, Bitcoin fails to reclaim 88,800 and faces rejection at that level. Short setups may form on a confirmed bearish retest, targeting 84,200, with invalidation if price reclaims the entry. Should 84,200 break as well, additional downside opens up, offering further short opportunities toward 78,300 as the next major downside area.

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

🚀 Altcoin Insights:

Interestingly, while Bitcoin traded sideways over the weekend, TOTAL3 moved higher since Friday and once again reached the next higher technical level at $847B, where it faced a clean rejection early this morning. The level was tagged precisely before price rolled over, further confirming its technical significance and influence on market structure. The divergence is notable, and it remains to be seen whether altcoins can continue to advance while Bitcoin consolidates, or whether Bitcoin reasserts leadership by choosing a direction and pulling altcoins along with it.

TOTAL3 (Source: Tradingview)

Ethereum/Bitcoin traded largely sideways over the weekend. After finding support at the 0.03255 technical level on December 18th, the pair pushed higher and has since held at elevated levels. However, momentum has so far been insufficient to drive a decisive move toward the next higher technical level at 0.03723, keeping ETH/BTC in consolidation for now.

Ethereum / Bitcoin (Source: Tradingview)

We continue to prioritize Bitcoin and the strongest large-cap altcoins from our Q4 Watchlist, while deliberately avoiding excessive exposure to low-cap projects. Current market conditions still favor a cautious approach, with BTC and top-tier large caps offering sufficient volatility and opportunity without unnecessary risk.

That said, sustained dollar weakness and potential capital rotations from commodities and equities into crypto remain key variables to watch, as they could ultimately determine whether this market can push meaningfully higher again.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.