Hello and happy Friday!

Markets delivered a paradox this week: macro conditions are improving, yet risk assets continue to fracture.

This week’s report breaks down the disconnect with 14 detailed charts covering CPI expectations, AI-driven equity volatility, collapsing crypto prices, ETF flow dynamics, and evolving liquidation clusters.

The crypto section dissects Bitcoin, Ethereum, and Solana, delivering long and short trading setups with precise entry points, targets, and invalidation zones to help you navigate this market environment with confidence.

You're overpaying for crypto.

Every exchange has different prices for the same crypto. Most people stick with one and pay whatever it costs.

CoW Swap checks them all automatically. Finds the best price. Executes your trade. Takes 30 seconds.

Stop leaving money on the table.

Here’s what we’ll cover today:

🌍 Market Recap & Macro Overview: Can a “Goldilocks” CPI keep rate cuts alive, and why AI disruption fears are shaking equities despite improving inflation? Plus: why Japan’s bond market still matters for global risk.

📈 Bitcoin (BTC) Breakdown: What continued ETF outflows and building downside leverage mean for BTC’s next move, and why $65,500 is the key battleground.

📊 Ethereum (ETH) Outlook: Is ETH consolidating or preparing for another leg lower? What the BTC pair and leverage map around $1,500 signal about risk and opportunity.

🚀 Solana (SOL) Analysis: Can SOL defend $78 and reverse its downtrend, or does a break open the path toward $66? The key levels to watch next.

Let’s dive in 👇

Stop overpaying to swap crypto.

The exchange you're using? Probably charging you more than you need to pay.

CoW Swap compares prices across every major exchange in real time. Gets you the best deal automatically. You just swap like normal.

No extra work. Better prices.

🌍 Market Recap & Macro Overview:

All eyes today are on the delayed January CPI report, with analysts forecasting core inflation to tick down to 2.5% year-over-year, the closest the Fed has gotten to its 2% target since the post-pandemic surge above 6% in 2022. If confirmed, it keeps alive the prospect of one or two rate cuts in the second half of the year, though the Fed is almost certain to hold in March regardless. The "Goldilocks" framing is earning its name.

Goldilocks ahead? (Source: Bloomberg)

That constructive macro backdrop is playing out against a fragile equity picture. The S&P 500 erased an early jobs-data-fueled rally to finish Wednesday flat, then fell another 1.6% Thursday, its worst day since Thanksgiving, as AI disruption fears swept through tech and punished companies seen as vulnerable to displacement. The index is holding around 6,800, but the AI narrative has introduced a source of volatility that strong macro data alone cannot easily offset.

US Stocks Finish Session Flat (Source: Bloomberg)

Nowhere has the risk-off mood cut deeper than in crypto. Coinbase hit a year low around $140 after reporting a $667 million fourth-quarter net loss, a stunning reversal from a $1.3 billion profit in the same period a year ago, as falling digital asset prices crushed trading volumes. Bitcoin has shed over 50% from its October peak, and Standard Chartered has slashed its year-end target to $100,000, warning of a potential drop to $50,000 before any floor is found.

You're overpaying for crypto.

Every exchange has different prices for the same crypto. Most people stick with one and pay whatever it costs.

CoW Swap checks them all automatically. Finds the best price. Executes your trade. Takes 30 seconds.

Stop leaving money on the table.

Coinbase Shares Trade at Year Low (Source: Bloomberg)

Rounding out the picture, Japan's bond market has quietly recovered from January's dramatic blowup, when the 40-year JGB yield spiked above 4% in its largest move since 1999. Fiscal stimulus fears around then-opposition leader Takaichi were the trigger, but her subsequent election win and reassurances on fiscal discipline have pulled yields back to pre-crisis levels. The episode is worth remembering: Japan's ultra-low yields have long funded leveraged bets on higher-returning foreign assets, and any sustained rise carries contagion risk well beyond Tokyo.

Japan Yields Drop to Levels Seen Before January’s Drama (Source: Bloomberg)

The macro narrative is improving, but today's snapshot is a reminder that it competes with AI-driven equity volatility, a crypto market in deep correction, and a Japan that can still generate global turbulence. A soft CPI print would be a genuine positive, the question is whether markets have the patience to let it matter.

📈 Bitcoin (BTC) Breakdown:

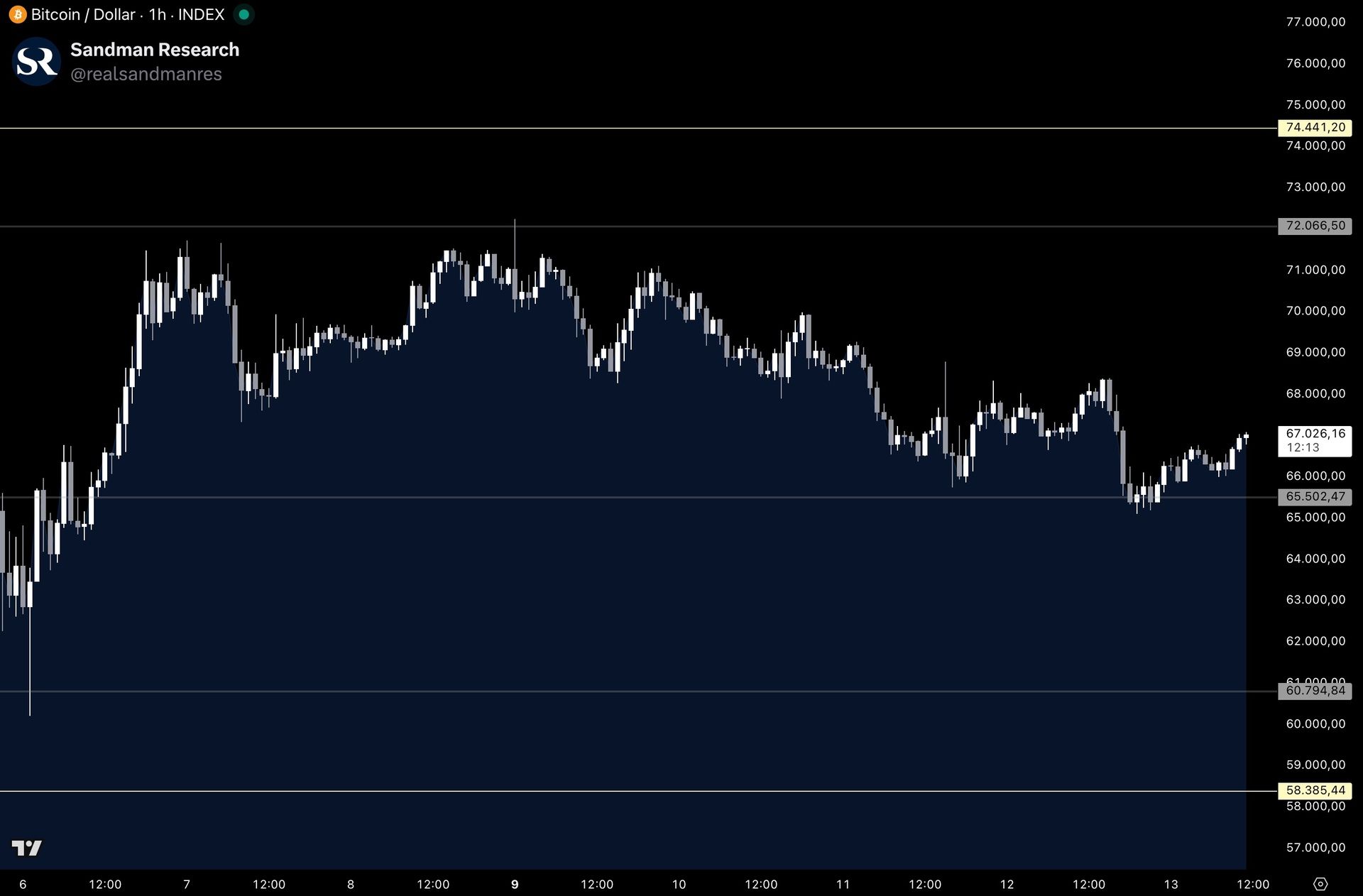

Bitcoin trended lower throughout the week, forming lower highs and lower lows after facing rejection at the key $72,000 technical level on Monday. From there, price accelerated toward the next major support at $65,500, which was tested on Thursday and has held so far. BTC is currently trading around $66,900, remaining within a higher-timeframe downtrend.

Bitcoin Price Chart (Source: Tradingview)

Get the Edge Most Retail Traders Don’t Have

Become a paying subscriber of Sandman Research to get this post and all subscriber-only insights, trade setups, and macro intelligence used by top crypto traders.

Upgrade Now → Get Full AccessA subscription gets you:

- Clear Trade Setups for BTC & Altcoins: Step-by-step guidance with entry, stop, and take-profit levels so you can act confidently during market swings.

- Macro & Market Intelligence: Understand which macro events and liquidity shifts are moving crypto, so you’re never caught off guard by volatility.

- Exclusive ETF & On-Chain Flow Analysis: See capital movements and liquidation clusters before the crowd, giving you an edge in timing entries and exits.

- Altcoin & Sector Insights: Identify early rotation opportunities in high-potential sectors like AI-focused altcoins, without wasting time on dead projects.

- Actionable, Risk-Aware Playbooks: Convert research into actual trades with structured setups, technical breakdowns, and scenario-based strategies.