Hello and happy Wednesday!

Markets are navigating a rapidly changing macro landscape this week as investors turn to gold amid rising policy uncertainty. With today’s FOMC meeting in focus, attention has shifted from rate decisions to Chair Powell’s messaging on independence, inflation risks, and the path forward in an increasingly complex environment.

Inside today’s report, 12 key charts break down the key macro and crypto developments shaping market structure right now. The analysis is designed to highlight actionable levels, risks, and trading opportunities as markets adjust to a new regime.

Here’s what’s in today’s report:

📅 Macro Review: A comprehensive look at the dollar’s historic selloff, stubbornly high Treasury yields, gold’s continued surge, and why traditional market relationships are breaking down ahead of a pivotal Fed meeting.

📊 Crypto Market Overview: Clear technical analysis of Bitcoin’s reclaim of key levels, higher-timeframe structure, and well-defined bullish and bearish trade scenarios amid improving short-term momentum.

🔍 Bitcoin vs. Altcoins: An assessment of shifting dominance trends, recent altcoin outperformance, and the conditions required for a more sustained rotation beyond Bitcoin.

📈 Key Reversal Signals: A focused technical review of ETH/BTC and OTHERS/BTC, highlighting the exact levels that would confirm either a broader altcoin recovery or renewed relative weakness.

🚀 Chart of the Week: A detailed technical breakdown of a standout setup, outlining precise long and short scenarios, key levels, and risk management considerations within a still-challenging altcoin environment.

Let’s dive in 👇

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

📅 Macro Review:

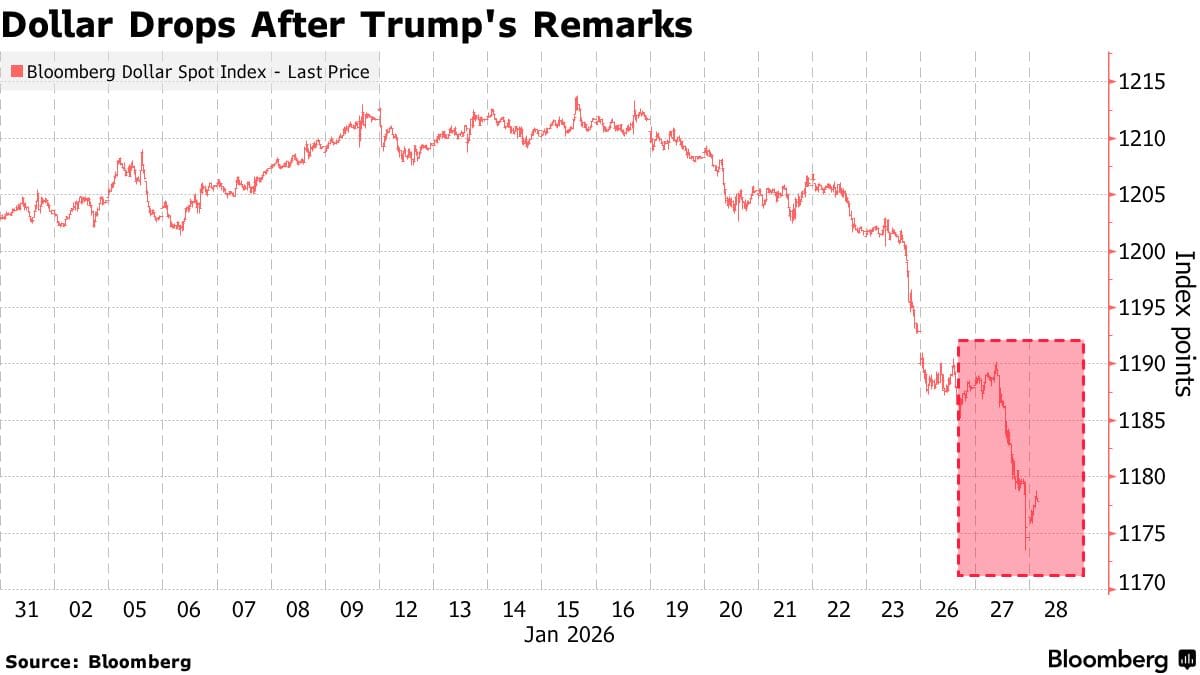

The dollar suffered its steepest drop since early 2022 after President Trump said he welcomed the currency's decline, calling it "great" for American business. The Bloomberg Dollar Index fell 1.2% in a single session, marking the most dramatic selloff since Trump's tariff announcements last April. This sharp move signals growing market anxiety about policy uncertainty and it further confirms our macro thesis of a weakening dollar fueling equity demand in early 2026.

Dollar Drops After Trump’s Remarks (Source: Bloomberg)

The dollar's weakness hasn't brought relief to bond markets, where long-term Treasury yields remain stubbornly elevated near 5% despite the Fed's rate cuts over the past year. This disconnect suggests investors are pricing in persistent inflation risks and mounting fiscal concerns rather than responding to easier monetary policy. Today's FOMC meeting, where the Fed is expected to hold rates steady, will be closely watched for Chair Powell's commentary on the policy path forward as markets anticipate only one or two more cuts this year.

Higher Longer-Term US Yields Since Fed Rate Cuts Began (Source: Bloomberg)

Against this backdrop of dollar weakness and policy uncertainty, gold has extended its historic rally to approach $5,300 per ounce after gaining roughly 60% in 2025. The precious metal is benefiting from geopolitical tensions, central bank diversification away from the dollar, and concerns about Fed independence. With analysts projecting continued ETF inflows and heightened macro uncertainty, gold's safe-haven appeal remains firmly intact.

Gold Extends Relentless Rally in 2026 (Source: Bloomberg)

Get the Edge Most Retail Traders Don’t Have

Become a paying subscriber of Sandman Research to get this post and all subscriber-only insights, trade setups, and macro intelligence used by top crypto traders.

Upgrade Now → Get Full AccessA subscription gets you:

- Clear Trade Setups for BTC & Altcoins: Step-by-step guidance with entry, stop, and take-profit levels so you can act confidently during market swings.

- Macro & Market Intelligence: Understand which macro events and liquidity shifts are moving crypto, so you’re never caught off guard by volatility.

- Exclusive ETF & On-Chain Flow Analysis: See capital movements and liquidation clusters before the crowd, giving you an edge in timing entries and exits.

- Altcoin & Sector Insights: Identify early rotation opportunities in high-potential sectors like AI-focused altcoins, without wasting time on dead projects.

- Actionable, Risk-Aware Playbooks: Convert research into actual trades with structured setups, technical breakdowns, and scenario-based strategies.