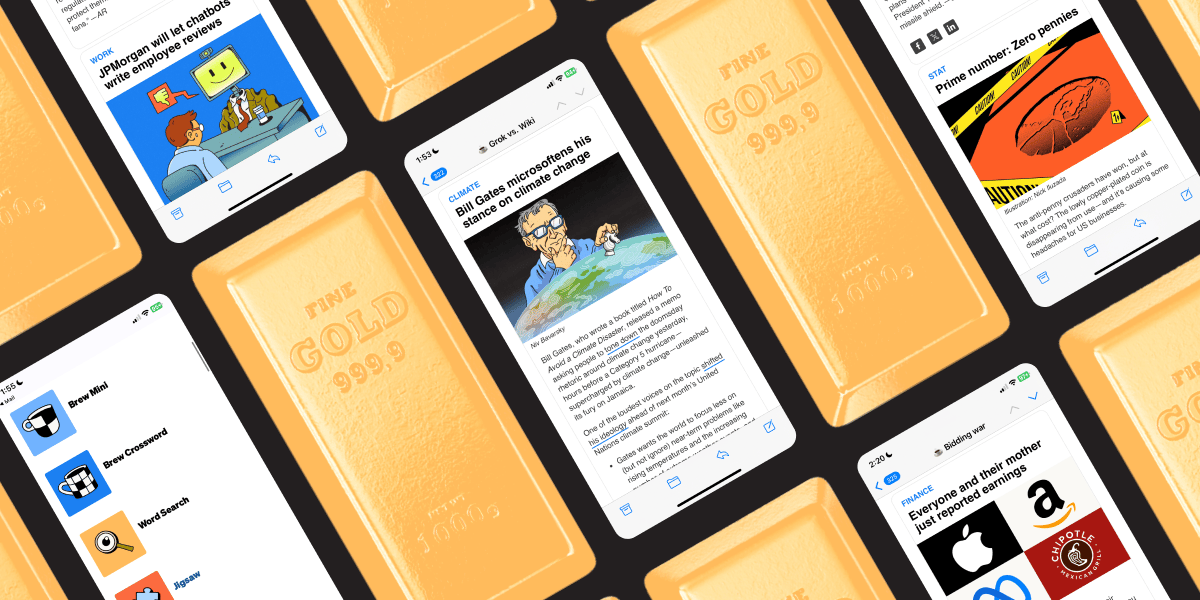

Business news worth its weight in gold

You know what’s rarer than gold? Business news that’s actually enjoyable.

That’s what Morning Brew delivers every day — stories as valuable as your time. Each edition breaks down the most relevant business, finance, and world headlines into sharp, engaging insights you’ll actually understand — and feel confident talking about.

It’s quick. It’s witty. And unlike most news, it’ll never bore you to tears. Start your mornings smarter and join over 4 million people reading Morning Brew for free.

Hey there, and happy Friday!

As we head into the final stretch of the year, markets are showing a growing divergence beneath the surface. Global equities continue to grind higher and print fresh record highs, while crypto markets remain under pressure, with Bitcoin trading decisively below its long-term trend and institutional participation fading. This week’s Friday report focuses on these fractures and what they mean for positioning as we approach 2026.

Here’s what we’ll cover today:

🌍 Market Recap & Macro Overview: Equities extend their rally as the S&P 500 and European markets hit new highs, supported by strong growth data and easing policy concerns. Crypto, however, continues to weaken technically, while silver posts explosive gains, highlighting a market environment where risk-on momentum and defensive hedging coexist.

📈 Bitcoin (BTC) Breakdown: Bitcoin remains stuck below the critical 88,800 level and below its 365-day moving average, consolidating between resistance and key support at 84,200. ETF flows were consistently negative, underscoring weak institutional demand as liquidation clusters build on both sides of price.

📊 Ethereum (ETH) Outlook: ETH continues to drift lower after failing to reclaim 3,059, trading between key levels while ETH/BTC remains pinned to the pivotal 0.03255 support. ETF flows stay muted, and positioning suggests traders are waiting on BTC direction before committing.

🚀 Solana (SOL) Analysis: SOL shows ongoing relative weakness versus Bitcoin after printing a fresh low on its BTC pair. Price remains capped below 130, with liquidation data pointing to rising volatility and reinforcing the case for a BTC-heavy, defensive posture until altcoins regain strength.

Let’s dive in 👇

Wall Street’s Morning Edge.

Investing isn’t about chasing headlines — it’s about clarity. In a world of hype and hot takes, The Daily Upside delivers real value: sharp, trustworthy insights on markets, business, and the economy, written by former bankers and seasoned financial journalists.

That’s why over 1 million investors — from Wall Street pros to Main Street portfolio managers — start their day with The Daily Upside.

Invest better. Read The Daily Upside.

🌍 Market Recap & Macro Overview:

Bitcoin continues to trade decisively below its 365-day moving average, a technical breakdown that has historically signaled weak momentum and increased risk of deeper corrective phases. This sustained weakness matters because it challenges the narrative of Bitcoin as a store of value during periods of macro uncertainty. It also highlights how fading institutional flows are directly impacting price action, with confidence failing to recover meaningfully since the October correction. Later in this report, we provide a full Bitcoin deep dive, including trading scenarios for the weekend ahead.

Bitcoin Trading Below 365-Day Moving Average (Source: Bloomberg)

In sharp contrast, the S&P 500 closed at 6,932 on Wednesday, extending its winning streak and posting a near 2% gain on the session. The index has advanced steadily since rebounding from an early-2025, tariff-driven pullback, as investors have largely shrugged off concerns around higher import duties following the administration’s rollback of its most restrictive measures. Strong macro data has reinforced this optimism, with revised Q3 GDP growth coming in at 4.3% and cooling labor costs supporting the view that the Fed has successfully engineered a soft landing. For investors, this reflects a market still willing to pay premium valuations for quality growth, even as inflation remains above the Fed’s 2% target.

S&P 500 Extends Winning Streak (Source: Bloomberg)

European equities followed suit, with the Stoxx 600 Index reaching a fresh record near 590. The move was driven in part by broad-based strength in banks and cyclical stocks. Adding to the positive tone, the ECB upgraded its 2025 growth outlook to 1.4% from 1.2%, signaling resilience in domestic demand despite ongoing manufacturing weakness. Meanwhile, the Bank of England’s December rate cut to 3.75% helped fuel a late rally in UK equities, further reinforcing the region’s risk-on momentum.

European Stocks Trade at Record Level (Source: Bloomberg)

Silver has emerged as one of the year’s standout performers, more than doubling from roughly $25 per ounce in early 2025 to above $70 by late December. The rally was supercharged by a historic short squeeze, accelerating gains in an already tight market. Behind the move lies a powerful mix of surging industrial demand tied to solar and EV production, aggressive speculative positioning amplified by retail participation, and a broader shift toward tangible assets as inflation expectations remain stubborn. Silver’s outsized performance relative to gold underscores how supply constraints and momentum-driven flows can generate extreme moves.

Silver Has More Than Doubled This Year (Source: Bloomberg)

As we head into the final days of 2025, markets are displaying a clear split personality: record highs in global equities, technical breakdowns in crypto, and explosive gains in select commodities. This divergence suggests investors are simultaneously embracing risk-on momentum while maintaining defensive hedges. Looking ahead to 2026, the central question is whether this gap resolves through a broader rally that eventually lifts crypto alongside traditional risk assets, or whether underlying cracks in sentiment deepen and force a more meaningful reassessment of valuations and portfolio allocations.

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

Get the Edge Most Retail Traders Don’t Have

Become a paying subscriber of Sandman Research to get this post and all subscriber-only insights, trade setups, and macro intelligence used by top crypto traders.

Upgrade Now → Get Full AccessA subscription gets you:

- Clear Trade Setups for BTC & Altcoins: Step-by-step guidance with entry, stop, and take-profit levels so you can act confidently during market swings.

- Macro & Market Intelligence: Understand which macro events and liquidity shifts are moving crypto, so you’re never caught off guard by volatility.

- Exclusive ETF & On-Chain Flow Analysis: See capital movements and liquidation clusters before the crowd, giving you an edge in timing entries and exits.

- Altcoin & Sector Insights: Identify early rotation opportunities in high-potential sectors like AI-focused altcoins, without wasting time on dead projects.

- Actionable, Risk-Aware Playbooks: Convert research into actual trades with structured setups, technical breakdowns, and scenario-based strategies.