Hello and happy Monday!

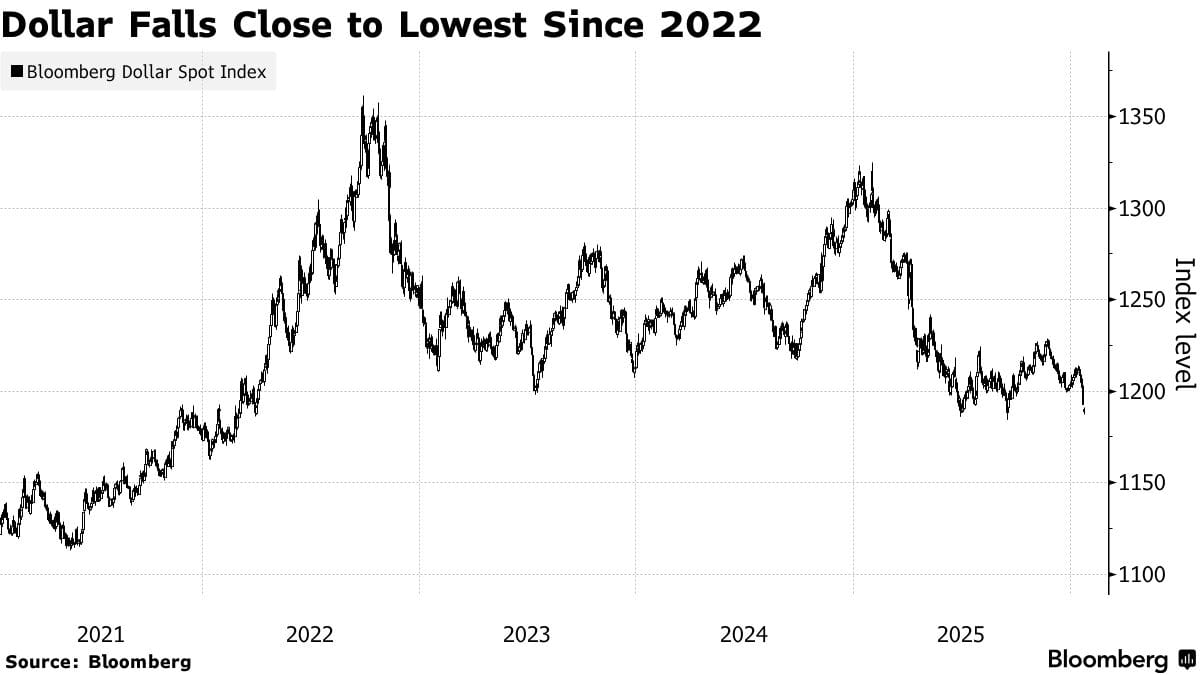

Erratic tariff headlines around Greenland, growing expectations for U.S. rate cuts, and rising speculation of coordinated currency intervention between the U.S. and Japan have combined to spark a sharp selloff in the dollar.

How will this impact Bitcoin, altcoins, and broader risk assets, and which levels should investors watch this week? This report breaks it all down with 10 key charts, actionable trade setups, and the scenarios most likely to shape market direction in the days ahead.

Here’s what we’ll cover today:

📈 Market Review: The U.S. dollar hits multi-year lows as tariff uncertainty, dovish Fed expectations, and currency intervention fears collide. We examine why this is important for risk assets, and why capital still refuses to rotate into small caps and altcoins despite improving conditions.

🔍 Current Market Conditions: Bitcoin sentiment has rolled back into extreme fear as price slips below key levels. ETF flows remain negative, signaling ongoing institutional caution. We analyze whether this weakness represents structural risk, or a late-stage shakeout ahead of a larger move.

👀 Key Events Ahead: All eyes turn to the Fed. With rates expected to remain unchanged, Powell’s tone will dictate direction across equities and crypto. We highlight the key signals markets will react to and how to position around elevated volatility.

📊 Technical Analysis: Key Bitcoin levels, liquidation clusters, and short-term bullish and bearish trading scenarios. We outline where reactions matter most and how to manage risk around a high-impact macro week.

🚀 Altcoin Insights: TOTAL3 and ETH/BTC sit at critical zones. We explain why altcoins remain vulnerable, where downside risks accelerate, and why selectivity and liquidity remain essential in the current environment.

Let’s dive in 👇

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

📈 Market Review:

The U.S. dollar just hit 97.09, its lowest level since 2022. Trump's erratic tariff threats over Greenland followed by sudden reversals, combined with fears of joint currency intervention between the U.S. and Japan after the New York Fed checked dollar/yen rates with dealers on Friday have triggered a sharp selloff. With markets pricing in more rate cuts this year than other major central banks, plus Trump expected to nominate a dovish Fed chair in May, the dollar's weakness looks set to continue. For crypto investors, this is crucial and serves as a strong bullish backdrop.

Dollar Falls Close to Lowest Since 2022 (Source: Bloomberg)

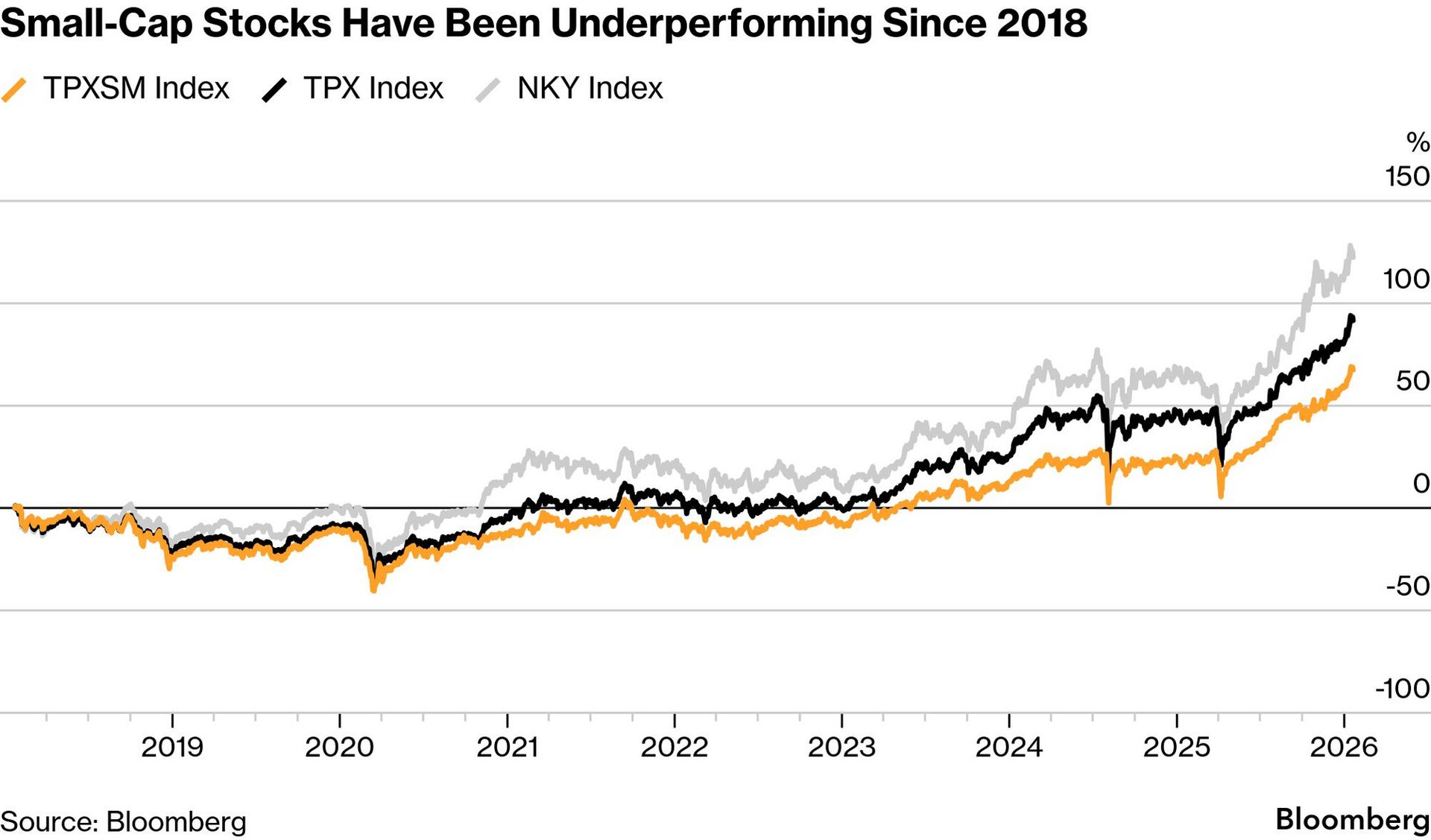

Yet despite this seemingly bullish backdrop, small-cap stocks continue lagging badly, the same pattern crushing altcoins right now. Bitcoin dominance sits near 59% with the CMC Altcoin Season Index at just 17, meaning 83% of altcoins underperformed Bitcoin, while major tokens like Solana dropped 34% through year-end 2025. Just as small-cap stocks trade at historically cheap valuations but can't attract capital, altcoins remain stuck in a liquidity desert where money refuses to rotate broadly despite occasional narrative-driven pumps in select tokens.

Small-Cap Stocks Have Been Underperforming Since 2018 (Source: Bloomberg)

The Magnificent 7 tech stocks are finally cracking, up just 0.5% this year while the broader S&P 500 climbed 1.8%, a dramatic reversal from their years of dominance. For the first time since 2022, the majority of the Magnificent 7 performed worse than the S&P 500, with Meta down 4.39% and Apple off 3.98% as investors question stretched valuations.

Rally by Mag 7 Stocks Has Faded in Recent Months (Source: Bloomberg)

The reason is simple: Mag 7 profits are expected to grow just 18% in 2026, barely faster than the 13% projected for the rest of the S&P 500. When Big Tech was doubling everyone else's growth, premium valuations made sense, but with that advantage now compressed to 5 percentage points, the case for concentration has collapsed.

Big Tech’s Earnings Advantage Is Narrowing (Source: Bloomberg)

The setup is clear: dollar weakness should fuel risk assets, earnings growth is normalizing across markets, and concentrated leadership in both stocks and crypto is showing cracks. But liquidity still hasn't rotated broadly, small caps and altcoins remain stuck despite improving conditions. The question for 2026 is whether this dollar weakness finally becomes the catalyst that breaks the concentration trade and sparks the broad-based rally that crypto investors have been waiting for, or if capital continues hiding in proven winners while everything else gets left behind.

🔍 Current Market Conditions:

Bitcoin sentiment has deteriorated meaningfully again, reversing the tentative recovery. The Crypto Fear & Greed Index has fallen back to 19 (extreme fear), down sharply from mid-January highs, as Bitcoin slipped below $86,000. This move signals that confidence has once again broken before it could fully re-establish, raising the risk that the recent bounce was corrective rather than the start of a durable trend.

Bitcoin Price Chart (Source: Tradingview)

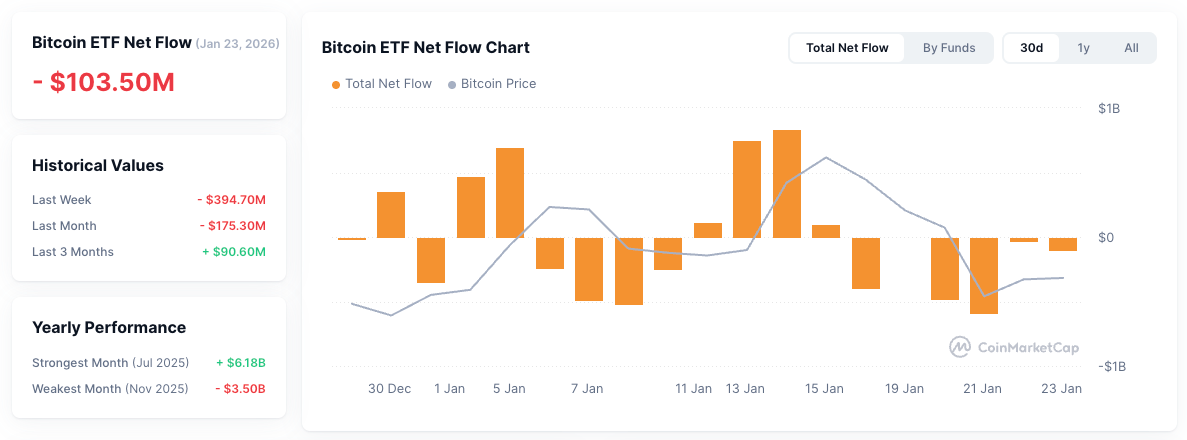

ETF flows reinforce this renewed fragility. Unlike the prior week’s brief stabilization, US spot Bitcoin ETFs recorded net outflows throughout the entire past week, indicating sustained institutional risk reduction rather than a single-event reaction. The lack of any meaningful dip-buying at these levels suggests that larger players remain cautious and unwilling to add exposure ahead of key macro uncertainty and the upcoming fed week, keeping downside pressure intact.

Bitcoin ETF Net Flow (Source: CoinMarketCap)

The takeaway for investors is defensive. Sentiment and flows are no longer stabilizing, they are actively weakening again. A recovery now requires a clear reversal in ETF flows and a stabilization in sentiment metrics. Absent that, the probability increases that Bitcoin revisits lower support zones rather than resuming its prior uptrend. This week’s macro events will be decisive in determining whether fear moderates, or deepens further.

👀 Key Events Ahead:

Markets enter the week focused on policy signals and earnings, with macro data acting as confirmation rather than the primary driver. Tuesday’s January Consumer Confidence will offer an early read on demand resilience. A weaker print would reinforce late-cycle concerns, while stability could help keep risk sentiment supported ahead of the Fed.

Wednesday is the pivotal event. The Fed is widely expected to hold rates unchanged, placing full emphasis on Chair Powell’s press conference. Markets will scrutinize any shift in language around inflation progress, labor market cooling, and the timing of eventual rate cuts. Acknowledgment that policy is sufficiently restrictive, or comfort with easing financial conditions, would be read as dovish and supportive for risk assets, including crypto. In contrast, resistance to early easing expectations or renewed inflation caution could trigger a broader risk-off move, with crypto likely to amplify equity reactions.

Friday’s December PPI will serve as an inflation cross-check ahead of the next CPI cycle. Softer producer prices would reinforce disinflation trends and support duration-sensitive and speculative assets; upside surprises would challenge rate-cut expectations.

Investor Implications: This is a Fed-driven volatility week. Direction hinges on Powell’s tone rather than the rate decision itself. A dovish read-through favors risk and crypto beta, while a firm stance risks position unwinds. Expect sharp moves around the press conference and prioritize reaction over anticipation.

🚨 Every week, we produce multiple in-depth reports, our Monday Market Report is the only free piece.

Upgrade to Full Research Access and get:

Complete market coverage across crypto, equities, and macro trends

Deep-dive analysis with 26+ extra charts each week

Long & short trading setups for Bitcoin and select altcoins

Exclusive insights trusted by top investors

Make smarter trades, optimize your portfolio, and grow and protect your capital. Upgrade today, your future self will thank you.

📊 Technical Analysis:

Bitcoin broke below the 88,800 technical level on Sunday and continued lower following a bearish retest. Price sold off to 86,000 after the breakdown, before rebounding to 88,300. Currently, BTC is trading around 87,500, with 88,800 now acting as resistance and the next lower technical level at 84,200 serving as the primary downside target and potential support.

Bitcoin Price Chart (Source: Tradingview)

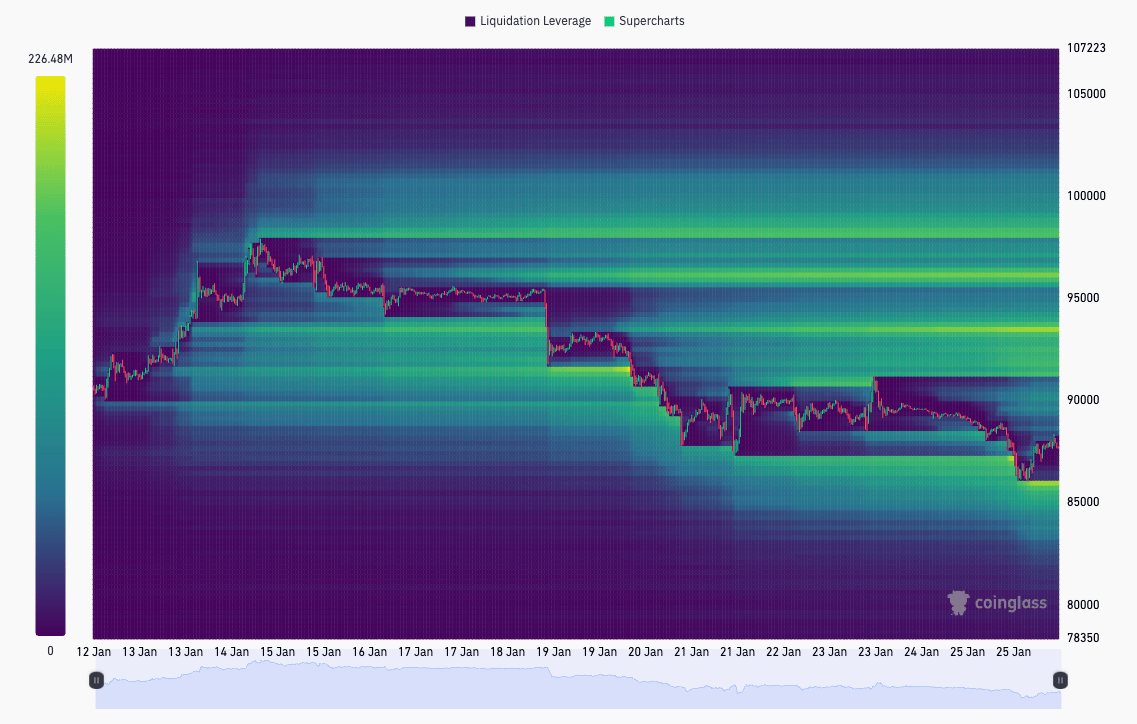

The two-week Bitcoin liquidation heatmap continues to show a higher concentration of leverage to the upside, favoring a potential recovery rather than immediate continuation lower. Notable liquidation clusters sit around 92,000 and extend up toward 100,000. On the downside, liquidation clusters remain just below recent lows near 86,000. With leverage stacked on both sides of current price and the FOMC meeting ahead this week, heightened short-term volatility is likely.

Bitcoin Liquidation Heatmap (Source: Coinglass)

Bullish Scenario

In the bullish case, Bitcoin shows early-week strength and reclaims the 88,800 level. Long setups become attractive after a successful bullish reclaim and retest, targeting 92,000, with invalidation on a loss of 88,800. A clean reclaim of 92,000 could open additional long opportunities on a bullish retest, targeting a move toward 95,000.

Bearish Scenario

In the bearish case, Bitcoin fails to reclaim 88,800 and is rejected at that level. Short setups may form on a confirmed bearish retest, targeting 84,200, with invalidation on a reclaim of the level. If 84,200 breaks, downside opens further, with Bitcoin likely seeking a fresh lower low within the broader structure. Additional short opportunities could emerge on a bearish retest, targeting 78,300, with invalidation on a reclaim of the broken level.

🚀 Altcoin Insights:

TOTAL3 also saw a sharp sell-off on Sunday, dropping more than 3.6% intraday. Price action respected key technical levels, with the move lower occurring after a failed reclaim and rejection at the 847B resistance. The market then found support at the 816B level, where selling pressure stalled. From there, TOTAL3 showed an initial bullish response, rebounding toward 833B. It now trades between these two key levels and remains rangebound until a decisive breakout occurs.

TOTAL3 (Source: Tradingview)

ETH/BTC edged higher over the weekend before rolling over alongside the broader market on Sunday, declining by roughly 2.9%. Importantly, the pair held above the 0.03255 support level after a clean retest and has so far produced a modest bullish reaction, currently trading near 0.03295. This level remains structurally significant: since being reclaimed in August last year, ETH/BTC has not sustained a move below it, aside from brief deviations. A confirmed break would likely signal a prolonged period of Ethereum underperformance, which historically translates into broader weakness across the altcoin market.

Ethereum / Bitcoin (Source: Tradingview)

Taken together, these dynamics suggest altcoins remain at a critical juncture. Many key metrics are sitting directly on support, where a failure would likely confirm continuation of the broader bearish structure. While sharp relief moves remain possible, sustained outperformance appears unlikely as long as geopolitical uncertainty and macro pressure persist. For now, positioning favors liquidity and selectivity, with Bitcoin as the core exposure and only a narrow group of high-cap altcoins offering relative safety. Lower-cap assets continue to carry elevated downside risk, with thin liquidity amplifying volatility in both directions.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.