Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Hello and happy Monday!

The U.S. dollar is searching for direction after a sharp 2025 decline, and U.S. manufacturing remains stuck in contraction. Against this backdrop, Bitcoin has shown renewed strength, pushing to new short-term highs and hinting at improving risk appetite.

This week may prove critical in determining whether these early signals develop into a more durable trend as we move deeper into 2026.

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

Here’s what we’ll cover today:

📈 Market Review: The dollar continues to consolidate as manufacturing remains in contraction, Japanese bond yields surge to multi-decade highs, and Bitcoin rallies above $93,000.

🔍 Current Market Conditions: Crypto sentiment remains cautious, despite Bitcoin’s rally. ETF flows turned decisively positive on Friday, reinforcing the importance of institutional participation.

👀 Key Events Ahead: Markets open reacting to the Venezuela situation, while ISM Manufacturing PMI, labor market data, and Friday’s Jobs Report will be closely watched.

📊 Technical Analysis: Bitcoin has successfully reclaimed the $90,000 level for the first time since mid-December. Upside liquidity has largely been cleared, while downside risk remains if momentum fades.

🚀 Altcoin Insights: TOTAL3 continues higher after reclaiming key resistance, but ETH/BTC weakness confirms that Bitcoin remains the primary leader.

Let’s dive in 👇

📈 Market Review:

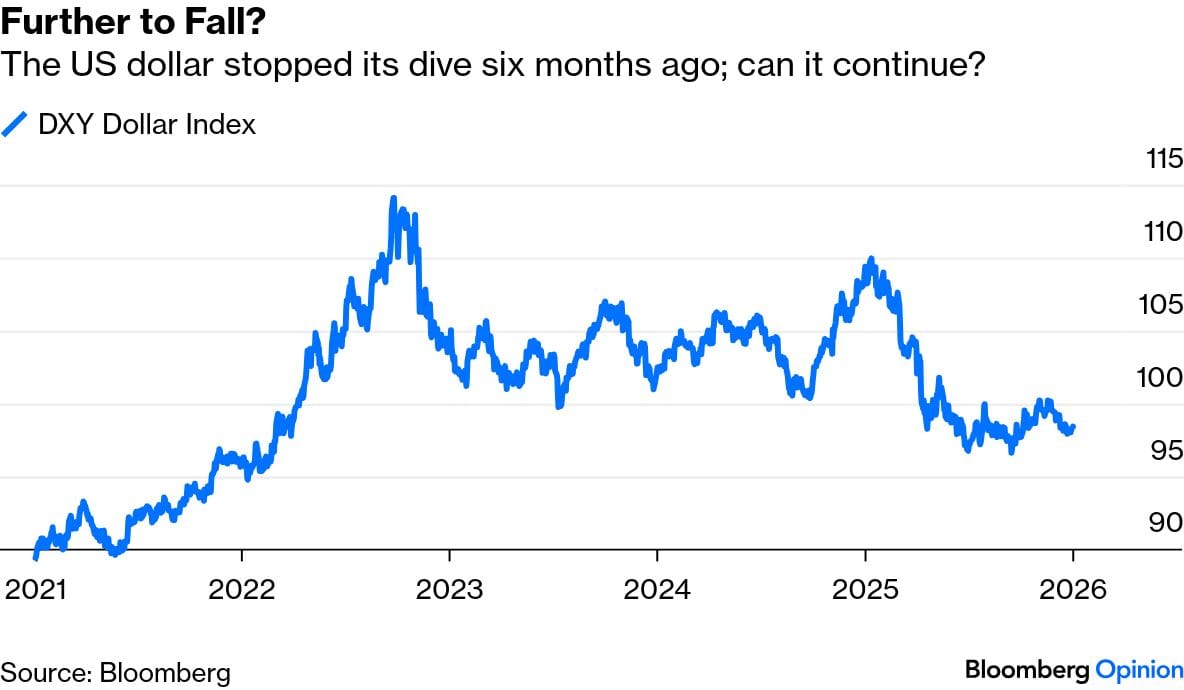

The Bloomberg Dollar Index continues to trade sideways just below 100 after a sharp decline from its 2025 peak near 110. The key question for investors is whether this downtrend has run its course or if further dollar weakness lies ahead. A softer dollar supports emerging markets, and risk assets, while easing pressure on dollar-denominated debt. However, any renewed hawkish shift from the Fed could quickly challenge this trend and stabilize the dollar.

Further to Fall? (Source: Bloomberg)

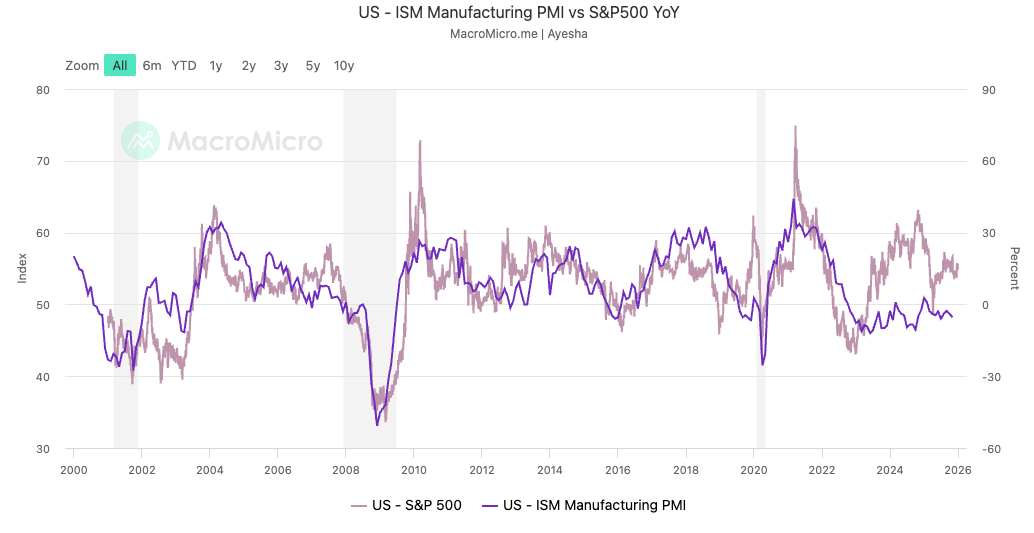

At the same time, U.S. manufacturing remains stuck in contraction. ISM Manufacturing PMI has failed to reclaim the 50 expansion level, even as the S&P 500 has posted positive year-over-year returns. Today’s release is expected to come in around 48.3–48.4, little changed from December’s 48.2, highlighting the ongoing weakness in industrial activity. This divergence underscores how heavily markets are relying on services and technology growth. While this raises questions around valuation sustainability, it is notable that 56% of surveyed manufacturing executives expect revenues to improve in 2026, pointing to optimism for a second-half recovery despite current softness.

US ISM Manufacturing PMI vs S&P500 YoY (Source: MacroMicro)

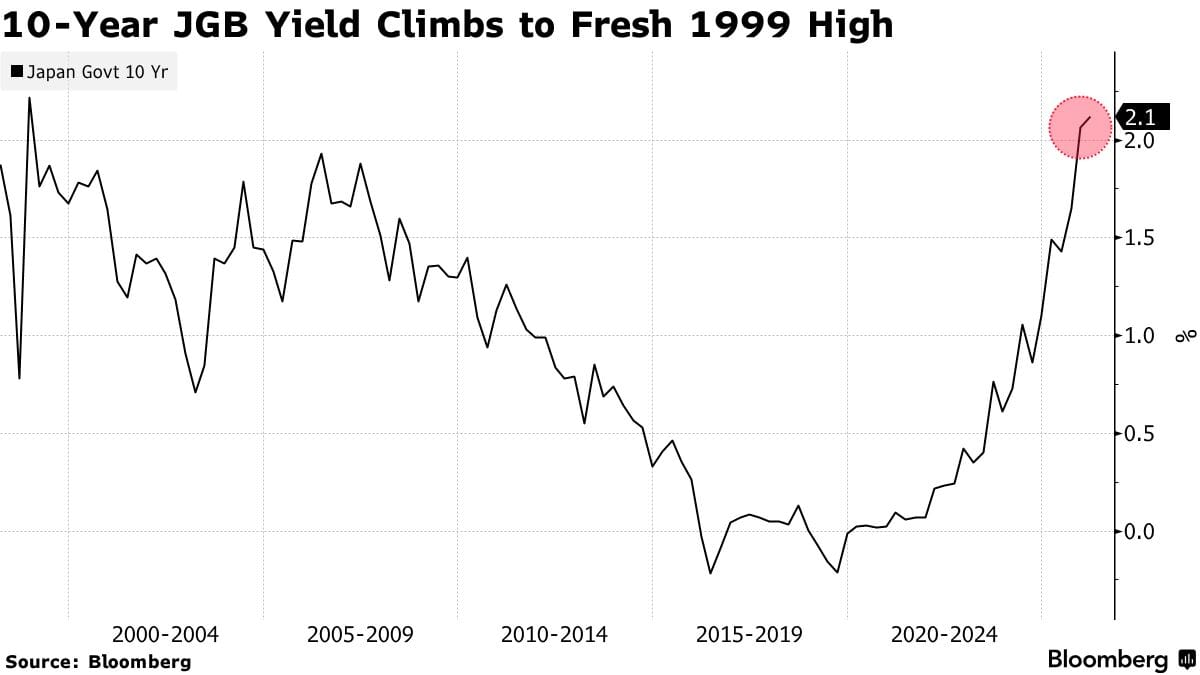

Adding to the global macro shift, Japanese government bond yields have surged to levels last seen in 1999, with the 10-year JGB reaching 2.1%. This move signals a clear departure from decades of ultra-loose policy by the Bank of Japan. Rising yields are strengthening the yen and may force Japanese institutional investors to reassess their large overseas allocations. More broadly, this development highlights growing pressure on highly indebted sovereigns.

10-Year JGB Yield Climbs to Fresh 1999 High (Source: Bloomberg)

Against this backdrop, risk appetite is showing early signs of revival. Bitcoin has rallied to a three-week high above $93,000, rebounding sharply from its December 31 close below $88,800. The move suggests that bearish positioning late last year may have been overextended. Beyond crypto, Bitcoin often acts as a barometer for liquidity and investor risk appetite, making this rally relevant for broader markets. We explore Bitcoin’s technical setup in more detail later in today’s report.

Bitcoin Touches 3-Week High on Renewed Investor Demand (Source: Bloomberg)

Overall, the early weeks of 2026 are defined by uncertainty and realignment: a dollar searching for direction, manufacturing data stuck in contraction, a historic shift in Japanese bond markets, and renewed risk-on behavior led by crypto. Whether these forces begin to align or continue to diverge will be critical for asset allocation decisions, as the interaction between currencies, rates, and risk sentiment is likely to drive performance in the months ahead.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

🔍 Current Market Conditions:

Despite Bitcoin’s strength over the weekend, the Crypto Fear & Greed Index remains in fear territory, currently at 27. A move back toward neutral would help confirm that the recent reset in both sentiment and price action is gaining traction. However, if Bitcoin fails to hold current price levels and sentiment remains stuck in fear, this would increase the risk of further downside and deeper corrections as we move into 2026.

Crypto Fear and Greed Index (Source: Coinglass)

ETF flows remain a key driver. While flows were mixed to negative for most of last week and occurred on relatively low volume, sentiment shifted meaningfully on Friday. U.S. spot Bitcoin ETFs saw $471 million in net inflows, providing a clear confidence boost. This inflow helped support price over the weekend, allowing Bitcoin to reclaim higher levels and hold above the $90,000 supply zone.

Bitcoin ETF Net Flow (Source: CoinMarketCap)

As the new trading week begins, ETF flows will be critical to monitor. U.S. markets are reopening with investors also reacting to developments around Venezuela, making early-week positioning especially important. If spot ETF inflows remain positive, they could reinforce the bullish momentum established on Friday. As highlighted repeatedly, Bitcoin remains highly dependent on traditional investor participation at this stage of the cycle, with sustained ETF inflows acting as a key confirmation signal.

👀 Key Events Ahead:

This week’s macro calendar becomes more active, with a strong focus on growth and labor market data that will shape expectations around monetary policy and overall risk sentiment as we start off the new year.

Markets open today reacting to the Venezuela situation, following U.S. military action and the arrest of President Maduro. The key question will be how risk assets, energy markets, and safe havens price in this geopolitical shock, particularly given relatively thin liquidity. Also on Monday, December ISM Manufacturing PMI data will provide an important read on U.S. industrial activity, as explained in the macro section.

Wednesday brings important labor market signals with December ADP employment data and November JOLTS Job Openings. Together, these releases will help assess hiring momentum and labor demand. Further cooling would reinforce the disinflation trend, while resilience could pressure rate-cut expectations.

Friday is the key event of the week with the December Jobs Report. Payroll growth, unemployment, and wage growth will be closely watched, with any meaningful surprise likely to drive volatility across rates, equities, and crypto markets. The week concludes with January Michigan Consumer Sentiment data, offering an early read on consumer confidence and inflation expectations as the new year gets underway.

🔒 Important Update for the New Year

The Monday Market Report will remain free. Starting in the new year, Wednesday and Friday reports will move fully private and be available exclusively to paid subscribers.

Full Research Access gives you complete market coverage, deep-dive analysis, and exclusive insights trusted by top investors, for the best price currently.

Make smarter trades, improve portfolio decisions, and stay ahead of the crowd. Upgrade now, your future self will thank you.

📊 Technical Analysis:

Early this morning, Bitcoin broke above the key $90,000 technical level and pushed as high as $93,300 before pulling back. Price is currently trading around $92,900, after briefly retesting $92,000. This is a crucial development, as every previous attempt to reclaim the $90,000 area since December 12 has failed. BTC now needs to show decisive strength, with the next key upside level at $95,000, which was lost in November.

Bitcoin Price Chart (Source: Tradingview)

The two-week Bitcoin liquidation heatmap shows that upside leverage has largely been cleared by the recent move higher, presenting a more cautious setup. There is currently very little liquidation leverage remaining above price, while a notable cluster has formed around $86,300, extending down toward $83,000. It remains to be seen whether price can continue higher or if it will target lower levels again.

Bitcoin Liquidation Heatmap (Source: Coinglass)

Bullish Scenario:

In the bullish case, Bitcoin starts the week with strength and continues higher toward the next key technical level at $95,000. Long setups become attractive on a successful retest of $92,000, targeting $95,000, with invalidation if price loses $88,800. If BTC reclaims $95,000, additional long opportunities may emerge on a bullish retest, targeting the next higher level at $98,800.

Bearish Scenario:

In the bearish case, Bitcoin fails to reclaim $95,000 and faces rejection at that level. Short setups may form on a confirmed bearish retest, targeting $92,000, with invalidation if price reclaims the entry. Should $92,000 break, downside opens up again, offering short opportunities toward $88,800.

🚀 Altcoin Insights:

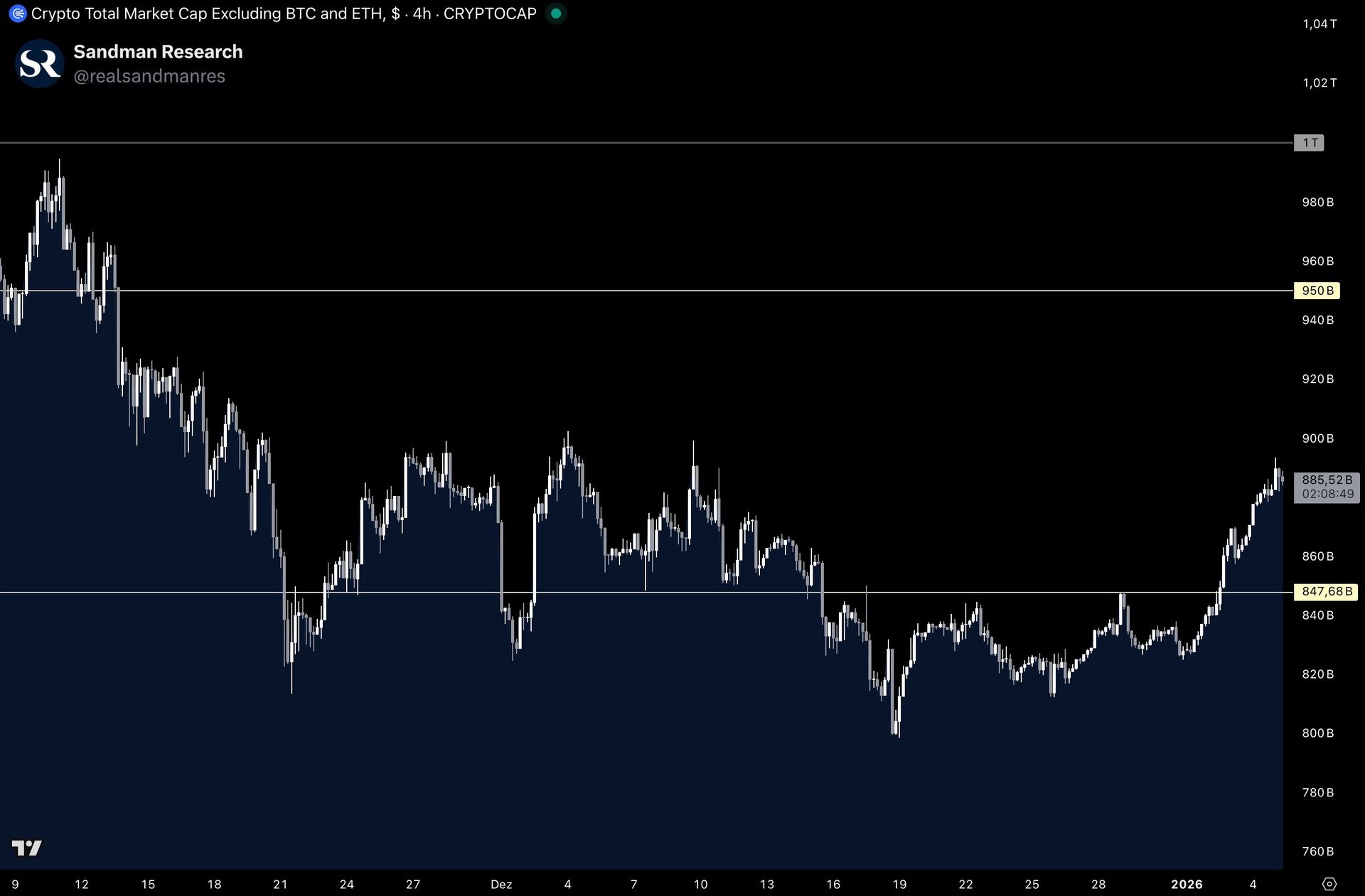

TOTAL3 also showed strength over the weekend, moving higher alongside Bitcoin. The metric is currently sitting around 885B, extending its move from the 847B level, which it successfully reclaimed on January 2. This level is crucial to hold, as it acted as resistance throughout the second half of December and TOTAL3 was previously unable to reclaim it. The next higher target for TOTAL3 sits at 950B.

TOTAL3 (Source: Tradingview)

Ethereum/Bitcoin moved lower from Friday and continued to weaken over the weekend, confirming that Bitcoin led the recent move higher. While Ethereum did rise against the dollar, it underperformed relative to Bitcoin. This behavior is typical in early risk-on phases and reinforces that altcoins are not yet strong enough to take the spotlight.

Ethereum / Bitcoin (Source: Tradingview)

If this trend continues, it fits well with the framework outlined in our Q1 watchlist. The first quarter may not yet be the phase where altcoins outperform, but rather a period to position selectively ahead of the next regime shift. This favors disciplined and defensive exposure to strong projects and established leaders, allowing Bitcoin to regain strength before a broader rotation into higher-beta assets. That said, we remain cautious, as a meaningful shift in market structure has not yet been confirmed.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.