Good Morning and welcome to a new week!

In today’s report, we delve into the implications of these developments on the crypto market, analyze the latest Bitcoin price action, and highlight the technical, macroeconomic, and on-chain factors shaping the current landscape.

Here’s what we’ll cover today:

📈 Market Review: A review of last week’s price action and key events in traditional markets and crypto.

🔍 Current Market Conditions: Market Sentiment Check and Deep Dive into important data.

👀 Key Events Ahead: Upcoming macroeconomic influences, and potential catalysts.

📊 Technical Analysis: Key technical levels, areas of interest, and trade scenarios for the week ahead.

🚀 Altcoin Insights: Notable performers, sector strength, and potential catalysts.

Let’s dive in!

📈 Market Review:

Markets continue to exhibit mixed signals as we enter June, with digital assets showing resilience while traditional fixed income faces structural headwinds. Here's what the charts are telling us.

Despite some early June selling, Bitcoin is holding steady above the key psychological level of $102,000. On-chain data shows continued institutional interest, with large holders (those owning between 100 and 1,000 BTC) adding about 122,330 BTC in recent weeks. The 4-hour chart shows a period of sideways consolidation, with Bitcoin maintaining strong support around $106,000. Although volatility has eased from recent highs, the asset seems to be forming a base that could support potential upside moves. For a detailed look at Bitcoin and our trade setups, see the technical analysis section.

Volatility Concentrated in Super-Long Bonds (Source: Bloomberg)

The Treasury market presents a more concerning picture. Thirty-year bond volatility remains elevated above 20%, a level that historically signals significant market stress. With 30-year yields pushing above 5% for the first time since 2007, we're observing what may be a structural shift in the fixed income landscape.

For investors, it may mean that traditional portfolios need to adapt and we could see more institutional capital rotating into alternatives like Bitcoin and other cryptocurrencies.

Global Stocks Hit First Record Since February (Source: Bloomberg)

The MSCI ACWI, which tracks global equities, has rebounded to new highs since February after a sharp policy-driven dip in April. This bounce came alongside a partial rollback of proposed tariffs, which helped ease some of the uncertainty weighing on risk assets.

Still, the speed of both the selloff and recovery shows how sensitive markets remain to political headlines. Elevated political risk could continue to impact market behavior in the months ahead.

US Job Market Moderated Only Gradually in May (Source: Bloomberg)

U.S. labor data shows continued moderation with May payrolls adding 139,000 jobs after downward revisions to prior months. The unemployment rate holds steady around 4.2%, while prime-age participation rates remain stable. This data supports the view of a gradually cooling labor market rather than an abrupt deterioration.

That’s important, as it gives the Federal Reserve more flexibility in managing interest rates without risking a hard landing.

🔍 Current Market Conditions:

Following the recent correction in the crypto market, the Fear and Greed Index has also cooled off. After spending a prolonged period in “greed” territory, indicating an overheated market, the index has now reset to a neutral reading of 55. This shift suggests that market sentiment has normalized, potentially laying the groundwork for a more sustainable and healthy upside.

Crypto Fear and Greed Index (Source: Coinglass)

At the same time, total net inflows into Bitcoin spot ETFs have turned negative in recent days, with notable outflows marking the start of the month. The key question now is whether renewed demand will return quickly enough to support a rebound in price, or if this signals the beginning of a deeper correction.

While we currently lean toward the former, expecting demand to stabilize and support further gains, the situation warrants close monitoring.

Total Bitcoin Spot ETF Net Inflow (Source: Coinglass)

The chart from Bloomberg shows the European Central Bank’s revised inflation forecasts through 2027. Notably, the ECB now expects inflation to fall even further below its 2% target in 2026, with the updated (blue line) forecast dipping below previous estimates (white line).

ECB Sees Inflation Even Further Below Target in 2026 (Source: Bloomberg)

This downward revision signals a weaker inflation outlook and suggests the ECB may maintain looser monetary policy for longer than previously anticipated. For Bitcoin and Crypto, this could be a constructive signal.

Persistently low inflation reduces pressure on central banks to tighten policy aggressively, potentially supporting liquidity conditions and further strengthening our bullish thesis.

👀 Key Events Ahead:

This week brings several key events for markets, starting with renewed U.S.–China trade talks on Monday, which could influence investor sentiment and policy outlooks. On Wednesday, all eyes will be on the release of U.S. CPI inflation data, a critical indicator for assessing the Federal Reserve’s next steps. This is followed by Thursday’s PPI inflation data and the latest initial jobless claims, offering additional insights into inflation pressures and labor market conditions. The week wraps up on Friday with the University of Michigan’s consumer sentiment report and inflation expectations survey, both of which serve as important measures of household outlooks and future price expectations.

US Consumer Prices Picking Up on Tariffs Spillover (Source: Bloomberg)

Core consumer prices have been in a clear disinflationary trend since mid-2022. The monthly changes peaked around 0.6% in June 2022 and have steadily declined to much lower levels by 2024. The May 2025 Bloomberg survey forecast shows approximately 0.3% month-over-month, which represents a continuation of the overall disinflationary pattern.

This suggests underlying price pressures have moderated significantly from the 2022 highs, though the chart notes that tariff spillover effects may be starting to influence the underlying inflation gauge.

Bitcoin (white) and Global M2 (blue) (Source: Tradingview)

The early June selloff from ~$110k to $102k perfectly aligns with our 10-week leading M2 framework. The M2 money supply contractions in late March/early April predicted this correction with remarkable accuracy. More importantly, M2 growth began accelerating in mid-April, which suggests significant Bitcoin strength into late June and July.

If this correlation continues to hold, we could see Bitcoin surging toward the $120k area by end-Q3 2025. This would be driven by traditional macro liquidity factors rather than crypto narratives, reflecting Bitcoin's evolution into a monetary asset.

📊 Technical Analysis:

Now that we’ve covered the key macro drivers and current sentiment shifts, it’s time to zoom in on what really matters for traders this week: Bitcoin’s price action.

In the following section, we break down the current technical setup and share our trade scenarios for both the bullish and bearish case.

Price is at a pivotal level, and the next move could unfold fast.

Bitcoin is currently hovering around the key technical level of $106,000, after rising sharply from the key support at $102,000 on Friday. Price action is now at a critical juncture, and a decisive move appears likely. We could either see a retest of the $102,000 level or a swift break above $106,100, which would open the door for a push toward all-time highs.

Bitcoin Price Chart (Source: Tradingview)

The Bitcoin two-week liquidation heatmap currently favors the upside, which also aligns with the previously discussed M2 correlation thesis, suggesting potential for further gains. Most major liquidation clusters lie above the current price, with significant levels at $106,900 and around $110,000. However, it's worth noting a small cluster is forming to the downside near the $100,000 mark.

Bitcoin Liquidation Heatmap (Source: Coinglass)

Bullish Scenario: In a bullish case, we want to see price break and hold above the $106,100 resistance. A clean flip and bullish retest of this level would confirm continuation of the broader uptrend that began in April. This setup would target all-time highs, with potential extension toward the $120,000 region. Long positions become attractive on a confirmed flip and hold above $106,100, with invalidation if price drops back below. The next key take-profit zone is at $109,300.

Bearish Scenario: In a bearish outcome, Bitcoin fails to break above $106,100 and turns lower, likely retesting the $102,000 support. A confirmed rejection at $106,100 followed by a bearish retest would present a short opportunity, with invalidation if price reclaims the level. Initial targets lie at $103,500, with a deeper move aiming for $102,000.

🚀 Altcoin Insights:

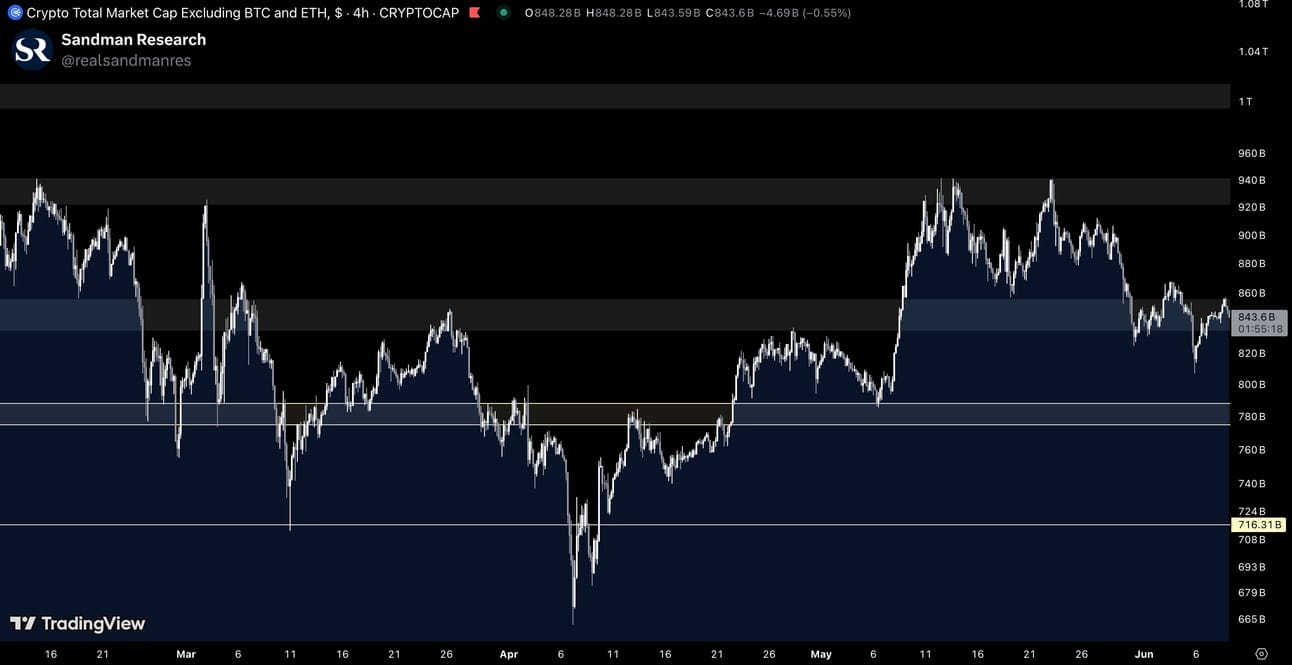

After an attempt to break through the resistance around 940B, the TOTAL3 altcoin market cap index has seen a significant pullback over the past few days, currently sitting at support around 840B once again. This suggests that altcoin holders will still need to remain patient before seeing meaningful sector outperformance and sustained parabolic upside.

We believe the macroeconomic and geopolitical environment plays a role here, as ongoing uncertainty is keeping many investors from moving aggressively into risk-on assets.

TOTAL3 Altcoin Index (Source: Tradingview)

That said, we continue to expect that the time for altcoins to shine will come, especially as major global macro indicators and financial conditions gradually ease and point toward expansion later in the year. In the meantime, it remains worthwhile to monitor high-potential projects and possible outperformers in order to be well-positioned once market sentiment shifts and altcoins begin to lead again.

More on the altcoin market and our current positioning in Wednesday’s Altcoin Market Report.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

If you want to stay ahead of the curve with in-depth analysis and real-time updates, make sure to subscribe to Premium Research for even more insights - you won’t want to miss what’s coming next!

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.