Good Morning and welcome to a new week!

In today’s report, we delve into the implications of these developments on the crypto market, analyze the latest Bitcoin price action, and highlight the technical, macroeconomic, and on-chain factors shaping the current landscape.

Here’s what we’ll cover today:

📈 Market Review: A review of last week’s price action and key events in traditional markets and crypto.

🔍 Current Market Conditions: Market Sentiment Check and Deep Dive into important data.

👀 Key Events Ahead: Upcoming macroeconomic influences, and potential catalysts.

📊 Technical Analysis: Key technical levels, areas of interest, and trade scenarios for the week ahead.

🚀 Altcoin Insights: Notable performers, sector strength, and potential catalysts.

Let’s dive in!

📈 Market Review:

Last week, financial markets showed notable resilience, pushing higher even as tensions between the U.S. and China remain elevated. The S&P 500 continued its impressive rally, closing at $5,686.66, fueled primarily by the strength of the tech sector.

However, the market's upward movement resembled a rollercoaster, with sharp surges followed by brief pullbacks, indicating a sense of nervous optimism rather than unwavering confidence in the sustainability of this trend.

Rollercoaster Roundtrip for Stocks (Source: Bloomberg)

This market resilience seems increasingly out of step with the growing geopolitical and economic risks. Recession fears have risen sharply, yet stock prices have largely ignored these signals, continuing their upward trajectory. Investors appear to be turning a blind eye to broader macroeconomic concerns, preferring to focus on high-growth sectors, particularly those driven by AI, such as Nvidia and Microsoft.

In contrast, Apple has shown relative weakness, weighed down by its significant exposure to China.

Recession Expectations Based On MLIV Pulse Survey (Source: Bloomberg)

One of the key concerns facing global markets is the escalating trade tension between the United States and China. The tariff hikes imposed by the U.S. have already begun to disrupt shipping volumes, and sentiment among businesses suggests that the economic consequences are underappreciated by financial markets. Retailers, manufacturers, and logistics firms are starting to issue warnings about supply disruptions and margin pressures, as goods from China become more expensive and harder to source.

The potential for these frictions to spill over into the broader economy is significant, particularly if they begin to weigh on consumer spending and corporate investment.

Big Tech Passes the Earnings Test (Source: Bloomberg)

Beneath the surface, the tech sector continues to exert a disproportionate influence on the broader market, driving indices higher despite signs of weakening fundamentals in other areas.

Volatility remains elevated, and any further deterioration in U.S.-China relations could shake investor confidence. For now, however, markets appear to be caught in a delicate balancing act, with momentum pushing higher even as macroeconomic realities loom in the background.

Number of Ships Headed to the US Sinks (Source: Bloomberg)

Recent data shows a stark decline in container ships departing Chinese ports for the United States, with volumes down approximately 40% from this year's peak. This shipping reduction may indicate weakening US consumer demand, inventory adjustments by retailers, evolving global supply chains, or possibly early signs of broader economic deceleration.

These shipping metrics offer valuable insight into real-time trade dynamics that often precede official economic reports and could influence retail sector performance in coming months. The data specifically tracks dry cargo vessels on a 15-day rolling average basis, providing a timely window into trade patterns between the world's two largest economies.

Now let’s dive into the part you’re really here for: the charts, key levels, trade scenarios and what’s next for crypto. 🔥

Data-driven analysis and unparalleled market intelligence, exclusively at Sandman Research.

🔍 Current Market Conditions:

The Crypto Fear & Greed Index, a sentiment indicator we’ve been consistently monitoring, offers an objective gauge of market psychology based on factors like volatility, volume, social media activity, and market momentum.

The latest reading stands at 52, reflecting a neutral sentiment among market participants. This follows a sharp dip to 10 in February, marking the lowest level of fear since the depths of the 2022 bear market.

Crypto Fear and Greed Index (Source: Coinglass)

Such a dramatic shift from extreme fear to neutrality suggests the market has undergone a healthy sentiment reset, which could serve as an early signal of renewed strength and the potential beginning of a broader expansion phase.

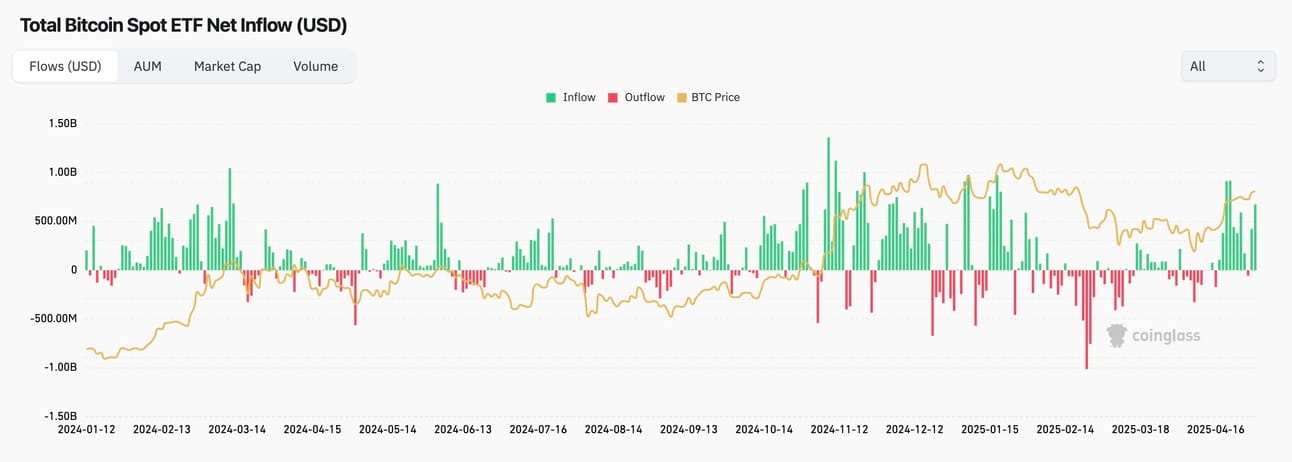

Total Bitcoin Spot ETF Net Inflow (Source: Coinglass)

A notably positive development has been the total Bitcoin spot ETF inflows over the past week, which have remained consistently strong and positive, with just a single day of minor outflows on Wednesday.

Historically, these ETF flows tend to occur during price rallies, sustained inflows often go hand in hand with Bitcoin trending higher, as shown in the attached chart.

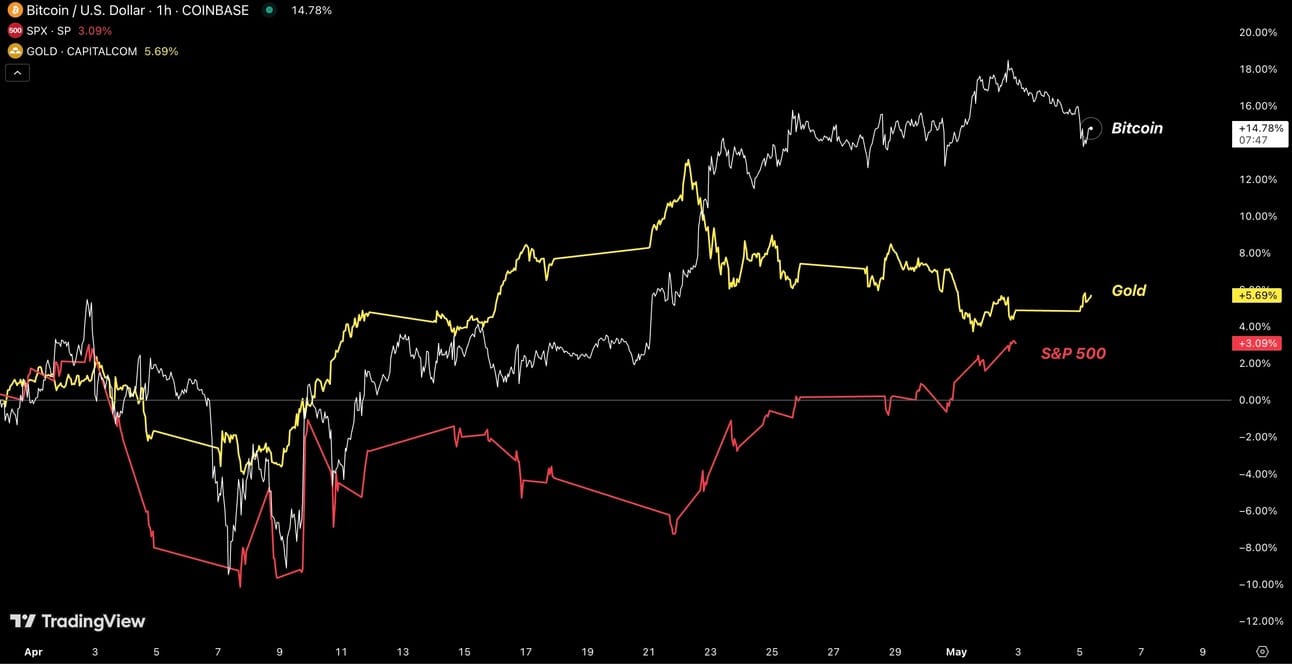

Bitcoin outperforming Gold and the S&P 500 in April (Source: Tradingview)

Compared to traditional assets like the S&P 500 index or gold, Bitcoin has delivered the strongest performance throughout April, posting gains of over 14%, while gold and the S&P 500 clearly lagged behind, failing to recover as much.

Given the persistent positive inflows, this could signal that Wall Street is beginning to recognize Bitcoin’s role as digital gold and a hedge against inflation and economic uncertainty.

👀 Key Events Ahead:

This week’s key focus is the upcoming FOMC meeting on Wednesday, where the Federal Reserve will announce its policy decision, followed by a press conference with Jerome Powell that could have significant market implications. Earlier in the week, on Monday, the ISM Services PMI will provide insight into the strength of the U.S. services sector. Then on Thursday, the market will closely watch the release of initial jobless claims, which will offer fresh data on the state of the labor market.

The ISM Services PMI is a monthly report that shows how the U.S. services sector is performing, this includes industries like finance, healthcare, and retail. It’s considered a leading indicator of the business cycle because it reflects how businesses are feeling about the economy. If the number is above 50, it signals growth; below 50 means contraction. When the ISM trends down over time, it can suggest the economy is slowing, possibly heading toward a recession. If it's rising, it may point to economic expansion ahead. Investors watch it closely to gauge where we are in the cycle, growth, slowdown, or recovery.

Our stance remains bullish, and while we may see this metric contract in the next few readings, we expect it to begin trending higher again, moving back above 50 and eventually toward the 60 range.

Target Rate Probabilities for 7 May 2025 Fed Meeting (Source: CME FedWatch)

The CME FedWatch Tool estimates the probability of future Federal Reserve interest rate decisions by analyzing 30-Day Fed Funds futures prices, which reflect market expectations for the average daily Effective Federal Funds Rate (EFFR) in each month. It assumes rate changes occur in 25 basis point increments and calculates probabilities by comparing expected rate changes to these increments, producing a binary tree of potential FOMC outcomes.

Currently, the tool shows a 98.8% probability that the Fed will leave interest rates unchanged at the upcoming meeting, despite public pressure from President Donald Trump for rate cuts. This decision reflects the Fed's cautious approach amid persistent inflation and a solid labor market, as evidenced by the recent addition of 177,000 jobs in April.

Solid US Jobs Numbers Reinforce Fed’s Holding Pattern (Source: Bloomberg)

While inflation has shown signs of easing, the tariffs imposed by the Trump administration introduce uncertainty regarding future price stability. The Fed aims to balance the risks of inflation against potential economic slowdown, opting to hold rates steady while monitoring economic indicators closely.

📊 Technical Analysis:

Bitcoin started the week trading sideways below the $95,000 resistance, holding firm until it broke out and pushed higher on Thursday. It reached a high of $97,920 on Friday, where price was rejected and reversed. From that point, it sold off throughout the weekend and into the start of the week, ultimately closing the weekly candle back below the key $95,000 level.

Early this morning, price bounced off $93,700, a level that acted as support last week and was tested multiple times before the breakout above $95,000. Bitcoin is currently trading at $94,680.

Bitcoin Price Chart (Source: Tradingview)

The 3-day Bitcoin liquidation heatmap shows leveraged positions fairly evenly distributed, with major liquidity clusters to the upside around $98,700, just under a significant key level that remains untested, and to the downside just below the recent low near $93,000.

Bitcoin Liquidation Heatmap (Source: Coinglass)

Bullish Scenario: In a bullish scenario, we’d want to see Bitcoin resume its upward trend, reinforcing the recently formed uptrend and framing the weekend selloff as a higher low formation. For this to play out, price needs to reclaim $95,000 quickly and trend higher, potentially targeting resting liquidity on the heatmap and the key level around $98,800. Long setups become attractive on a bullish retest following a reclaim of $95,000, with invalidation if price fails to hold above that level. The previous high at $97,900 and the $98,800 key level offer logical profit-taking zones.

Bearish Scenario: In a bearish case, Bitcoin fails to reclaim $95,000 and continues to decline, potentially invalidating the lower timeframe bullish market structure and revisiting the major support around $92,000. Short setups would be valid on a bearish retest of $95,000, with trade invalidation if price manages to reclaim that level.

🚀 Altcoin Insights:

Altcoins have shown clear signs of relief and began stabilizing throughout April as well, following the sharp sell-off triggered by the tariff news. They posted strong gains at the start of the month, with the TOTAL3 altcoin index rising over 26% in just 21 days.

After that surge, the TOTAL3 managed to hold above a major key level and has since traded mainly sideways between $790B and $830B.

TOTAL3 Altcoin Index (Source: Tradingview)

While Bitcoin and select strong altcoins have recently managed to shift market structure and invalidate their bearish trends, the TOTAL3 index, and by extension, the altcoin market as a whole, has yet to do so, as it continues to trade within a higher timeframe downtrend. For a shift toward further and sustained upside in the altcoin market, we’d like to see the TOTAL3 break above the previous lower high at $850B and reclaim that level, potentially setting the stage for bullish trend continuation.

We’ll go over this and other metrics in depth in Wednesday’s dedicated Altcoin Market Report, where we cover the entire altcoin market and one community-requested altcoin.

Make sure to submit your chart requests via email or on X, and subscribe to our newsletter to receive all future updates directly in your inbox.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

If you want to stay ahead of the curve with in-depth analysis and real-time updates, make sure to subscribe to Premium Research for even more insights - you won’t want to miss what’s coming next!

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.