Good Morning and welcome to a new week!

Bitcoin faces a challenging market landscape as we kick off a new trading week, with Trump’s tariffs set to take effect on April 2nd adding to macroeconomic uncertainty. In today’s report, we’ll dive into the latest price movements, critical technical levels, and the key on-chain and macroeconomic factors shaping the market.

Here’s what we’ll cover today:

📈 Market Review: A review of last week’s price action and key events in traditional markets and crypto.

🔍 Current Market Conditions: Market Sentiment Check and Deep Dive into important data.

👀 Key Events Ahead: Upcoming macroeconomic influences, and potential catalysts.

📊 Technical Analysis: Key technical levels, areas of interest, and potential scenarios for the week ahead.

🚀 Altcoin Insights: Notable performers, sector strength, and potential catalysts.

Let’s dive in!

📈 Market Review:

Last week was eventful for both traditional markets and crypto, with Bitcoin facing rejection after consolidating at $88,000 throughout the trading week and selling off sharply over the weekend, now trading at $82,000. After gaining 1.2% on Monday and Tuesday, the S&P 500 hit resistance at $5,780 and dropped 3.65% from Wednesday to Friday, currently sitting at $5,580 ahead of the U.S. market open later today.

S&P 500 Price Chart (Source: StockCharts)

Bitcoin Price Chart (Source: StockCharts)

Amidst all the fear and uncertainty, we’d like to share two metrics plotted against the S&P 500, published by fellow analysts at Global Macro Investor, that potentially suggest a bottom may be near. These two charts highlight how extreme bearish sentiment has historically coincided with major bottoms in the S&P 500.

S&P 500 Chart with US Sentiment Survey (Source: LSEG Datastream GMI)

S&P 500 Chart with CB Consumer Expectations For Stock Prices to Decline Over Next 12 Months (Source: LSEG Datastream GMI)

The first chart shows the percentage of bearish respondents in the AAII Sentiment Survey. Spikes above 60%, marked in pink, have often aligned with key turning points in the market, signaling capitulation before a rebound. The second chart tracks consumer expectations for stock prices to decline over the next 12 months. Similarly, extreme readings above 44% have historically marked major buying opportunities.

Both indicators suggest that when investor pessimism reaches extreme levels, the market is often near a bottom, as seen in past corrections and bear markets.

🔍 Current Market Conditions:

Many analysts are revising their targets downward, anticipating further downside as market sentiment remains bearish, with the Fear and Greed Index currently sitting at 34, firmly in fear territory, reflecting broader uncertainty among investors.

Crypto Fear and Greed Index (Source: Coinglass)

One notable development has been the Bitcoin spot ETFs, which recorded nine consecutive days of positive net inflows, signaling steady institutional demand. However, this trend was disrupted on Friday, as stock markets experienced a sharp selloff, leading to a total net outflow of -93 million dollars from Bitcoin ETFs. This shift suggests that, much like traditional markets, crypto remains highly sensitive to macroeconomic uncertainty, with capital outflows reflecting risk-off sentiment across global markets.

Total Bitcoin Spot ETF Net Inflow (Source: Coinglass)

Another key metric we’ve been tracking for a long time is the global M2 money supply, which has historically shown a strong correlation with Bitcoin’s price action, often considered the true driver of risk asset prices. When plotting the 10-week lead of global M2 against Bitcoin, the correlation becomes evident, suggesting that Bitcoin is either close to forming a bottom or has already done so. If this relationship holds, a bullish reversal could be on the horizon.

Bitcoin Price Chart with Global M2 10-Week Lead (Source: Tradingview)

👀 Key Events Ahead:

This week marks a major turning point in the global trade war as President Trump prepares to introduce a new wave of tariffs on April 2nd, a day he has called "Liberation Day."

These tariffs will target over 25 countries, adding 20% or more to import costs and impacting more than $1.5 trillion in trade by the end of April. While some believe this could bring clarity to the market, the reality may be quite different. Existing tariffs on steel, aluminum, and key imports from Canada, Mexico, and China are now being compounded by additional levies, including new 25% auto tariffs and sanctions on Venezuelan oil. With trade tensions reaching new heights, market volatility is all but certain in the days ahead.

(Source: Getty Images)

This week is packed with key economic events that could drive market volatility. On Tuesday, the ISM Manufacturing PMI and JOLTS Job Openings reports will provide insight into economic activity and labor demand. Wednesday brings the ADP Nonfarm Payrolls report, while Thursday features Jobless Claims and the ISM Services PMI. The week culminates on Friday with the highly anticipated Nonfarm Payrolls report, the Unemployment Rate, and Average Hourly Earnings, all of which will shape expectations for the Federal Reserve’s next moves.

Beyond economic data, major market-moving events include Trump’s "Liberation Day" on Wednesday, marking the rollout of new tariffs, and a speech from Federal Reserve Chair Jerome Powell on Friday.

📊 Technical Analysis:

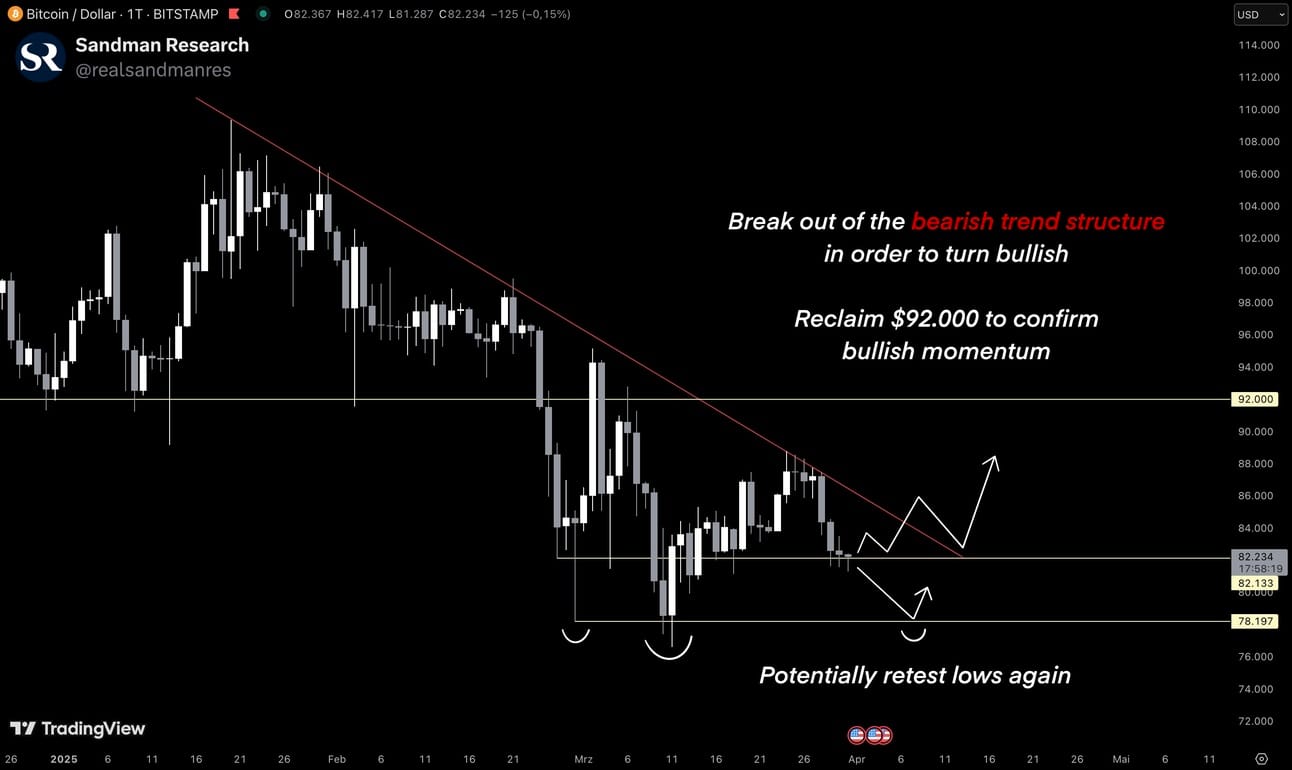

After establishing a lower timeframe uptrend following the sweep of $78,000 in mid-March, Bitcoin faced rejection at $88,000 last week, confirming a lower high within a broader bearish market structure. The price is currently holding just above $82,000, where it found support over the weekend and is now attempting to bounce.

Bitcoin Price Chart (Source: Tradingview)

The liquidation heatmap reveals a significant cluster of leveraged liquidations just above the recent rejection level at $88,000, indicating potential interest from market makers targeting that area and a possible push higher. However, with a smaller liquidity cluster and broader liquidity spread to the downside, the possibility of a bearish continuation remains in play.

Bitcoin Liquidation Heatmap (Source: Coinglass)

The Bitcoin monthly candle is set to close in 14 hours, and for a positive close, the price needs to reclaim $83,316. It’s worth noting that the monthly chart remains very bullish, having retested a key level of interest that aligns with both previous cycle highs and the initial top from March 2024.

Bitcoin Monthly Price Chart (Source: Tradingview)

Bullish scenario: To flip bullish in the short term, Bitcoin needs to hold above $82,000 and potentially move back toward resistance at $88,000. A continuation of the trend and a move toward all-time highs can be expected once Bitcoin reclaims the key level of $92,000 and re-enters the previous trading range.

Bearish scenario: In a bearish case, Bitcoin continues its broader downtrend and breaks below the key $82,000 level, targeting the lows around $78,000. In a „worst-case“ scenario, bitcoin would lose support there and put in a new lower low within the current downtrend. This would likely go hand in hand with traditional markets seeing more blood as well.

🚀 Altcoin Insights:

Altcoins followed Bitcoin’s lead, establishing a lower high within their bearish trend, with TOTAL3 losing major support at the key $780B level. It is currently trading below and likely targeting the next support at $716B again. In a bullish scenario, TOTAL3 would need to reclaim $780B quickly, followed by the previous key level at $850B, where it was previously rejected. This would allow for a new higher high to form, breaking the bearish trend and potentially giving altcoins a chance to push higher again.

TOTAL3 Chart (Source: Tradingview)

With heightened volatility expected in the coming days, altcoins are likely to see significant price swings as well. On days like these, it’s crucial to follow the guidance of experienced traders like the experts from Swiss Circle. Be sure to check their updates and briefings to stay informed.

Off the Grid by Gunzilla Games $GUN (Source: Epic Games)

A potential catalyst for the gaming sector could be the long-awaited mainnet and token launch of Gunzilla Games, the studio behind the biggest Web3 game, Off The Grid. The token is set to go live on Binance at 13:00 UTC later today, and if the launch is successful, it could spark speculation on other gaming tokens. However, overall market sentiment remains very bearish, so it remains to be seen whether a positive impact can materialize.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

If you want to stay ahead of the curve with in-depth analysis and real-time updates, make sure to subscribe to Premium Research for even more insights - you won’t want to miss what’s coming next!

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.