Good Morning and welcome to a new week!

In today’s report, we delve into the implications of these developments on the crypto market, analyze the latest Bitcoin price action, and highlight the technical, macroeconomic, and on-chain factors shaping the current landscape.

Here’s what we’ll cover today:

📈 Market Review: A review of last week’s price action and key events in traditional markets and crypto.

🔍 Current Market Conditions: Market Sentiment Check and Deep Dive into important data.

👀 Key Events Ahead: Upcoming macroeconomic influences, and potential catalysts.

📊 Technical Analysis: Key technical levels, areas of interest, and trade scenarios for the week ahead.

🚀 Altcoin Insights: Notable performers, sector strength, and potential catalysts.

Let’s dive in!

📈 Market Review:

The macroeconomic landscape continues to evolve in favor of risk assets as we close out May 2025. The dollar's persistent weakness has reached new depths, with the Bloomberg Dollar Spot Index hitting its lowest levels since December 2023. Currently trading around 1,200, the greenback has extended its decline from the early 2025 peaks, falling approximately 8% from its highs.

This weakness indicates that market participants are increasingly anticipating the end of the Federal Reserve's tightening cycle, as softening economic data leads to rising expectations of potential interest rate cuts.

Dollar Hits Lowest Since December 2023 (Source: Bloomberg)

Long-term Treasury yields have climbed to multi-year highs, with 30-year yields approaching levels last seen in 2007. The chart shows a dramatic ascent from the pandemic lows near 1% to current levels approaching 5%.

This rise in long-term rates, combined with elevated debt levels, creates what we call "fiscal dominance“, a scenario where debt service costs force central banks to eventually capitulate and maintain accommodative policies despite inflationary pressures.

30-year yields rise closer to levels last seen in 2007 (Source: Bloomberg)

Perhaps most telling is the relationship between S&P 500 earnings yields and government bond yields. The bottom panel of the earnings yield chart shows this spread has turned negative for the first time since the financial crisis, with the 10-year Treasury yield now exceeding the S&P 500's earnings yield.

This inversion typically signals either bond yields are too high or equity valuations are stretched. Given current fiscal dynamics, some analysts expect bond yields to eventually decline, which could improve the relative attractiveness of risk assets.

S&P’s Earnings Yields Drop Below Bonds (Source: Bloomberg)

The fundamental tension between rising yields and unsustainable debt dynamics creates the perfect environment for Bitcoin adoption. Central banks face an impossible choice: continue fighting inflation with higher rates and risk sovereign debt crises, or accept higher baseline inflation to keep debt service manageable.

Bitcoin benefits from either outcome, as a hedge against currency debasement or as a safe haven during financial instability.

Now let’s dive into the part you’re really here for: the charts, key levels, trade scenarios and what’s next for Bitcoin. 🔥

Data-driven analysis and unparalleled market intelligence, exclusively at Sandman Research.

🔍 Current Market Conditions:

Not only have Bitcoin and crypto asset prices surged, but the fear and greed index tracking market sentiment has also climbed significantly. In March, this metric was still in extreme fear territory, with readings as low as those seen during previous bear markets. However, as soon as Bitcoin gained traction, the fear and greed index followed, and we are currently reading 69 on this metric, signaling greed.

Crypto Fear and Greed Index (Source: Coinglass)

Notably, the first time Bitcoin crossed the 100k mark and entered new all-time high territory in December of last year, this metric was sitting even higher, indicating more pronounced overvaluation and extreme greed. That move was followed by a sell-off, which pushed Bitcoin’s price back into the high 70s.

Total Bitcoin Spot ETF Net Inflow (Source: Coinglass)

Meanwhile, total Bitcoin spot ETF net inflows remained positive throughout the entire last week, closing with consecutive back-to-back inflows. This reflects continued institutional demand and sustained buying pressure, even at elevated price levels. It remains a key metric to watch, offering a glimpse into how Wall Street is trading and where smart money is flowing.

👀 Key Events Ahead:

This week brings a series of key economic events. On Monday, U.S. markets are closed in observance of Memorial Day. Tuesday will see the release of U.S. Durable Goods Orders and Consumer Confidence data, both important indicators of economic activity and sentiment. On Wednesday, markets will focus on the release of the FOMC meeting minutes, which could offer valuable insight into the Federal Reserve’s policy outlook. Thursday features several significant data points, including the second estimate of Q1 GDP, Initial Jobless Claims, and Pending Home Sales. Friday is packed with crucial U.S. economic data, highlighted by the Core PCE Inflation report, a key measure watched by the Federal Reserve. Also on the agenda are Personal Spending, the Goods Trade Balance, Chicago PMI, and the University of Michigan’s updates on Consumer Sentiment, Consumer Expectations, and 1-Year Inflation Expectations.

A World of Debt Worries (Source: Bloomberg)

The chart from Bloomberg, based on IMF data, illustrates the increasingly precarious state of global government debt. Many of the world’s largest and most influential economies are now carrying debt loads that exceed 100% of GDP, with Japan surpassing 150% and the United States, the United Kingdom, France, and others falling into the 100–150% range. This pattern is not isolated; it reflects a systemic issue among developed nations that are running persistent deficits without a clear path to fiscal sustainability.

Such high levels of debt, especially when coupled with aging populations and slowing growth, create pressure on central banks and governments to maintain accommodative monetary policies. The reality is that servicing this debt without triggering financial instability or economic contraction often leads to policies that suppress interest rates and tolerate higher inflation. In this environment, the purchasing power of fiat currencies becomes increasingly vulnerable, and confidence in government financial stewardship begins to erode.

Bitcoin, with its fixed supply and decentralized nature, emerges as a credible alternative. It offers a hedge against fiat debasement and becomes more attractive in a world where traditional store-of-value assets like government bonds may yield negative real returns. As trust in legacy institutions wanes and monetary policy remains constrained by fiscal realities, both retail and institutional investors are likely to continue turning to Bitcoin and other cryptoassets. This dynamic supports the long-term thesis for crypto adoption, not as a short-term trade, but increasingly as a structural response to a global financial system under increasing strain.

📊 Technical Analysis:

If we take a look at the Bitcoin price chart, our key levels continue to be precisely respected, even as Bitcoin pushes into new all-time highs. The previous all-time high and key level at $109,300 acted as both support and resistance and triggered a short trade on two occasions, as outlined in last week’s report.

These trades were entered on successful bearish retests of that level, targeting the $106,100 key level. However, in both instances, the target was not reached, and the trades were stopped out at break-even. Earlier this morning, Bitcoin reclaimed the $109,300 level again and is currently trading at $109,800.

Bitcoin Price Chart (Source: Tradingview)

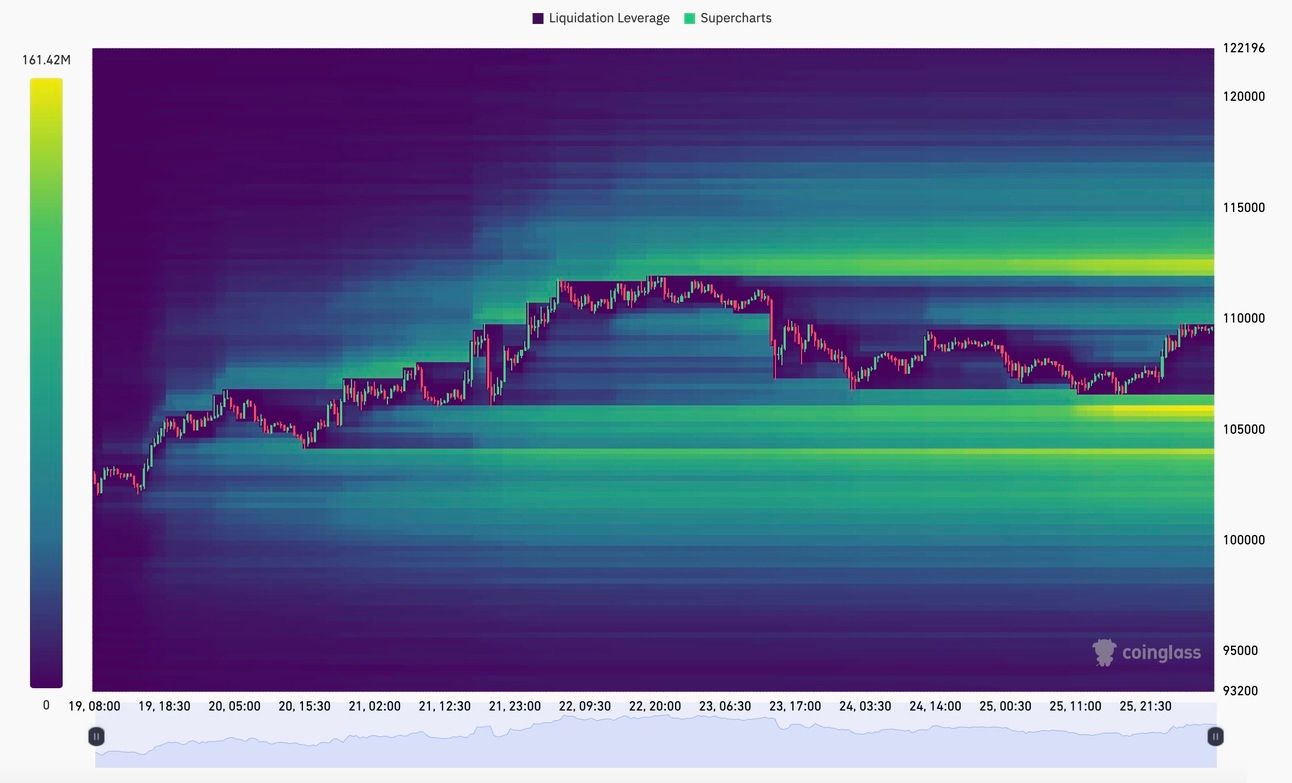

The Bitcoin liquidation heatmap highlights a concentration of liquidation leverage around the $106,000 region, as well as at $104,000. There also remains a significant amount of leveraged liquidation interest above the recent highs, particularly around the $112,000 zone, making movement in either direction possible.

Bitcoin Liquidation Heatmap (Source: Coinglass)

Bullish Scenario: In a bullish case, we would want to see Bitcoin continue to hold firm at elevated levels, ideally above the $102,000 key level, unlike the previous attempts in December and January when Bitcoin failed to sustain above it. On lower timeframes, holding above the $109,300 key level reclaimed this morning is important. Long opportunities could emerge on a successful bullish retest of this level, with a first target at $111,900 and second target being price discovery and invalidation if the price fails to remain above the entry level.

Bearish Scenario: In a bearish case, Bitcoin loses support at the recently regained $109,300 level and moves lower, potentially targeting the key levels at $106,100 and $102,000 if the first one fails to provide strong support. Short opportunities may arise on a successful bearish retest of $109,300, with invalidation if the price reclaims the level.

🚀 Altcoin Insights:

Altcoins have been trading at elevated levels since April and have managed to shift market structure bullish, establishing an early bullish trend overall when looking at the total3 altcoin index. However, after facing rejection at the 940B level twice, they are currently unable to continue higher and are trading between two major levels, waiting for a fresh push higher.

TOTAL3 Altcoin Index (Source: Tradingview)

Make sure to track this index and OTHERS as well to see if the market aligns with buying opportunities on the altcoins you are monitoring. We are closely tracking various high-cap altcoins at the moment, and when looking for buying opportunities, confluence increases when the individual coin is sitting at support and the index (overall market) is doing so as well, making a trend continuation more likely.

Interesting niches continue to be the AI and RWA sectors as the obvious plays; however, we expect the gaming niche to perform substantially as well once catalysts arrive, as it is currently very undervalued compared to the other sectors. Altcoins as a whole are still lagging behind Bitcoin, and we are continuing to monitor the market and various other metrics in our Wednesday Altcoin Market Report, exclusively available for premium research members.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

If you want to stay ahead of the curve with in-depth analysis and real-time updates, make sure to subscribe to Premium Research for even more insights - you won’t want to miss what’s coming next!

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.