Good Morning and welcome to a new week!

Despite the 90-day tariff pause by the US, trade tensions with China remain strained, and the overall situation continues to be uncertain and unpredictable.

In today’s report, we delve into the implications of these developments on the crypto market, analyze the latest BTC price action, and highlight the technical, macroeconomic, and on-chain factors shaping the current landscape.

Here’s what we’ll cover today:

📈 Market Review: A review of last week’s price action and key events in traditional markets and crypto.

🔍 Current Market Conditions: Market Sentiment Check and Deep Dive into important data.

👀 Key Events Ahead: Upcoming macroeconomic influences, and potential catalysts.

📊 Technical Analysis: Key technical levels, areas of interest, and potential scenarios for the week ahead.

🚀 Altcoin Insights: Notable performers, sector strength, and potential catalysts.

Let’s dive in!

📈 Market Review:

The US-China conflict is intensifying, with tech bans, tariffs, and threats to supply chains causing widespread economic impact. This isn't just a trade issue, it's a clash of global powers. Both the US and China are escalating, each believing they hold the stronger position. The US has banned chip exports to China, while China is considering rare earth export restrictions and shifting oil imports away from the US.

US Government Bonds 10 YR Yield and DXY (Source: Tradingview)

Bond yields surged while the dollar sold off, a concerning divergence that triggered a basis trade unwind and rattled markets. Since Trump’s announcement of a 90-day tariff pause, however, conditions have started to calm.

As we highlighted last week, this move underscores that keeping rates low remains Trump’s main objective. Climbing yields pressured the administration to step back from tariffs to avoid deeper market disruption. At this point, the bond market isn’t just responding to policy, it’s driving it.

Gold continues to outperform (Source: Tradingview)

For investors, the outlook is volatile. Key opportunities include long positions in gold, silver, rare earth producers, and energy stocks, while shorting semiconductors, retail stocks reliant on China, and the broader equity market through puts or inverse ETFs could be profitable strategies. With supply chain disruptions and rising inflation, a new era of geopolitical risk and market uncertainty is emerging, and entirely passive investment strategies may no longer be reliable.

Bitcoin surged early this morning (Source: Bloomberg)

Early this morning, Bitcoin broke out of the recently established range between $83,000 and $86,000, where it had been trading for 9 days, and surged to $87,600. It now remains to be seen whether Bitcoin can confirm this breakout or fall back into the previous trading range.

🔍 Current Market Conditions:

Looking at the Crypto Fear & Greed Index, current market sentiment remains in fearful territory, sitting at 39, just shy of crossing into neutral. We find this reading to be quite accurate, given the broader uncertainty still priced into the market and the risk of further downside. It’s also worth noting that this metric reset sharply in February, briefly dropping to 10, a level last seen during the depths of the bear market.

Crypto Fear and Greed Index (Source: Coinglass)

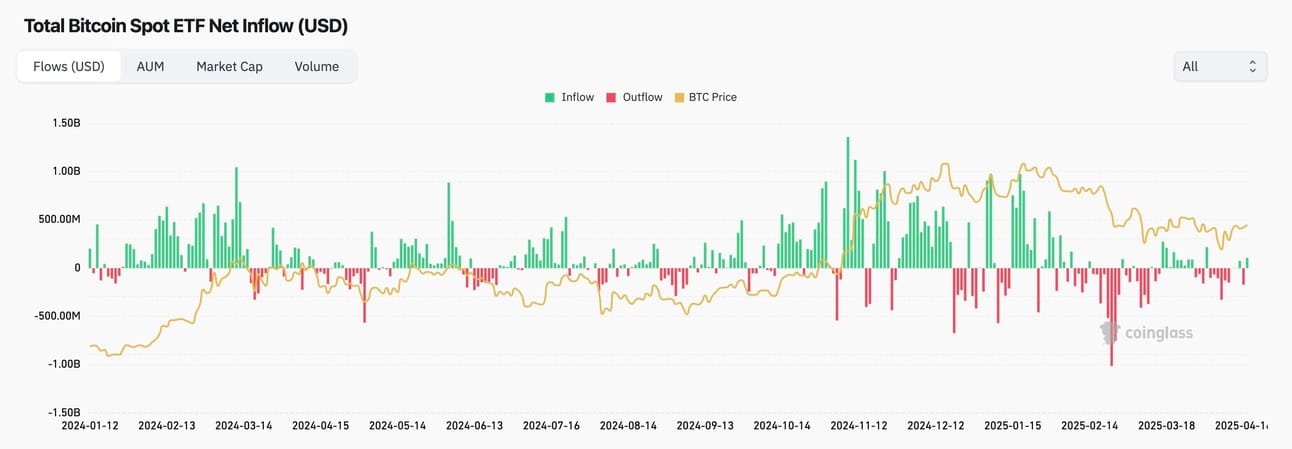

Meanwhile, Bitcoin spot ETF flows turned positive again on Thursday, a sign of renewed institutional demand and growing confidence. To support a sustained bullish trend, we’d like to see these inflows remain consistently positive in the days ahead.

Total Bitcoin Spot ETF Net Inflow (Source: Coinglass)

Tech stocks are now more oversold than at any time since the COVID crash. Only seven times since 1988 have over 55% of NASDAQ 100 stocks had a 14-day RSI below 30, each time during major crises like 9/11, the 2008 financial collapse, or the COVID panic.

Investor sentiment reflects that fear. Bullish sentiment just hit 23.6%, the lowest since December 2008. The VIX briefly spiked above 60, a level not seen since COVID or the recent yen carry trade unwind. The AAII survey shows 62% of investors are bearish, the highest since March 2009. Consumer confidence is also weakening, with nearly half of respondents expecting stocks to fall over the next year.

Institutional positioning confirms the mood: Bank of America reported the largest drop in U.S. equity exposure on record, and CFTC data shows traders are net short the S&P 500. Overall, fear and pessimism are deeply priced into the market, levels usually seen near major bottoms.

👀 Key Events Ahead:

Key events in the U.S. this week include important economic data releases and major company earnings reports. On Wednesday, markets will be watching the latest Services and Manufacturing PMI figures along with new home sales data. Thursday brings initial jobless claims, durable goods orders, and existing home sales, all of which could provide further insight into the health of the economy. On Friday, consumer sentiment data will round out the week, offering a snapshot of how confident households feel about the economic outlook. These releases come alongside a packed week of earnings from major companies, which could significantly influence market sentiment.

Target Rate Probabilities for next FOMC Meeting (Source: FedWatch)

The next major event markets are focused on is the Fed’s FOMC meeting on May 6–7. Currently, there’s just a 12.7% chance of a rate cut being priced in, meaning markets expect the Fed to hold rates steady. However, attention will also turn to balance sheet policy, with growing speculation that the Fed could announce an end to quantitative tightening (QT).

📊 Technical Analysis:

If we take a look at the chart, we can see how Bitcoin formed a range after breaking above both the key level at $81,400 and the red trendline. This range was respected multiple times until price broke out early this morning with a strong 4h candle. So far, Bitcoin has closed two 4h candles above the range, further confirming the breakout.

Bitcoin Price Chart (Source: Tradingview)

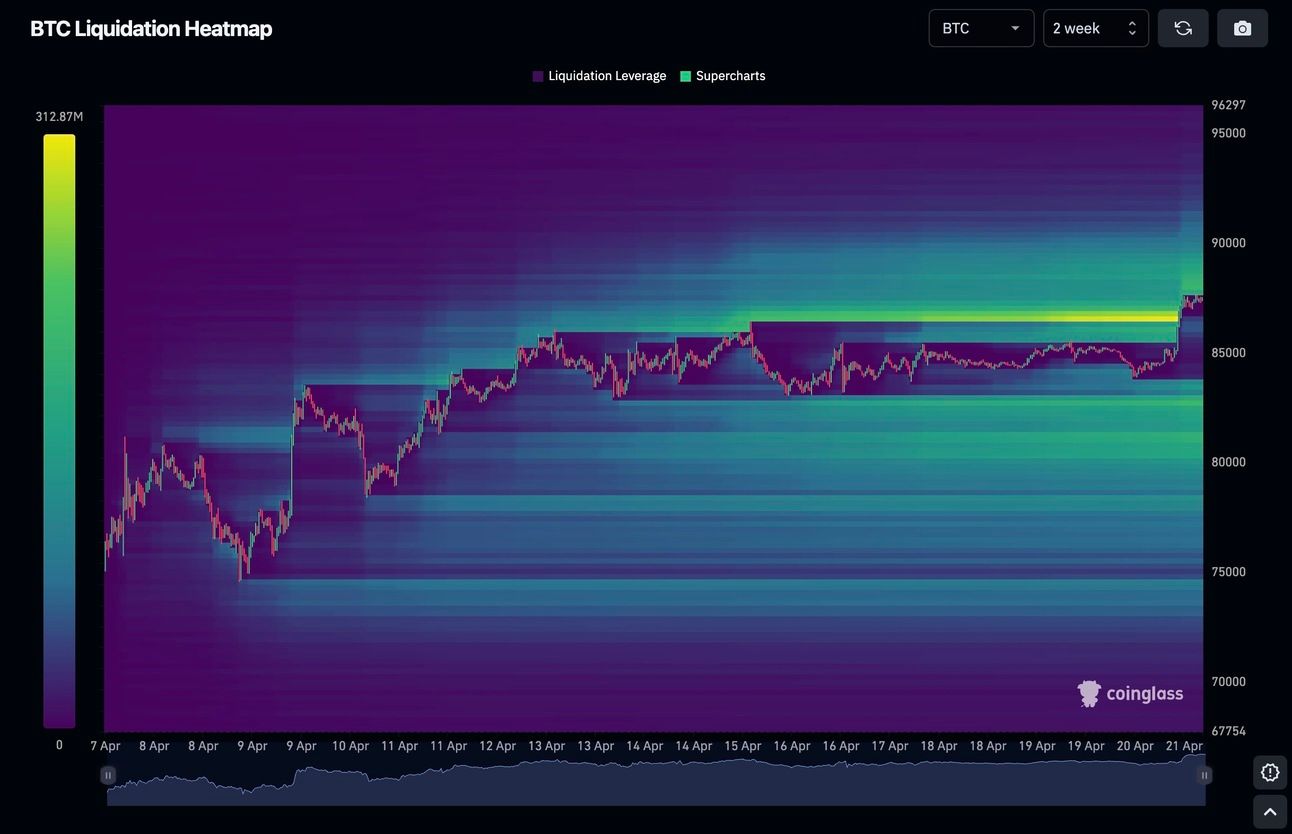

The Bitcoin liquidation heatmap shows that with this recent move, most of the resting upside liquidity, clustered around $86,600, was taken out. The remaining clusters of liquidation leverage are now spread fairly evenly to both the upside and downside, making a move in either direction possible.

Bitcoin Liquidation Heatmap (Source: Coinglass)

Bullish Scenario: In a bullish case, we’d like to see Bitcoin hold above the previous range highs at $86,000, further confirming the breakout and showing strength. A retest of that level is possible, and if successful, we’d expect price to push toward $88,800 and ideally flip that level as well. This would indicate short-term strength and potentially mark a shift in momentum, establishing a higher high on the higher timeframe and potentially kickstarting a new uptrend. Long opportunities arise on a successful retest of $86,000, with $88,800 as the target and invalidation if the level fails to hold.

Bearish Scenario: In a bearish case, Bitcoin fails to hold above $86,000 and falls back into the previous trading range. A continuation to the downside would then open the door for a potential breakdown below the range, likely targeting the major key level at $81,400 again. This remains a crucial support level, if lost, further downside and new lower lows could follow. Short opportunities arise on bearish retests of $86,000, $83,000, or $81,400, targeting the next lower key levels respectively, with invalidation if price reclaims the entry level.

🚀 Altcoin Insights:

Altcoins are once again at a crucial make-or-break point, with TOTAL3 currently hovering just below the major key level of $780B. As highlighted in last week’s altcoin market report, reclaiming this level is critical to anticipate sustained bullish momentum and a potential trend shift across the altcoin space. A decisive move above $780B, followed by continuation towards the next key level at $850B, would strengthen the outlook for a broader recovery. A break above $850B would establish a new higher high, setting the stage for a potential uptrend to unfold. However, if price faces rejection at $780B, further downside becomes likely and the risk of new lows remains on the table.

TOTAL3 Altcoin Index Chart (Source: Tradingview)

For now, we continue to hold off on entering low-cap altcoin positions or going risk-on, as we wait for clearer signs of a shift in market sentiment and sustained upside. With Bitcoin dominance continuing to rise and printing new highs, it’s fair to question whether it even makes sense to be allocated to altcoins at this stage.

We’d love to hear your take, feel free to drop a comment.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

If you want to stay ahead of the curve with in-depth analysis and real-time updates, make sure to subscribe to Premium Research for even more insights - you won’t want to miss what’s coming next!

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.