Good Morning and welcome to a new week!

In today’s report, we delve into the implications of these developments on the crypto market, analyze the latest Bitcoin price action, and highlight the technical, macroeconomic, and on-chain factors shaping the current landscape.

Here’s what we’ll cover today:

✅ Bitcoin Hits $106K Target: Precision Play Nets 4% Gain for Premium Research Subscribers

📈 Market Review: A review of last week’s price action and key events in traditional markets and crypto.

🔍 Current Market Conditions: Market Sentiment Check and Deep Dive into important data.

👀 Key Events Ahead: Upcoming macroeconomic influences, and potential catalysts.

📊 Technical Analysis: Key technical levels, areas of interest, and trade scenarios for the week ahead.

🚀 Altcoin Insights: Notable performers, sector strength, and potential catalysts.

Let’s dive in!

✅ Bitcoin Hits $106K Target:

Early this morning, Bitcoin saw a sharp move to the upside, reaching our full take profit level at $106,100, the exact area we’ve repeatedly identified in previous reports as a key target. This rally followed a clean long setup that triggered on Thursday, when Bitcoin successfully retested the critical $102,000 support level.

We had outlined this scenario multiple times in recent updates, anticipating that a bounce from this zone could fuel a continuation toward the $106K region.

Bitcoin Hits $106,100 Profit Target (Source: Tradingview)

This precise execution allowed our premium research subscribers to capitalize on a well-structured 4% move, fully aligned with the strategy we’ve been sharing. These types of setups, built on strong confluence between key levels, market structure, and momentum, are what we focus on consistently in our private reports.

If you're looking for timely market insights, detailed altcoin analysis, and actionable trade scenarios published three times per week, consider subscribing to our Premium Research service.

📈 Market Review:

The current macroeconomic landscape presents a complex picture as we head into late May, with several key indicators suggesting potential headwinds for the US economy and financial markets.

The Bloomberg Dollar Spot Index shows the greenback remains stuck near a 15-month low, continuing a downward trajectory that began earlier this year. After reaching a peak around 1,300 in late 2024, the dollar has experienced a sharp decline through April and early May 2025, currently hovering around the 1,220 level. This weakness reflects market expectations of Federal Reserve rate cuts and growing concerns about US fiscal sustainability.

The Dollar Is Stuck Near a 15-Month low (Source: Bloomberg)

According to Bloomberg survey data, analysts broadly expect US tariffs on Chinese goods to remain at 30% in the near term, with the median estimate maintaining this level through the first six months of President Trump's second term. Expectations become more divergent when looking further ahead, with analysts anticipating a potential reduction to 20% as a final level after trade negotiations conclude.

The wide range of estimates (from 3% to 60% for the final tariff level) underscores significant uncertainty about the administration's long-term trade strategy.

Analysts Expect US Tariffs on China to Stay at 30% (Source: Bloomberg)

US Treasury yields have climbed higher for three consecutive weeks, with particularly notable movements in both the 2-year and 10-year yields during April 2025.

The chart shows a significant spike in both yields, with the 10-year experiencing a weekly move of approximately 50 basis points in mid-April. This persistent upward pressure comes as traders carefully analyze economic data for signs of a lasting economic slowdown.

US Yields Grind Higher for Third Consecutive Week (Source: Bloomberg)

The recent Moody's downgrade of US sovereign debt from AAA to AA+ completes a trifecta, with all three major rating agencies now aligned in their assessment of US creditworthiness. While this change appears largely symbolic and should not trigger mechanical consequences in the financial system, the timing is significant. Unlike the 2011 S&P downgrade, most institutional agreements now reference "US government securities" rather than specific rating thresholds, preventing forced selling or technical defaults.

However, today's market environment differs substantially from 2011. Bond markets are already under pressure from record issuance, and mounting concerns about fiscal sustainability. The unanimous message from rating agencies about deteriorating trust in US fiscal management comes at a particularly vulnerable moment, with equity valuations stretched after an aggressive rally.

Investors should prepare for potential volatility in the coming days. A modest 2-3% equity pullback would not be surprising given current conditions. Nevertheless, there remains reason for cautious optimism. If liquidity conditions continue to improve and financial conditions maintain their easing trend, markets could quickly recover from any near-term volatility. The fundamental backdrop still supports risk assets, particularly if the Federal Reserve pivots to a more accommodative stance as expected. Patient investors who weather the potential turbulence may be rewarded as markets adapt to the evolving fiscal and monetary landscape.

🔍 Current Market Conditions:

Current market sentiment has flipped very bullish again in no time. Remember how we’ve been tracking fearful sentiment for months and now, after just one strong surge in Bitcoin, the Fear and Greed Index has quickly jumped, currently sitting in greed territory with a reading of 71.

Crypto Fear and Greed Index (Source: Coinglass)

While sentiment can be tricky to gauge in crypto, especially with social media timelines and analysts often painting vastly different pictures, the Fear and Greed Index, though not perfect, remains one of the most objective and consistent tools to monitor how the broader market is feeling. It helps identify both overheated and underrated phases.

In bull markets, this index can stay elevated for extended periods, as seen in past altcoin seasons, but it's still important to stay cautious. A high reading typically reflects an overheated market, which could hint at a potential cooldown or pullback.

Total Bitcoin Spot ETF Net Inflow (Source: Coinglass)

Meanwhile, total Bitcoin spot ETF net inflows remained positive last week, closing with consecutive back-to-back inflows. This is a strong sign of continued institutional demand and sustained buying pressure, even at elevated prices. It’s a key metric to watch, as it offers a glimpse into how Wall Street is trading and where smart money is flowing.

Note how inflows were minimal or even negative at lower prices during periods of uncertainty and now, as sentiment shifts and price climbs, inflows pick up again. That’s why it’s important to be early. We positioned ourselves ahead of the crowd and ahead of institutions. Kudos.

👀 Key Events Ahead:

Key events this week include Monday’s release of the Chinese Unemployment Rate, Chinese Industrial Production, and Eurozone CPI. On Thursday, we will see the US Initial Jobless Claims, Services and Manufacturing PMI, as well as Existing Home Sales. Friday brings the US New Home Sales report.

The Congressional Budget Office data reveals a concerning trajectory for US debt, projected to exceed 106% of GDP by 2029, surpassing the post-WWII record, and approaching 115% by 2034. This path forces central banks into a difficult choice: continue expanding debt through monetary accommodation or face a deflationary collapse. The political consequences of the latter make it nearly impossible to choose.

US Debt Burden Heads Toward Uncharted Territory (Source: Bloomberg)

This creates "the perfect storm" for Bitcoin and crypto: Growing sovereign debt necessitates currency debasement. Central banks can't significantly raise rates without triggering debt crises, creating an environment where fiat currencies gradually lose purchasing power, driving capital toward hard-capped assets like Bitcoin.

As debt-to-GDP ratios exceed historical precedents, the probability of a "phase shift" in the global monetary system increases. Throughout history, debt supercycles typically end with monetary resets. Bitcoin represents the first decentralized alternative positioned to benefit from this potential regime change. Accelerating debt creates "exponential momentum" in adoption of alternative financial systems. As traditional systems strain under debt burdens, digital asset innovation offers efficiency that becomes increasingly attractive.

These debt dynamics provide fundamental validation for Bitcoin as an asymmetric bet on a new financial architecture emerging from the inevitable constraints of our debt-based system, now clearly pushing against its mathematical boundaries.

Global M2 and Bitcoin (Source: LSEG Datastream, Bloomberg - Global Macro Investor)

The chart provides compelling visual evidence supporting these dynamics, tracking global M2 money supply against Bitcoin's price from 2013 to 2025. Global M2 has grown from approximately $60 trillion in 2013 to over $110 trillion by 2025, nearly doubling in just over a decade. Bitcoin's price has responded dramatically, rising from around $10 to approximately $100,000 during the same period, a 10,000x increase.

As central banks continued expanding the money supply to manage growing debt burdens, Bitcoin, with its algorithmically limited supply, has captured increasing value, functioning precisely as theoretical models would predict for a hard-capped asset during periods of monetary debasement.

The chart effectively illustrates that we're not merely theorizing about future scenarios, we're actively witnessing the mathematical relationship between expanding money supply and Bitcoin's value appreciation playing out in real time.

📊 Technical Analysis:

If we take a look at the Bitcoin price chart, it’s remarkable how precisely our key levels have been respected, both in past price action and more recently during Bitcoin’s climb over the past few weeks. Most notably, the $98,800 level acted as lower timeframe support, initiating a perfect bounce that propelled price back above the $102,000 key level and the current range lows, which have held strong so far.

Early this morning, price attempted to reclaim the next higher key level at $106,100. While it did manage to briefly break above, it couldn’t hold the level and faced sharp rejection, selling off and currently trading back at the critical $102,000 zone.

Now let’s dive into the part you’re really here for: the charts, key levels, trade scenarios and what’s next for Bitcoin. 🔥

Data-driven analysis and unparalleled market intelligence, exclusively at Sandman Research.

Bitcoin Price Chart (Source: Tradingview)

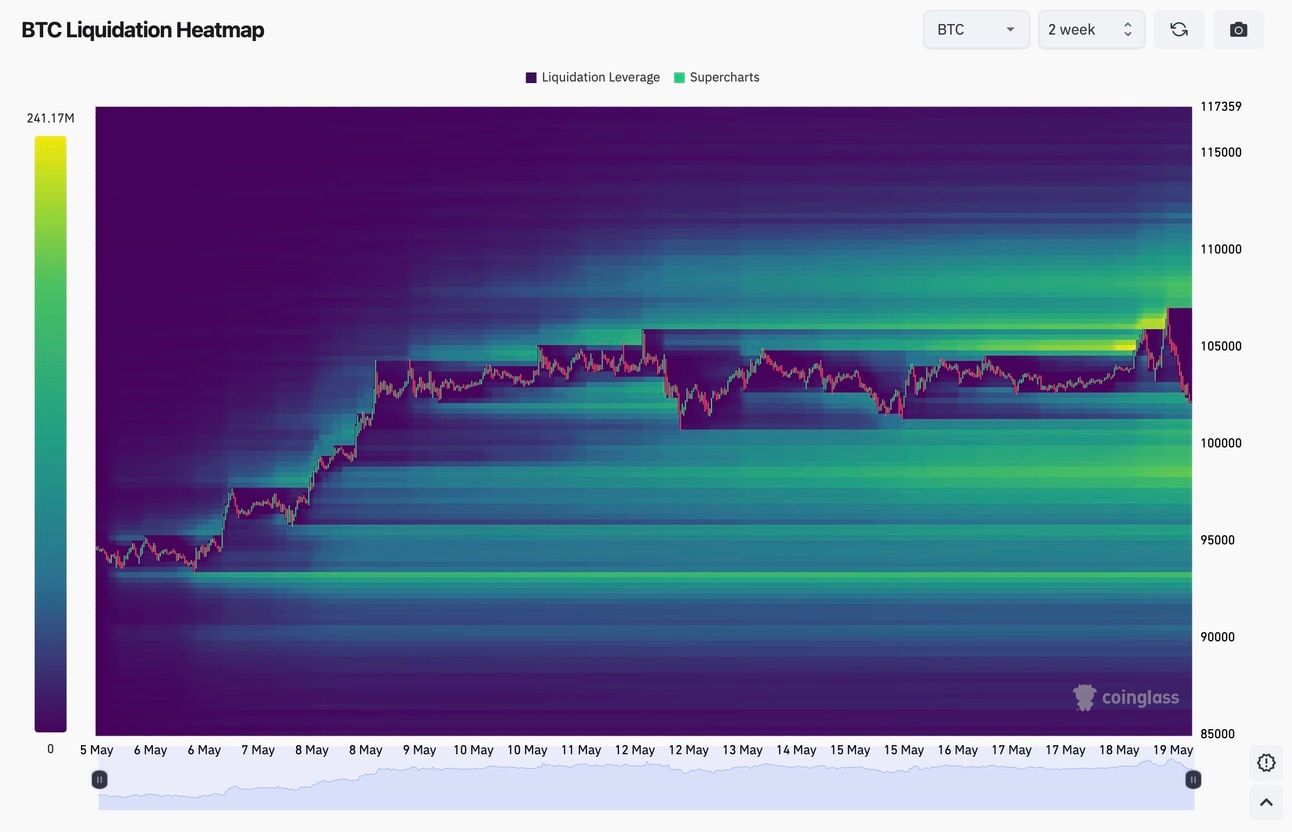

The Bitcoin liquidation heatmap clearly shows a cluster of liquidated orders around the $106,000 region after the recent price spike. There remain significant amounts of leveraged liquidation interest above the recent highs and around the $110,000 zone potentially hinting at further upside. To remain objective, however, it’s worth noting that the more significant liquidation clusters currently sit to the downside. Liquidity is spread relatively evenly but extends all the way down to the $92,000 region, which happens to align with a major key level on our chart.

As we’ve said many times before, price could easily dip to retest $92,000 while still remaining in a broader bullish trend. As long as that level holds, the bullish market structure would remain intact, and further upside could follow.

Bitcoin Liquidation Heatmap (Source: Coinglass)

Bullish Scenario: Note how during the previous two breakouts above $100,000, Bitcoin was unable to hold above that level for longer than two weeks in either case, dropping below quickly afterward. For things to be different this time, we’d ideally like to see Bitcoin hold above the $102,000 key level and successfully reclaim $106,100 in the coming days. Long trade opportunities arise if we get a successful bullish retest of $102,000, targeting $106,100 again. If price drops further, we’d closely watch the $98,800 level for a potential bullish retest, in that case, $102,000 would become the initial profit target.

Bearish Scenario: In a bearish setup, Bitcoin clearly loses the $102,000 support and moves lower, with $98,800 likely to be tested first. If that level doesn’t hold, price could continue its decline, targeting $95,000 and $92,000, both key levels of interest. Short opportunities arise on a bearish retest of $102,000, with partial profit-taking at each level on the way down to $92,000.

🚀 Altcoin Insights:

Altcoins are currently in a very interesting position after seeing a spike following Bitcoin’s surge earlier this month. The TOTAL3 chart reflects this well, as the recent impulsive leg clearly broke above the previous lower high of the bearish trend, establishing a new higher high and potentially shifting market structure into a bullish phase.

At the moment, it seems to be forming a lower high within this newly established bullish trend and as long as TOTAL3 does not drop back below $780B, the bullish structure remains intact. A key area to watch for a potential lower high and a possible next leg up for the broader altcoin market is around $840B, a historically significant zone.

TOTAL3 Altcoin Index (Source: Tradingview)

When investing in and trading altcoins, we can use both the TOTAL3 altcoin index chart and Bitcoin as confluence, checking if their market structures align to validate potential entries. For instance, if Solana is sitting at a major support level and both TOTAL3 and Bitcoin are also holding support within a broader bullish trend, these charts can help gauge market sentiment and confirm alignment with the individual altcoin setup, adding confidence to the trade. Likewise, as TOTAL3 approaches major support, we can monitor our altcoin watchlist to identify emerging opportunities in price action that align with the broader market trend.

That being said, we are still focusing on high-cap coins and not taking on too much risk just yet. There are plenty of promising setups within the Top 10 and Top 20 by market capitalization, strong names that have already shown resilience and are worth watching for potential entries on pullbacks. Later in the cycle, once we see clear strength and follow-through in these larger caps, we can begin to shift our focus to niches, smaller projects, or even upcoming IDOs and launches.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

If you want to stay ahead of the curve with in-depth analysis and real-time updates, make sure to subscribe to Premium Research for even more insights - you won’t want to miss what’s coming next!

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.