Good Morning and welcome to a new week!

Bitcoin is navigating a tough market environment as traditional markets experience a historic sell-off following the implementation of Trump’s tariffs last week. In today’s report, we break down the latest price action, key technical levels, and the most important on-chain and macroeconomic factors driving the current market conditions.

Here’s what we’ll cover today:

📈 Market Review: A review of last week’s price action and key events in traditional markets and crypto.

🔍 Current Market Conditions: Market Sentiment Check and Deep Dive into important data.

👀 Key Events Ahead: Upcoming macroeconomic influences, and potential catalysts.

📊 Technical Analysis: Key technical levels, areas of interest, and potential scenarios for the week ahead.

🚀 Altcoin Insights: Notable performers, sector strength, and potential catalysts.

Let’s dive in!

📈 Market Review:

U.S. stock markets experienced their steepest decline since 2020 on Friday, as escalating trade tensions and renewed inflation concerns triggered widespread selling. The S&P 500 slid nearly 6% for its worst week in four years, while the Nasdaq Composite dropped 5.8%, officially entering a bear market. Following the announcement, Bitcoin demonstrated relative strength against traditional markets and moved sideways throughout the remainder of the week. We saw a strong sell-off begin Sunday night, with U.S. index futures and Bitcoin moving lower and all of them putting in new yearly lows.

U.S. Stock Market and Bitcoin see historic sell-off (Source: Tradingview)

The sharp sell-off followed China’s announcement of a 34% tariff on all U.S. imports, set to begin April 10, mirroring the tariffs imposed by the U.S. earlier in the week. Investor sentiment was further dampened by comments from Federal Reserve Chair Jerome Powell, who warned that the tariffs could lead to higher inflation and slower economic growth. While the March jobs report showed stronger-than-expected job creation, the unemployment rate ticked up to 4.2%, and concerns over recession risks grew.

U.S. Government Bonds 10 YR Yield falling to 3.9% (Source: Tradingview)

Bond markets reflected the shift in risk appetite, with the 10-year Treasury yield falling to 3.9%, its lowest level in months. Market participants are now pricing in up to five interest rate cuts this year, as the Fed may prioritize supporting growth over controlling inflation.

The week ended with heightened uncertainty, with investors closely watching for further developments in U.S.–China relations and potential shifts in Fed policy.

🔍 Current Market Conditions:

With Bitcoin hitting a new yearly low, the current market sentiment is understandably poor, and the crypto fear and greed index reflects this, currently sitting in fear territory at 23 points. In contrast, the stock market fear and greed index is at 4, indicating extreme fear.

Crypto Fear and Greed Index (Source: Coinglass)

ETF flows continued to be negative towards the end of last week, with traditional markets selling off, and they're likely off to a rough start this week as well. This will depend on how the macro situation evolves and whether any positive catalysts emerge strong enough to shift the situation in the short term.

Total Bitcoin Spot ETF Net Inflow (Source: Coinglass)

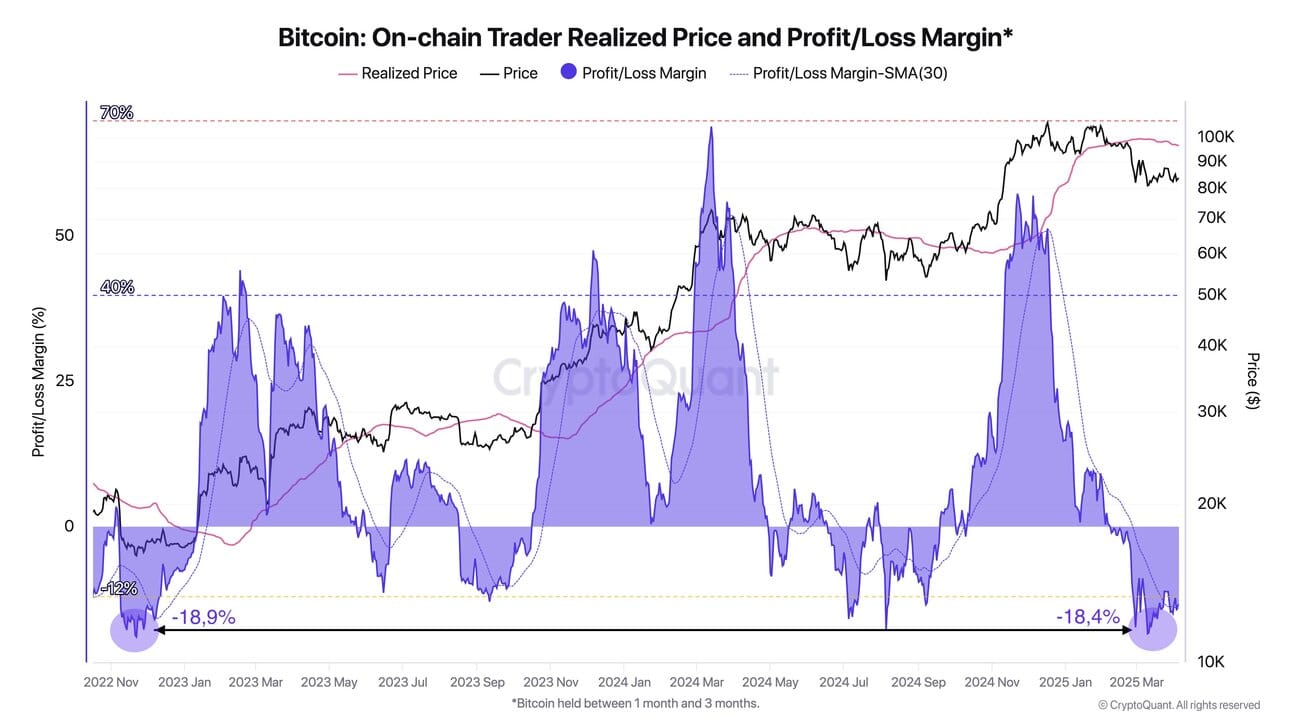

The current realized losses suggest that Bitcoin may be forming a local bottom rather than approaching a top. What stands out is the sharp drop in the Profit/Loss Margin for short-term holders, those who have held Bitcoin between one and three months. This metric has fallen to around -18.4%, a level very similar to the deep capitulation seen in late 2022, when the market also reached -18.9%. Historically, when short-term holders are this deep in losses, it often signals a period of capitulation and marks the end of a downtrend. These moments tend to occur near local bottoms, as weaker hands are flushed out and more experienced or institutional investors begin to accumulate.

Bitcoin Realized Price and Profit/Loss Margin (Source: CryptoQuant)

In contrast, when the Profit/Loss Margin rises sharply into the positive territory, especially above 40%, it has often coincided with local tops, as we saw in March and November 2024. That makes the current structure very different from a topping formation. In short, this kind of on-chain behavior reflects fear and capitulation, not euphoria. It’s the kind of setup that has historically preceded recoveries rather than further breakdowns.

👀 Key Events Ahead:

This week brings several key U.S. economic data releases that could impact financial markets. On Wednesday, the Federal Reserve will publish the minutes from its most recent meeting, offering insight into policymakers' views on inflation, interest rates, and the broader economy. Then on Thursday, markets will closely watch the latest CPI inflation report, a major indicator of price pressures, along with weekly jobless claims that provide a snapshot of labor market strength. Finally, Friday rounds out the week with the PPI inflation report, which reflects wholesale price trends, and the University of Michigan’s consumer sentiment index, a key measure of how confident Americans are feeling about the economy. Together, these data points could set the tone for how both traditional and crypto markets respond in the days ahead.

Target Rate Probabilities for 7 May 2025 Fed Meeting (Source: CME FedWatch)

Markets are now pricing in a higher probability of a rate cut at the upcoming May 7, 2025 FOMC meeting. According to the latest CME FedWatch data, expectations spiked this morning, with a 60.5% chance that the Federal Reserve will lower its target rate by 25 basis points, bringing it down to the 400–425 bps range. Currently, these expectations sit around 48%. Just a month ago, markets were still heavily leaning toward no change, but that sentiment has shifted significantly in recent days as economic data and financial market stress increase. With volatility returning and equities under pressure, expectations for a more accommodative Fed are rising quickly.

📊 Technical Analysis:

Bitcoin lost crucial support at $81,400 and quickly sold off, a scenario we mentioned on our X yesterday. Make sure to follow us there (@realsandmanres) to stay updated on spontaneous updates and briefings. This selloff also broke below the previous lows at $78,000, marking new yearly lows and continuing the ongoing higher timeframe downtrend.

Bitcoin Price Chart (Source: Tradingview)

If we zoom out on the daily chart, we can see that price is approaching a region of heavy interest, specifically the previous year's major resistance at $73,000 and the 0.618 Fibonacci retracement level of the major swing move just below. These target areas were highlighted in one of our early reports on this platform, and if markets continue to lack positive catalysts and bullish momentum, it’s increasingly likely that Bitcoin will attempt to test this region again.

Bitcoin Liquidation Heatmap (Source: Coinglass)

The Bitcoin liquidation heatmap shows that most of the downside liquidity has been taken out with this recent move, with the remaining cluster above previous resistance at $88,000 still intact. This could suggest a potential quick reversal, although we advise caution, as liquidity appears thinly spread in this area, making price action volatile and further downside possible.

Bullish Scenario: In a bullish case, Bitcoin manages to reverse and quickly reclaims previous support around $81,400, showing strength and potentially gearing up for another leg up targeting the key level of interest at $92,000. This level must be reclaimed in order to rule out further downside and anticipate a sustainable bullish trend continuation. To see strength here quickly, we would need strong macroeconomic developments or news in the coming days; otherwise, the situation remains uncertain.

Bearish Scenario: In a bearish case, price continues lower without finding any support, targeting the area of interest around the previous year’s resistance and the 0.618 Fibonacci retracement level. This is where the first support is likely to kick in, and potential long opportunities could arise, with invalidation if Bitcoin fails to hold and continues lower. Significant volume is currently in the mid-60’s, which can easily be seen when plotting a volume profile onto the range. Another bearish scenario would be an initial reversal here, with price trending higher in the short term but getting rejected when retesting previous support at $81,400, turning it into resistance. This would open potential short opportunities on the retest, with invalidation if Bitcoin reclaims that level.

🚀 Altcoin Insights:

Altcoins have seen significant losses following the sell-off in equities and Bitcoin, with the TOTAL3 altcoin index losing crucial support at key levels around $780B and $716B. It has dropped over -13% in the last two days, currently trading at $687B. While TOTAL3 did retest a previous high from July 2024 at $661B, a continuation lower targeting the key area below $650B remains a possibility, especially if the macro situation doesn’t resolve itself. To shift towards a bullish outlook and anticipate some upside, TOTAL3 would need to reclaim at least $716B and ideally the key area of interest around $780B.

TOTAL3 Altcoin Index (Source: Tradingview)

While there are multiple rare buying opportunities at the moment, with seemingly low risk and potentially high reward, it's important to note that the current situation is driven by panic and fear. Markets could easily continue lower as we don’t yet know the full scope or economic impact of these tariffs. In our opinion, slowly scaling into high caps and promising projects could be a good strategy soon, looking for opportunities in major altcoins, avoiding high-risk plays or memecoins for now, as further downside is still possible.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

If you want to stay ahead of the curve with in-depth analysis and real-time updates, make sure to subscribe to Premium Research for even more insights - you won’t want to miss what’s coming next!

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.