Good morning and welcome to this week’s Altcoin Market Update!

As the market cycle unfolds, altcoins are trading at critical levels. In today’s update, we’ll take a closer look at the broader market landscape to assess whether momentum is shifting and what that could mean for the days ahead.

Additionally, we’ll analyze key macroeconomic factors to offer a well-rounded outlook on what’s next for altcoins.

Here’s what we’ll cover today:

📅 Macro Review: How major events like the FOMC Meeting and the macroeconomic environment impact altcoins.

📊 Crypto Market Overview: Breaking down Bitcoin, TOTAL3 & OTHERS to gauge overall market strength.

🔍 Bitcoin vs. Altcoins: Analyzing BTC Dominance (BTC.D) and OTHERS Dominance (OTHERS.D) to identify rotation.

📈 Key Reversal Signals: Watching OTHERS/BTC for potential reversal signs and altseason triggers.

🚀 Chart of the Week and Opportunities Ahead: An altcoin to watch and what’s next if momentum picks up?

Let’s dive in!

📅 Macro Review:

The US economy is showing unexpected strength, with recent ISM services data pointing to a mild recovery after weeks of concern. Many feared that new tariffs would weigh heavily on growth, but so far, the impact seems less severe than anticipated. Some analysts even believe the economic bottom might already be behind us.

US Services Activity Firms Along With Prices (Source: Bloomberg)

Meanwhile, the US government's tariff policy remains a hot topic, especially with proposals like a 100% tariff on foreign films. This raises complex questions about how digital content is taxed across borders, an area where tariffs are rarely applied. Such moves could trigger retaliation, particularly in sectors like digital cloud services, and add a new layer of tension to global trade dynamics.

Currency markets are also reacting. The Taiwanese dollar has gained surprisingly strong momentum against the US dollar, possibly due to insurance firms hedging their dollar exposure. Others speculate that the US may be allowing its currency to weaken as a strategic move, boosting exports, improving trade leverage, and reinforcing its global influence. On the geopolitical front, there are hints of de-escalation: Former Treasury Secretary Steven Mnuchin has mentioned the possibility of reducing some tariffs, suggesting a softer stance toward China. At the same time, places like Hong Kong are managing their currencies tightly, likely in response to ongoing trade and financial pressures.

U.S. Dollar Index Continues Weakening (Source: Tradingview)

For investors, a weaker US dollar can have far-reaching effects. It often encourages other countries to buy US Treasuries, helps support global growth, and tends to push up commodity prices like oil and gold. Central banks around the world are also increasing their gold holdings, possibly as a hedge against volatility. All of this points to a more complex but opportunity-rich environment. Keeping an eye on trade negotiations, currency moves, and commodity trends could help investors position themselves more wisely in this shifting macro landscape.

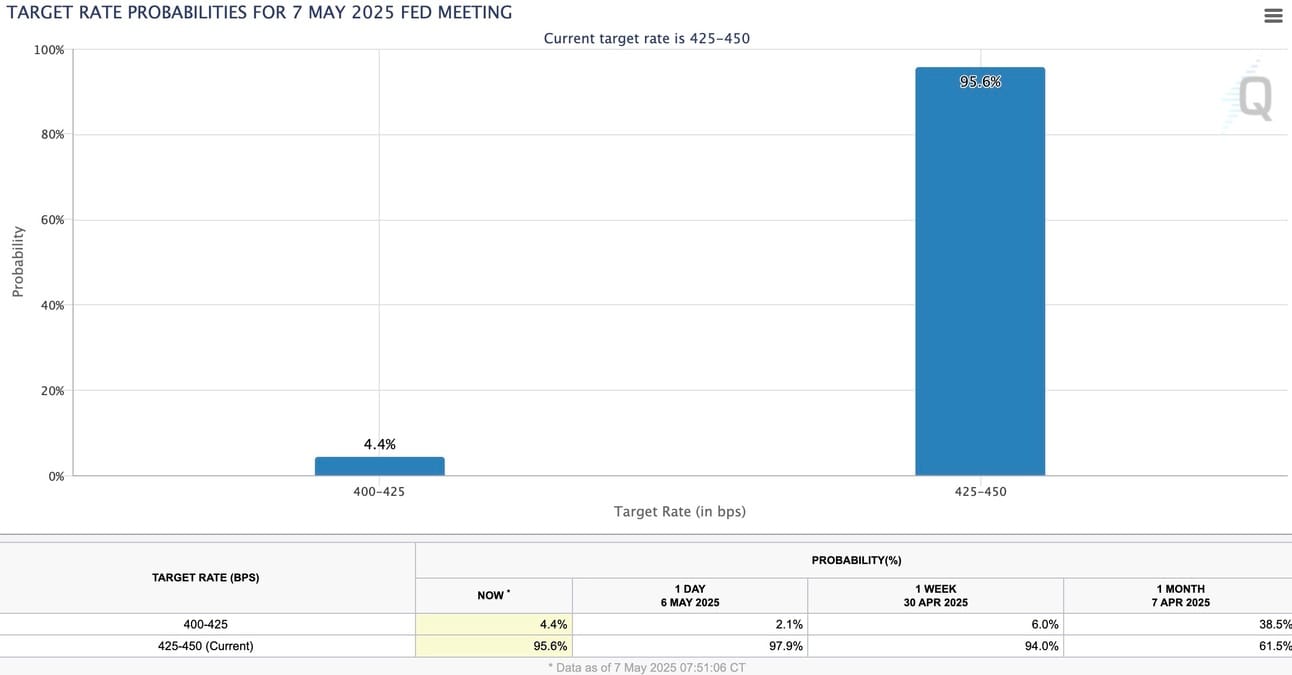

Target Rate Probabilities for 7 May 2025 Fed Meeting (Source: Fedwatch)

Looking ahead, all eyes are on the Federal Reserve's policy meeting scheduled for Wednesday, May 7. The central bank is widely expected to keep its benchmark interest rate steady at 4.25% to 4.5%.

However, the focus will be on Fed Chair Jerome Powell's commentary during the post-meeting press conference. Investors are eager to glean insights into the Fed's future policy direction, especially in light of persistent inflation concerns and recent economic data. A dovish tone from Powell, suggesting potential future rate cuts, could bolster risk appetite and support crypto prices. Conversely, a more hawkish stance emphasizing inflation control might exert downward pressure on these assets.

Now let’s dive into the part you’re really here for: the charts, key levels, trade scenarios and what’s next for crypto. 🔥

Data-driven analysis and unparalleled market intelligence, exclusively at Sandman Research.

Subscribe to Premium Research to read the rest.

Become a paying subscriber of Premium Research to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Institutional-Grade Market Analysis: Deep-dive reports on Bitcoin and Altcoins, delivering expert insights multiple times per week.

- Macro Coverage: Stay informed with global macroeconomic trends and key economic events that impact the crypto market.

- Exclusive Data & Research: Access proprietary insights and in-depth market intelligence used by top traders and institutions.

- Actionable Intelligence: Identify key technical levels, trade setups, and high-probability scenarios before the market reacts.

- Exclusive Access to Market-Moving Insights – Stay ahead with exclusive research before it reaches the public.