🚨 This week, global markets appear increasingly uncertain as the US dollar drifts toward multi-year lows and trade tensions resurface. Could this shifting backdrop create new openings for Bitcoin, or signal broader market risk?

In today’s deep dive, we explore how dollar weakness, evolving tariff policies, and institutional positioning may be shaping market dynamics. With volatile liquidation clusters and major technical zones approaching, are we nearing a breakout, or a shakeout?

Here’s what we’ll cover today:

📈 Market Review: How the dollar’s steep decline and easing oil prices may create a favorable backdrop for risk assets, while ongoing tariff threats weigh on traditional markets.

🔍 Current Market Conditions: A close look at recent Bitcoin Spot ETF flows and shifting market sentiment, examining how sustained demand and investor positioning are shaping short-term momentum.

👀 Key Events Ahead: An overview of the critical economic calendar this week, including the BRICS summit and US data releases, and how these could influence risk sentiment and asset flows.

📊 Technical Analysis: Why Bitcoin’s repeated tests of $109,300 are crucial for the next leg higher or a pullback, and what traders should expect if these levels fail or hold.

🚀 Altcoin Insights: Examining total3 altcoin resistance and Ethereum’s recent key level reclaim, signaling potential shifts in altcoin leadership if momentum builds.

Ready to capitalize on the macro-to-crypto convergence?

📈 Market Review:

The Bloomberg Dollar Spot Index continues its sharp decline, falling to levels last seen in early 2022. It recently broke below the key 1,190 support level, further indicating this isn’t just a short-term correction but a sustained move lower. A weakening dollar often creates a more favorable environment for risk assets like Bitcoin and other cryptocurrencies, as investors look for alternatives to dollar-denominated holdings. Technically, the dollar looks vulnerable, trading well below its key moving averages with no sign of stabilization.

Dollar Slumps To Multi-Year Lows (Source: Bloomberg)

A second chart highlights how extreme this decline is: the DXY is now trading at its largest discount to the 200-day moving average since 2004. This kind of deviation typically signals one of two things: either a major shift in currency regime or a market that’s extremely oversold and due for a bounce.

The Dollar’s Deepest Downdraft in Two Decades (Source: Bloomberg)

Either way, this move is historically significant. For crypto investors, it suggests growing tailwinds, as dollar weakness has often been associated with increased interest in alternative assets and stores of value like Bitcoin.

Oil Gains Lost (Source: Bloomberg)

Meanwhile, crude oil prices have cooled off. After spiking to nearly $82 per barrel due to tensions between Iran and Israel, oil futures have dropped back to the $67–68 range. This pullback removes a key inflation driver and suggests that geopolitical risk premiums across markets are easing. For crypto, this is broadly positive, as lower oil prices reduce the risk of renewed inflation and in turn, reduce the chances of central banks tightening monetary policy further.

S&P 500 Is Tracking a Third Month of Gains (Source: Bloomberg)

Equity markets are also showing strength. The S&P 500 has now posted three consecutive months of gains after a sharp sell-off in early April. Its recovery from a -6% drawdown earlier this year shows that risk appetite remains strong despite ongoing macro headwinds. This resilience supports the broader market environment for crypto, as institutional capital often flows across both equities and digital assets when liquidity remains available.

On the policy front, Treasury Secretary Bessent confirmed that President Trump will move forward with enforcing tariffs on countries that haven’t secured trade deals with the U.S. The pause in tariff implementation has been extended from July 9th to August 1st, giving more time for negotiations but keeping the threat of disruption alive. This uncertainty could weigh on global growth expectations and keep investors cautious, particularly in traditional markets.

How Would Investors Change Their Strategy? (Source: Bloomberg)

Lastly, recent survey data reveals how split institutional sentiment remains. While 35.1% of investors said they’d stick to their current investment strategies even if tariffs return, 32.1% said they would significantly reduce their exposure to global equities. This suggests that if trade tensions escalate, sharp outflows from traditional risk assets could follow, strengthening the case for Bitcoin and gold as resilient, alternative stores of value in uncertain macro environments.

🔍 Current Market Conditions:

With Bitcoin’s June recovery from $98,000 to now $109,000, the CoinGlass Fear and Greed Index jumped sharply, rising from 37 at the June lows to a current reading of 74, signaling greed. As explained in previous articles, during bull markets and uptrends, this metric can quickly rise into greed or even extreme greed territory, often signaling overheated conditions and potential short-term pullbacks. For a healthy and sustainable uptrend, we’d prefer to see this reset back toward neutral soon.

Crypto Fear and Greed Index (Source: Coinglass)

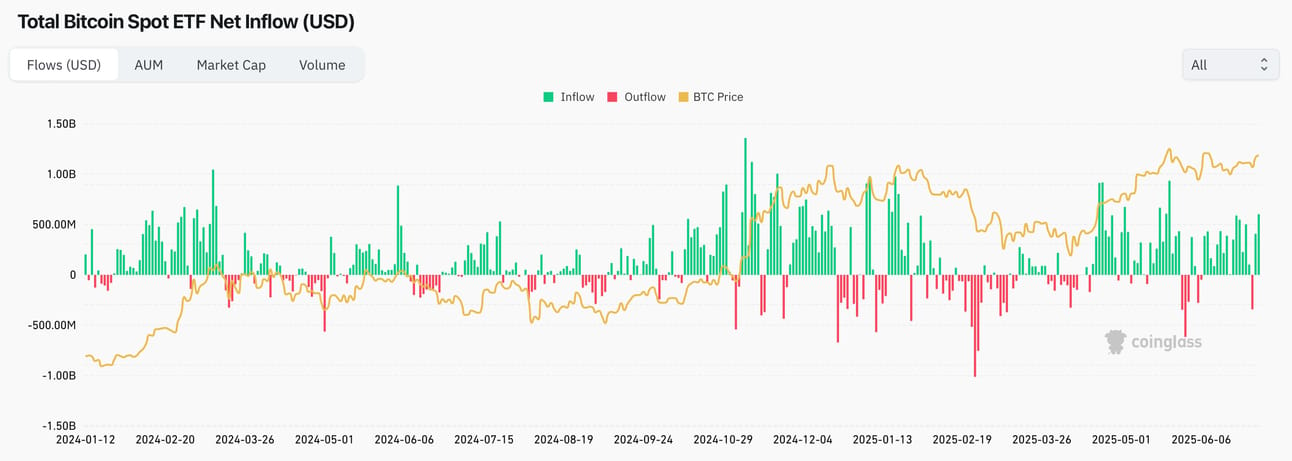

Total Bitcoin Spot ETF net flows saw a notable outflow on July 1st, with -$342 million exiting the funds. However, this is not concerning, it was the only day of outflows since June 9th. Nearly a full month of consistent net inflows reflects strong underlying demand for the asset.

Total Bitcoin Spot ETF Net Inflow (Source: Coinglass)

Bitcoin closed the week at $109,231, its highest weekly close ever. This milestone marks a potential breakout above prior resistance and confirms strong bullish market structure. Historically, weekly closes at new highs tend to precede further upside as momentum builds and sidelined capital re-enters. This close adds further conviction to our bullish thesis and suggests that Bitcoin could be entering the next leg of its macro uptrend.

👀 Key Events Ahead:

This week brings a series of important events that could influence global markets. On Monday, the BRICS Summit will take place, drawing attention to geopolitical developments and potential shifts in global economic alignment. Tuesday will see the release of the NFIB Small Business Index and U.S. consumer credit data, both offering insights into the health of the American consumer and small business sector. On Wednesday, investors will closely watch U.S. wholesale inventories and the FOMC meeting minutes, which may provide further clarity on the Fed’s policy stance and economic outlook. Thursday will bring the latest data on initial jobless claims, a key indicator for labor market conditions. Finally, Friday rounds out the week with the release of the U.S. federal budget balance, shedding light on the government's fiscal position

BRICS Expands in the Middle East and Africa (Source: Bloomberg)

In addition to this week's key economic events, markets will now also have to price in rising geopolitical risk. President Trump announced a 10% tariff on companies supporting BRICS-aligned policies, with no exceptions. This policy targets not only the original BRICS members (Brazil, Russia, India, China, and South Africa) but also the bloc's recent expansion into the Middle East and Africa, as shown by new member countries in these strategically important regions.

This sharpens trade tensions and could have broad market implications, likely pressuring equities and global trade while potentially increasing demand for alternative assets like Bitcoin and gold, as investors seek hedges against the widening scope of trade restrictions across an increasingly large economic bloc.

⚠️ If you’re reading this, you’re serious about gaining a real crypto edge , but the free tier only scratches the surface:

The real power lies in Full Access, where you get complete market coverage and exclusive insights trusted by top investors.

For better portfolio decisions and smarter trades, upgrade now, your future self will thank you.

Don’t let limited data limit your decisions. ⏳

📊 Technical Analysis:

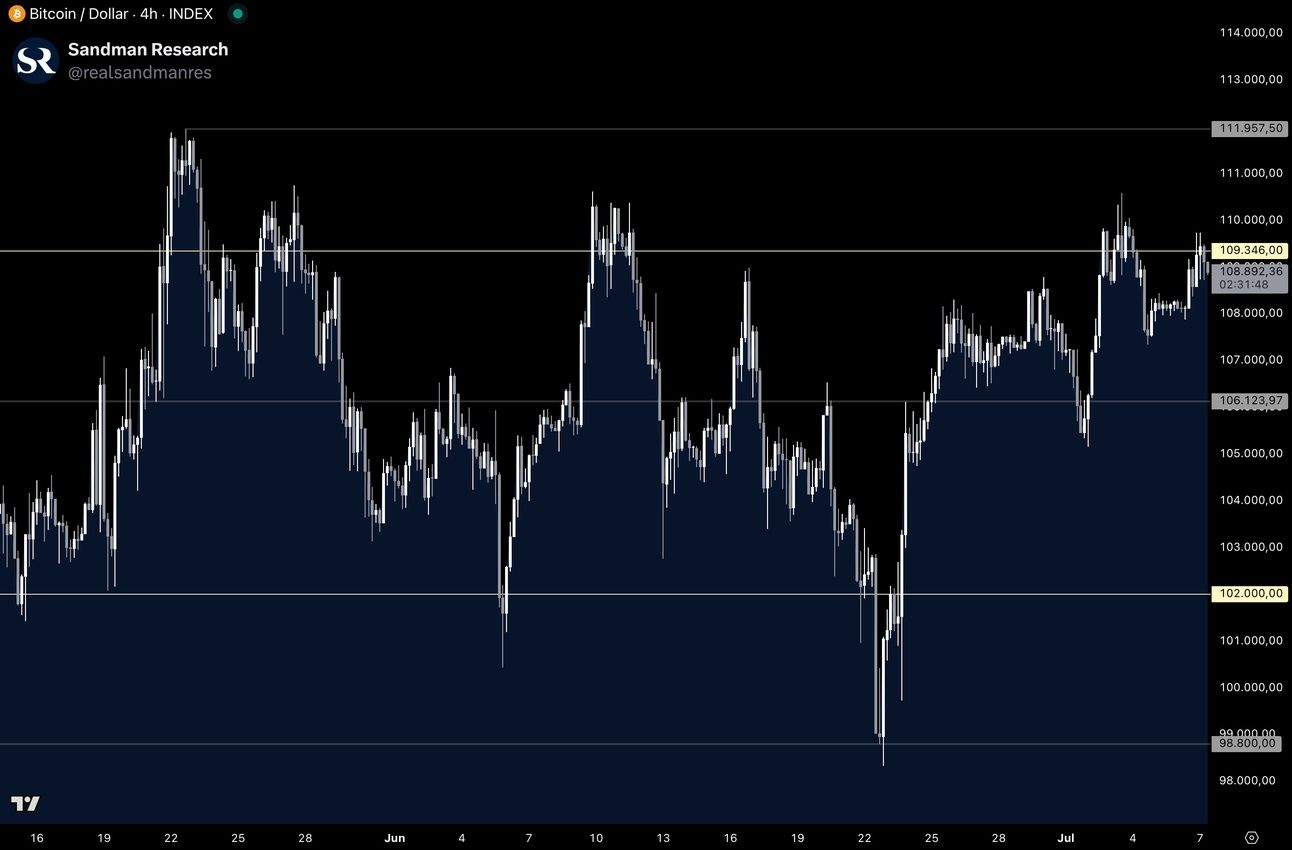

Despite Bitcoin closing its highest weekly candle to date, price was once again unable to reclaim the key resistance at $109,300 and has faced rejection so far. If this move fails and Bitcoin trends lower from here, it would mark the third rejection around this level since May, further underscoring its significance and the upside potential once it’s successfully reclaimed.

Bitcoin Price Chart (Source: Tradingview)

The Bitcoin two-week liquidation heatmap currently shows clusters of leveraged liquidations both above and below current price, with both sides carrying equal significance. Upside liquidations lie around $110,800, just above the July highs, while downside clusters sit near $104,700, just below the early July lows. This balance increases the likelihood of sharp moves in either direction, warranting caution.

Bitcoin Liquidation Heatmap (Source: Coinglass)

Bullish Scenario:

In a bullish case, we’d want to see Bitcoin finally reclaim the $109,300 level, signaling decisive strength and potential continuation toward fresh all-time highs. Long opportunities emerge on a confirmed flip of $109,300 with a successful retest, targeting the ATH at $111,900. Invalidation occurs if price fails to hold above the entry. Additional long setups could arise on a retest of $106,100, targeting $109,300, invalidated if price breaks below the entry.

Bearish Scenario:

In a bearish case, Bitcoin sees a clear rejection at current levels again, unable to reclaim $109,300. This opens up short opportunities on a failed retest of that level, targeting $106,100, with invalidation if price moves back above the entry level.

🚀 Altcoin Insights:

Similar to Bitcoin, the Total3 altcoin index is currently facing headwinds at the key resistance area around $850B. We’d expect Bitcoin to lead the way by flipping $109,300 first, before seeing altcoins break through their own resistance, with both likely moving in tandem.

TOTAL3 (Source: Tradingview)

On the flip side, if Bitcoin is rejected around current levels, we’d expect Total3 and the broader altcoin market to pull back as well, potentially more sharply than Bitcoin, as is often the case.

Ethereum Price Chart (Source: Tradingview)

Notably, Ethereum, the altcoin market leader, has managed to reclaim the key level at $2,525 and is currently holding above it. Continued strength in Ethereum could potentially hint at a sentiment shift and the beginning of a phase where altcoins outperform Bitcoin in terms of returns, although it’s still too early to confirm, and clear signals have yet to emerge.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

If you want to stay ahead of the curve with in-depth analysis and real-time updates, make sure to subscribe to Full Research Access for even more insights - you won’t want to miss what’s coming next!

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.