Global trade tensions are easing as the US and EU finalize a major trade deal and the US-China tariff pause gets extended another 90 days. These breakthroughs could be removing key risks that have weighed on markets, fueling dollar weakness, reducing inflation pressure, and opening the door for renewed capital inflows into risk assets like Bitcoin and crypto.

Here’s what we’ll cover today:

📈 Market Review: Trade breakthroughs, tariff pauses, and macro easing are reshaping the global risk landscape.

🔍 Current Market Conditions: Bitcoin sits in a strong position with continued ETF inflows, yet sentiment remains cautious. What spot flows are signaling, and whether this calm before the storm is bullish.

👀 Key Events Ahead: All eyes on the Federal Reserve and Bank of Japan as they deliver key interest rate decisions. How could these moves impact global liquidity, the dollar, and ultimately crypto?

📊 Technical Analysis: Bitcoin is consolidating between major support and resistance. We’ll outline the key breakout levels and strategies for trading this range without unnecessary risk.

🚀 Altcoin Insights: We identify if Altcoins could lead the next rotation and how to position your portfolio for strength.

Ready to make sense of this macro-crypto convergence? Let’s dive in.

📈 Market Review:

The U.S. and EU have reached a new trade deal setting tariffs at 15% on most EU exports, while the EU commits to major U.S. energy purchases and significant investments. A recent agreement with Japan adds to signs of improving global trade stability.

In addition, the U.S.–China tariff pause has been extended for 90 days, easing supply chain pressures, lowering inflation risks, and supporting a weaker dollar, conditions that typically favor risk assets like Bitcoin and crypto. These developments, combined with central bank dynamics, reinforce a constructive outlook for the crypto market.

Central Bank Rate Decisions This Week (Source: Bloomberg)

This week brings a busy schedule of central bank decisions, particularly in emerging markets where rate-cutting cycles are continuing. While the Federal Reserve is widely expected to hold rates steady at this meeting, even the prospect of future policy easing is influencing market positioning. The divergence between a still-hawkish Fed and more accommodative global central banks is creating currency volatility, a dynamic that often supports flows into alternative assets like Bitcoin.

S&P 500 Rally Stretches Valuations (Source: Bloomberg)

The S&P 500 has staged an impressive rally since April, driving forward price-to-earnings ratios to around 22.5x, up from roughly 18x in the spring. This represents a significant valuation expansion, reflecting growing confidence in a soft landing scenario where corporate earnings remain resilient despite tighter monetary conditions. While such elevated valuations would typically signal caution, robust earnings momentum combined with expectations for rate cuts provides fundamental support for risk assets.

US Firms Exceed Profit Estimates at Strongest Rate in Four Years (Source: Bloomberg)

US corporate earnings are currently at their strongest in four years, with profit beat rates approaching levels last seen in Q2 2021. This consistency highlights corporate America’s adaptability and operational efficiency in a challenging macro environment. Strong earnings reduce recession risk and keep investor focus on growth opportunities rather than defensive positioning.

Allocation Shift (Source: Bloomberg)

Meanwhile, institutional capital is rotating out of US Treasuries and into corporate credit, signaling a structural shift in risk appetite. This move reflects confidence in corporate fundamentals and a willingness to assume credit risk over duration risk. Importantly, this trend weakens demand for the dollar and aligns with our thesis that alternative stores of value, including Bitcoin and other Cryptocurrencies, are positioned to attract continued capital inflows in this evolving macro environment.

🔍 Current Market Conditions:

The Crypto Fear and Greed Index remains elevated in greed territory with a current reading of 74. Considering Bitcoin is trading near all-time highs, the fact that sentiment is not in extreme greed is a healthy sign, especially as market momentum remains strong and ETF inflows show continued demand. These factors suggest potential for further upside.

Crypto Fear and Greed Index (Source: Coinglass)

Total Bitcoin Spot ETF flows closed last week in positive territory, despite Monday through Wednesday showing net outflows. As noted in Friday’s report, we viewed this as healthy profit-taking rather than a structural breakdown or fundamental shift.

Total Bitcoin Spot ETF Net Inflow (Source: Coinglass)

With price action strengthening over the weekend and recent trade deals bringing greater market certainty, we expect ETF inflows to remain positive in the week ahead.

👀 Key Events Ahead:

Key events this week include several important economic data releases and central bank decisions across major economies. On Monday, there are no major scheduled data releases. Tuesday brings U.S. JOLTS Job Openings and U.S. Consumer Confidence. Wednesday is packed with key events: ADP Payrolls, U.S. Q2 GDP, the Federal Reserve interest rate decision, and the Powell press conference. On Thursday, attention turns to U.S. Jobless Claims, Core PCE inflation data, and Japan, where the Bank of Japan will announce its interest rate decision along with a press conference, monetary policy statement, and outlook report. Finally, Friday includes the U.S. Jobs Report, ISM Manufacturing PMI, and the Trump tariff deadline.

The most critical event for crypto this week is the Federal Reserve’s interest rate decision and Powell’s press conference on Wednesday, July 31. Markets are widely expecting the Fed to hold rates steady, but traders are focused on any signals about the timing and scale of future cuts. After recent data, expectations for a September cut remain uncertain, with probabilities hovering near 50%.

What to watch in Powell’s tone:

If he leans dovish, emphasizing economic risks or suggesting cuts are coming soon, it could weaken dollar demand and drive fresh upside in Bitcoin and altcoins.

If he sounds hawkish, citing inflation persistence or strong labor conditions, even small hints of delayed easing could pressure risk assets and potentially trigger a crypto pullback.

Crypto investors should pay attention to Powell’s comments on inflation, growth, and policy outlook. This decision and press conference will likely set the market tone for the first half of August.

⚠️ If you’re reading this, you’re serious about gaining a real crypto edge , but the free tier only scratches the surface:

The real power lies in Full Access, where you get complete market coverage and exclusive insights trusted by top investors.

For better portfolio decisions and smarter trades, upgrade now, your future self will thank you.

Don’t let limited data limit your decisions. ⏳

📊 Technical Analysis:

Bitcoin reclaimed the key level of $118,400 over the weekend, supported by strong upside momentum and buying pressure. So far, every breakout attempt above this level has failed, and for sustained upside, price must now hold above it.

Bitcoin Price Chart (Source: Tradingview)

The two-week Bitcoin liquidation heatmap shows notable clusters of leveraged liquidations on both sides of the current price, suggesting volatility in either direction. Significant clusters are positioned around $121,000 and just below $115,000.

Two-Week Bitcoin Liquidation Heatmap (Source: Coinglass)

Bullish Scenario

In the bullish case, Bitcoin needs to hold above the reclaimed $118,400 level and establish it as support for the next move higher. Long setups become attractive on a successful bullish retest, with targets at $121,000 initially and all-time highs as the secondary objective. Invalidation occurs if price loses the entry level.

Bearish Scenario

In the bearish case, Bitcoin fails to break out once again and drops back below $118,400. Short opportunities arise on a successful bearish retest of that level, targeting the next key support at $116,900. Invalidation occurs if price reclaims the entry level.

🚀 Altcoin Insights:

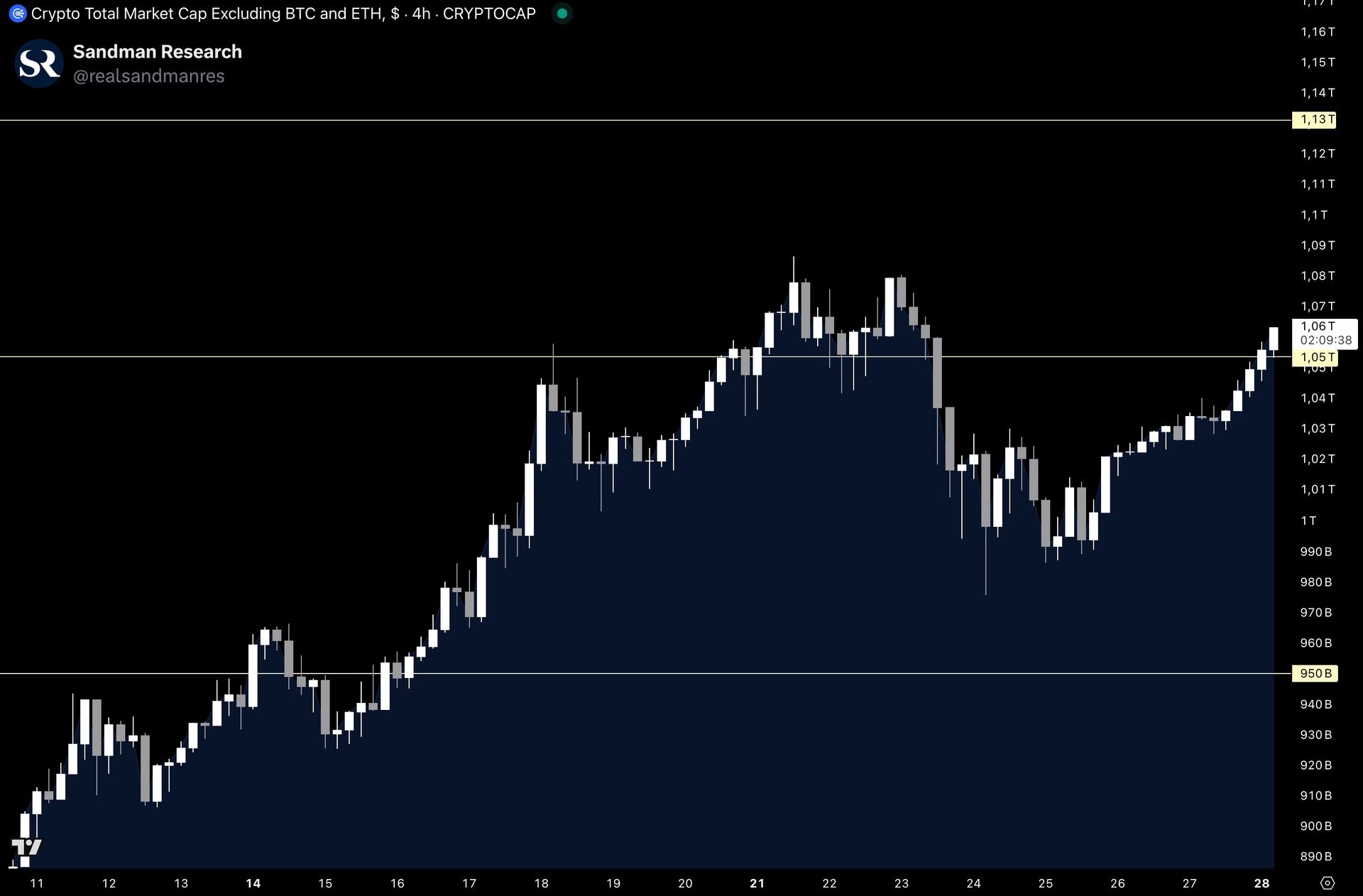

With Bitcoin trending higher over the weekend, TOTAL3 also showed strength, reclaiming the important $1.05 trillion key level once again. This level is crucial to hold for sustained upside, with the next major technical target at $1.13 trillion, near previous cycle highs.

TOTAL3 (Source: Tradingview)

Now is an opportune time to position ahead in the market. If strong spot positions were not accumulated around the April lows, we believe it is prudent to do so at this stage. Our approach remains focused on maintaining a Bitcoin-heavy portfolio while selectively allocating to high-market-cap cryptocurrencies with established narratives and strong reputations, primarily those ranked within the top 20, to manage risk effectively.

Additionally, we require altcoins to demonstrate clear outperformance or a structural bullish trend not only against the US dollar but also relative to Bitcoin. This dual confirmation provides greater conviction for potential upside and supports disciplined capital risk management.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

If you want to stay ahead of the curve with in-depth analysis and real-time updates, make sure to subscribe to Full Research Access for even more insights - you won’t want to miss what’s coming next!

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.