Good morning and welcome to this week's altcoin market update.

The crypto market has reached a pivotal inflection point. Bitcoin ETFs just recorded their largest single-day inflows ever at $1.5 billion, while Ethereum ETFs are posting their strongest demand since launch. This isn't the tentative institutional dipping we saw earlier, this is full-scale institutional FOMO as major funds abandon cautious allocation strategies for aggressive positioning.

But the real story is happening beneath the surface: altcoin dominance is surging, Bitcoin dominance is in freefall, and key altcoin pairs are approaching historical breakout levels that have previously triggered major altseason runs.

Here’s what we’ll cover today:

📅 Macro Review: Record ETF inflows, dollar weakness, and tech sector strength are creating the perfect storm for crypto. We'll break down why this institutional acceleration changes everything and what it means for the next phase of the bull market.

📊 Crypto Market Overview: Bitcoin eyes a breakout above $118,400 while TOTAL3 reclaims the trillion-dollar milestone. We explore why the broader altcoin market is positioned for explosive upside even if BTC consolidates.

🔍 Bitcoin vs. Altcoins: BTC Dominance is experiencing its second-largest correction of the cycle while OTHERS Dominance reclaims 2023 lows. These rotation signals have historically preceded the most profitable altcoin rallies.

📈 Key Reversal Signals: OTHERS/BTC approaches the golden trendline while ETH/BTC breaks into bullish trend structure. We'll show you the exact levels that could trigger the next altseason and how this setup compares to 2017 and 2021.

🚀 Chart of the Week: ??? breaks above key resistance in the red-hot RWA narrative. This DeFi play bridging traditional finance with blockchain is setting up for a potential trend reversal that could lead the next sector rotation.

Let’s dive in!

📅 Macro Review:

The past few weeks have marked a major turning point for the crypto market. Bitcoin ETFs are seeing record-breaking inflows, up to $1.5 billion in a single session, far exceeding the volatile patterns we saw earlier this year. This suggests institutions are no longer just testing the waters. They're now moving toward firm, aggressive allocation. Ethereum ETFs are also showing their strongest inflows to date in July 2025, signaling that institutional interest is expanding beyond just Bitcoin.

US Bitcoin and Ether ETFs Daily Net Flow (Source: Bloomberg)

Meanwhile, the Bloomberg Dollar Index has fallen more than 8% from its 2025 highs, moving from around 1,300 to near 1,200. As global economic conditions improve and monetary policy outlooks shift, the dollar’s strength is fading. A weaker dollar typically creates ideal conditions for risk assets like crypto to perform well, and we expect this trend to continue.

Dollar Retreats as Correction Follows This Year’s Pattern (Source: Bloomberg)

The technology sector has been another key driver of risk-on sentiment. Tech stocks have rallied over 40% from their April lows, with the major innovation leaders, often referred to as the "Magnificent Seven“, leading the charge. This recovery shows that investor confidence in growth and innovation is back. Since crypto often trades in line with high-growth tech, this supports our bullish view on the digital asset space.

Magnificent Seven Jump Over 40% From April Lows (Source: Bloomberg)

Oil markets, which had briefly spiked during the Iran–Israel conflict, have also returned to normal much faster than many expected. The narrowing of WTI crude’s prompt spread from $1.50 to around $1.20 per barrel reflects improving supply confidence and fading geopolitical premiums.

Oil Edges Lower as Investors Weigh Trade Talk Progress (Source: Bloomberg)

With energy prices stabilizing, inflationary pressures ease, which gives central banks more flexibility. We see this as a supportive backdrop for speculative assets like crypto.

📊 Crypto Market Overview:

Bitcoin managed to reclaim the $118,400 key level once again on Tuesday and is currently retesting it. Keep in mind: since reaching fresh all-time highs and pulling back into the current zone between $116,900 and $118,400, every breakout attempt has failed, with Bitcoin quickly falling back into the range.

Bitcoin Price Chart (Source: Tradingview)

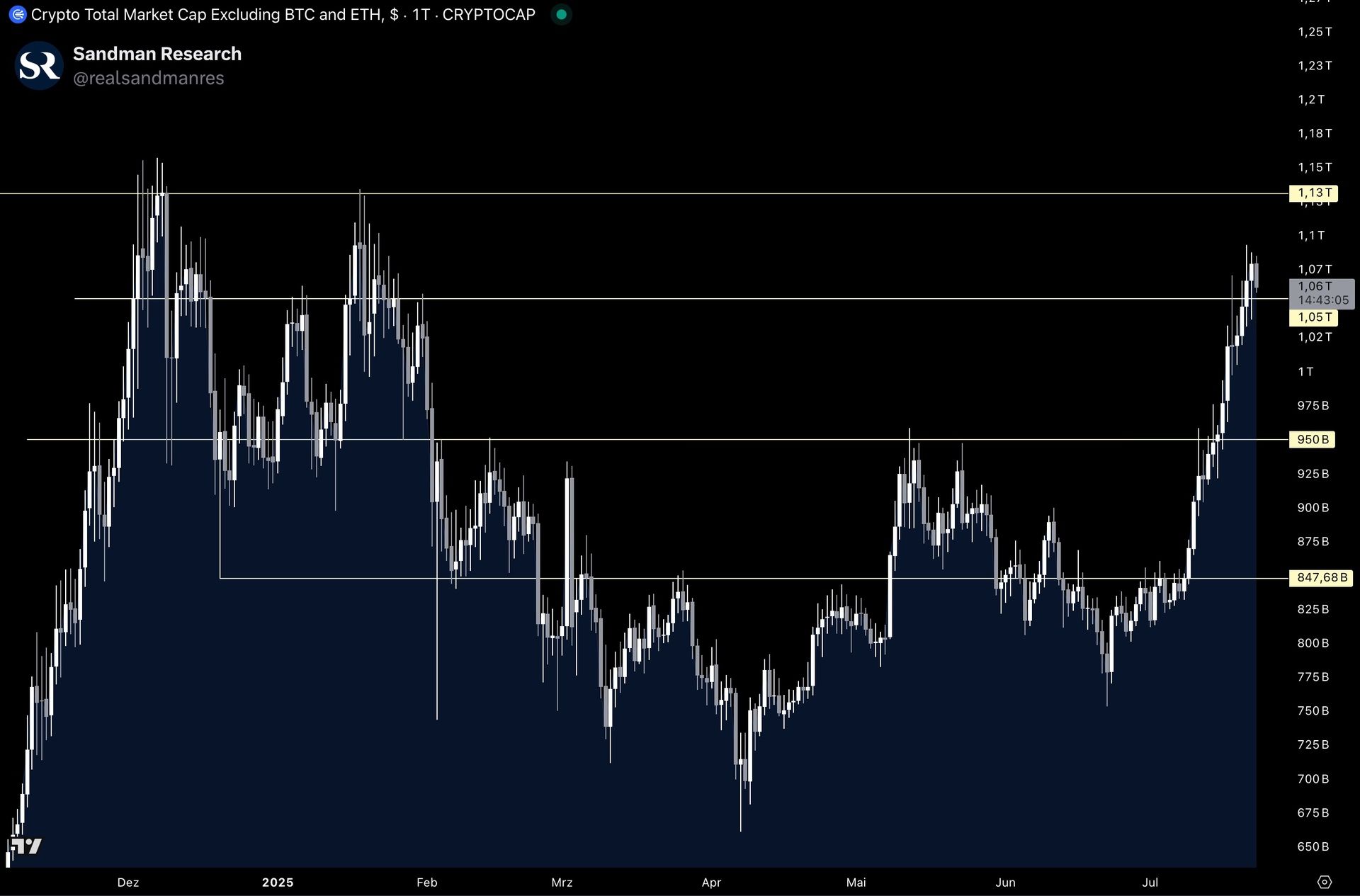

TOTAL3 managed to trend higher and reclaim the important $1.05T key level, a major milestone as it broke above the $1 trillion mark and this significant technical area. Holding this level now is crucial to enable further upside and make a trend continuation possible.

TOTAL3 (Source: Tradingview)

By reclaiming the $300B key level, OTHERS has shifted higher timeframe market structure to bullish and printed a higher high within the current trend. While it's just as important for OTHERS to hold here, a pullback and formation of a lower high could see the metric drop below $300B again, without necessarily being bearish. The same applies to TOTAL3.

OTHERS (Source: Tradingview)

Gain Full Research Access to read the rest.

Become a paying subscriber of Sandman Research to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Institutional-Grade Market Analysis: Deep-dive reports on Bitcoin and Altcoins, delivering expert insights multiple times per week.

- Macro Coverage: Stay informed with global macroeconomic trends and key economic events that impact the crypto market.

- Exclusive Data & Research: Access proprietary insights and in-depth market intelligence used by top traders and institutions.

- Actionable Intelligence: Identify key technical levels, trade setups, and high-probability scenarios before the market reacts.