📉 With major central banks pivoting toward rate cuts and inflation expectations creeping higher, the macro backdrop is quickly turning crypto-friendly.

Bitcoin remains resilient above $116K after hitting new highs last week, supported by strong ETF inflows and weakening dollar sentiment.

But with Jerome Powell’s speech on Tuesday and a packed calendar of U.S. economic data ahead, markets are on edge. Will macro policy reinforce the bull case, or crack the surface of recent strength?

Here’s what we’ll cover today:

📈 Market Review: Rate cuts are on the table and ETFs are absorbing supply—but could sticky inflation and trade volatility undermine the bullish narrative?

🔍 Current Market Conditions: Bitcoin remains in the greed zone, yet sentiment feels muted. Why is enthusiasm lagging price—and could that be a good thing?

👀 Key Events Ahead: Powell’s upcoming speech and key economic reports may redefine the outlook for crypto and risk assets. What signals matter most?

📊 Technical Analysis: Bitcoin is pinned between support and resistance. Which level will give first—and how do we trade the range without getting trapped?

🚀 Altcoin Insights: Ethereum breaks out vs. Bitcoin, and TOTAL3 reclaims $1.05T—but are altcoins ready to follow, or is ETH the lone leader?

Ready to make sense of this macro-crypto convergence? Let’s dive in.

📈 Market Review:

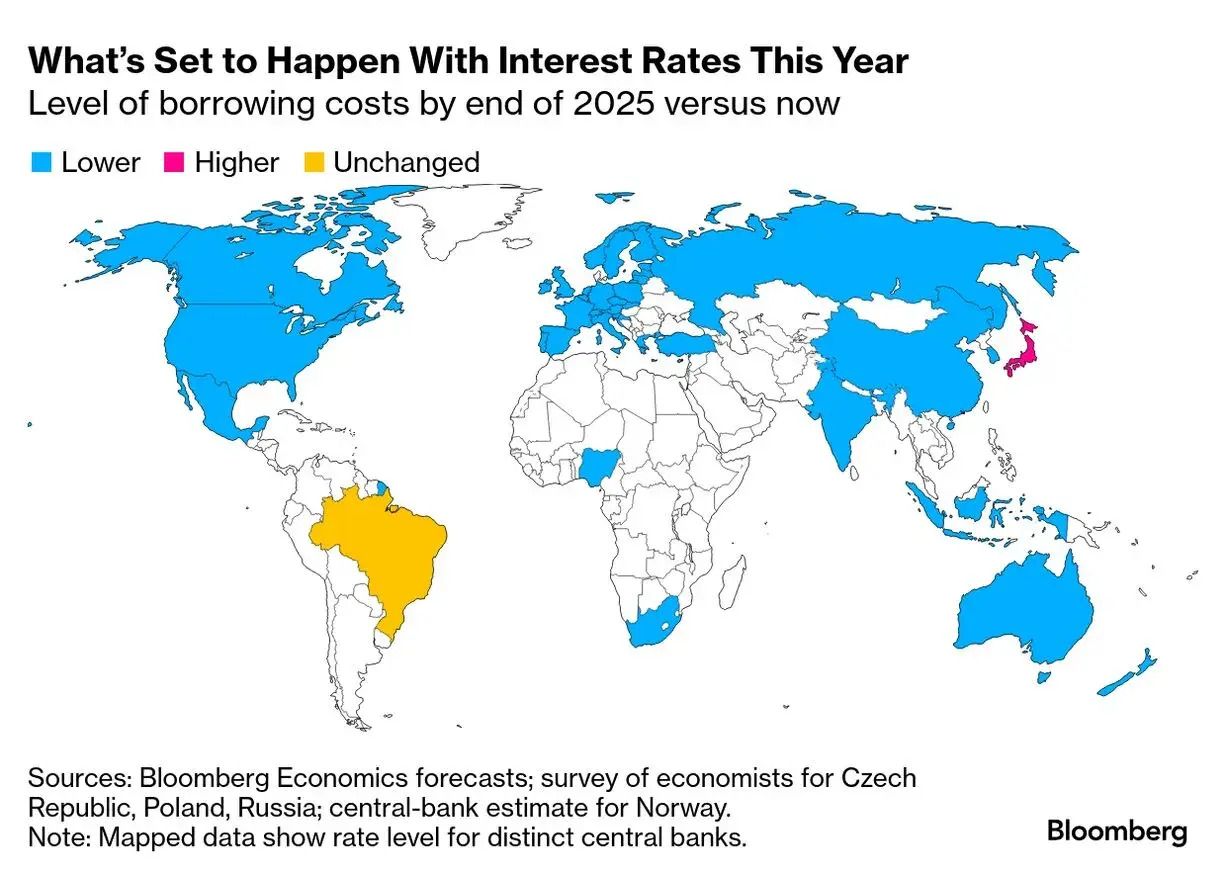

Most major economies, including the U.S., Europe, and Asia are now clearly shifting toward interest rate cuts by the end of the year. Central banks are pivoting into easing cycles, creating a supportive environment for risk assets like Bitcoin. As borrowing costs fall, the opportunity cost of holding non-yielding assets like crypto decreases. We’ve already seen this play out in the past week, with ETF inflows into crypto assets accelerating sharply, further confirming this trend.

What’s Set to Happen With Interest Rates This Year (Source: Bloomberg)

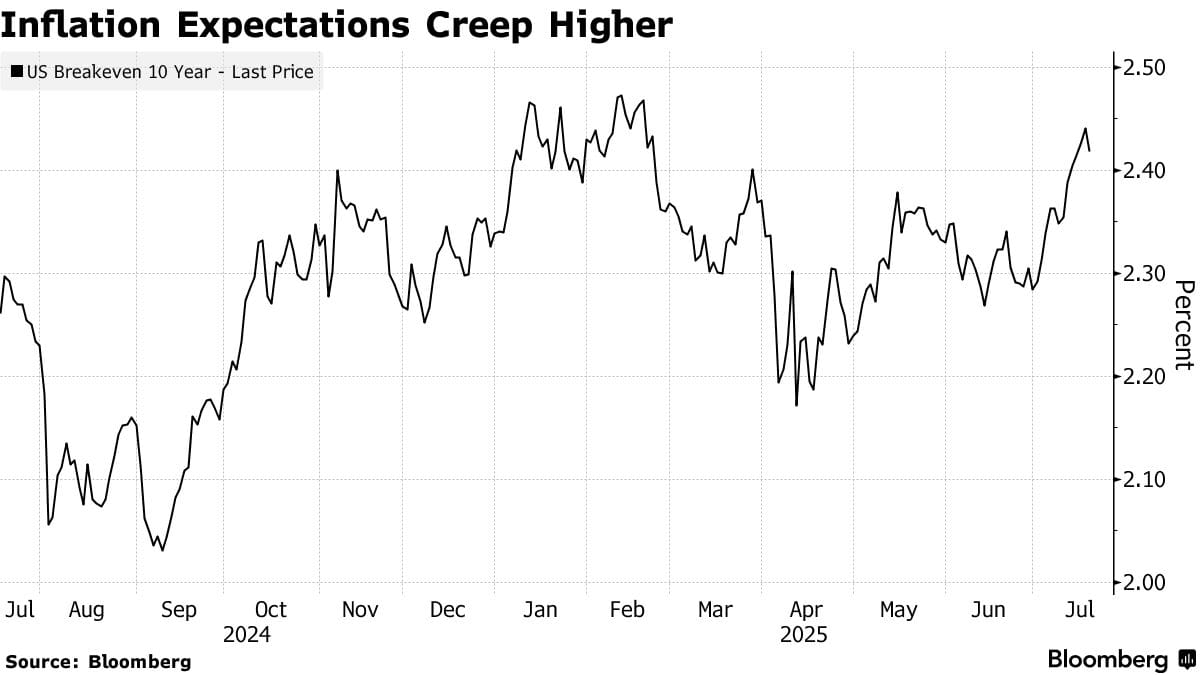

In the U.S., inflation expectations have been steadily rising since mid-2025, with the 10-year breakeven rate now nearing 2.45%. This signals that markets anticipate more persistent inflation than the Federal Reserve may be comfortable with. Normally, rising inflation expectations push investors toward hard assets, and Bitcoin is increasingly seen as "digital gold" in this context. Despite concerns earlier in the year, Bitcoin has remained resilient and is still up 26% year-to-date.

Inflation Expectations Creep Higher (Source: Bloomberg)

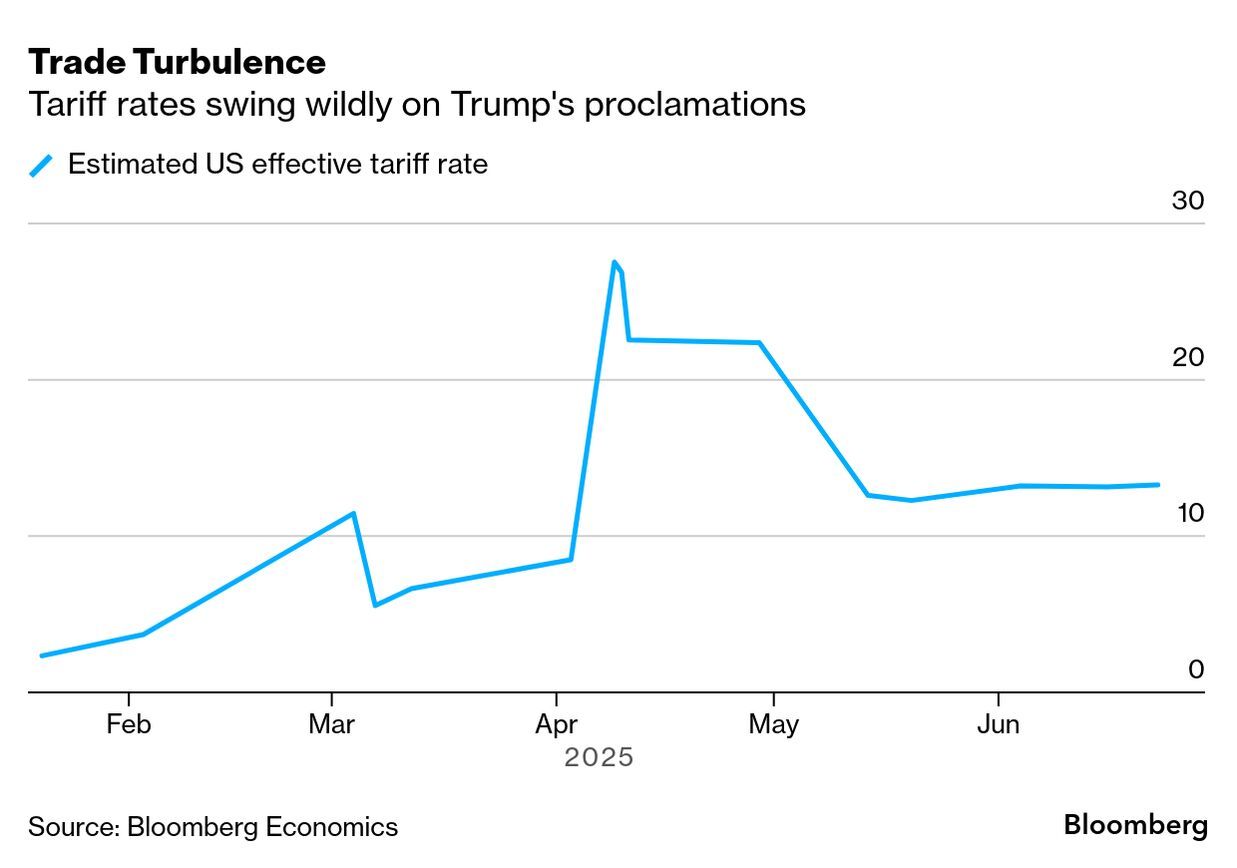

U.S. trade policy remains a source of market volatility. Tariff rates spiked as high as 25% in April before easing back to around 12% by mid-year. These sharp swings have added uncertainty to global trade and currency flows, weakening investor confidence in the U.S. dollar. In our view, this drives international capital toward alternative stores of value, further strengthening the long-term case for crypto.

Trade Turbulence (Source: Bloomberg)

The continuation of the “America First” approach presents structural challenges for the dollar, but acts as a tailwind for Bitcoin and the broader digital asset space.

🔍 Current Market Conditions:

When Bitcoin entered new all-time highs a little over a week ago, the Crypto Fear & Greed Index surged to a reading of 78, well into greed territory and just two points shy of extreme greed. Since then, we’ve seen a cooling off as anticipated, not just in price but also in sentiment, with the index now sitting at 72, still firmly in the greed zone.

Crypto Fear and Greed Index (Source: Coinglass)

During previous bull markets, and especially during parabolic runs in Bitcoin and other cryptocurrencies, this metric remained in extreme greed territory for many days or even weeks. This suggests that, based on sentiment alone, we’re not yet in extreme territory, leaving room for further upside.

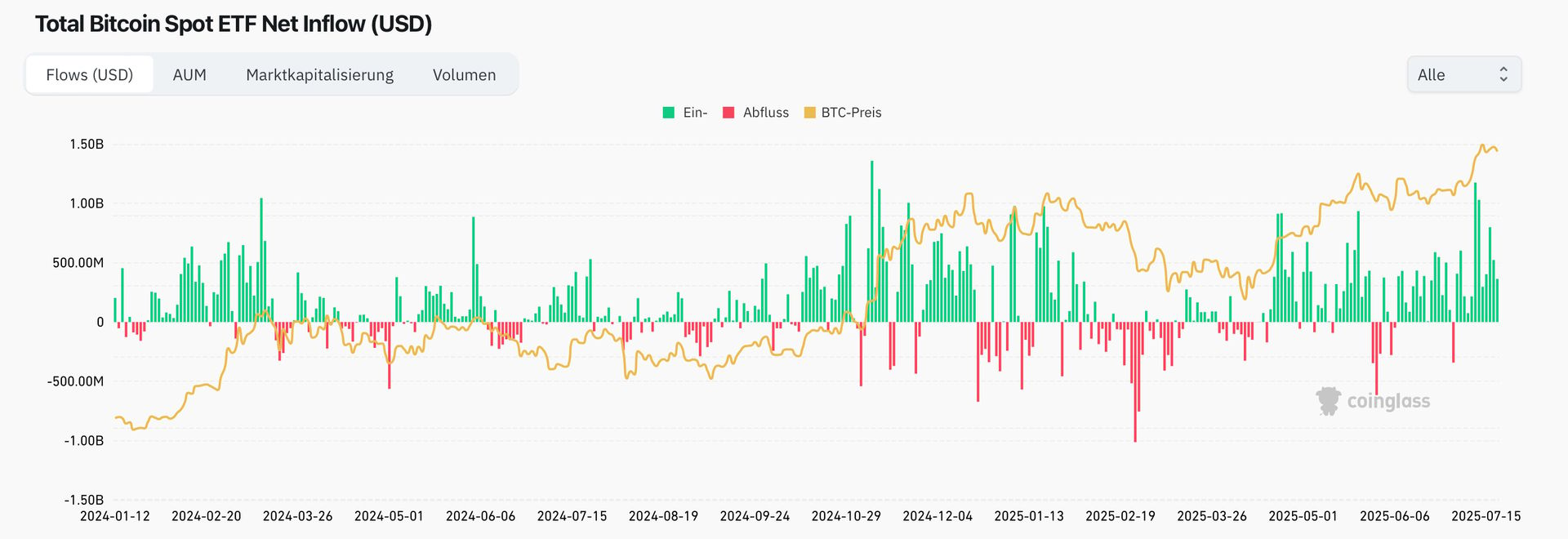

Total Bitcoin Spot ETF Net Inflow (Source: Coinglass)

Total Bitcoin Spot ETF inflows also remain consistently positive as we enter the new week. Last week didn’t see a single day of outflows, further confirming strong demand from institutions and the traditional finance sector. We expect this trend to continue, with no signs of major profit-taking on the horizon.

👀 Key Events Ahead:

This Tuesday, July 23, Fed Chair Jerome Powell will deliver a speech. Any new signals about interest rates or inflation could move markets, so it’s worth keeping an eye on. On Wednesday, July 24, we’ll get data on U.S. existing home sales, a useful indicator of how strong or weak the housing market is right now. Thursday, July 25 is packed with economic updates: jobless claims, reports on the services and manufacturing sectors, and new home sales data will all be released. These numbers will give us a clearer picture of how the U.S. economy is holding up. Finally, on Friday, July 26, durable goods orders are coming out. This report shows how much businesses are spending on big-ticket items and can offer insight into overall confidence in the economy.

The most critical event for crypto this week is Fed Chair Powell’s speech on Tuesday, July 23.

Following hotter-than-expected inflation figures and shifting rate-cut expectations, markets have priced in roughly a 20 bp Fed cut by September, down from earlier optimism for deeper easing. Traders will be listening closely to Powell’s tone:

If he leans dovish, highlighting economic fragility or signaling a willingness to cut rates earlier, it could trigger further dollar weakness and boost Bitcoin and altcoins.

If he stresses caution, citing persistent inflation or tight labor conditions, even subtle hawkish notes may spook risk assets and trigger a pullback.

Crypto investors should focus on his language around inflation, growth, and the timeline for changing policy, this speech could set the market tone through the week.

⚠️ If you’re reading this, you’re serious about gaining a real crypto edge , but the free tier only scratches the surface:

The real power lies in Full Access, where you get complete market coverage and exclusive insights trusted by top investors.

For better portfolio decisions and smarter trades, upgrade now, your future self will thank you.

Don’t let limited data limit your decisions. ⏳

📊 Technical Analysis:

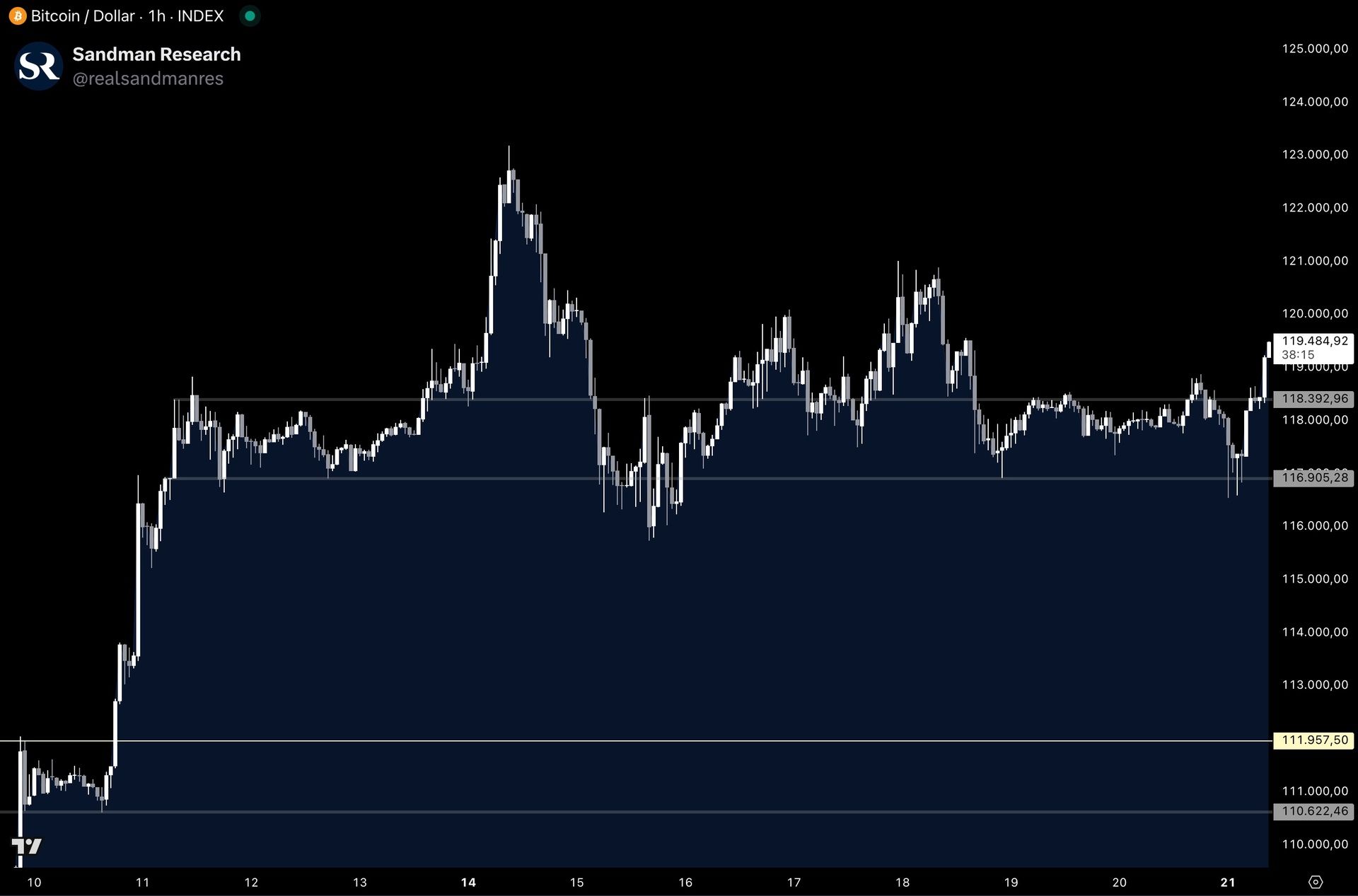

After reaching a fresh all-time high at $123,181, Bitcoin has pulled back and cooled off, though it continues to find support around $116,900, with no daily candle closes below this level so far. Price has been oscillating around that level, repeatedly attempting to reclaim $118,400 for a potential move higher, but failing each time, quickly dropping back below it.

Bitcoin Price Chart (Source: Tradingview)

The two-week Bitcoin liquidation heatmap shows that a significant cluster of leveraged positions around $116,700 has already been flushed out. However, notable clusters remain on both sides of price, particularly around $121,000 above and $116,200 below, making a move in either direction still very possible.

Bitcoin Liquidation Heatmap (Source: Coinglass)

Bullish Scenario

In a bullish case, we’d want to see Bitcoin clearly reclaim the key $118,400 level and begin trending higher, signaling continuation to the upside. Long opportunities arise once $118,400 is flipped into support, with initial targets at the $121,000 swing high and, beyond that, a potential move toward new all-time highs. Additional long entries may present themselves on a bullish retest of $116,900, targeting $118,400, with invalidation if price drops below that level again.

Bearish Scenario

In a bearish case, Bitcoin fails to reclaim $118,400 once again and trends lower. This opens up short opportunities on a bearish retest of $118,400, targeting $116,900, with invalidation if price reclaims the entry level. A confirmed daily close below $116,900 would mark a loss of key support and potentially trigger further downside toward the $111,900 area.

We are refraining from trading with full size in these conditions, as price action remains indecisive around key levels. Risk management remains our top priority.

🚀 Altcoin Insights:

A sign of altcoin strength is the TOTAL3 chart forming a fresh higher high following Bitcoin’s surge, hinting at a shift in market structure and sentiment, with interesting opportunities emerging in the altcoin space. TOTAL3 just reclaimed the important key level of $1.05T after regaining the $1 trillion mark last Thursday.

TOTAL3 (Source: Tradingview)

Notably, ETH/BTC has also entered a bullish trend, forming a fresh higher high by reclaiming 0.026 last week. Since then, it has surged further, reclaiming 0.0299 and now approaching the next key level at 0.03272. Ethereum trending higher against Bitcoin means ETH is outperforming BTC and currently acting as the stronger-performing asset. While this typically points to broader altcoin strength, it’s important to note that most altcoins are still underperforming Ethereum.

Ethereum / Bitcoin (Source: Tradingview)

This can be tricky to interpret, but simply put: Ethereum is the second-lowest-risk asset in crypto, and currently it outperforms Bitcoin. However, lower-cap altcoins that don’t outperform Ethereum (in BTC terms) carry not only higher risk but also, based on recent performance, offer weaker returns. That said, there have certainly been individual outperformers, but investing in them typically carries more risk, especially at this stage of the cycle.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

If you want to stay ahead of the curve with in-depth analysis and real-time updates, make sure to subscribe to Full Research Access for even more insights - you won’t want to miss what’s coming next!

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.