Good morning and welcome to this week’s Altcoin Market Update.

An unexpected political twist is shaking the macro landscape. U.S. Congresswoman Anna Paulina Luna claims Fed Chair Jerome Powell’s firing is imminent, shortly after Donald Trump criticized the Fed’s controversial $2.2B building renovation. As of Monday, traders still priced an 80% chance of Powell finishing his term, but this scenario now feels far less certain.

A change in Fed leadership would introduce new uncertainty around interest rate policy and could rattle markets. For crypto, this may fuel volatility, if central bank credibility comes into question.

Meanwhile, BTC has pulled back from its highs, but altcoin dominance and strength vs. BTC is rising. Could this be the early stages of a longer trend?

Here’s what we’ll cover today:

📅 Macro Review: Powell’s potential ouster could shake up the rate path, risk sentiment, and credibility of the Fed. We’ll break down what this means for crypto, and why the next move may catch many off guard.

📊 Crypto Market Overview: Bitcoin may have topped for now, but TOTAL3 and OTHERS are holding key support. We explore why the broader altcoin market looks poised to break out even as BTC cools off.

🔍 Bitcoin vs. Altcoins: BTC Dominance is pulling back while OTHERS Dominance is surging. These trend shifts have historically preceded strong altcoin rallies. We’ll walk through what to watch as rotation intensifies.

📈 Key Reversal Signals: OTHERS/BTC and ETH/BTC are pressing into breakout territory. We’ll show you what confirmation looks like and how this setup compares to previous cycles.

🚀 Chart of the Week A breakout-level setup is forming in one of the strongest altcoins in the AI narrative. It’s holding a critical support and could lead the next leg up if strength continues.

Let’s dive in!

📅 Macro Review:

Bitcoin ETFs recorded $2.7 billion in net inflows last week, marking one of their strongest weeks since launch. The sharp rise, shown clearly at the end of the chart, highlights renewed institutional demand. Consistent inflows throughout 2024 and 2025 reinforce the view that Bitcoin is becoming a strategic allocation in many portfolios.

Investors Pour $2.7 Billion into US Bitcoin ETFs Last Week (Source: Bloomberg)

In a political twist, U.S. Congresswoman Anna Paulina Luna claimed Federal Reserve Chair Jerome Powell’s firing is imminent. This came shortly after former President Donald Trump implied that Powell’s role could be in jeopardy, specifically referencing controversial and expensive renovations at the Federal Reserve building. While largely dismissed by markets until now, this is a scenario that remains entirely unpriced.

In our Monday report, we highlighted that traders currently assign an 80% probability to Powell completing his term.

US Congresswoman Anna Paulina Luna claims Powell’s Firing is imminent (Source: X)

A disrupted Fed could trigger uncertainty around monetary policy, potentially giving risk assets like Bitcoin a short-term lift, though this isn’t a long-term bullish catalyst. More likely, the immediate effect would be sharp market gyrations, possibly offering both opportunity and risk to crypto traders.

Underlying US Inflation Softer Than Projected (Source: Bloomberg)

On the macro side, June CPI data delivered a more nuanced inflation picture. Core CPI rose by 0.2% month-over-month, while the annual rate edged up to 2.9%, compared to 2.8% in May. Headline CPI accelerated to 2.7% year-over-year, up from 2.4% the previous month. The chart indicates inflation has been gradually increasing in early 2025, rather than continuing the previous downward trend.

Traders Reluctant on September Rate Cut After CPI Data (Source: Bloomberg)

This inflation surprise triggered volatility in rate cut expectations. Traders initially priced in minimal policy easing for September, later shifted toward a full 25bps cut in mid-June, and have since adjusted back to roughly 20bps of easing priced in. These rapid changes underline the market’s ongoing sensitivity to inflation data and macro signals.

US Inflation Expectations Revert (Source: Bloomberg)

Meanwhile, consumer inflation expectations have normalized. One-year and three-year outlooks are both anchored around 3%, similar to pre-pandemic levels. This suggests the elevated inflation psychology of 2021–2022 has faded, giving the Federal Reserve more flexibility to support growth without the fear of de-anchoring expectations. Well-anchored expectations also support risk assets, including crypto, by reducing macroeconomic uncertainty.

Now let’s dive into the part you’re really here for: the charts, key levels, trade scenarios and what’s next for Bitcoin and Altcoins. 🔥

Gain clarity in chaos, anticipate the next move, and position with precision, only with Sandman Research.

📊 Crypto Market Overview:

After reaching a new all-time high on Monday at $123,181, Bitcoin pulled back and retraced over the following days, finding support again on Tuesday around the $116,900 level. Currently, it's creeping higher once more, sitting just above the key level at $118,300.

Bitcoin Price Chart (Source: Tradingview)

TOTAL3 also trended higher in recent days. Notably, while Bitcoin saw a pullback after Monday’s high, TOTAL3 remained relatively strong, holding elevated levels and currently consolidating around the key $950B area.

TOTAL3 (Source: Tradingview)

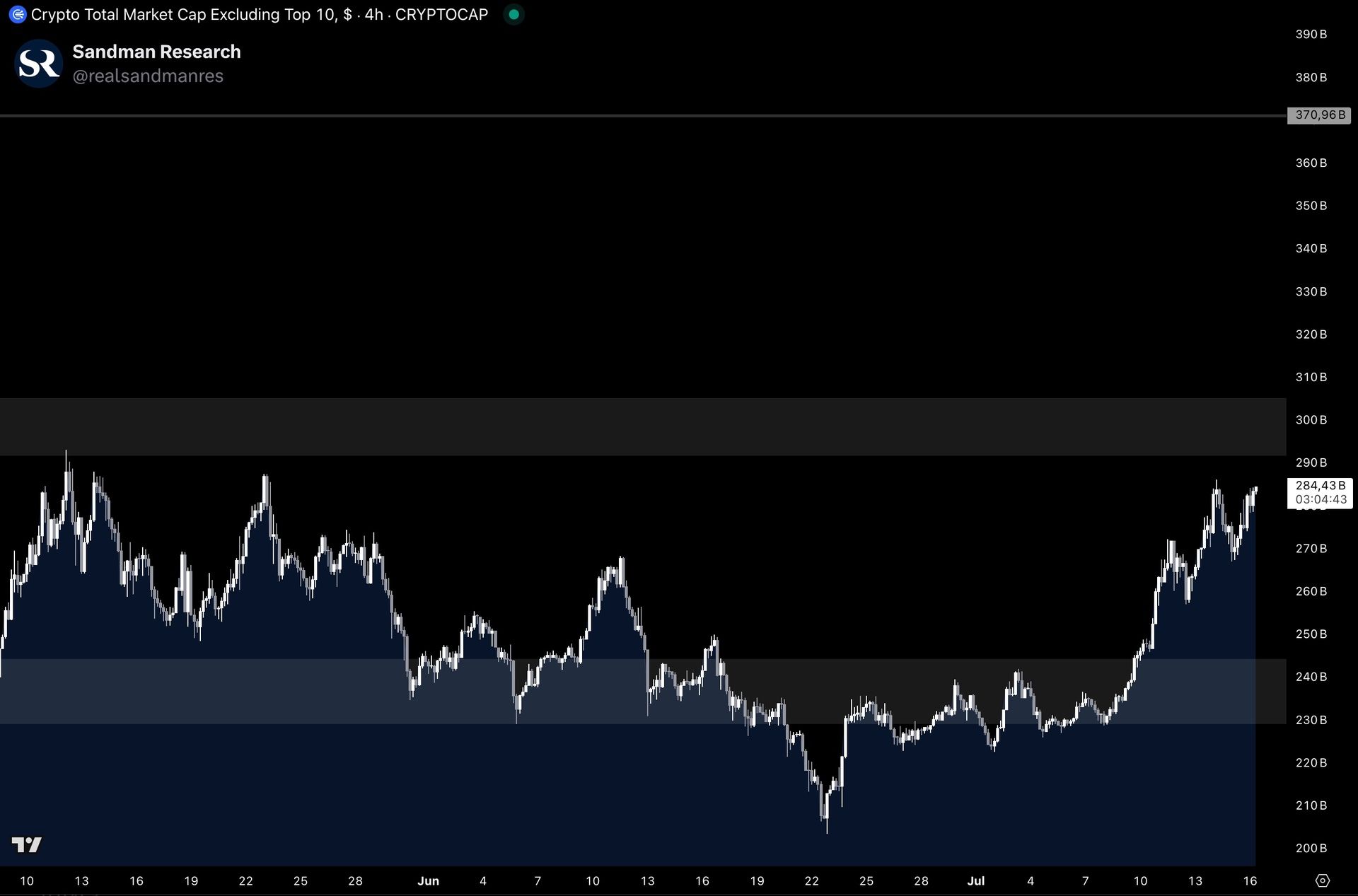

OTHERS followed a similar path, surging alongside Bitcoin and TOTAL3, it moved clearly above the $240B key zone and is now approaching the next major resistance at $300B, a crucial level to reclaim for continued upside.

OTHERS (Source: Tradingview)

Gain Full Research Access to read the rest.

Become a paying subscriber of Sandman Research to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Institutional-Grade Market Analysis: Deep-dive reports on Bitcoin and Altcoins, delivering expert insights multiple times per week.

- Macro Coverage: Stay informed with global macroeconomic trends and key economic events that impact the crypto market.

- Exclusive Data & Research: Access proprietary insights and in-depth market intelligence used by top traders and institutions.

- Actionable Intelligence: Identify key technical levels, trade setups, and high-probability scenarios before the market reacts.