Best Price. Every Trade.

Built for active crypto traders. CoW Swap always searches across every major DEX and delivers the best execution price on every swap you make. Smarter routes. Better trades. No wasted value. Find your best price today. So why trade on any one DEX when you can use them all?

Good morning and welcome to this week’s altcoin market update.

Global markets are shifting once again, this time under growing pressure. U.S. equities just posted their longest losing streak since late August, AI valuations are undergoing a meaningful reset, and Bitcoin continues to lag behind traditional assets such as gold, Treasuries, and major equity indices. Meanwhile, smaller digital assets are seeing outsized stress as liquidity tightens. Despite the weakness, improving seasonality and cooling inflation could still support a year-end recovery if macro conditions stabilize.

Here’s what we’ll cover today:

📅 Macro Review: U.S. equities face their sharpest multi-day pullback in months, AI valuations compress meaningfully, and Bitcoin continues to underperform both traditional assets and gold.

📊 Crypto Market Overview: Bitcoin loses the 92,000 support, falls as low as 89,200, and continues to trade below the key level. TOTAL3 and OTHERS extend their structural downtrends after losing major support zones.

🔍 Bitcoin vs. Altcoins: BTC.D breaks below 59.96% and trends lower toward 58.59%, while OTHERS.D continues to show strength above 7.21%. Clear bullish and bearish setups remain in play.

📈 Key Reversal Signals: OTHERS/BTC pushes higher and approaches the 2.9M technical zone, while ETH/BTC consolidates above 0.03255. Both pairs sit at pivotal levels for potential late-cycle rotation.

🚀 Chart of the Week: ??? retests key support again. Both long and short scenarios remain active, with the chart favoring disciplined, higher-timeframe setups.

Let’s dive in!

📅 Macro Review:

The S&P 500's four consecutive days of losses mark its longest losing streak since late August, and the magnitude of these declines, several sessions falling more than 1%, has quickly reduced the complacency that defined much of the prior rally. While such streaks are normal within typical market volatility, the timing is significant. Coming after extended gains and just ahead of the holiday period, the pullback raises the question of whether this is simply healthy profit-taking or an early indication of a more meaningful correction taking shape.

S&P 500 Suffers Fourth Straight Day of Declines (Source: Bloomberg)

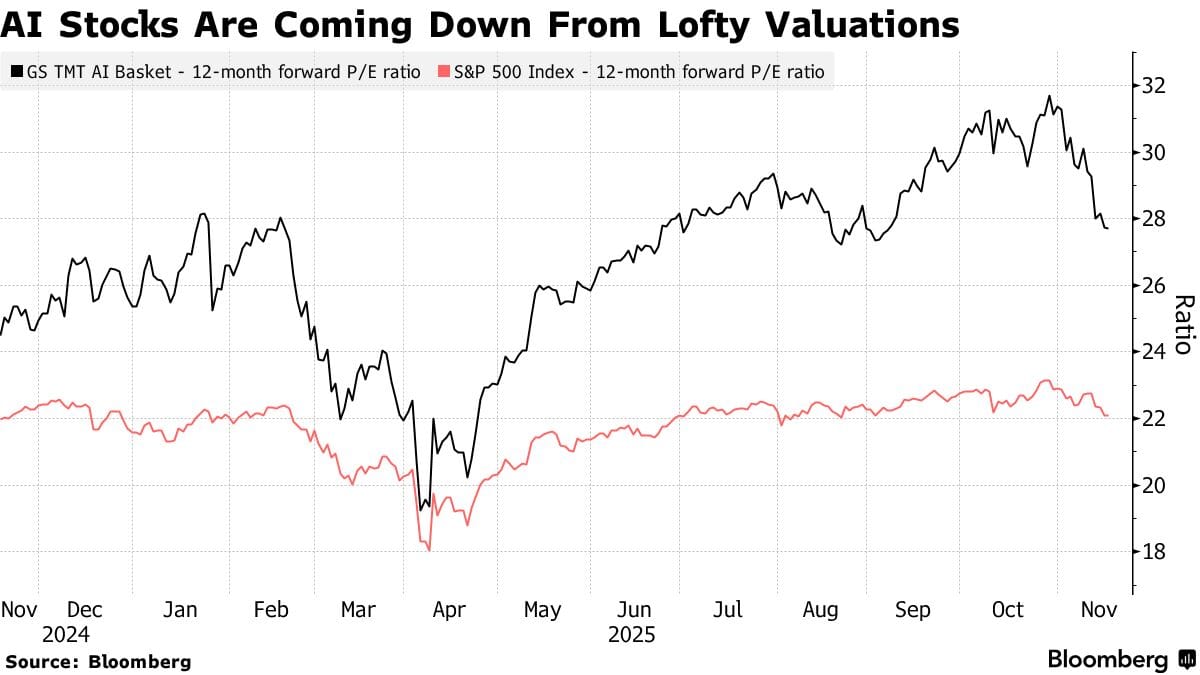

At the same time, AI-focused equities are undergoing a notable valuation reset following months of extraordinary strength. The GS TMT AI Basket’s forward P/E has contracted from above 32 in October to around 28, moving closer to the S&P 500’s multiple near 22. This shift suggests investors are becoming more selective, reassessing lofty expectations and demanding clearer evidence that AI-driven earnings can justify the substantial infrastructure spending across the sector. As enthusiasm cools, valuations are normalizing toward a more sustainable footing.

AI Stocks Are Coming Down From Lofty Valuations (Source: Bloomberg)

Bitcoin’s performance in 2025 has also been disappointing relative to traditional assets, lagging even safe-haven instruments like Treasuries. After a rally following April’s “Liberation Day,” Bitcoin slipped into a persistent downtrend, which accelerated during the recent “crypto meltdown.” Meanwhile, gold has surged roughly 50% year-to-date, Treasuries have held firm, and equity indices such as the Nasdaq have continued to deliver double-digit gains. The divergence underscores how quickly sentiment can shift in high-beta assets when liquidity tightens and macro conditions soften.

Bitcoin Lags Behind Even T-Bills in 2025 (Source: Bloomberg)

The pressure has been even more acute across smaller digital assets, where altcoins are experiencing significant stress. The MarketVector Digital Assets 100 Small-Cap Index has tumbled from over $8,000 in August to around $5,000, effectively unwinding much of the year’s earlier progress. This move highlights the inherent volatility and liquidity constraints of lower-capitalization cryptocurrencies, which tend to amplify broader market trends. It also reinforces our consistently defensive stance throughout 2025, avoiding deep exposure to small-cap altcoins, a view we reiterated frequently to readers.

AI Stocks Are Coming Down From Lofty Valuations (Source: Bloomberg)

Despite the current weakness, several factors still support the potential for a year-end rebound. Seasonal patterns typically favor equities into late December, and the recent pullback has eased overbought conditions, creating more appealing entry points for investors who have remained on the sidelines. If inflation continues to cool and the Federal Reserve adopts even a slightly more accommodative tone, risk appetite could re-emerge quickly. The recent washout in speculative areas, crypto, small caps, and high-multiple tech, may ultimately prove constructive, helping to clear excesses and setting the stage for a more durable, broad-based advance as we head into 2026.

Get the Edge Most Retail Traders Don’t Have

Become a paying subscriber of Sandman Research to get this post and all subscriber-only insights, trade setups, and macro intelligence used by top crypto traders.

Upgrade Now → Get Full AccessA subscription gets you:

- Clear Trade Setups for BTC & Altcoins: Step-by-step guidance with entry, stop, and take-profit levels so you can act confidently during market swings.

- Macro & Market Intelligence: Understand which macro events and liquidity shifts are moving crypto, so you’re never caught off guard by volatility.

- Exclusive ETF & On-Chain Flow Analysis: See capital movements and liquidation clusters before the crowd, giving you an edge in timing entries and exits.

- Altcoin & Sector Insights: Identify early rotation opportunities in high-potential sectors like AI-focused altcoins, without wasting time on dead projects.

- Actionable, Risk-Aware Playbooks: Convert research into actual trades with structured setups, technical breakdowns, and scenario-based strategies.