🚨 Dear Reader: There will be no market report published on Monday, November 10.

We’ll be back with the next update on Wednesday, November 12, after which the regular publishing schedule will resume.

Best Price. Every Trade.

Built for active crypto traders. CoW Swap always searches across every major DEX and delivers the best execution price on every swap you make. Smarter routes. Better trades. No wasted value. Find your best price today. So why trade on any one DEX when you can use them all?

Hey there, and happy Friday!

This week’s focus turns to the growing tension between rising yields and an improving liquidity outlook as markets approach year-end. Bitcoin is once again testing a critical support level that has held since the 2022 bear market, while the Federal Reserve’s upcoming halt to quantitative tightening could soon reintroduce fresh liquidity into the system. With global markets consolidating and crypto sentiment cautious, investors are watching closely to see whether this pullback marks a pause, or the start of a larger shift.

Here’s what we’ll cover today:

🌍 Market Recap & Macro Overview: Bitcoin retests long-term support around its 365-day moving average. Treasury yields climb back above 4%, ETF flows soften, and the Fed’s QT halt on December 1st could reignite year-end liquidity. What this means for macro and crypto risk appetite.

📈 Bitcoin (BTC) Breakdown: Price forms new lows at $98,900. ETF flows negative for most of the week, but a midweek inflow hints at improving sentiment. Key levels and trading setups outlined.

📊 Ethereum (ETH) Outlook: ETH retests $3,059 support and faces rejection at $3,430. ETF flows remain negative but show signs of stabilization. Liquidation clusters near $3,900 keep a potential bullish reversal in play.

🚀 Solana (SOL) Analysis: SOL pulls back from $160 to $154 with next support at $143. BTC pair retests key levels, and heatmap positioning still favors a possible upside move once liquidity resets.

Let’s dive in 👇

🌍 Market Recap & Macro Overview:

Bitcoin is once again testing a critical support level that has served as a foundation since the depths of the 2022 bear market. After retreating from its recent peak near $120,000, the asset is now hovering around its 365-day moving average, a key technical line that has historically marked local bottoms during pullbacks. A decisive break below could invite another wave of liquidation and weakness, while a successful defense would reaffirm confidence in the ongoing bull market structure. For crypto investors, this level represents a clear battleground between long-term conviction and short-term volatility, with detailed trading setups and chart analysis covered later in this report.

Bitcoin Retests Support That Held Since 2022 Rout (Source: Bloomberg)

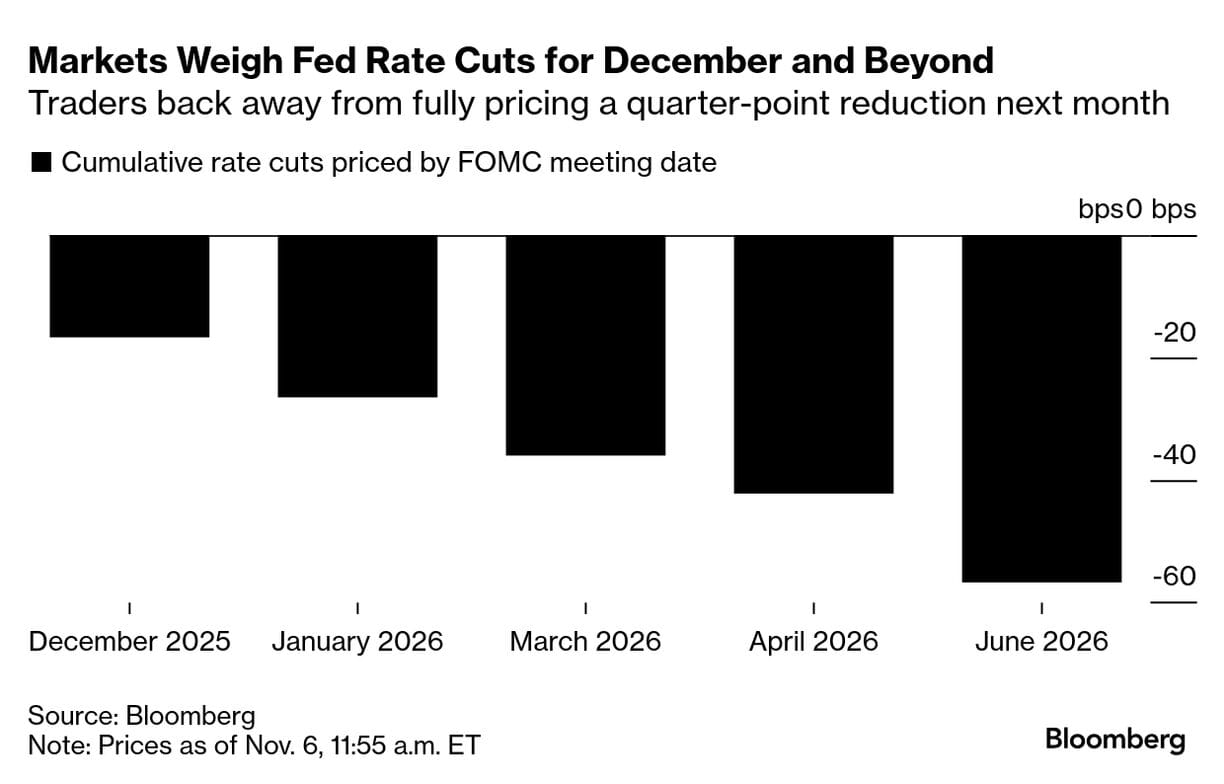

The bond market has recently recalibrated its expectations for Federal Reserve policy. Traders now see only around 15 basis points of easing priced in for December, compared to a full 25-basis-point cut anticipated just weeks ago. Longer-term projections have also moderated, with roughly 60 basis points of total cuts now expected by mid-2026. While this implies a temporarily tighter liquidity backdrop, the broader picture remains supportive for risk assets over the coming months as the U.S. government’s funding impasse resolves and the Fed halts its quantitative tightening program on December 1st, both of which are likely to inject fresh liquidity into markets.

Markets Weigh Fed Rate Cuts For December and Beyond (Source: Bloomberg)

Treasury yields have edged higher again, with the 10-year note trading around 4.11% after briefly dipping below the 4% threshold. The move reflects more measured expectations for policy easing, alongside persistent concerns about fiscal discipline and inflation resilience. Rising yields help explain the recent weakness in crypto markets, as higher risk-free rates tend to drain liquidity and reduce speculative appetite across digital assets. However, the recent climb in yields appears modest relative to the strong equity performance year-to-date, and renewed liquidity inflows could help cap further upside in yields heading into year-end.

Ten-Year Treasury Yield Extends Rise Above 4% Mark (Source: Bloomberg)

The S&P 500 has also lost momentum, extending its pullback from record highs set in late October. After topping out above $6,900, the index has slipped to around $6,700, a roughly 3% correction that interrupted one of the longest winning streaks in recent history. This decline aligns with the small and short-lived corrections seen throughout the year, where every dip has so far been met with strong buying interest. The combination of resilient corporate earnings, moderating inflation, and an improving liquidity outlook suggests that equities could regain traction as year-end approaches. For crypto investors, continued strength in equities and easing financial conditions could once again translate into improved risk appetite across digital assets.

Stocks Extend Slide From All-Time Highs (Source: Bloomberg)

Taken together, these developments illustrate a market in transition. With the Fed turning more cautious, yields creeping higher, and risk assets entering a consolidation phase, investors should prepare for a more uneven landscape ahead. For crypto participants, this means staying nimble: monitoring macro signals closely, managing risk as liquidity tightens, and recognizing that Bitcoin’s next major move will likely hinge on how traditional markets adapt to this evolving rate environment.

Gain Full Research Access to read the rest.

Become a paying subscriber of Sandman Research to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Institutional-Grade Market Analysis: Deep-dive reports on Bitcoin and Altcoins, delivering expert insights multiple times per week.

- Macro Coverage: Stay informed with global macroeconomic trends and key economic events that impact the crypto market.

- Exclusive Data & Research: Access proprietary insights and in-depth market intelligence used by top traders and institutions.

- Actionable Intelligence: Identify key technical levels, trade setups, and high-probability scenarios before the market reacts.