Fuel your business brain. No caffeine needed.

Consider this your wake-up call.

Morning Brew}} is the free daily newsletter that powers you up with business news you’ll actually enjoy reading. It’s already trusted by over 4 million people who like their news with a bit more personality, pizazz — and a few games thrown in. Some even come for the crosswords and quizzes, but leave knowing more about the business world than they expected.

Quick, witty, and delivered first thing in the morning, Morning Brew takes less time to read than brewing your coffee — and gives your business brain the boost it needs to stay sharp and in the know.

Hello and happy Monday!

As we move into the final stretch of 2025, markets are navigating a far more complex backdrop than just a week ago. With systemic risks emerging globally, particularly from Japan, and investors reassessing policy expectations into 2026, liquidity and positioning are once again becoming the dominant forces shaping price action across risk assets.

Here’s what we’ll cover today:

📈 Market Review: Bitcoin continues to lag after a sharp Q4 correction, while rates markets signal growing concern that policy may have stayed restrictive for too long. Japan has emerged as a new source of global instability as rising yields and a weakening yen threaten broader spillovers.

🔍 Current Market Conditions: Crypto sentiment remains deeply depressed, with Fear & Greed hovering near extreme fear. ETF flows have stayed mostly negative, reinforcing a risk-off stance among institutional investors, while BTC price action continues to compress within a wide but well-defined range.

👀 Key Events Ahead: With the Christmas holiday approaching, liquidity will be thin, but several important data releases still carry weight. Inflation, growth, and consumer data early in the week could influence expectations around future Fed easing and drive outsized reactions across crypto and broader risk markets.

📊 Technical Analysis: Bitcoin has reclaimed the 88,800 level after multiple failed attempts, forming a potential base for a move back toward 92,000 if support holds. Liquidation data shows upside liquidity building near key resistance, while downside risk remains present near lower range support.

🚀 Altcoin Insights: Altcoins continue to underperform, with TOTAL3 losing a critical support level that must be reclaimed to unlock broader upside. ETH/BTC remains a relative bright spot, holding above key support.

Let’s dive in 👇

📈 Market Review:

While the S&P 500 has managed to eke out gains of roughly 13-14% year-to-date, the MSCI World Ex-USA Index has surged over 24%, nearly double the return of American equities. Market performance continues to be heavily concentrated in mega-cap technology names, while broader participation has lagged. In December, the Federal Reserve delivered a quarter-point rate cut accompanied by hawkish guidance, signaling just one additional cut in 2026 amid visible internal disagreement. This has reintroduced uncertainty around whether monetary conditions will remain sufficiently supportive to justify elevated equity valuations as markets move into the new year.

US Stocks Underperformed (Source: Bloomberg)

Bitcoin’s 2025 has been defined by sharp swings and fading momentum. After peaking above $120,000 in October, BTC entered a prolonged corrective phase and is now trading near $89,000, roughly 30% below its highs. Several factors have contributed to this weakness: spot ETF flows have turned decisively negative in recent weeks, on-chain data points to continued whale distribution rather than accumulation, and seasonality has offered little support, with December historically ranking among Bitcoin’s softer months. Together, these dynamics have weighed on sentiment and limited upside follow-through.

Bitcoin Faced Turbulence in 2025 (Source: Bloomberg)

In rates markets, the U.S. Treasury curve has steepened aggressively, reaching its widest slope in nearly four years. The spread between two-year and ten-year yields has expanded as investors increasingly price in deeper and earlier rate cuts than signaled by the Fed itself. This steepening reflects growing concern that policy may have remained restrictive for too long, raising risks to growth in 2026. At the same time, it highlights longer-term investor unease around fiscal sustainability and the potential persistence of inflationary pressures.

Treasury Curve Is The Steepest In Nearly Four Years (Source: Bloomberg)

Japan has emerged as a key source of global instability. The Bank of Japan’s rate hike to 0.75% on December 19, the highest level since 1995, has failed to stabilize markets and instead triggered renewed stress in the bond market. Japan’s 10-year yield surged to 1.84% earlier this month, its highest level since 2008, and has since pushed toward 2.1%, a concerning move for a government with debt exceeding 230% of GDP. The resulting unwind of the yen carry trade is forcing leveraged investors to liquidate positions in global risk assets to cover yen-denominated liabilities. Compounding the issue, the yen has weakened to around 157 per dollar despite higher rates, signaling eroding confidence in policymakers’ ability to regain control and raising fears of broader currency and sovereign stress.

10-Year JGB Yield Climbs Toward 2.1% (Source: Bloomberg)

As 2025 draws to a close, the macro focus is shifting from cautious positioning to monitoring systemic risk, particularly stemming from Japan. The deleveraging of yen-funded trades is already contributing to higher volatility in U.S. equities, especially in crowded technology names. With Japanese institutions holding more than $1 trillion in U.S. Treasuries, any accelerated capital repatriation could reverberate across global bond markets. That said, policymakers still retain powerful tools, and markets have shown an ability to adapt quickly. While risks are elevated, especially heading into early 2026, a stabilizing policy response or coordinated action could just as quickly restore confidence. Staying flexible and risk-aware remains essential as investors navigate what is shaping up to be a more complex but not unmanageable macro environment.

Wall Street’s Morning Edge.

Investing isn’t about chasing headlines — it’s about clarity. In a world of hype and hot takes, The Daily Upside delivers real value: sharp, trustworthy insights on markets, business, and the economy, written by former bankers and seasoned financial journalists.

That’s why over 1 million investors — from Wall Street pros to Main Street portfolio managers — start their day with The Daily Upside.

Invest better. Read The Daily Upside.

🔍 Current Market Conditions:

The Crypto Fear & Greed Index remains near extreme fear territory, currently registering 24, a level that reflects depressed sentiment and very low investor confidence. Historically, readings in this range have often coincided with or formed close to local market bottoms, creating attractive risk-reward conditions for longer-term entries. However, at this stage, price action has yet to confirm such a shift. Momentum remains muted, and without a clear structural reversal or expanding volume, sentiment alone is still not sufficient to signal a sustainable turnaround.

Crypto Fear and Greed Index (Source: Coinglass)

ETF flows over the past week reinforce this cautious backdrop. While flows were mixed overall, the balance skewed negative, with notable outflows on Monday, Tuesday, Thursday, and Friday. Wednesday stood out as the sole exception, recording a sizable $458M in net inflows across Bitcoin ETF products. The broader picture, however, remains one of weak demand. Persistently soft ETF participation highlights ongoing risk aversion, particularly among traditional and institutional investors, who continue to refrain from adding exposure in the current environment.

Bitcoin ETF Net Flow (Source: CoinMarketCap)

This lack of conviction has been clearly reflected in Bitcoin’s price behavior. Throughout December, BTC has traded largely sideways, consolidating within a broad range between 84,200 and 95,000. The absence of a decisive breakout in either direction underscores the current equilibrium between buyers and sellers, and confirms that the market remains in a wait-and-see mode.

👀 Key Events Ahead:

This week’s U.S. macro calendar is quieter due to the Christmas holiday, but still meaningful for market expectations, with several key data points shaping the macro backdrop as liquidity remains thin.

The week starts on Monday with October PCE inflation, the Fed’s preferred inflation gauge. A softer-than-expected print would reinforce disinflation, support expectations for faster or deeper rate cuts, and act as a bullish tailwind for risk assets, including Bitcoin and altcoins. A hotter print, however, would challenge the easing narrative, tighten financial conditions, and likely be bearish for crypto, especially given the market’s already fragile sentiment.

On Tuesday, attention shifts to growth and consumer strength with Q3 2025 GDP, Conference Board Consumer Confidence, and October New Home Sales. Together, these releases will offer a clearer picture of whether the U.S. economy is cooling smoothly or showing renewed resilience. Strong data could support a more cautious Fed stance, while weakness would reinforce expectations for further easing.

Wednesday brings October Durable Goods Orders, providing insight into business investment and manufacturing demand, a key signal for longer-term growth momentum.

Markets will be closed Thursday for Christmas, which will further reduce liquidity and could amplify volatility around earlier data releases.

With trading volumes already subdued, even moderate surprises this week could have an outsized impact on Bitcoin, Ethereum, and broader risk assets as investors recalibrate growth, inflation, and liquidity expectations heading into year-end.

🚨 Each week, we produce multiple in-depth reports, the Monday Market Report is currently the only free piece of content, and it won’t stay that way. With growing investor demand, it will go private in the future.

Full Research Access gives you complete market coverage, deep-dive analysis, and exclusive insights trusted by top investors, for the best price currently.

Make smarter trades, improve portfolio decisions, and stay ahead of the crowd. Upgrade now, your future self will thank you.

📊 Technical Analysis:

Bitcoin crawled back above the 88,800 key technical level early this morning after three failed attempts over the past week. Notably, despite dropping to 84,200 again on Thursday, BTC did not form a lower low within the current structure. This makes the reclaim of 88,800 a potentially important foundation for a move back toward, and possibly above, 92,000, as long as this level continues to hold as support.

Bitcoin Price Chart (Source: Tradingview)

The two-week Bitcoin liquidation heatmap supports this view. A major cluster of leveraged liquidations sits just below the 92,000 technical level, extending up toward the next key target at 95,000. If global markets open the week on a constructive note and no negative macro surprises emerge, price could be drawn toward these liquidity levels, allowing BTC to grind higher. On the downside, however, a notable liquidation cluster remains around the lower support near 84,200, reminding us that a clean bullish reversal is not yet guaranteed.

Bitcoin Liquidation Heatmap (Source: Coinglass)

Bullish Scenario:

In the bullish case, Bitcoin starts the week with strength and continues higher, holding above the 88,800 technical level and pushing toward 92,000. Long setups become attractive on a successful retest of 88,800, targeting 92,000, with invalidation if price loses 88,800 again. If BTC also reclaims 92,000, additional long opportunities open up, targeting 95,000, 98,800, and ultimately 102,000.

Bearish Scenario:

In the bearish case, Bitcoin fails to reclaim 92,000 and faces rejection at that level. Short setups may form on a confirmed bearish retest, targeting 88,800, with invalidation if price reclaims the entry. Should 88,800 break and flip back into resistance, further short opportunities open on a bearish retest of that level, targeting 84,200 as the next major downside area.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

🚀 Altcoin Insights:

Altcoins showed relative weakness, as Bitcoin managed to push higher and reclaim a key technical level while TOTAL3 fell below the critical 847B support on Monday and has yet to reclaim it. This remains a crucial level to watch this week. Altcoins need to collectively regain this support to have any realistic chance of sustained upside. Once reclaimed and accompanied by improving momentum, strength can return quickly, but until then, investors should remain cautious.

TOTAL3 (Source: Tradingview)

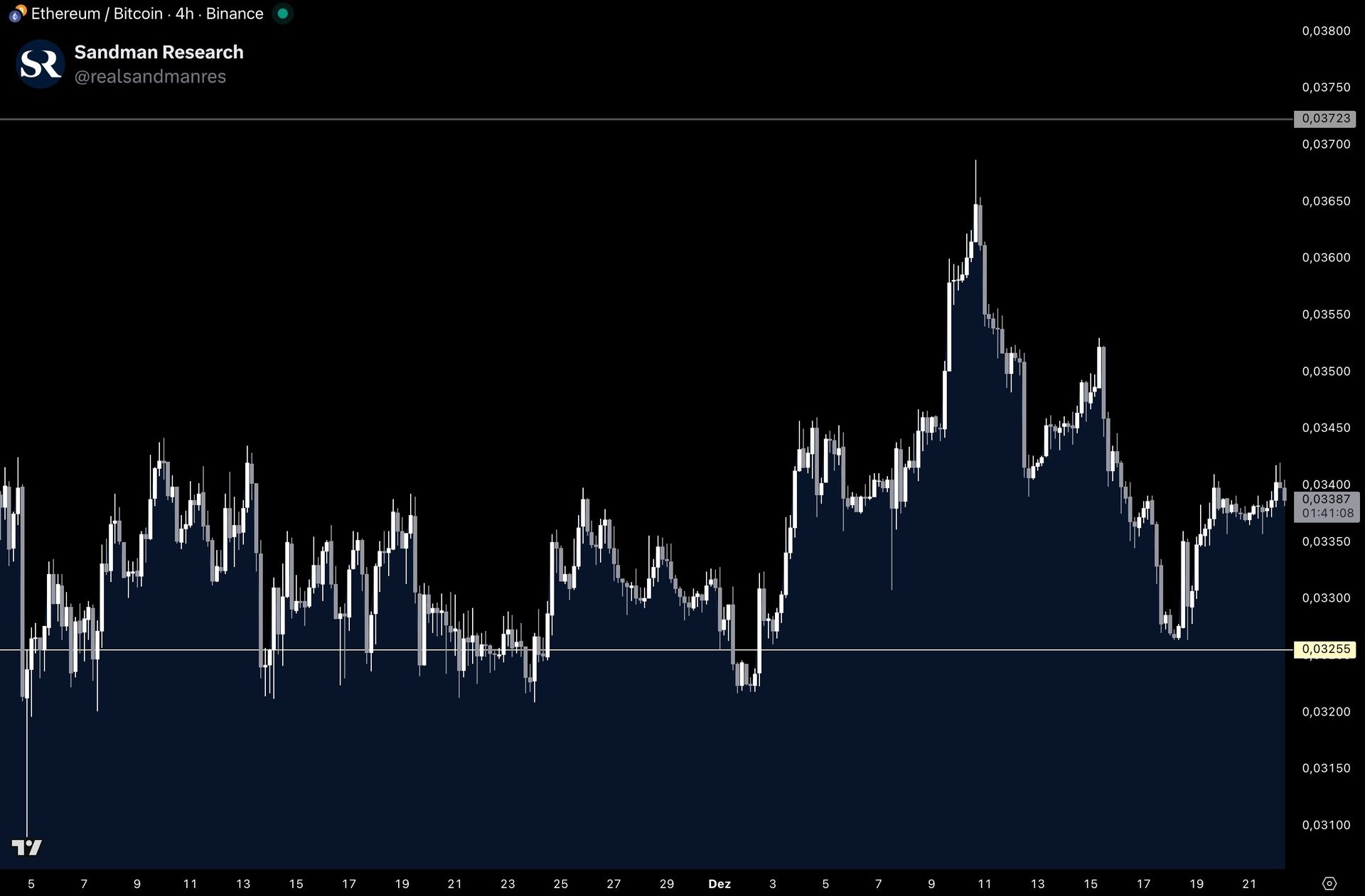

Ethereum/Bitcoin, on the other hand, continues to show resilience. The pair held firmly above the 0.03255 technical support, printing a clear bullish reaction on Thursday and pushing higher from there, now trading just below 0.034. This level has acted as a strong base throughout the end of the year, having been tested multiple times without a decisive breakdown, aside from brief downside wicks. As long as 0.03255 continues to hold, it serves as a solid accumulation zone and baseline for a potential next leg higher.

Ethereum / Bitcoin (Source: Tradingview)

With the anticipated year-end rally failing to materialize so far, our positioning remains defensive. We continue to focus primarily on Bitcoin and the strongest large-cap altcoins from our Q4 Watchlist, while deliberately avoiding outsized risk in low-cap projects. Current market conditions still favor caution, and exposure to BTC and top-tier large caps provides sufficient volatility and opportunity without unnecessary risk.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.