Become An AI Expert In Just 5 Minutes

If you’re a decision maker at your company, you need to be on the bleeding edge of, well, everything. But before you go signing up for seminars, conferences, lunch ‘n learns, and all that jazz, just know there’s a far better (and simpler) way: Subscribing to The Deep View.

This daily newsletter condenses everything you need to know about the latest and greatest AI developments into a 5-minute read. Squeeze it into your morning coffee break and before you know it, you’ll be an expert too.

Subscribe right here. It’s totally free, wildly informative, and trusted by 600,000+ readers at Google, Meta, Microsoft, and beyond.

Hello and happy Wednesday!

As we move through the week, markets are adjusting to a sharp rise in volatility across macro and crypto. Bitcoin’s dramatic drop-and-recovery, weakening U.S. manufacturing data, and a potentially softening dollar have all reshaped investor expectations heading into December. At the same time, equities continue to show resilience despite elevated uncertainty, and crypto markets are testing major technical levels that will define the next move. With macro currents shifting and risk appetite fluctuating, this week becomes pivotal for positioning into year-end.

Here’s what we’ll cover today:

📅 Macro Review: Bitcoin whipsawed before reclaiming resistance; U.S. manufacturing contracted sharply; the dollar may retrace toward Q3 levels; equities remain resilient but volatile.

📊 Crypto Market Overview: Bitcoin reclaimed 92,000 and hit 94,000 before pulling back; TOTAL3 and OTHERS saw strong reversals but still must reclaim higher levels to shift structure.

🔍 Bitcoin vs. Altcoins: BTC.D continues higher toward 59.96% as Bitcoin leads the rally; OTHERS.D breaks down toward 6.93%, signaling renewed altcoin weakness.

📈 Key Reversal Signals: OTHERS/BTC prints seven consecutive red candles; ETH/BTC retests its critical 0.03255 support zone, making this a decisive moment for altcoin relative strength.

🚀 Chart of the Week: ??? retests the major long-term support level. Both long and short setups remain active, offering asymmetric opportunities across higher timeframes.

Let’s dive in 👇

📅 Macro Review:

Bitcoin whipsawed traders over the past week, plunging from our technical level at $92,000 to a low near $84,000 on December 1st before sharply recovering back toward $93,000 and reclaiming the 92,000 resistance. This price action highlights how sensitive Bitcoin remains to shifts in risk sentiment and suggests the asset is still moving within a broader consolidation after its prior run-up. For investors, the key question now is whether this rebound reflects renewed buying interest, or simply a technical relief rally before another leg lower. We break down the signals pointing in each direction later in this report.

Bitcoin Whipsaws Traders (Source: Bloomberg)

U.S. manufacturing activity weakened further in November, with the ISM Purchasing Managers Index contracting at its fastest pace in four months and new orders also sliding deeper below the 50 expansion line. These readings confirm that factory activity continues to struggle despite earlier optimism about U.S. economic resilience. With momentum softening into year-end, investors are increasingly considering the possibility of a December rate cut, an outcome that could reduce pressure on risk assets and influence crypto markets through improved liquidity expectations.

US Factory Activity Contracts by Most in Four Months (Source: Bloomberg)

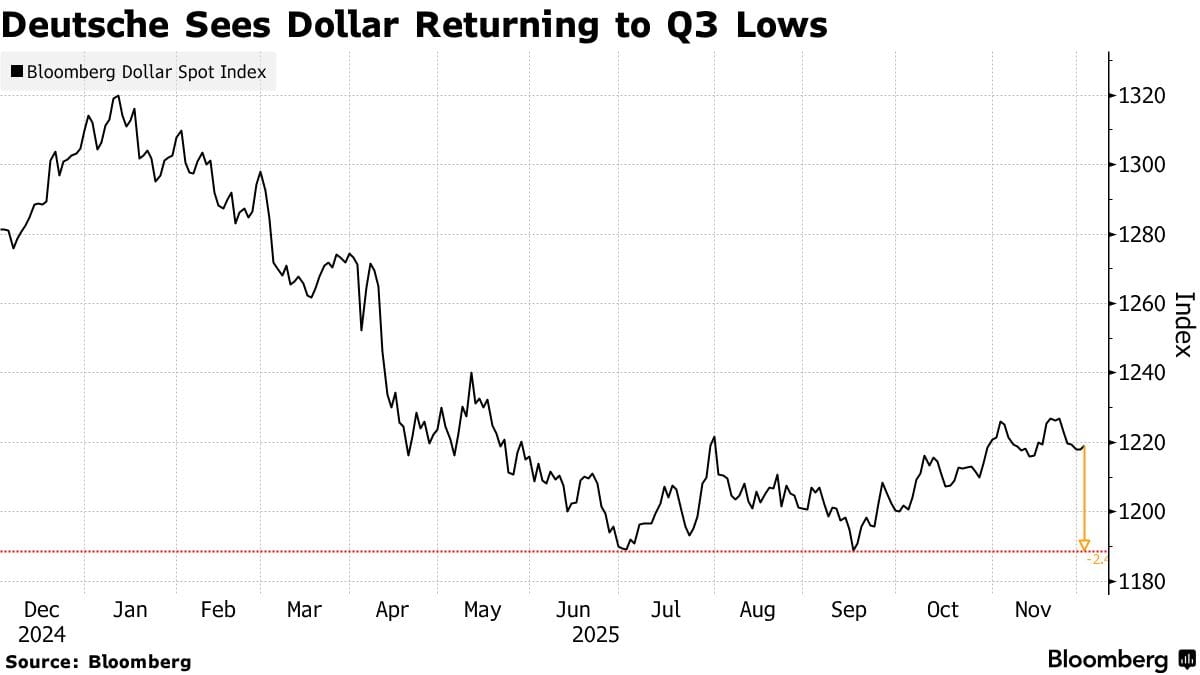

The U.S. dollar has extended a strong uptrend since September, rising from the 1,190 area to roughly 1,220 on the Bloomberg Dollar Spot Index as investors favored dollar strength amid mixed global economic data. This has weighed on risk assets broadly. However, Deutsche Bank now expects the dollar to retreat back toward its Q3 levels around 1,185–1,190, a move that would likely provide meaningful tailwinds for equities, commodities, and digital assets. A turn in dollar momentum would signal a shift in broader market conditions and could help reaccelerate the risk-on behavior seen earlier this year.

Deutsche Sees Dollar Returning to Q3 Lows (Source: Bloomberg)

U.S. equities also showed resilience in November, with the S&P 500 reversing nearly all of its 5% October drawdown and reclaiming the 6,800 region. This V-shaped recovery reflected strong dip-buying and continued confidence despite more mixed economic signals. Even so, the yellow-shaded area on the chart illustrates the elevated volatility and the market’s ongoing difficulty establishing a clean directional trend. With valuations stretched and macro uncertainty rising, whether this rally can extend meaningfully will depend on earnings support and improving data.

November U-Turn (Source: Bloomberg)

Taken together, weakening manufacturing, a potentially softening dollar, equity resilience, and crypto volatility, markets appear to be entering a transition phase as 2025 closes out. Investors should watch closely to determine whether the recent pickup in risk appetite is sustainable or merely year-end positioning before a potentially more challenging backdrop in early 2026.

All the news that matters to your career & life

Hyper-relevant news. Bite-sized stories. Written with personality. And games that’ll keep you coming back.

Morning Brew is the go-to newsletter for anyone who wants to stay on top of the world’s most pressing stories — in a quick, witty, and actually enjoyable way. If it impacts your career or life, you can bet it’s covered in the Brew — with a few puns sprinkled in to keep things interesting.

Join over 4 million people who read Morning Brew every day, and start your mornings with the news that matters most — minus the boring stuff.

Get the Edge Most Retail Traders Don’t Have

Become a paying subscriber of Sandman Research to get this post and all subscriber-only insights, trade setups, and macro intelligence used by top crypto traders.

Upgrade Now → Get Full AccessA subscription gets you:

- Clear Trade Setups for BTC & Altcoins: Step-by-step guidance with entry, stop, and take-profit levels so you can act confidently during market swings.

- Macro & Market Intelligence: Understand which macro events and liquidity shifts are moving crypto, so you’re never caught off guard by volatility.

- Exclusive ETF & On-Chain Flow Analysis: See capital movements and liquidation clusters before the crowd, giving you an edge in timing entries and exits.

- Altcoin & Sector Insights: Identify early rotation opportunities in high-potential sectors like AI-focused altcoins, without wasting time on dead projects.

- Actionable, Risk-Aware Playbooks: Convert research into actual trades with structured setups, technical breakdowns, and scenario-based strategies.