Receive Honest News Today

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Hello and happy Wednesday!

Bitcoin is attempting to build a higher-timeframe base after reclaiming key levels, global risk appetite is improving as capital rotates into emerging markets, and liquidity conditions are quietly easing as the Federal Reserve’s balance sheet begins to expand again.

With sentiment improving but positioning increasingly crowded, this week’s focus is on whether these signals can translate into sustained trends.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Here’s what we’ll cover today:

📅 Macro Review: Bitcoin ETFs record their largest inflow since October; emerging market equities reach new all-time highs; the Fed resumes balance sheet expansion; and investor sentiment remains broadly constructive.

📊 Crypto Market Overview: Bitcoin reclaims the 92,000 level while attempting to establish an uptrend; TOTAL3 and OTHERS pull back from recent highs but remain structurally supported above key levels.

🔍 Bitcoin vs. Altcoins: Bitcoin dominance continues drifting lower toward key support; OTHERS dominance attempts a rebound but remains within a broader bearish structure.

📈 Key Reversal Signals: OTHERS/BTC approaches critical resistance following a strong bounce; ETH/BTC remains range-bound, testing patience as investors wait for a decisive breakout.

🚀 Chart of the Week: ??? stands out with relative strength, reclaiming major support and presenting clearly defined long and short opportunities at key technical levels.

Let’s dive in 👇

📅 Macro Review:

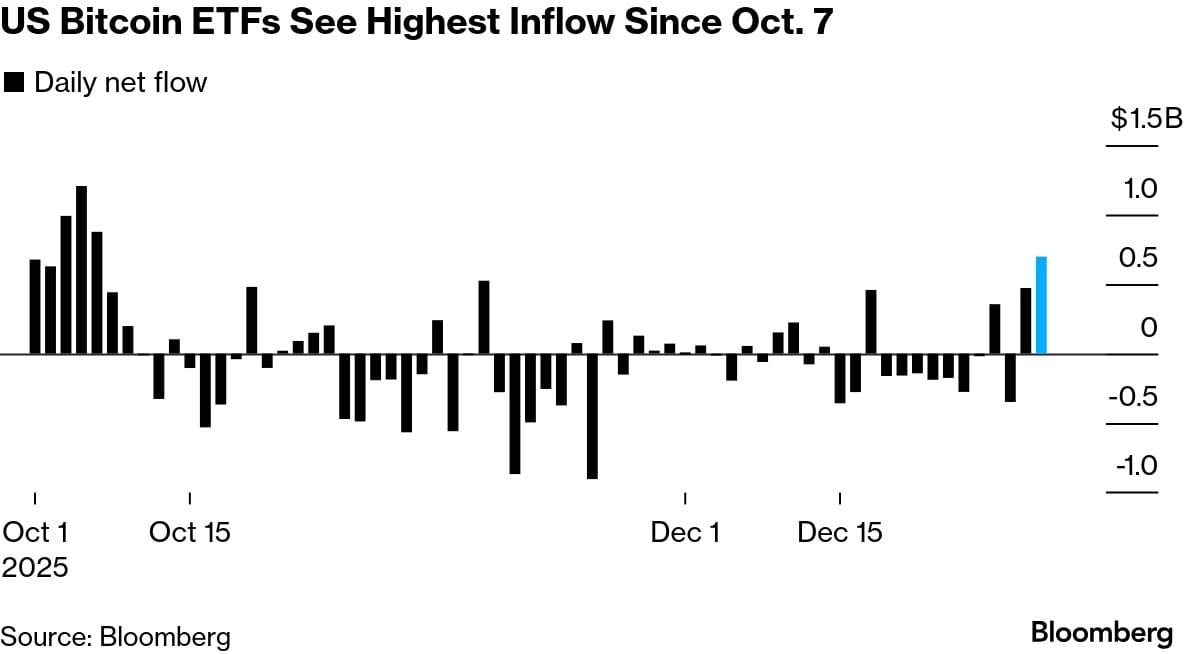

US Bitcoin ETFs saw their largest single-day inflow since early October, with more than $600 million entering the market during Monday’s session (highlighted in blue). This represents a clear shift from the choppy and often negative flows seen throughout much of Q4, pointing to renewed institutional interest as digital assets begin to show early signs of regained momentum. That said, Tuesday recorded outflows again, suggesting confidence may still be fragile. This remains a key metric to monitor as the week progresses.

US Bitcoin ETFs See Highest Inflow Since Oct. 7 (Source: Bloomberg)

Get the Edge Most Retail Traders Don’t Have

Become a paying subscriber of Sandman Research to get this post and all subscriber-only insights, trade setups, and macro intelligence used by top crypto traders.

Upgrade Now → Get Full AccessA subscription gets you:

- Clear Trade Setups for BTC & Altcoins: Step-by-step guidance with entry, stop, and take-profit levels so you can act confidently during market swings.

- Macro & Market Intelligence: Understand which macro events and liquidity shifts are moving crypto, so you’re never caught off guard by volatility.

- Exclusive ETF & On-Chain Flow Analysis: See capital movements and liquidation clusters before the crowd, giving you an edge in timing entries and exits.

- Altcoin & Sector Insights: Identify early rotation opportunities in high-potential sectors like AI-focused altcoins, without wasting time on dead projects.

- Actionable, Risk-Aware Playbooks: Convert research into actual trades with structured setups, technical breakdowns, and scenario-based strategies.