Best Price. Every Trade.

Built for active crypto traders. CoW Swap always searches across every major DEX and delivers the best execution price on every swap you make. Smarter routes. Better trades. No wasted value. Find your best price today. So why trade on any one DEX when you can use them all?

Hey there, and happy Friday!

This week’s focus shifts to the tightening liquidity environment across global markets, a dynamic that’s quietly driving risk assets lower despite recent rate cuts. As Federal Reserve balance sheet runoff strains bank reserves and repo markets flash signs of stress, Bitcoin has faced one of its weakest Octobers on record.

Here’s what we’ll cover today:

🌍 Market Recap & Macro Overview: Liquidity stress deepens as bank reserves hit cycle lows. Fed balance sheet, repo rates, and Treasury flows analyzed, why this could mark a key turning point for risk assets.

📈 Bitcoin (BTC) Breakdown: Key levels at $109,300 and $111,900 in focus. ETF flows flip negative midweek, liquidation heatmap reveals clusters near $116,800, full bullish and bearish trading scenarios inside.

📊 Ethereum (ETH) Outlook: Range tightening between $3,728–$4,000. ETF flow dynamics, key resistance at $4,111, and leveraged positioning updates, potential breakout setup forming.

🚀 Solana (SOL) Analysis: Support at $179 and resistance at $187 back in play. Heatmap shows major leverage imbalance, all key levels, setups, and trading scenarios detailed.

Let’s dive in 👇

🌍 Market Recap & Macro Overview:

The interplay between Federal Reserve operations, Treasury cash management, and tightening funding conditions explains why risk assets have struggled this month despite rate cuts, and why we may be nearing a major inflection point. Bank reserves have fallen to around $2.8T, the lowest since 2020 and near the lower boundary of the Fed’s “ample” range. The continued balance sheet runoff is now creating visible funding market stress, signaling that liquidity is running lean just as the Fed prepares to halt further reductions.

Bank Reserves Have Fallen to Lowest Since 2020 (Source: Bloomberg)

In a rare break from its typical October strength, Bitcoin has underperformed nearly every major asset class, while gold, equities, and commodities posted gains. As one of the most liquidity-sensitive assets globally, Bitcoin’s weakness aligns with ongoing drains from rising Treasury cash balances, increased reverse repo usage, and shrinking bank reserves, a combined $170B liquidity withdrawal since early October. With the TGA inflated to $965B and banks parking cash in the RRP, the fuel that powers Bitcoin rallies has been temporarily sidelined.

Bitcoin Underperforms Other Assets (Source: Bloomberg)

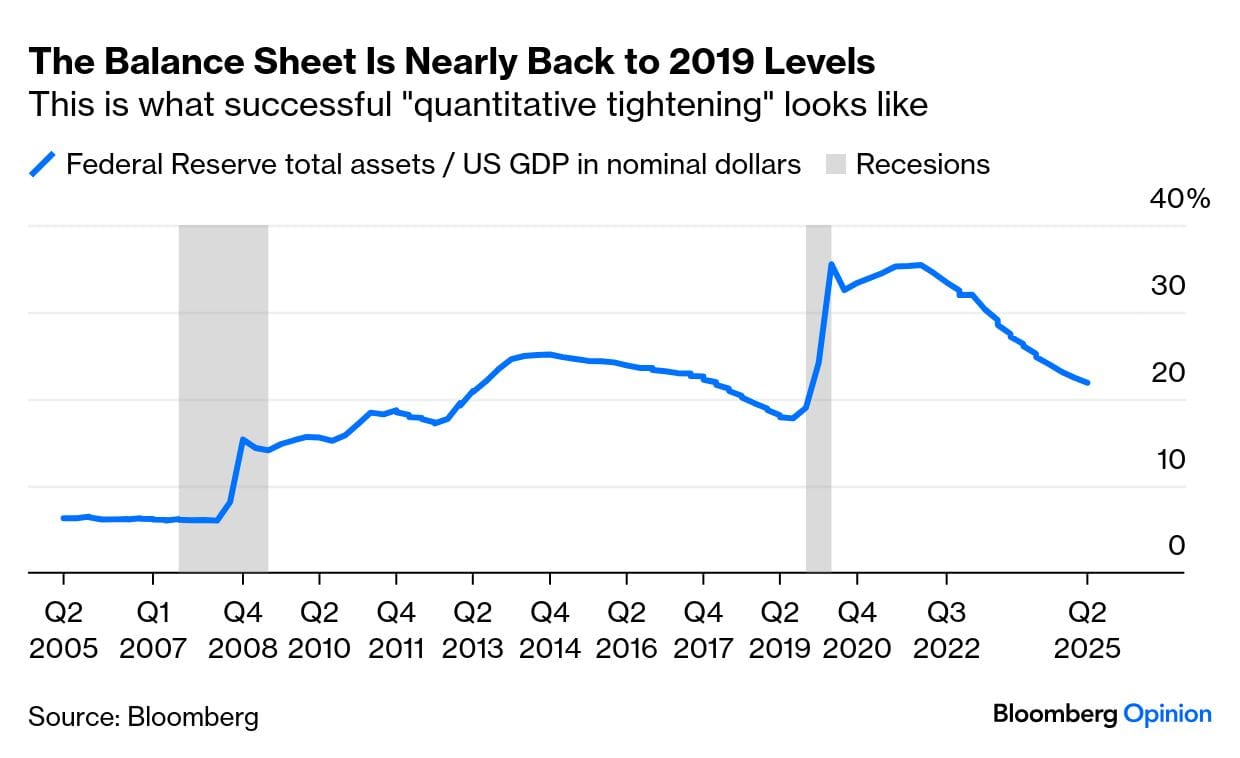

The Fed’s balance sheet now stands near 20% of GDP, almost back to pre-pandemic levels after peaking above 35%. This marks one of the most aggressive QT cycles in history. While the Fed has so far avoided major instability, rising repo market stress shows the system is close to its limit. The scheduled end of QT on December 1st could be the pivot, signaling the start of a new liquidity regime where conditions stabilize and improve.

The Balance Sheet Is Nearly Back to 2019 Levels (Source: Bloomberg)

Repo rates have surged above 4.20%, while Standing Repo Facility usage hit a record $10B daily, confirming the tightest money market conditions of this cycle. These are signs of genuine funding strain, not just technical factors, as banks compete for scarce reserves. Yet this pressure likely peaks now: as month-end passes, RRP balances should decline, and Treasury spending will draw down the TGA, injecting cash back into the system.

Fed Sees Funds Rate as More Critical to Assessing Reserves (Source: Bloomberg)

In short, Bitcoin and risk assets have struggled not because of rate policy, but because of liquidity plumbing. From mid-November onward, as government spending resumes and QT ends, liquidity conditions should turn decisively positive, historically the spark for renewed strength in Bitcoin and high-beta altcoins.

Current macro and liquidity conditions are creating critical inflection points for crypto, Bitcoin, Ethereum, and Solana are entering a critical weekend.

Risks are rising, but opportunities are forming, full trading setups, key levels, and ETF flows revealed in today’s report behind the paywall.

💡 Lock in the yearly subscription now, the cheapest option, saving $49 annually versus monthly, and get full access to all market insights.

Gain Full Research Access to read the rest.

Become a paying subscriber of Sandman Research to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Institutional-Grade Market Analysis: Deep-dive reports on Bitcoin and Altcoins, delivering expert insights multiple times per week.

- Macro Coverage: Stay informed with global macroeconomic trends and key economic events that impact the crypto market.

- Exclusive Data & Research: Access proprietary insights and in-depth market intelligence used by top traders and institutions.

- Actionable Intelligence: Identify key technical levels, trade setups, and high-probability scenarios before the market reacts.