🚨 CRITICAL WEEK AHEAD:

Iranian strikes trigger massive crypto liquidations as Bitcoin plunges from $106K to $98K, but our subscribers were prepared. While traders lost $827 million in 24 hours, we positioned our readers to profit from both waves of the sell-off.

This week's geopolitical chaos has created the perfect storm: oil spiking toward 2025 highs, gold testing $3,300, and the dollar showing temporary strength despite long-term weakness. Smart money is rotating, and we're tracking every move.

Here’s what we’ll cover today:

📈 Market Review: How we navigated the Iranian strike aftermath while $1.16B in leveraged positions got wiped out, plus the energy/crypto correlation nobody saw coming.

🔍 Current Market Conditions: Real-time sentiment analysis as geopolitical tensions meet Liberation Day tariff fallout - why this week's data could trigger the next major move.

👀 Key Events Ahead: Fed positioning ahead of jobless claims data, Iran's next move, and why Bitcoin may go on a huge move soon

📊 Technical Analysis: The exact levels where smart money is accumulating, why $102K is the line in the sand, and our proprietary signals flashing warning signs.

🚀 Altcoin Insights: Why the selloff may not be over yet, the hidden rotation mainstream analysts are missing

Ready to stay ahead of the next liquidation event?

Let’s dive in!

📈 Market Review:

Global markets continue to navigate heightened geopolitical tensions following weekend U.S. military action against Iranian nuclear facilities, while investors grapple with the lingering effects of April's "Liberation Day" tariffs.

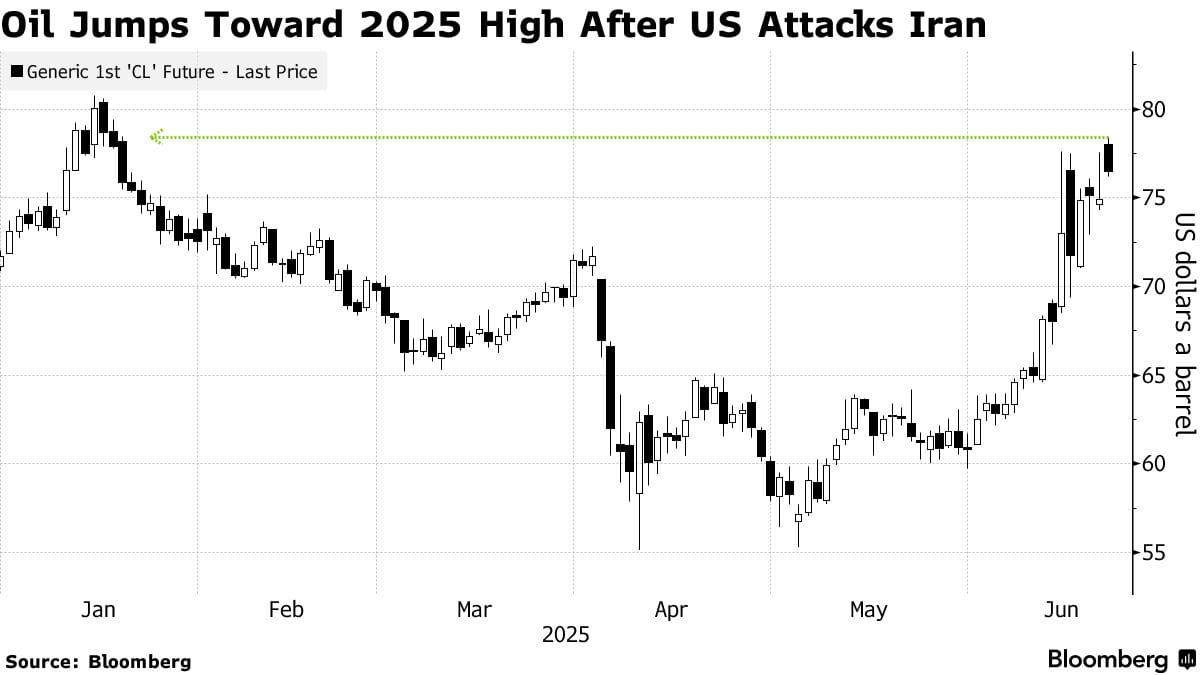

Oil jumped after the US struck Iran's nuclear sites, stoking concerns that energy supplies from the Middle East could be disrupted. Global benchmark Brent surged to $77.035 a barrel, before paring much of that gain in heavy trading.

Oil Jumps Toward 2025 High After US Attacks Iran (Source: Bloomberg)

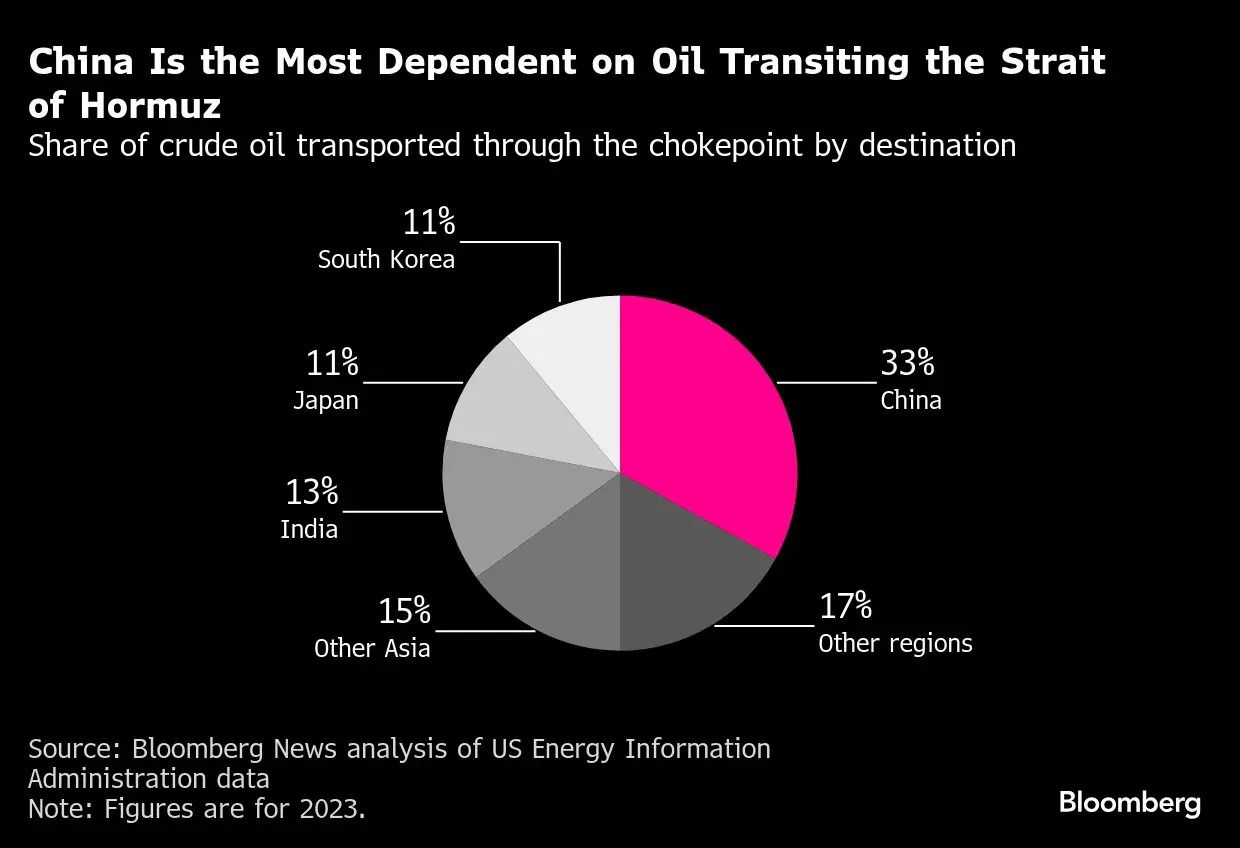

The Strait of Hormuz remains at the center of supply risk concerns, as highlighted by our chart showing China's 33% dependence on oil transiting through this critical chokepoint. This vulnerability extends across Asian economies, with Japan (11%), South Korea (11%), India (13%), and other Asian nations (15%) collectively representing 72% of oil flows through the strait.

China Is the Most Dependent on Oil Transiting the Strait of Hormuz (Source: Bloomberg)

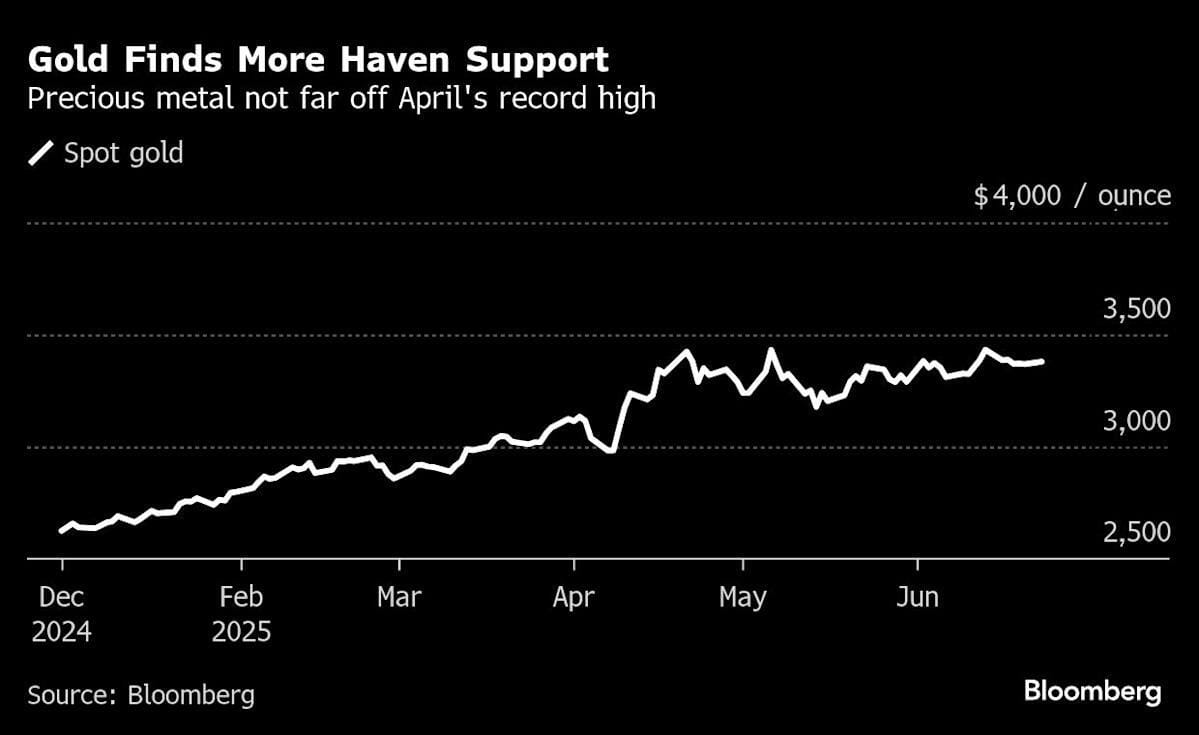

Gold continues to demonstrate its safe-haven credentials, with our third chart showing steady appreciation from approximately $2,500 per ounce in December 2024 to current levels around $3,300. Despite recent minor weakness, Gold fell to 3,362.24 USD/t.oz on June 23, 2025, down 0.20% from the previous day.

Over the past month, Gold's price has risen 0.47%, and is up 44.25% compared to the same time last year, the precious metal remains well-positioned near April's record highs.

Gold Finds More Haven Support (Source: Bloomberg)

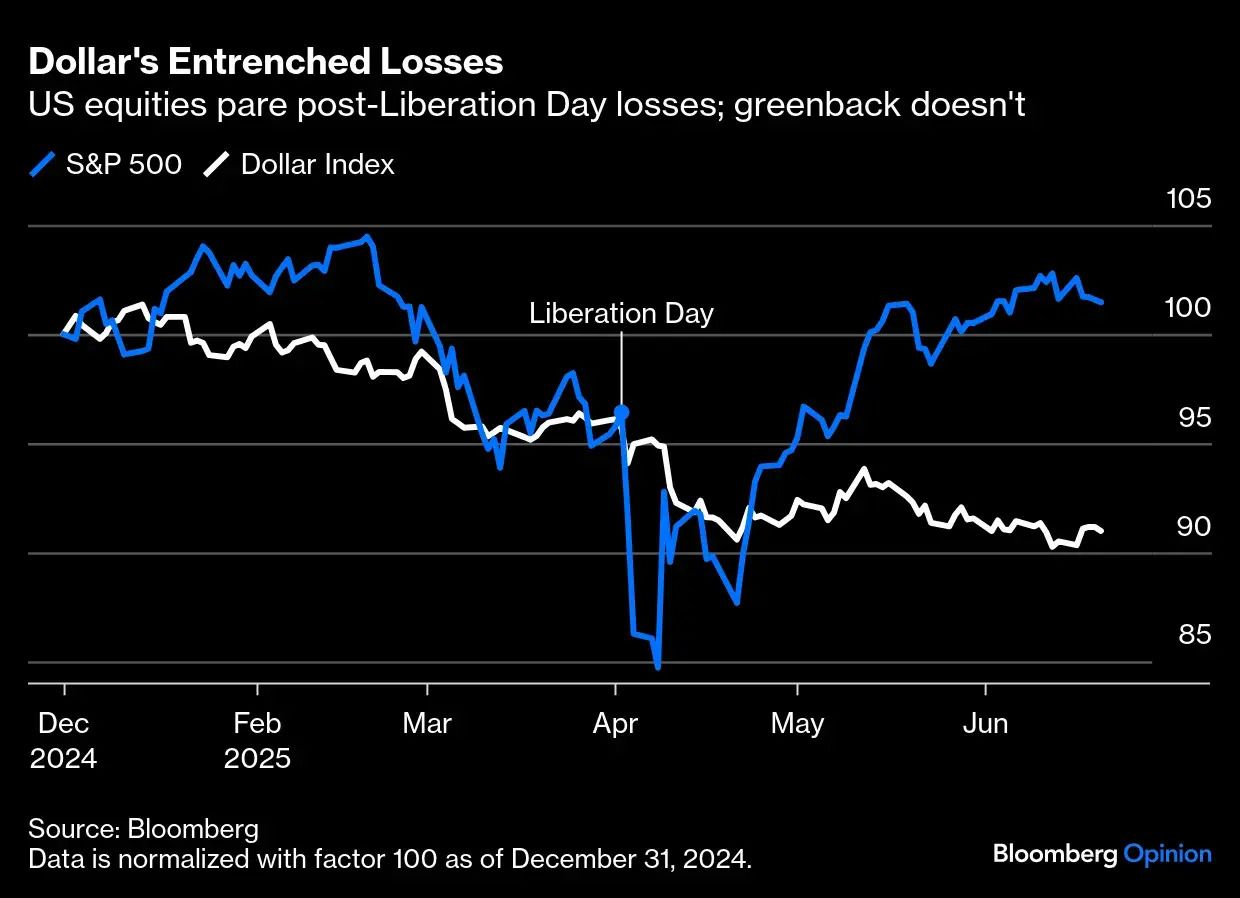

The U.S. dollar presents a mixed picture, with recent geopolitical tensions creating a short-term safe-haven bid while underlying structural weakness persists. Our chart reveals this dichotomy clearly: while the dollar has spiked following the weekend attacks on Iran as investors seek refuge, the longer-term trend since April's "Liberation Day" tariff announcements shows continued dollar weakness alongside equity market volatility.

The broader chart comparing dollar performance with the S&P 500 since December 2024 illustrates the dollar's persistent weakness, declining from around 100 to approximately 90 even as equity markets have shown resilience.

Dollar’s Entrenched Losses (Source: Bloomberg)

The crypto market has witnessed over $827 million in liquidations, with Bitcoin experiencing its worst single-day performance, plummeting 3.3% to $103,556 as geopolitical tensions triggered massive liquidation cascades exceeding $1.16 billion in leveraged positions within 24 hours.

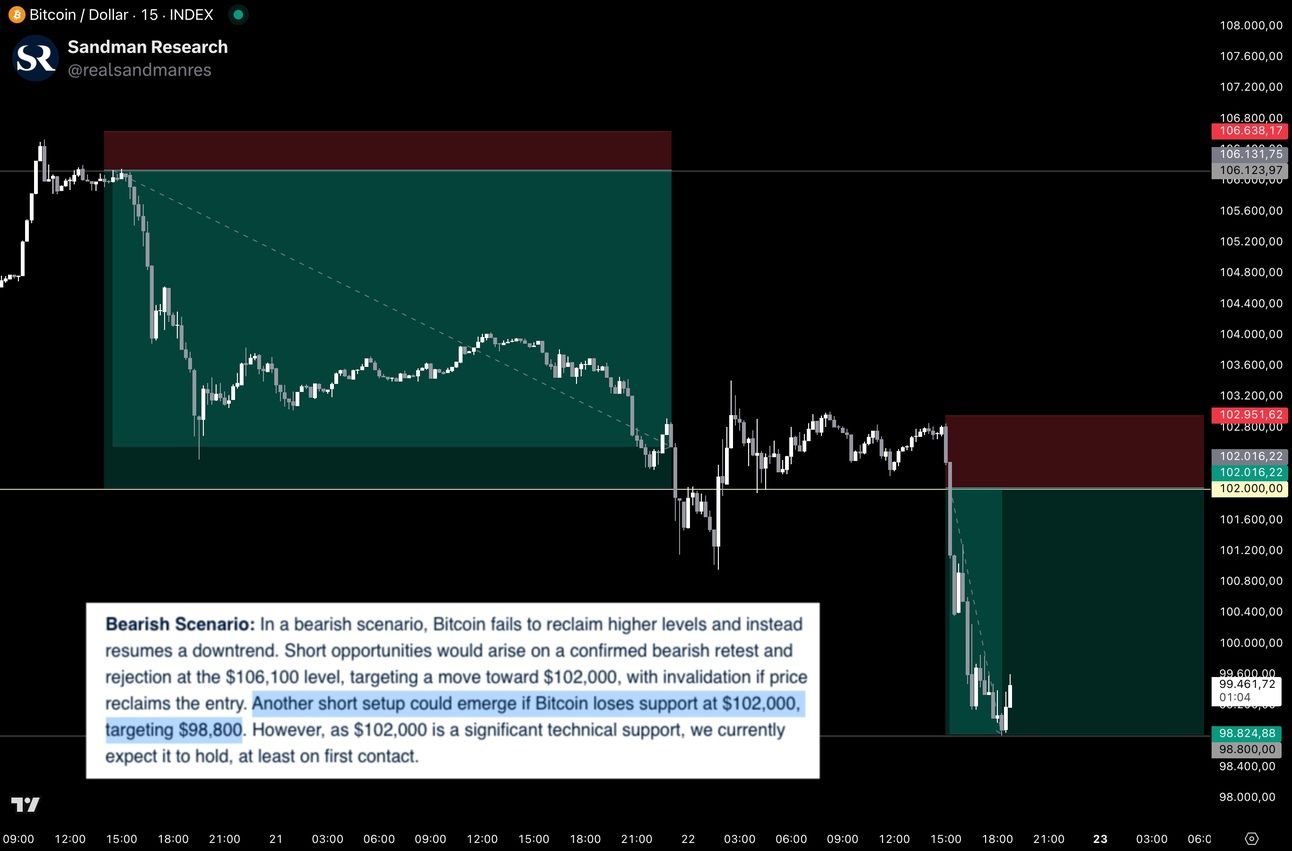

Friday’s Bearish Scenario unfolding precisely (Source: Tradingview, Friday Crypto Report)

At Sandman Research, our proprietary risk assessment models enabled us to prepare our subscribers for the dual-phase sell-off that caught most market participants off-guard.

We issued timely alerts ahead of both the initial decline from $106,100 to $102,000 and the subsequent drop to $98,800, protecting our readers from the devastating liquidation wave that followed.

🔍 Current Market Conditions:

The Crypto Fear and Greed Index has dropped significantly over the past few days. While it was still in greed territory with a reading of 61 on June 12th, we are now firmly in fear territory, with the index at 37.

This shift aligns with Bitcoin’s weekend sell-off, and it now remains to be seen whether this marks an oversold signal that could indicate a temporary bottom and reversal in both price and sentiment, or if we’ll remain in this zone for longer. Notably, with the current price of $102,000, this is the highest Bitcoin has ever traded while the Fear and Greed Index sits in fear territory.

Crypto Fear and Greed Index (Source: Coinglass)

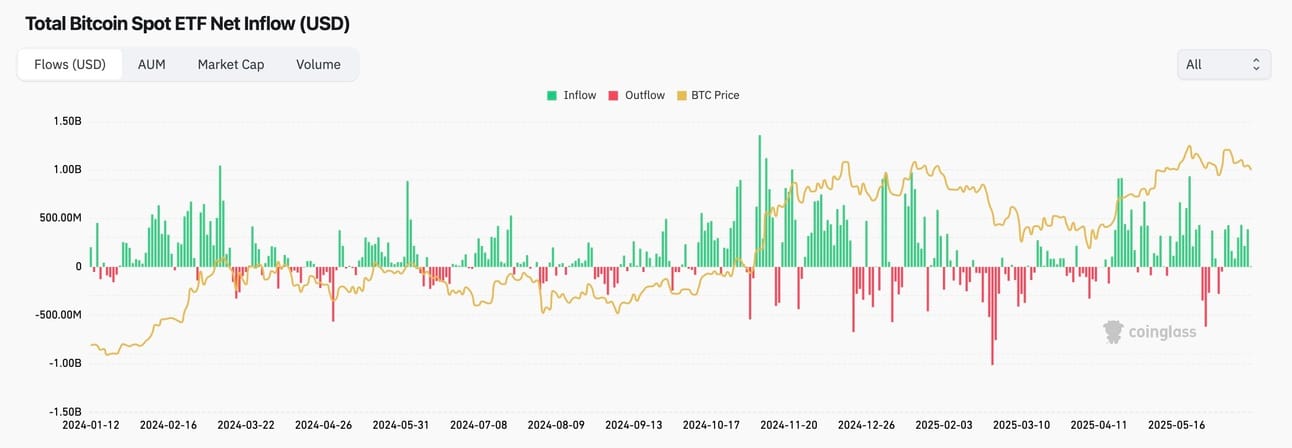

Meanwhile, total Bitcoin spot ETF net inflows continue their positive streak, with no negative outflows since June 6th. This is a bullish signal, pointing to underlying strength and investor trust despite peak uncertainty and ongoing geopolitical stress.

Investors appear confident for now, and we’ll be closely tracking this metric throughout the week.

Total Bitcoin Spot ETF Net Inflow (Source: Coinglass)

Bitcoin continues to closely track the global M2 money supply, with a 10-week lead offering the most consistent correlation. When looking at the current chart, we can observe a convergence forming: M2 is trending higher while Bitcoin undergoes a correction.

While this divergence is worth monitoring to evaluate the ongoing validity of the M2 lead model, it's important to note that a similar pattern occurred during the initial M2 breakout in November 2024. At that time, M2 moved higher first while Bitcoin initially trended lower before eventually following the upward move.

Bitcoin and Global M2 (Source: Tradingview)

Another noteworthy observation: just before Bitcoin's breakout in late 2024, geopolitical tensions between Iran and Israel reached their peak. Specifically, tensions escalated in late September, with the most critical moment occurring on or just after September 27, when Israeli airstrikes killed Hezbollah leader Hassan Nasrallah, widely seen as Iran’s key proxy in Lebanon.

That event, along with the subsequent correction in Bitcoin, is also marked on the chart and serves as a reference point for analyzing sentiment and macro correlation.

Perhaps we’re seeing this playbook unfold once again, with the U.S. strikes on Iran over the weekend potentially marking the peak in geopolitical stress. If history repeats, this could set the stage for a sharp market reversal from here.

👀 Key Events Ahead:

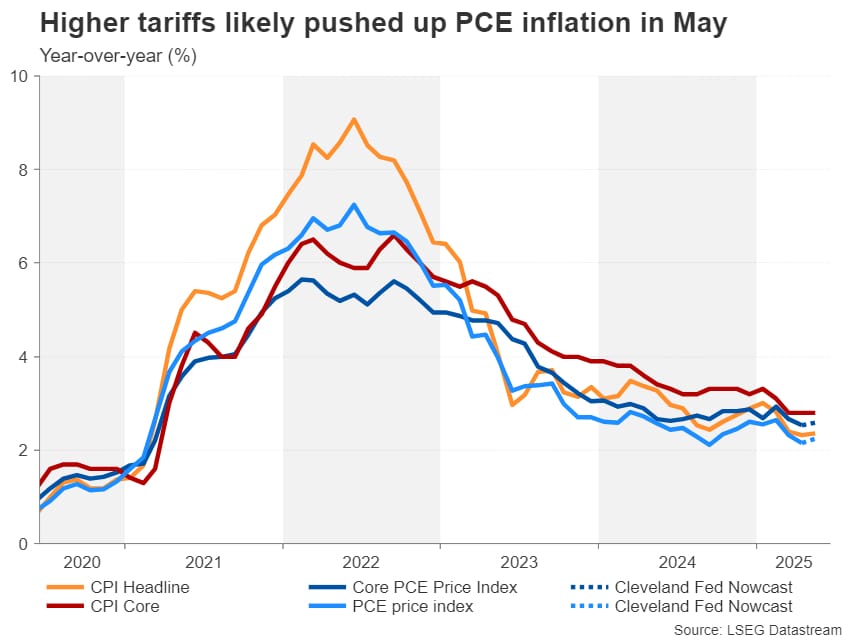

This week is packed with key U.S. economic events that could impact market sentiment. On Monday, we’ll see the release of the Services PMI, Manufacturing PMI, and Existing Home Sales, along with media coverage related to Middle East developments and their effect on stocks. Tuesday brings the House Price Index and the all-important Consumer Confidence report, followed by Fed Chair Powell’s testimony, which markets will be watching closely. On Wednesday, New Home Sales are due, along with a second round of testimony from Chair Powell. Thursday will be data-heavy, featuring Q1 GDP, weekly Jobless Claims, Durable Goods Orders, and Pending Home Sales. The week wraps up on Friday with the release of Core PCE Inflation and the latest Consumer Sentiment data, both closely watched indicators for inflation expectations and economic outlook.

Higher Tariffs Likely Pushed Up PCE Inflation in May (Source: LSEG Datastream)

While Core PCE inflation on Friday will be a key focus, one of the most significant and timely economic releases this week will be the initial jobless claims data, which has shown concerning upward momentum in recent weeks. Claims held steady at 248,000 for the week ending June 7, above the 242,000 expected, with the four-week moving average rising to 240,250, the highest since August 26, 2023.

This softening in the labor market comes at a critical time. The Federal Reserve kept interest rates unchanged at its June meeting, noting solid economic growth, low unemployment, and somewhat elevated inflation. However, if labor market data continues to deteriorate, it could point to a broader economic slowdown and may influence the Fed’s outlook on future rate cuts, especially as markets remain sensitive to geopolitical tensions and energy price volatility.

Now let’s dive into the part you’re really here for: the charts, key levels, trade scenarios and what’s next for Bitcoin and Altcoins. 🔥

Unlock smarter trades and better portfolio decisions, join now and keep reading!

⚠️ If you’re reading this, you’re serious about gaining a real crypto edge, but the free tier only scratches the surface:

The real power lies in Full Access, where you get complete market coverage and exclusive insights trusted by top investors.

For better portfolio decisions and smarter trades, upgrade now, your future self will thank you.

Don’t let limited data limit your decisions. ⏳

📊 Technical Analysis:

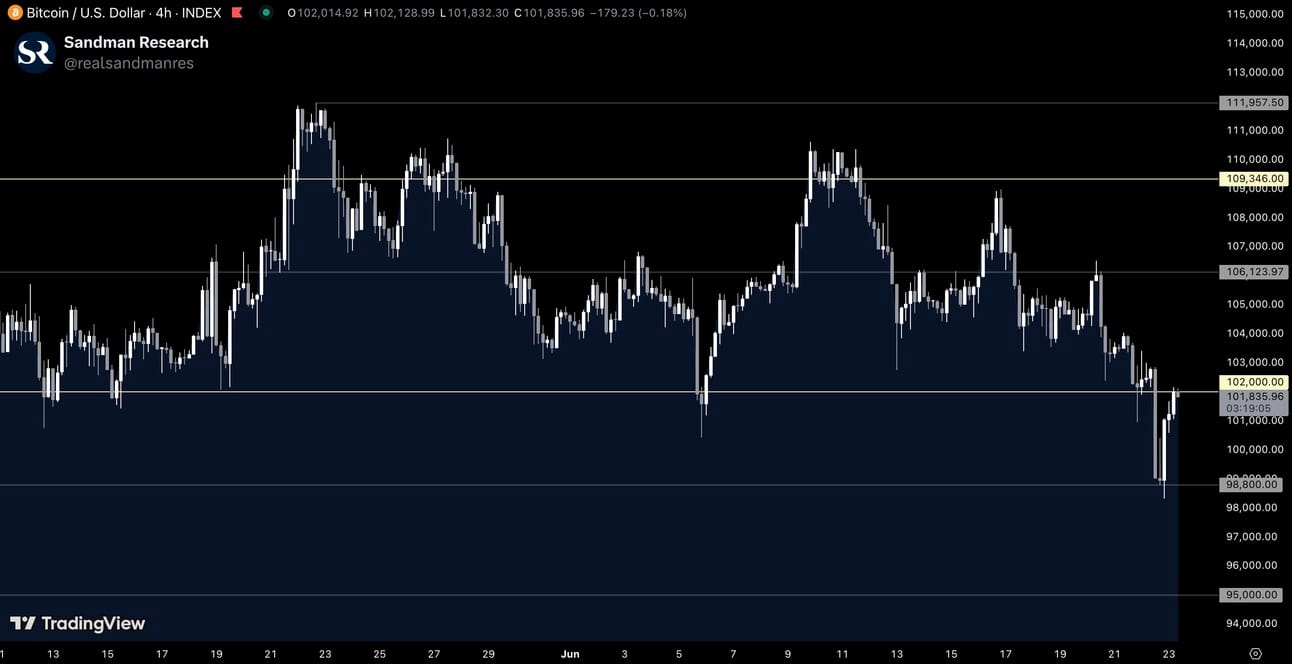

Bitcoin faced rejection at the exact key level of $106,100 on Friday, a scenario we had been monitoring for several days prior. From there, it quickly sold off and traded lower, reaching the next key level of $102,000 late Saturday, just before midnight. While this level initially offered support, it broke on Sunday afternoon, and the price continued to move lower. The third of our mentioned and closely monitored key levels at $98,800 was then hit precisely later on Sunday.

It's remarkable to see how accurately price reacted to the levels we had marked and observed for weeks. Very impressive and encouraging to see, especially in the midst of heightened uncertainty where many traders and investors have struggled.

Bitcoin Price Chart (Source: Tradingview)

The Bitcoin two-week liquidation heatmap currently paints a reasonable picture and hints at potential upside from here. The recent move triggered widespread liquidations, and we now see that clusters of leveraged liquidations to the downside have mostly been cleared. Notably, major clusters now remain above current highs, particularly in the $110,000 region.

Bitcoin Liquidation Heatmap (Source: Coinglass)

Bullish Scenario: In a bullish case, we would want to see Bitcoin reverse quickly from here, reclaiming both recent lower highs and important technical levels such as $102,000 and $106,000, ultimately targeting the highs and remaining liquidation zones near $110,000. Bullish trade opportunities may arise after a successful reclaim of $102,000, with a retest targeting $106,100. If price initially rejects at $102,000 and moves lower again, long opportunities could emerge from a successful retest of $98,800, targeting $102,000. In both cases, the trade would be invalidated if price fails to hold the respective entry level.

Bearish Scenario: In a bearish case, Bitcoin would face renewed rejection at $102,000 and continue to confirm current downward momentum. Short opportunities would arise on a successful bearish retest of $102,000, targeting $98,800, with invalidation if price reclaims that level. Should $98,800 fail to offer support and break as well, another short opportunity emerges, targeting $95,000, again, with the trade invalidated if price moves back above the entry level.

🚀 Altcoin Insights:

Similar to Bitcoin, the TOTAL3 chart (crypto total market cap excluding BTC and ETH) faced rejection at the key area around $860B and moved lower, actually dipping below the crucial key area of around $780B.

While we've seen a recovery in recent hours, with price slowly climbing higher again, it remains important to observe whether this level can be reclaimed and lead to further upside, or if price gets rejected again and continues lower, extending the bearish trend and likely targeting the next key level at $716B.

TOTAL3 (Source: Tradingview)

This will heavily depend on broader market dynamics and geopolitical developments. At this stage, we don’t anticipate any positive surprises, neither for the overall market nor for altcoins, as long as the current environment remains tense and uncertain.

Notably, this recent selloff has hit altcoins especially hard, as is often the case when Bitcoin corrects, sparking renewed debate on X about whether significant upside potential for altcoins remains, or whether they can be written off until the next cycle.

In our view, this kind of argumentation is rather uneducated and short-lived. Sentiment and analysis on X, even from larger accounts, often shifts quickly and isn’t necessarily well-grounded or well-supported.

The key indicators for altcoin and crypto market momentum remain liquidity and financial conditions, both of which are currently trending upward. Historically, these lead Bitcoin and the broader crypto market by several weeks or months.

We still expect risk-on assets to trend higher into the second half of the year, though patience is necessary, especially as further developments in geopolitical tensions may delay this recovery.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

If you want to stay ahead of the curve with in-depth analysis and real-time updates, make sure to subscribe to Premium Research for even more insights - you won’t want to miss what’s coming next!

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.