Good morning and welcome to this week’s altcoin market update.

The crypto market is navigating a crucial macro inflection point. The Fed is widely expected to hold rates steady at 5.25–5.50%, despite rising inflation expectations and growing political pressure from Trump.

Bitcoin dominance is rolling over, altcoin metrics are nearing breakout levels, and historical patterns suggest we may be on the verge of a new phase in the cycle.

Here’s what we’ll cover today:

📅 Macro Review: Record ETF inflows, dollar weakness, and inflation gridlock are aligning to drive capital into crypto. We’ll explore how these macro shifts are setting the foundation for altcoin momentum.

📊 Crypto Market Overview: Bitcoin remains stuck below $118,400, while TOTAL3 reclaims the $1T mark and altcoins flirt with key resistance. We break down the price structure and what needs to happen for the next leg up.

🔍 Bitcoin vs. Altcoins: BTC Dominance is rolling over after hitting resistance, while OTHERS.D slips below 2023 lows. These rotation signals often front-run the strongest phases of altseason. We look at where we are now.

📈 Key Reversal Signals: ETH/BTC is entering a bullish structure while OTHERS/BTC tests major resistance. We'll highlight the levels to watch and how this setup echoes early 2017 and 2021 rotations.

🚀 Chart of the Week: ??? holds a new floor at $0.40 after a 130% spike. This setup within the cross-border and RWA narrative could be a leading signal for sector-specific rotation.

Let’s dive in!

📅 Macro Review:

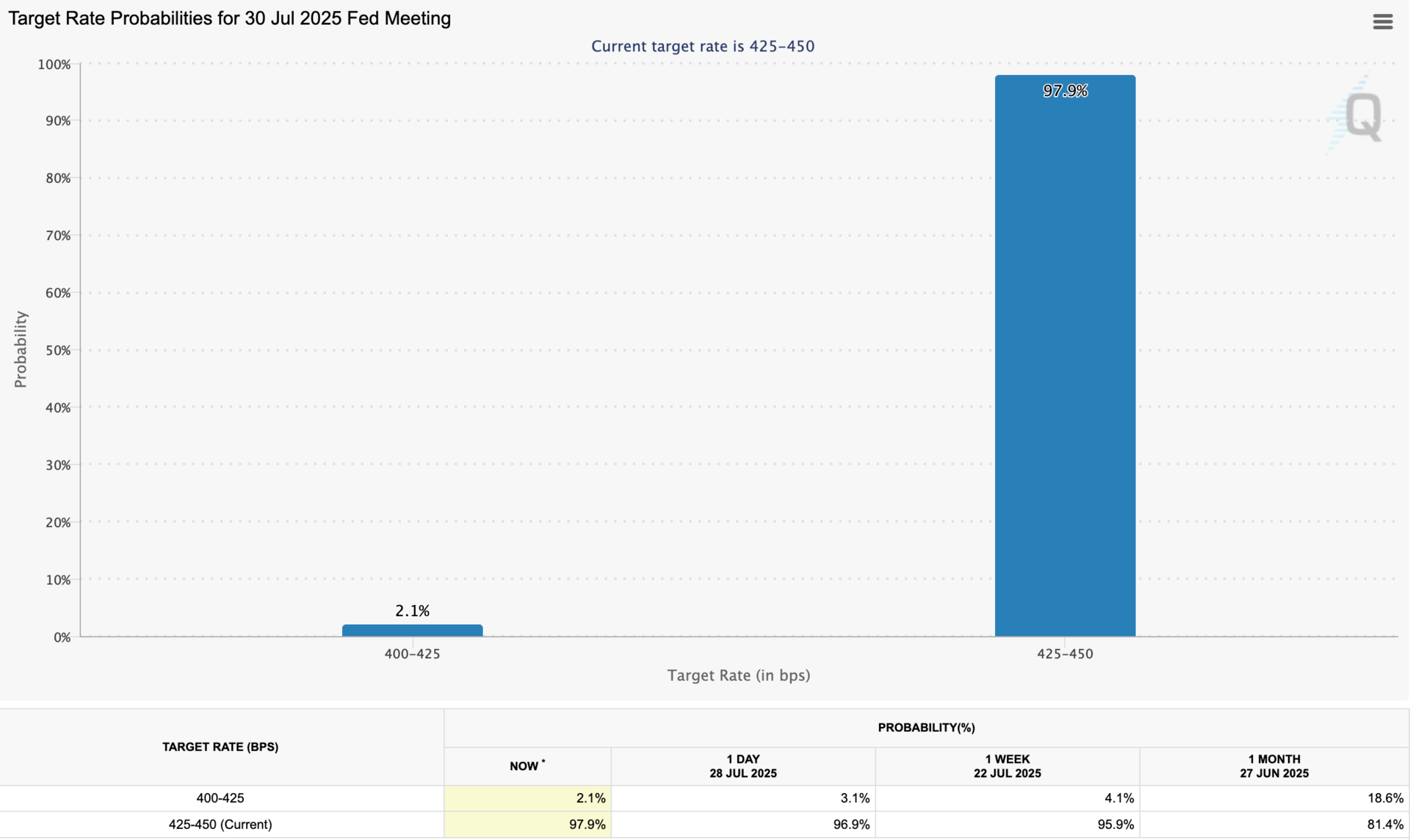

As we head into today’s pivotal Fed meeting, markets expect another “wait and see” from Chair Powell. CME FedWatch shows a 97.9% probability that the Fed holds rates steady at 5.25–5.50%. Just 2.1% expect a 25bps cut.

Target Rate Probabilities for 30 Jul 2025 Fed Meeting (Source: CME FedWatch)

Even looking one month ahead, only 18.6% see cuts beginning, reinforcing the view that rate cuts are delayed despite growing political pressure from Trump.

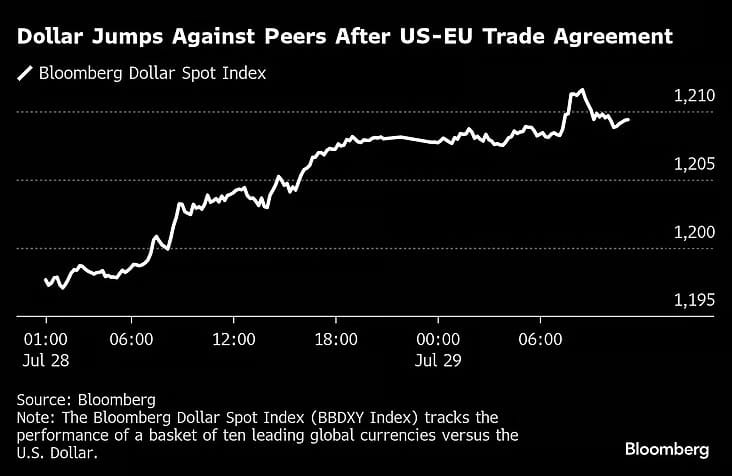

Dollar Jumps Against Peers After US EU Trade Agreement (Source: Bloomberg)

The recent +1.78% rally in the Bloomberg Dollar Spot Index is a positioning-driven bounce, triggered by short-term optimism around tariff de-escalation. Structurally, nothing has changed, $35T in U.S. debt, global de-dollarization pressure, and long-term inflation risk all remain in play. We view this as a counter-trend move within a broader dollar downtrend.

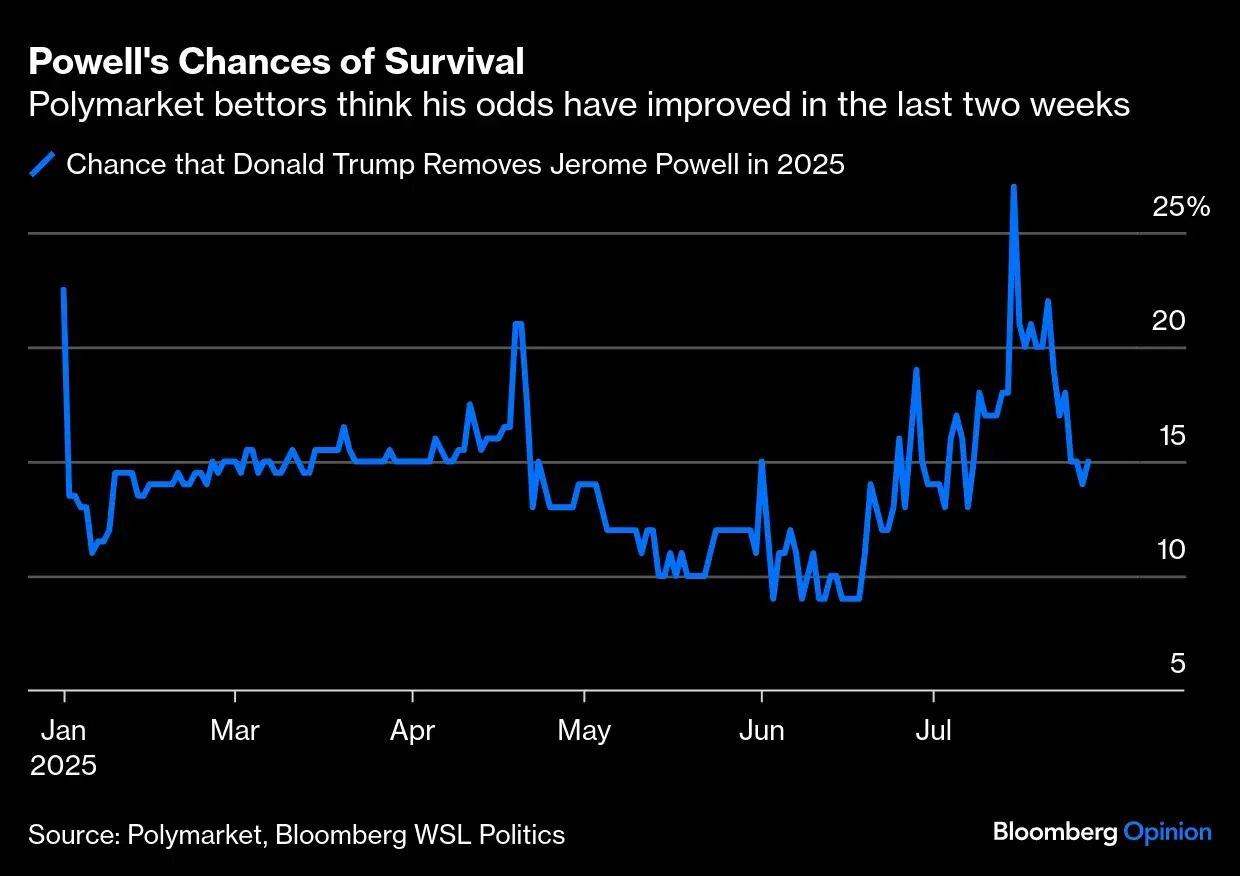

Powell’s Chances of Survival (Source: Bloomberg)

After peaking above 25%, betting markets now price Powell’s chance of removal at ~15%. The narrative of imminent political fallout has softened. This reduces immediate uncertainty, but the political shadow remains, reinforcing the appeal of non-sovereign assets like Bitcoin.

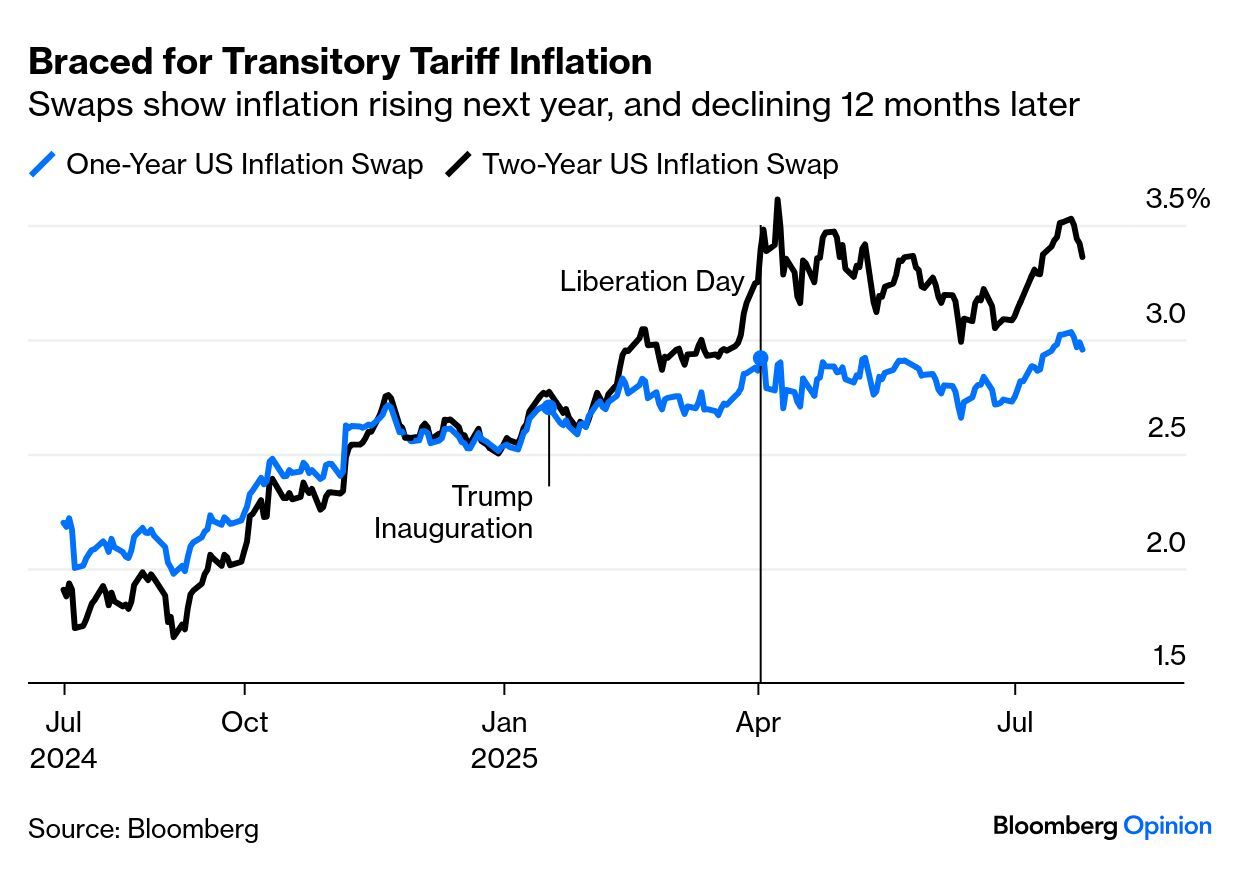

Braced for Transitory Tariff Inflation (Source: Bloomberg)

One-year inflation swaps approach 3%, two-year above 3.3%, markets expect the inflation impulse to persist. With tariffs embedding price pressure into forward expectations, the Fed is stuck: can’t hike, but also can’t cut. That gridlock supports Bitcoin as a superior inflation hedge.

Gold Trapped in Holding Pattern (Source: Bloomberg)

Gold’s price action has underwhelmed. After peaking near $3,500/oz earlier this year, it has moved sideways, failing to sustain any breakout despite rising inflation expectations and macro uncertainty. This lack of follow-through contrasts sharply with Bitcoin’s strength in the same environment./hq1

📊 Crypto Market Overview:

After failing to break out after reclaiming the $118,400 key level, Bitcoin fell back below and returned inside our range. Price is now finding support around the key level of $116,900 and is moving toward $118,400 again. So far, no breakout has been successful.

Bitcoin Price Chart (Source: Tradingview)

TOTAL3 has encountered resistance at the important $1.05T key level and has trended lower as well, with the next key support coming in at $950B. If TOTAL3 manages to climb higher, the next key level after $1.05T comes in at the previous cycle highs of $1.13T.

TOTAL3 (Source: Tradingview)

Similar to Bitcoin and TOTAL3, OTHERS are also finding resistance around their key level of $300B, so far unable to break higher and now moving lower again.

OTHERS (Source: Tradingview)

Gain Full Research Access to read the rest.

Become a paying subscriber of Sandman Research to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Institutional-Grade Market Analysis: Deep-dive reports on Bitcoin and Altcoins, delivering expert insights multiple times per week.

- Macro Coverage: Stay informed with global macroeconomic trends and key economic events that impact the crypto market.

- Exclusive Data & Research: Access proprietary insights and in-depth market intelligence used by top traders and institutions.

- Actionable Intelligence: Identify key technical levels, trade setups, and high-probability scenarios before the market reacts.