Hello and happy Friday!

This week brought significant movements across crypto and traditional markets, driven by tariffs, macroeconomic shifts and critical technical signals. Here’s a breakdown of the current landscape and key factors to watch going forward.

Here’s what we’ll cover today:

✅ Solana Long Target Hit: Swing Trade Successful

🌍 Market Recap & Macro Overview: Quick recap of crypto & traditional markets this week, also covering key macroeconomic factors affecting risk assets.

📈 Bitcoin (BTC) Breakdown: Key support & resistance zones for the weekend. ETF flows and their impact on BTC’s price action. Liquidation heatmap. Where the next opportunity could arise.

📊 Ethereum (ETH) Outlook: Is Ethereum showing strength or lagging compared to the rest of the market? ETF flows and other metrics. Key technical levels & trading setups.

🚀 Solana (SOL) Analysis: Solana’s trend structure compared to BTC & ETH. Crucial levels for continuation or correction and potential trade scenarios.

Let’s dive in!

✅ Solana Long Target Hit:

Before starting this week’s Friday Crypto Report, we’d like to highlight last week’s long trade scenario for Solana, which played out with unparalleled precision and ease, allowing our Premium Research Subscribers to capitalize on a move of over 10%.

After tapping into our initial entry at $147 on a successful retest, exactly as described in Friday’s report, Solana continued trading higher throughout the entire week, eventually reaching our profit target at $163 yesterday.

Over 10% Gain on Solana Trade Mentioned in Last Friday’s Report (Source: Tradingview)

Congratulations to those who followed the setup, this is exactly the kind of high-conviction, risk-controlled opportunity we highlight in our full premium reports.

If you're not already on our free list, we publish a completely free weekly market report every Monday, featuring trade scenarios for Bitcoin, join now for actionable alpha at no cost.

If you’re currently on the free list, consider upgrading to Premium Research to access all live trade scenarios and real-time market guidance.

🌍 Market Recap & Macro Overview:

One year ago, Jerome Powell dismissed concerns about stagflation. Today, that narrative has shifted. In recent remarks, he acknowledged that rising tariffs could drive inflation higher and slow growth. He avoided committing to rate cuts, briefly mentioned a rate hike by mistake, and warned that core PCE inflation could reach 4%, well above target.

This leaves the Fed trapped: unable to cut without fueling inflation, yet under pressure as growth softens. That is stagflation.

S&P 500 Edges Higher After Fed Meeting (Source: Bloomberg)

Markets are still pricing in US resilience, with elevated yields keeping the dollar supported for now. But this strength looks increasingly fragile. If inflation remains sticky and growth deteriorates, the Fed may eventually be forced to cut into high inflation, a move that would damage confidence in the dollar and weaken its real yield advantage.

Stagflation also undermines global risk sentiment. While the dollar often benefits from risk-off flows, a deeper loss of confidence in US policy could increase flows toward alternative stores of value such as gold or Bitcoin. Trade tensions and tariff threats add to the uncertainty, increasing the risk of capital flight and diversification away from dollar-denominated systems.

The U.S. dollar has entered a period of notable decline, with its trajectory following historical patterns where the dollar's strength oscillates over decades, often influenced by macroeconomic factors including monetary policy, trade balances, and global economic conditions.

Dollar Faces a Secular Decline (Source: Bloomberg)

Currently, the dollar's position relative to its long-term purchasing power parity (PPP) suggests significant overvaluation has corrected and moved into undervaluation territory. This represents a substantial shift from the dollar's strong performance during the late 2010s and early 2020s.

For context, the dollar has experienced multiple secular cycles since the 1990s, with previous major declines occurring in the mid-1990s and again around 2010. The current downward trend appears to be following similar historical patterns but with unique modern drivers.

Bitcoin Historically Rallying during Phases of Dollar Weakness (Source: Tradingview)

When the dollar weakens, global spending power increases and market sentiment shifts toward higher-risk investments. This "risk-on" environment has historically benefited Bitcoin significantly.

Dollar depreciation typically drives investors to seek alternative stores of value and growth assets. During past periods of dollar weakness, Bitcoin has captured substantial value as liquidity expands and inflation concerns prompt interest in assets with fixed supply mechanisms.

Now let’s dive into the part you’re really here for: the charts, key levels, trade scenarios and what’s next for crypto. 🔥

Data-driven analysis and unparalleled market intelligence, exclusively at Sandman Research.

📈 Bitcoin (BTC) Breakdown:

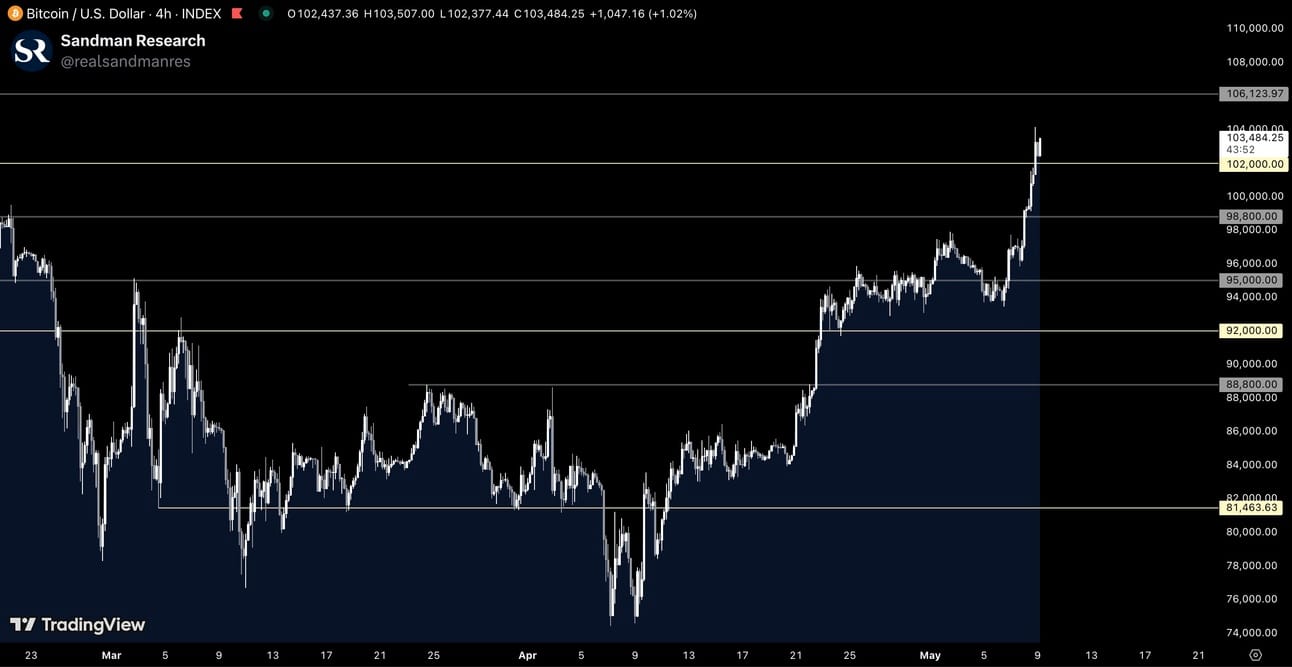

After battling at the crucial key resistance level of $95,000 over the past days, Bitcoin managed to break above it on Tuesday and confirmed the breakout yesterday with a strong and sharp bullish candle that shot up to $103,000, reclaiming both important key levels at $98,800 and $102,000.

Notably, $98,800 was perfectly retested on lower timeframes and acted as support, fueling the continuation of the rally.

Bitcoin Price Chart (Source: Tradingview)

The full analysis of Bitcoin, Ethereum, and Solana, including detailed data breakdowns and trade setups, is reserved exclusively for Premium Research Members.

To access the complete report, please consider joining our premium subscription.

Subscribe to Premium Research to read the rest.

Become a paying subscriber of Premium Research to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Institutional-Grade Market Analysis: Deep-dive reports on Bitcoin and Altcoins, delivering expert insights multiple times per week.

- Macro Coverage: Stay informed with global macroeconomic trends and key economic events that impact the crypto market.

- Exclusive Data & Research: Access proprietary insights and in-depth market intelligence used by top traders and institutions.

- Actionable Intelligence: Identify key technical levels, trade setups, and high-probability scenarios before the market reacts.

- Exclusive Access to Market-Moving Insights – Stay ahead with exclusive research before it reaches the public.