What Happens When $4.7T in Real Estate Debt Comes Due?

A wave of properties hit the market for up to 40% less than recent values. AARE is buying these income-producing buildings at a discount for its new REIT, which plans to pay at least 90% of its income to investors. And you can be one of them.

This is a paid advertisement for AARE Regulation CF offering. Please read the offering circular at https://invest.aare.com/

Hello and happy Wednesday!

As we move through the week, markets are tightening sharply ahead of today’s Fed meeting. Crypto liquidity has thinned dramatically, Bitcoin is compressing below major resistance, the dollar remains firm, and Treasury yields have stalled after months of easing. Investors now face a market where macro conditions are tightening again, order books are weakening, and expectations for 2026 rate cuts are collapsing.

With volatility likely to spike on Powell’s commentary, this week becomes crucial for positioning into the final stretch of 2025.

Here’s what we’ll cover today:

📅 Macro Review: Crypto market depth continues to erode; the dollar holds its ascending trend; Treasury yields stall after three cuts; markets slash 2026 easing expectations heading into a pivotal Fed decision.

📊 Crypto Market Overview: Bitcoin reclaimed 92,000 and nearly hit 95,000 before pulling back; TOTAL3 holds key support but can’t break 900B; OTHERS remains capped by resistance and stuck in bearish structure.

🔍 Bitcoin vs. Altcoins: BTC.D drifts lower into seasonal December weakness; OTHERS.D breaks down further after losing 6.93%, pushing altcoins deeper into structural weakness.

📈 Key Reversal Signals: OTHERS/BTC continues trending down after failing at 2.53M; ETH/BTC shows notable strength, pushing toward 0.03723 and confirming leadership of higher-cap assets.

🚀 Chart of the Week: ??? sits on major higher-timeframe support for the first time this year. Both long and short setups remain active, offering asymmetric opportunities after a sharp retrace.

Let’s dive in 👇

📅 Macro Review:

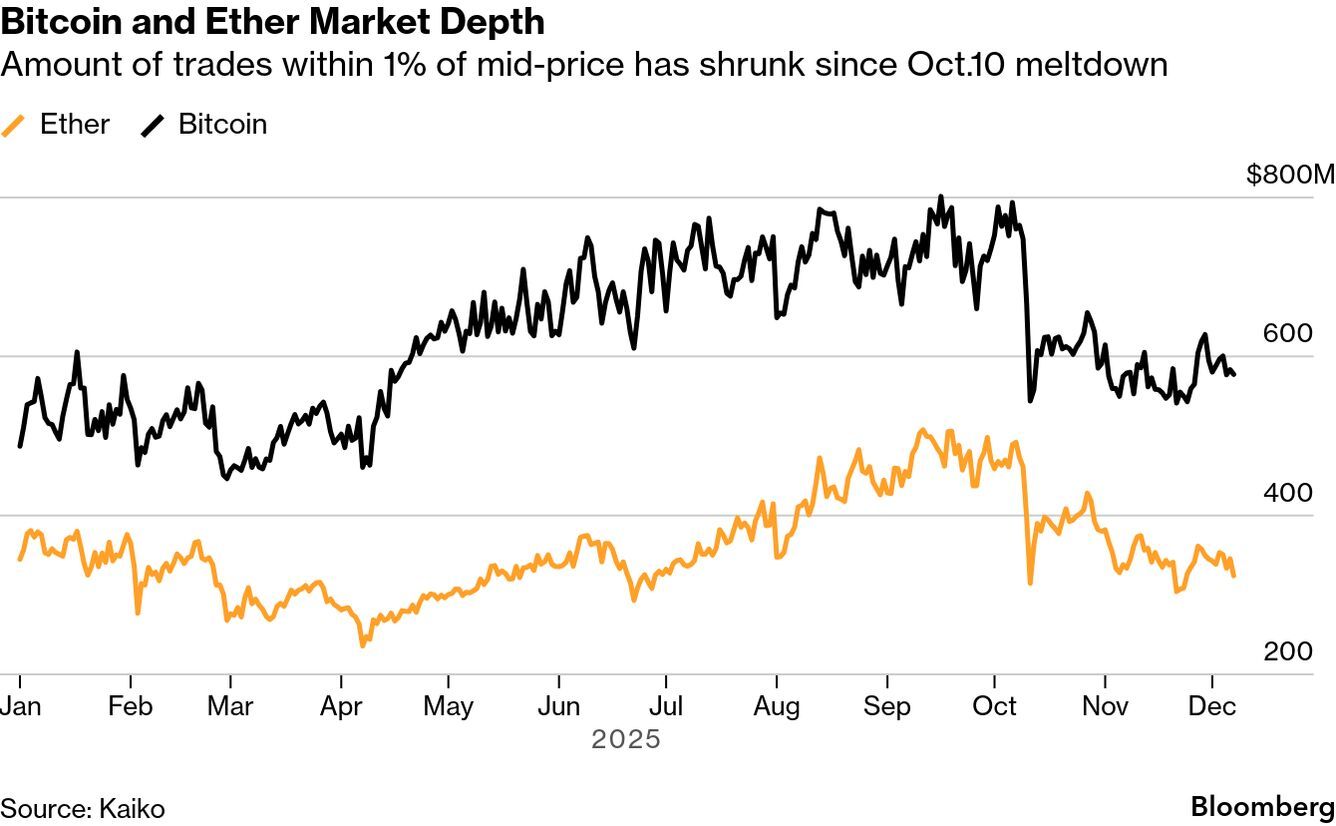

According to data from Kaiko, trade activity near the market center has dropped sharply since mid-October. This implies that the strong crypto rally earlier in the year has now shifted into an environment with thinner order books and weaker institutional participation. With market depth eroding, digital assets become more vulnerable to abrupt price swings, especially as traders reduce exposure ahead of today’s Fed decision. For crypto investors, this highlights the ongoing liquidity challenge at a time when broader risk assets are also under pressure.

Bitcoin and Ether Market Depth (Source: Bloomberg)

The Bloomberg Dollar Index has remained surprisingly steady, holding within an ascending channel throughout the second half of 2025. This trend signals persistent safe-haven demand and expectations that US rates will stay higher for longer relative to other major economies. A firm dollar continues to weigh on commodities, emerging markets, and USD-denominated debt. Technically, the dollar looks positioned for further consolidation, or even renewed strength, if Powell reinforces a cautious stance on the pace of future rate cuts.

Bloomberg Dollar Index Channel Holds Before Fed (Source: Bloomberg)

Treasury yields have been trending lower throughout 2025, with both the 2-year and 10-year declining from their multi-year highs as markets priced in the Fed’s easing cycle. But this downtrend has stalled recently: the 2-year now sits around 3.6%, and the 10-year just above 4%. The muted move in longer-dated yields, even after three rate cuts, shows bond markets remain skeptical about how much easing is truly ahead without risking a rebound in inflation. This leaves fixed-income investors in a difficult position: expecting more cuts, but unconvinced those cuts will be deep or durable enough to bring yields meaningfully lower.

Treasury Yields Drift Lower With Fed Cuts in Focus (Source: Bloomberg)

The most notable development, however, is the sharp repricing of 2026 rate-cut expectations. The SOFR futures spread has tightened to its lowest level since June, indicating markets are now pricing the smallest amount of 2026 easing in six months. It’s a significant reversal from the aggressive cutting cycle many were expecting earlier this year. This reflects growing recognition that the Fed remains divided, some members are increasingly concerned about softening labor data, while others remain focused on ensuring inflation doesn’t reaccelerate.

Fed Cuts Priced Out of Next Year (Source: Bloomberg)

All of this sets up a pivotal December Fed meeting. Today’s decision and Powell’s press conference will determine just how “hawkish” this incoming cut truly is. With crypto liquidity thinning, the dollar holding firm, Treasury yields stuck in a narrow range, and 2026 cut expectations collapsing, markets are preparing for a more restrictive environment than many anticipated. Investors should be ready for elevated volatility, especially if Powell’s tone deviates from expectations or the updated dot plot exposes deeper disagreements within the FOMC.

All the news that matters to your career & life

Hyper-relevant news. Bite-sized stories. Written with personality. And games that’ll keep you coming back.

Morning Brew is the go-to newsletter for anyone who wants to stay on top of the world’s most pressing stories — in a quick, witty, and actually enjoyable way. If it impacts your career or life, you can bet it’s covered in the Brew — with a few puns sprinkled in to keep things interesting.

Join over 4 million people who read Morning Brew every day, and start your mornings with the news that matters most — minus the boring stuff.

Get the Edge Most Retail Traders Don’t Have

Become a paying subscriber of Sandman Research to get this post and all subscriber-only insights, trade setups, and macro intelligence used by top crypto traders.

Upgrade Now → Get Full AccessA subscription gets you:

- Clear Trade Setups for BTC & Altcoins: Step-by-step guidance with entry, stop, and take-profit levels so you can act confidently during market swings.

- Macro & Market Intelligence: Understand which macro events and liquidity shifts are moving crypto, so you’re never caught off guard by volatility.

- Exclusive ETF & On-Chain Flow Analysis: See capital movements and liquidation clusters before the crowd, giving you an edge in timing entries and exits.

- Altcoin & Sector Insights: Identify early rotation opportunities in high-potential sectors like AI-focused altcoins, without wasting time on dead projects.

- Actionable, Risk-Aware Playbooks: Convert research into actual trades with structured setups, technical breakdowns, and scenario-based strategies.