Best Price. Every Trade.

Built for active crypto traders. CoW Swap always searches across every major DEX and delivers the best execution price on every swap you make. Smarter routes. Better trades. No wasted value. Find your best price today. So why trade on any one DEX when you can use them all?

Good morning and welcome to this week’s altcoin market update.

Markets are entering a critical pivot point as the Federal Reserve prepares to deliver its latest interest rate decision. With the Fed expected to lower rates to 3.75%–4.00%, AI-driven mega-caps surging, and Bitcoin hovering around key technical levels, capital flows are shifting beneath the surface, setting the stage for the next potential rotation phase in crypto.

This week, we’ll break down how these macro developments could influence Bitcoin’s trajectory, what altcoins are doing amid tight ranges, and the technical levels that traders should watch heading into Q4.

Here’s what we’ll cover today:

📅 Macro Review: Fed expected to cut rates 25bps to 3.75%–4.00%, S&P 500 hits new highs but breadth is narrow, with only 104 of 500 stocks advancing, potential end to QT may boost liquidity and support crypto.

📊 Crypto Market Overview: Bitcoin rejected at $115,300, briefly retested $111,900, now trading in between, TOTAL3 consolidates around $1.02T, OTHERS below 260B, bullish and bearish setups detailed with target and invalidation levels.

🔍 Bitcoin vs. Altcoins: BTC.D rejected at 59.96%, OTHERS.D stuck around 6.93%, potential for altcoin rotation exists if BTC.D falls below resistance and OTHERS.D reclaims its range, otherwise bearish structure continues.

📈 Key Reversal Signals: ETH/BTC remains below 0.03723, OTHERS/BTC approaching previous lows near 2M, reclaiming key levels would signal potential rotation into altcoins, while failure maintains bearish pressure.

🚀 Chart of the Week: ??? remains in a structural bullish trend since April; long and short setups defined, with clear targets and invalidation levels, defensive, higher-timeframe trades recommended.

Let’s dive in! 🚀

📅 Macro Review:

Today’s Federal Reserve’s FOMC meeting is almost certain to deliver another quarter-point rate cut, lowering the federal funds rate to a range of 3.75%–4.00%, with markets pricing in a 98% probability of this outcome. This would mark the lowest level since late 2022, continuing the Fed’s pivot from aggressive tightening toward supporting growth amid a weakening labor market. Beyond the rate decision, investors will closely watch Chair Jerome Powell’s press conference for guidance on the pace of future cuts and any hints about ending the central bank’s balance sheet runoff. For crypto and broader risk assets, a potential end to quantitative tightening could serve as a meaningful tailwind by easing financial conditions and boosting liquidity.

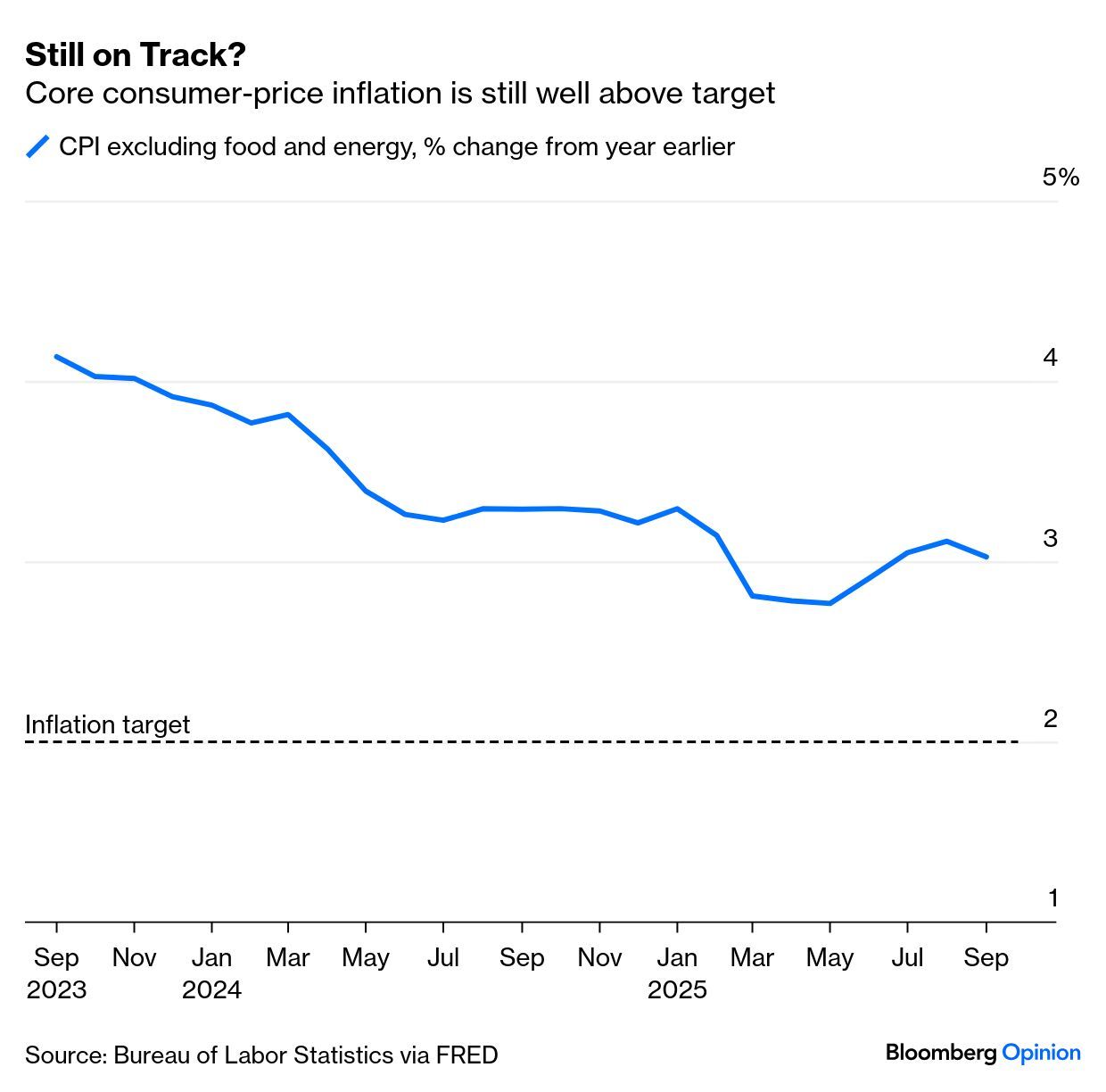

Core consumer-price inflation is still well above target (Source: Bloomberg)

Core inflation excluding food and energy remains stubbornly around 3%, still above the Fed’s 2% target despite significant improvement from late 2023’s 4% levels. This lingering stickiness keeps monetary policy in a delicate balance, the Fed cannot yet declare victory over inflation, but maintaining overly restrictive conditions risks stalling economic momentum.

S&P 500 Posts Its Thinnest Gain in More Than 30 Years (Source: Bloomberg)

Meanwhile, the S&P 500’s 0.23% daily gain masked troubling internals: only 104 of 500 stocks advanced, marking the narrowest breadth for a positive session in over 30 years. This concentration in winners echoes historic market tops, where a handful of stocks prop up indices while participation deteriorates. Although the index trades near 6,890 and continues to print new highs, the weakening breadth signals fragility beneath the surface. Institutional investors are watching these dynamics closely, as sustainable bull markets require broad participation, not just the strength of a few mega-cap names.

Apple, Microsoft and Nvidia Top $4 Trillion Level (Source: Bloomberg)

Apple, Microsoft, and Nvidia have each surpassed the $4 trillion market capitalization mark. This extreme concentration underscores both the transformative potential of AI infrastructure and the narrowing scope of market leadership. To put it in perspective, the entire cryptocurrency market remains below $4 trillion in total capitalization, highlighting the enormous growth potential still ahead for digital assets as institutional adoption deepens.

AI Rally Fuels Record Run in US Tech Stocks (Source: Bloomberg)

Since early 2022, the Magnificent Seven have gained over 150%, vastly outperforming the Nasdaq 100’s 65% rise and the global equity market’s modest 35% advance. This divergence highlights just how dependent the current bull market has become on AI-driven optimism. The speed and scale of this move rival past technological booms, but such concentration often precedes capital rotation. Looking ahead, we expect this AI enthusiasm to gradually spill over into the crypto sector, where AI-linked altcoins could significantly outperform once capital flows broaden beyond Bitcoin and Ethereum, a phase that typically characterizes the later stages of crypto bull markets.

Current macro conditions have major implications for crypto, and several indicators suggest we may be approaching a pivotal moment in the markets.

In this week’s crypto section, we break down the potential impact on Bitcoin and altcoins, highlighting one altcoin in particular that stands out with unique opportunities.

💡 Lock in the yearly subscription now, the cheapest option, saving $49 yearly, compared to monthly payments and get full access to all insights.

Gain Full Research Access to read the rest.

Become a paying subscriber of Sandman Research to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Institutional-Grade Market Analysis: Deep-dive reports on Bitcoin and Altcoins, delivering expert insights multiple times per week.

- Macro Coverage: Stay informed with global macroeconomic trends and key economic events that impact the crypto market.

- Exclusive Data & Research: Access proprietary insights and in-depth market intelligence used by top traders and institutions.

- Actionable Intelligence: Identify key technical levels, trade setups, and high-probability scenarios before the market reacts.