Crypto’s Most Influential Event

This May 5-7 in 2026, Consensus will bring the largest crypto conference in the Americas to Miami’s electric epicenter of finance, technology, and culture.

Celebrated as ‘The Super Bowl of Blockchain’, Consensus Miami will gather 20,000 industry leaders, investors, and executives from across finance, Web3, and AI for three days of market-moving intel, meaningful connections, and accelerated business growth.

Ready to invest in what’s next? Consensus is your best bet to unlock the future, get deals done, and party with purpose. You can’t afford to miss it.

Hey there, and happy Friday!

This week’s focus shifts to the accelerating flight to safety across global markets. Gold’s explosive rally has left the dollar flat and Bitcoin trailing behind, as investors flock toward traditional hedges amid renewed geopolitical tensions and slowing economic momentum. The move reflects a broader shift in sentiment: risk appetite is fading, and stability is back in demand.

Here’s what we’ll cover today:

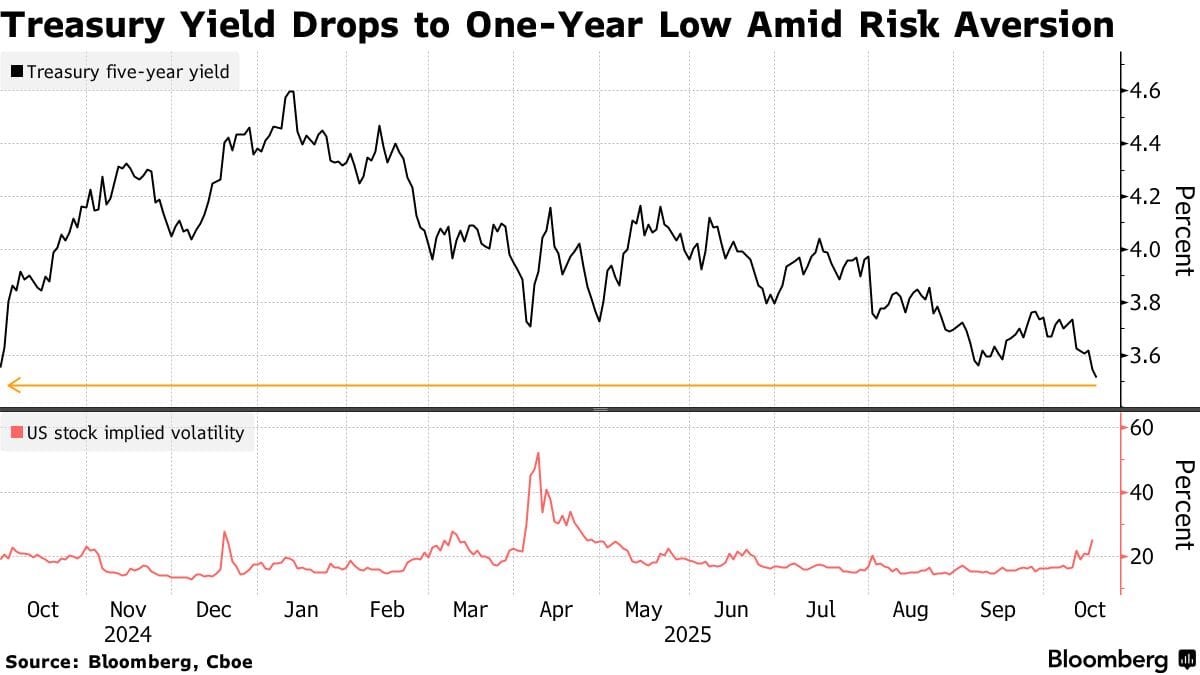

🌍 Market Recap & Macro Overview: Gold up nearly 60% YTD as geopolitical tensions fuel the biggest flight to safety in years. Treasury yields hit one-year lows, while risk assets remain fragile but stable.

📈 Bitcoin (BTC) Breakdown: BTC slips to $104K, retesting previous wick lows as ETF flows turn negative again. Key support sits at $102K with bearish structure still intact.

📊 Ethereum (ETH) Outlook: ETH loses key support at $3,728, with further downside risk toward $3,617. Mixed ETF flows highlight fading demand, but potential upside remains if sentiment improves.

🚀 Solana (SOL) Analysis: SOL rejects $206 and trades below $179, with next support at $168. Balanced liquidation clusters point to heightened volatility in both directions.

Let’s dive in 👇

🌍 Market Recap & Macro Overview:

Gold’s remarkable rally has left the dollar in the dust. Spot prices have climbed roughly 60% year-to-date, while the Bloomberg Dollar Index has remained largely flat. The precious metal’s ascent accelerated sharply in September, driven by heightened geopolitical tensions and renewed concerns over global economic stability. This surge underscores gold’s enduring role as the ultimate portfolio hedge when traditional correlations break down and uncertainty dominates markets.

Gold Outshines the Dollar (Source: Bloomberg)

The divergence between gold and Bitcoin has become increasingly pronounced throughout 2025, with physical gold outperforming its digital counterpart. On a normalized basis, gold is up nearly 60% year-to-date, while Bitcoin has gained about 25% over the same period, a reversal from Bitcoin’s typical volatility premium. This performance gap highlights a key behavioral dynamic: during episodes of geopolitical stress and trade war fears, investors continue to favor the 5,000-year-old safe haven over the 16-year-old cryptocurrency.

The Difference Between Gold and Digital Gold (Source: Bloomberg)

Notably, however, gold has tended to rise steadily during periods of uncertainty, while Bitcoin initially sold off before catching up strongly once market stress began to fade. The same pattern appears to be unfolding again. Should history repeat, Bitcoin could once more play catch-up into new all-time highs toward year-end and into 2026, as risk sentiment improves and gold stabilizes. We’ll take a closer look at Bitcoin and its trade scenarios in the technical analysis section.

Bitcoin Struggles to Recover from Weekend Crash (Source: Bloomberg)

The flight to safety has also extended into fixed income markets. Treasury yields have dropped to one-year lows as investors seek shelter from risk. The five-year Treasury yield, for instance, has fallen steadily from peaks above 4.6% in December to around 3.5% today, reflecting growing concerns about slowing growth and a clear shift toward risk aversion. Interestingly, equity market volatility has remained contained despite these moves, suggesting that investors are positioning for weaker growth rather than an imminent crisis. This combination of falling yields and stable volatility signals a delicate market balance: uncertainty is rising, but panic has yet to set in.

Treasury Yield Drops to One-Year Low Amid Risk Aversion (Source: Bloomberg)

In an environment still defined by geopolitical instability, shifting monetary policy expectations, and evolving market structure, classical risk management principles remain paramount. Investors should aim for balanced portfolios that blend traditional safe havens with growth-oriented assets, recognizing that strategies effective in calm markets often fail during turbulent periods. Ultimately, patience, discipline, and diversification continue to be the most reliable safeguards in navigating the uncertain macro landscape ahead.

We’re now diving into the crypto section, analyzing Bitcoin, Ethereum, and Solana in detail.

Explore key risks and opportunities, including actionable long and short trading scenarios for the weekend.

Gain Full Research Access to read the rest.

Become a paying subscriber of Sandman Research to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Institutional-Grade Market Analysis: Deep-dive reports on Bitcoin and Altcoins, delivering expert insights multiple times per week.

- Macro Coverage: Stay informed with global macroeconomic trends and key economic events that impact the crypto market.

- Exclusive Data & Research: Access proprietary insights and in-depth market intelligence used by top traders and institutions.

- Actionable Intelligence: Identify key technical levels, trade setups, and high-probability scenarios before the market reacts.