Stop Planning. Start Building.

End of the year? Or time to start something new.

With beehiiv, this quiet stretch of time can become your biggest advantage. Their platform gives you all the tools you need to make real progress, real fast.

In just days (or even minutes) you can:

Build a fully-functioning website with the AI website builder

Launch a professional-looking newsletter

Earn money on autopilot with the beehiiv ad network

Host all of your content on one easy-to-use platform

If you’re looking to have a breakthrough year, beehiiv is the place to start. And to help motivate you even more, we’re giving you 30% off for three months with code BIG30.

Hello and happy Monday!

Record highs in U.S. stocks met a weekend shock: a major threat to Fed independence. How could this impact equities, Bitcoin, and altcoins, and what levels should investors watch? This week’s report breaks it all down, with 10 key charts, actionable setups, and the scenarios that could define early 2026.

Here’s what we’ll cover today:

📈 Market Review: Why broad participation drove Friday’s record highs, and why markets tumbled over the weekend. We explore the interplay between Fed politics, the dollar, and risk assets, highlighting the risks investors can’t ignore.

🔍 Current Market Conditions: Bitcoin ETF flows and crypto sentiment remain unstable. We dissect the latest movements, show what they mean for short-term price action, and explain why institutional participation is still the key variable.

👀 Key Events Ahead: CPI, PPI, housing, and Philly Fed data are on the schedule, but with Fed independence in question, political headlines could dominate. We guide you on which releases could actually move markets.

📊 Technical Analysis: Key Bitcoin levels, liquidation clusters, and short-term trading setups for bulls and bears. We give actionable insight on what to watch if volatility returns.

🚀 Altcoin Insights: TOTAL3 and relative strength, where selective exposure matters, which assets show relative strength, and why altcoins remain beta plays dependent on BTC and equities.

Let’s dive in 👇

A big 2026 starts now. True builders use this stretch of time to get ahead, not slow down. Launch your website with AI, publish a stunning newsletter, and start earning more money quickly through the beehiiv Ad Network. Use code BIG30 for 30 percent off your first three months. Start building for 30% off today.

📈 Market Review:

U.S. equity markets closed Friday at record highs, with all four major indices hitting new all-time highs simultaneously, including small caps and the equal-weighted S&P 500. This is an important signal. It shows the rally is not being driven solely by a handful of mega-cap tech stocks, but by broad participation across the market. Historically, this type of breadth tends to make rallies more resilient and less prone to sudden, sharp reversals.

Record Highs for US Stock Benchmarks (Source: Bloomberg)

That strength, however, did not carry into the weekend. On Sunday evening, Fed Chair Jerome Powell revealed that the Justice Department had served the Federal Reserve with grand jury subpoenas that could lead to criminal indictments. Powell emphasized that the core issue is not the stated reason tied to testimony about Fed headquarters, but growing pressure on the Fed to set policy based on political preferences rather than economic data. Markets reacted immediately: the dollar fell 0.2%, and S&P 500 futures dropped roughly 0.5%. This matters because Fed independence is a cornerstone of modern financial markets. If it is questioned, predictability around rates, liquidity, and asset pricing quickly erodes.

Dollar Gauge Snaps Rally as Fed Faces DOJ Probe (Source: Bloomberg)

The futures move from 7,020 to 6,965 highlights what investors are most concerned about: the risk of losing a credible, independent central bank. With Powell’s term ending in May and the possibility that President Trump could soon announce a successor, uncertainty around future monetary policy is rising. Senator Thom Tillis has stated he will block any Fed nominee until the situation is resolved, offering some institutional guardrails, but confidence has already taken a hit.

US Stock Futures Drop After Fed Subpoena News (Source: Bloomberg)

At the same time, the U.S. Treasury yield curve has continued to steepen, with the spread between 2-year and 10-year yields widening back toward positive territory. This steepening has been driven primarily by easing short-term yields as markets price future Fed cuts, while longer-term yields remain relatively elevated due to persistent inflation concerns and rising fiscal deficits. In practical terms, bond investors are demanding a higher term premium to lend over longer horizons. Historically, this type of environment often precedes increased volatility, as periods of compressed bond market uncertainty tend to give way to sharp repricing once expectations shift.

Treasuries Curve Trends Steeper (Source: Bloomberg)

You're facing a market at record highs with three major risks converging: mounting threats to Fed independence, rising long-term interest rates, and valuations that leave little margin for error. This raises the importance of risk management. Rate-sensitive sectors may come under pressure, and portfolios should be evaluated for their ability to withstand both higher yields and volatility tied to potential leadership changes at the Fed. Friday’s broad market strength points to underlying economic resilience, but Sunday’s developments make clear that institutional risk now outweighs fundamentals in the short term, and markets are beginning to price that shift through increased volatility and more defensive positioning.

🔍 Current Market Conditions:

Bitcoin sentiment remains fragile despite brief signs of recovery. The Crypto Fear & Greed Index spiked to 45 (neutral territory) on January 6 but has since retreated to 26, firmly back in fear mode. This tells you that traders haven't regained confidence—any relief has been temporary and shallow, not the foundation for sustained strength.

Crypto Fear and Greed Index (Source: Coinglass)

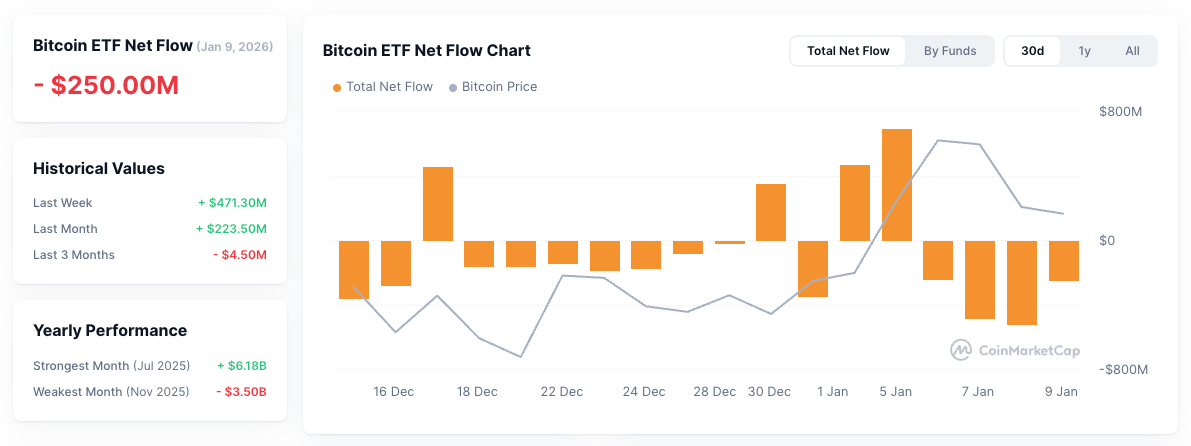

ETF flows paint the same picture of weakness. Monday delivered a powerful $697 million inflow into US spot Bitcoin ETFs, the strongest single day since October and a clear signal that institutions were buying. But the buying didn't last, outflows dominated every day after, hitting $521 million on Thursday and $250 million on Friday. This whipsaw action shows just how unstable sentiment is: early enthusiasm collapsed as soon as sellers returned.

Bitcoin ETF Net Flow (Source: CoinMarketCap)

The message for investors is straightforward: Bitcoin's direction hinges entirely on whether institutional money keeps flowing in through ETFs. Sustained inflows provide the support needed for prices to hold or advance, while persistent outflows create downward pressure and raise the risk of sharp corrections. Watching these flows this week will tell you whether institutions are committed or still heading for the exits, and that will determine whether Bitcoin can stabilize or faces further declines.

Stop planning. Start building. With beehiiv, this the end of the year is a great time to get ahead. Build a website with AI, launch a newsletter in minutes, and start earning through the Ad Network. Use code BIG30 for 30 percent off your first three months. Start building for 20 percent off today.

👀 Key Events Ahead:

Markets are starting the week with Fed independence concerns dominating sentiment, overshadowing fundamental factors as investors wait for clarity on the institutional crisis unfolding at the central bank. This backdrop means economic data may take a backseat to political headlines, at least until the situation stabilizes or Senate guardrails prove effective.

Tuesday’s December CPI print will be the most critical release, shaping near-term rate expectations and likely driving volatility across bonds, equities, and crypto. October New Home Sales will provide insight into housing demand under higher rates, influencing growth sentiment.

Wednesday brings November PPI data, highlighting inflation pressures at the producer level, alongside the anticipated U.S. Supreme Court ruling on tariffs, which could impact trade expectations, inflation, and market risk sentiment.

Thursday closes the week with the January Philly Fed Manufacturing Index, offering a snapshot of regional business confidence and manufacturing health.

Investor Implications: Positioning matters critically this week. The Fed crisis creates an environment where political headlines may override economic data, watch for developments on the DOJ situation or Senate reactions, as these could trigger sharp moves regardless of inflation prints. If markets can compartmentalize the institutional drama, then CPI and PPI become the key drivers for rate expectations across equities and crypto.

Stay flexible, hedge where appropriate, and recognize that technical support levels broken over the weekend suggest markets are in risk-off mode until clarity returns, use that framework to identify whether rallies are genuine reversals or selling opportunities.

🚨 Every week, we produce multiple in-depth reports, our Monday Market Report is the only free piece.

Upgrade to Full Research Access and get:

Complete market coverage across crypto, equities, and macro trends

Deep-dive analysis with 26+ extra charts each week

Long & short trading setups for Bitcoin and select altcoins

Exclusive insights trusted by top investors

Make smarter trades, optimize your portfolio, and grow and protect your capital. Upgrade today, your future self will thank you.

📊 Technical Analysis:

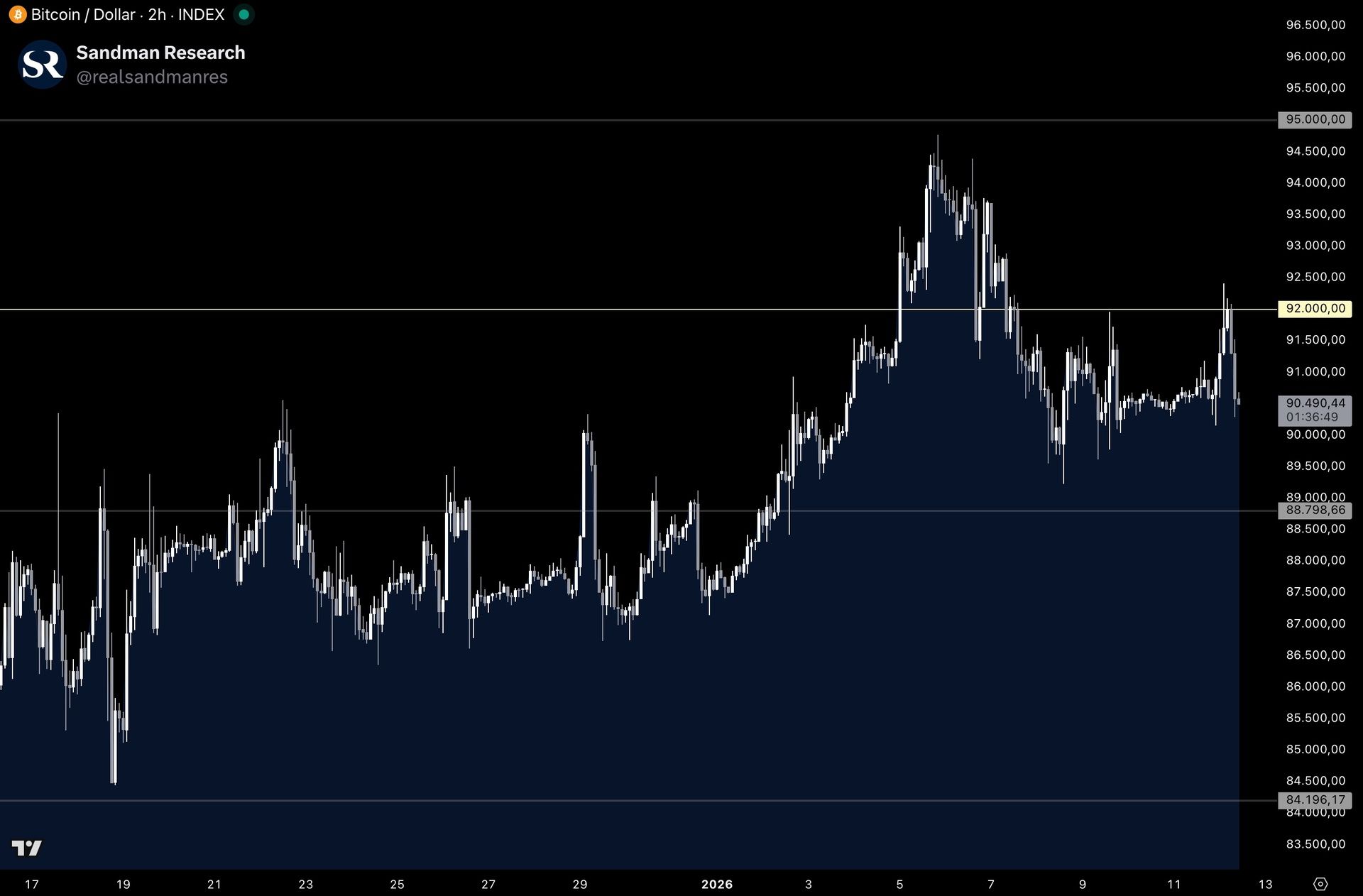

Early this morning, Bitcoin reached the next higher technical level at 92,000 but faced immediate resistance there and sold off following the announcement made by Jerome Powell. Price is currently sitting around 90,000, with the next technical support at 88,800 and resistance remaining around 92,000.

Bitcoin Price Chart (Source: Tradingview)

The two-week Bitcoin liquidation heatmap shows more liquidation leverage on the downside, favoring downside movements here rather than an immediate continuation higher. Notable clusters of leveraged liquidations are forming right around the technical support at 88,800, further confirming the importance of that level and pointing toward a potential retest. On the upside, thinner and less notable clusters are forming around 95,000, which also coincides with a key technical level.

Bitcoin Liquidation Heatmap (Source: Coinglass)

Bullish Scenario

In the bullish case, Bitcoin starts the week with strength and once again attempts a move higher toward the 92,000 technical level. Long setups become attractive after a successful reclaim and bullish retest of 92,000, targeting 95,000, with invalidation if price loses 92,000. If BTC first retests 88,800, additional long opportunities may emerge on a bullish retest, targeting a move back toward 92,000.

Bearish Scenario

In the bearish case, Bitcoin fails to reclaim 92,000 and faces rejection at that level. Short setups may form on a confirmed bearish retest, targeting 88,800, with invalidation if price reclaims the entry. Should 88,800 break, further downside opens up again, offering short opportunities targeting 84,200, with invalidation if price reclaims the entry.

🚀 Altcoin Insights:

TOTAL3 has been moving sideways above the 870B level since pulling back from the 920B highs last week, suggesting the market may be attempting to form a short-term base. That said, the structure remains fragile and exposed to broader market risk, particularly if U.S. equities or Bitcoin extend their weakness following the recent Fed-related developments. At this stage, TOTAL3 and altcoins more broadly continue to behave as high-beta assets, remaining reactive rather than leading, and closely tracking Bitcoin and equity market direction rather than outperforming independently.

TOTAL3 (Source: Tradingview)

Ethereum/Bitcoin has edged higher over the weekend, though it remains range-bound between resistance at 0.03723 and support at 0.03255. Notably, as Bitcoin sold off following Powell’s announcement, ETH/BTC actually moved higher, reinforcing Ethereum’s relative strength in the current environment. This is a meaningful observation, as during periods of heightened uncertainty, Ethereum has historically tended to underperform Bitcoin rather than outperform it.

Ethereum / Bitcoin (Source: Tradingview)

Despite Ethereum’s short-term relative strength, the broader altcoin landscape remains unchanged. As outlined in our Q1 watchlist, the first quarter is less about broad-based outperformance and more about selective positioning ahead of a potential regime shift later in the cycle. This favors a measured approach focused on quality and liquidity, with Bitcoin regaining leadership before capital meaningfully rotates into higher-beta assets. Until a clearer structural shift emerges, caution remains warranted despite pockets of relative strength.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.