Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Hey there, and happy Friday!

This week’s focus shifts firmly back to U.S. monetary policy after a pivotal Fed meeting that delivered both the expected 25 bps rate cut and a surprisingly divided committee outlook. At the same time, markets interpreted the decision as more dovish than the dot plot suggests: the dollar sank to multi-month lows, risk assets rallied globally, and Fed balance-sheet expansion is set to return via $40B in monthly T-bill purchases, an underappreciated shift that helps maintain liquidity conditions into year-end.

Here’s what we’ll cover today:

🌍 Market Recap & Macro Overview: A 25 bps cut, a sharply divided FOMC, and the return of Fed balance-sheet expansion through T-bill purchases. The dollar slid to mid-October lows, global equities hit fresh highs, and the delayed November inflation and jobs reports (now due Dec 16 & 18) have become critical macro catalysts.

📈 Bitcoin (BTC) Breakdown: BTC briefly lost 92,000 post-Fed before reclaiming it, but has yet to trend higher, with 95,000 still the key upside target. ETF flows were mixed but increasingly supportive as financial conditions ease and Fed liquidity returns. Liquidation clusters now sit heavily above price around 95,000.

📊 Ethereum (ETH) Outlook: ETH hit 3,430 before pulling back, remaining range-bound between 3,059 and resistance. ETH/BTC showed its strongest bounce from 0.03255 since early November, hinting at potential breakout momentum. ETF flows were mostly positive, though still low in volume.

🚀 Solana (SOL) Analysis: SOL continues to trade cleanly inside its 130–143 range. After rejecting 143 early in the week, price retested 130 post-Fed and bounced, now sitting mid-range at 137. SOL/BTC shows the same indecision, while heatmap data confirms tight clustering above and below—suggesting volatility once a breakout occurs.

Let’s dive in 👇

⚠️ Notice: Brief Pause in Publication

Dear readers, Please note that Sandman Research will take a short break from publishing during the week of December 15–19, 2025. No new reports will be released during this period.

We will resume our regular schedule on Monday, December 22, 2025, with the usual in-depth market coverage, analysis, and insights you rely on.

Thank you for your understanding, and we look forward to continuing to support your crypto and market research needs.

🌍 Market Recap & Macro Overview:

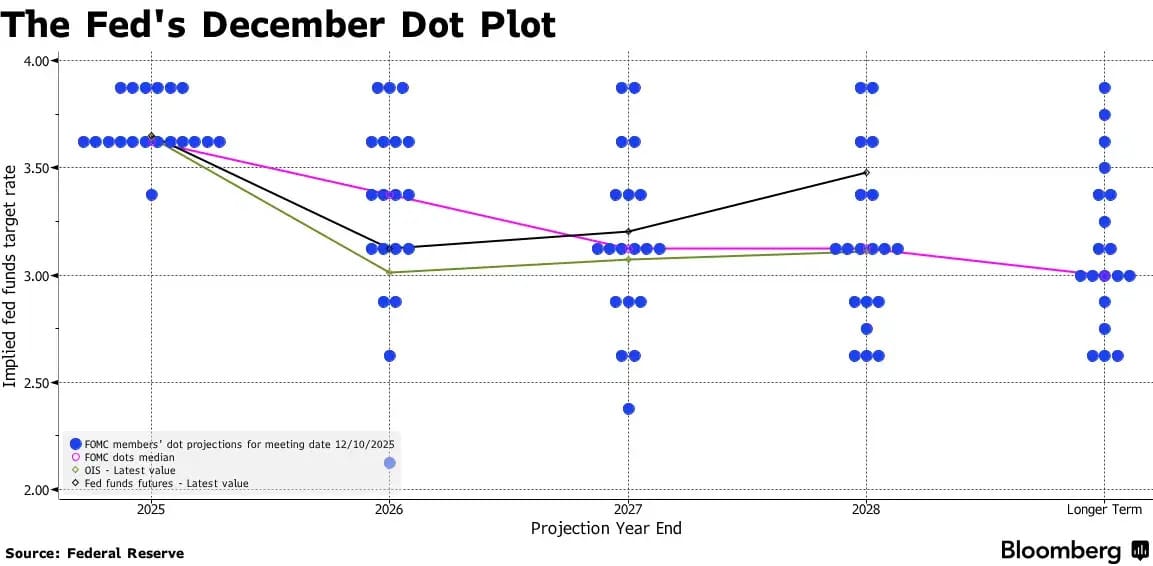

After cutting rates by 25 basis points, the Fed’s latest projections show just one additional cut in 2026 and another in 2027, placing the federal funds rate near 3% by the end of 2027. The real story, however, is the dispersion: four officials expect no cuts next year, and seven policymakers in total see zero or one cut. This level of divergence highlights a significantly fractured committee. For investors, the message is straightforward, predictable quarterly cuts are gone. Any future easing will be gradual, highly data-dependent, and increasingly uncertain. That puts enormous weight on the delayed November jobs and inflation reports, now scheduled for December 16 and 18 following the government shutdown.

The Fed’s December Dot Plot (Source: Bloomberg)

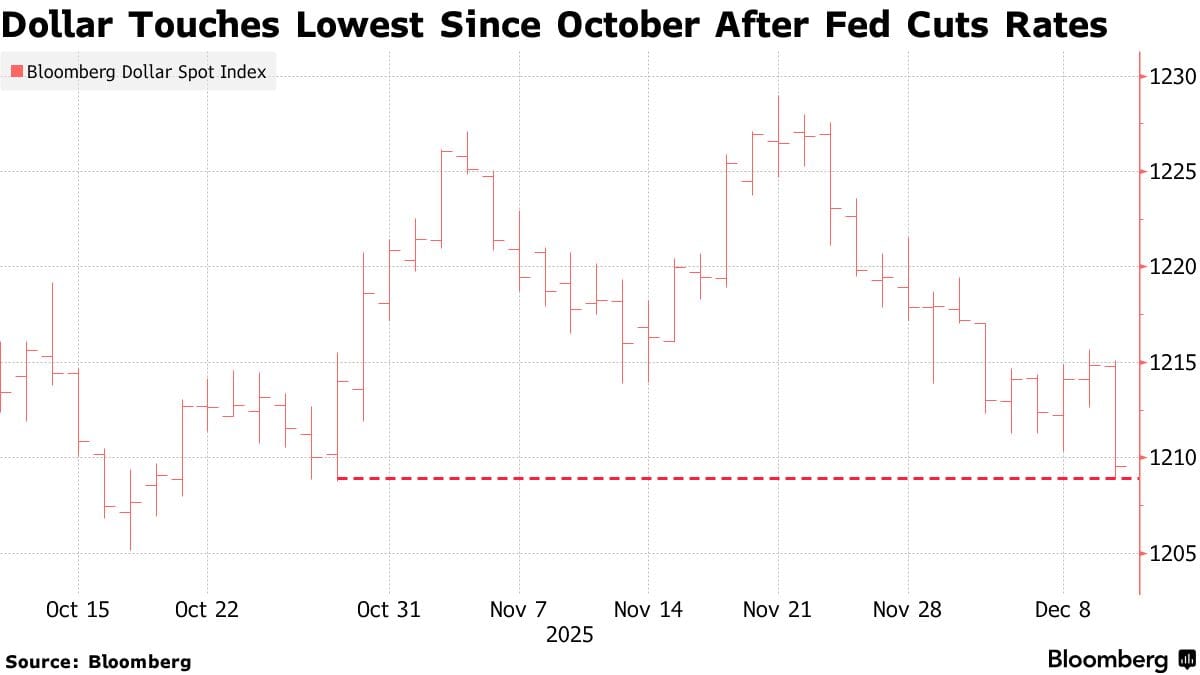

The dollar’s reaction reflected the market’s dovish interpretation almost immediately. The Bloomberg Dollar Spot Index sank to its lowest level since mid-October, sliding toward the 1,209 support level and falling about 0.6% on Wednesday alone as traders unwound bullish USD exposure. The index is now down nearly 8% year-to-date and extended its decline through Thursday after softer jobless claims reinforced expectations for more easing than the Fed is signaling. This pullback is providing broad tailwinds, making commodities more affordable globally, improving risk appetite, and supporting emerging-market inflows, all while suggesting markets suspect the Fed’s cautious posture may ultimately prove too restrictive.

Dollar Touches Lowest Since October After Fed Cuts Rates (Source: Bloomberg)

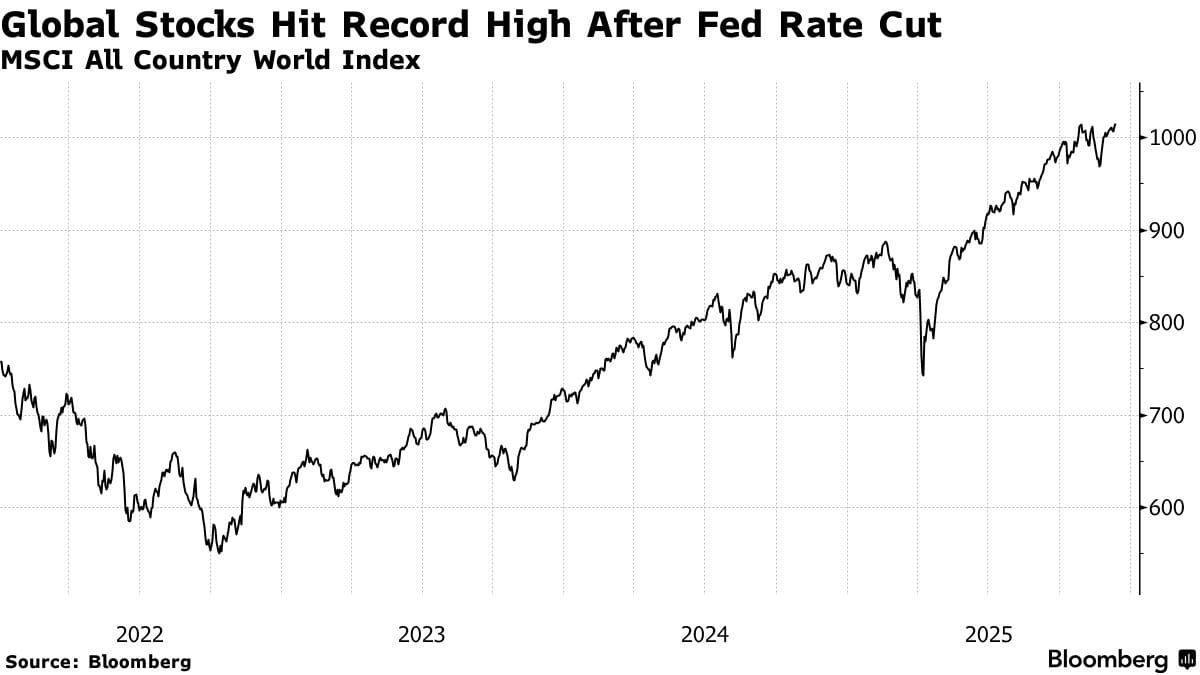

Global equities delivered a clear verdict as well: bullish. Stocks rallied sharply across the board after the decision. The MSCI All Country World Index broke to new all-time highs above 1,017, the S&P 500 closed just shy of its October record after rising 0.7%, the Dow added 497 points (1%), and the Russell 2000 pushed to a fresh all-time high. Investors are looking past the hawkish dot plot and focusing on what truly matters: Powell ruling out rate hikes, two market-implied cuts for 2026 despite the Fed projecting only one, and a globally synchronized easing cycle that continues to build momentum.

Global Stocks Hit Record High After Fed Rate Cut (Source: Bloomberg)

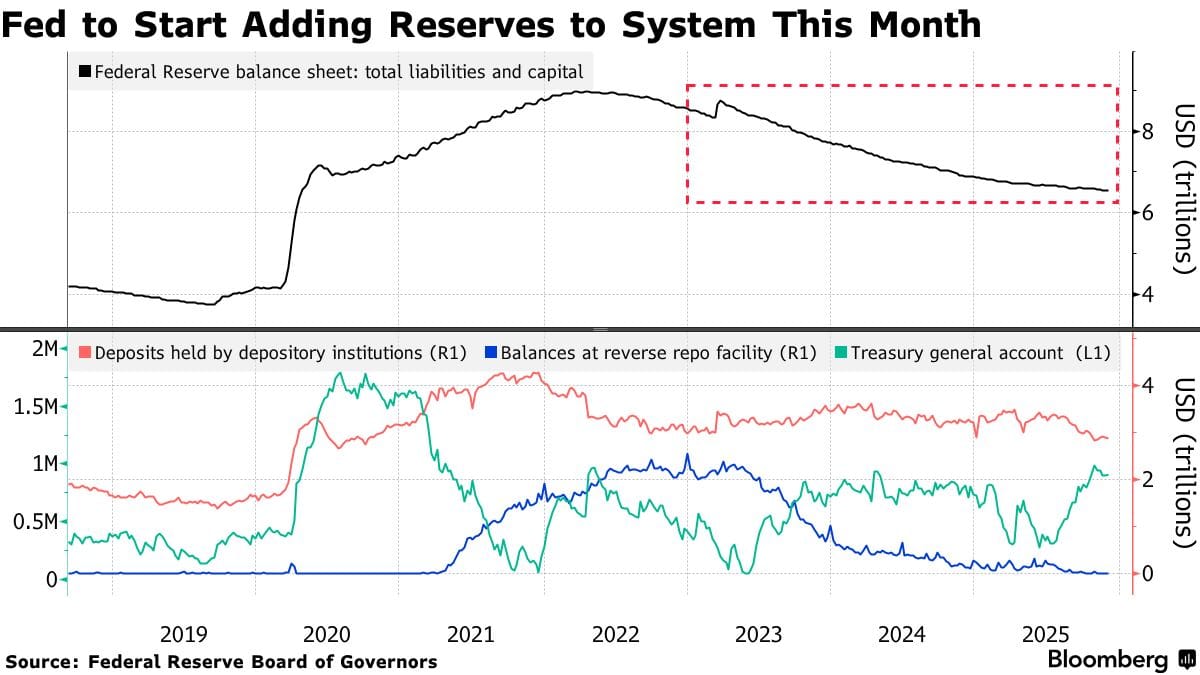

The Fed’s announcement that it will begin purchasing $40 billion in Treasury bills starting December 12 is more important than it seems at first glance. While not traditional quantitative easing aimed at long-term rates, these T-bill purchases are designed to restore “ample reserves” in the banking system after balances fell from $4.27 trillion in 2021 to roughly $2.83 trillion today. The Fed expects purchases to remain elevated for a few months before scaling back materially, and the move follows the official end of quantitative tightening in October. For markets accustomed to Fed liquidity support, the shift from balance-sheet runoff to balance-sheet expansion, technical or not, is a meaningful pivot that should keep financial conditions supportive and reduce the risk of any 2019-style funding stress.

Fed to Start Adding Reserves to System This Month (Source: Bloomberg)

The overall message is clear: the Fed has guided the economy into a soft landing and is now managing the transition with precision, even as internal disagreements suggest the road ahead won’t be perfectly smooth. With the dollar weakening, global equities breaking to new records, and Fed liquidity quietly returning, the broader environment continues to favor staying invested. Markets still expect two cuts in 2026, compared to the Fed’s conservative single-cut outlook, and Powell’s firm dismissal of rate hikes keeps the bias tilted toward easing. The key risk now lies in the delayed November data, those reports could be the catalyst that forces the Fed into a faster pace of cuts than it currently projects.

Wall Street’s Morning Edge.

Investing isn’t about chasing headlines — it’s about clarity. In a world of hype and hot takes, The Daily Upside delivers real value: sharp, trustworthy insights on markets, business, and the economy, written by former bankers and seasoned financial journalists.

That’s why over 1 million investors — from Wall Street pros to Main Street portfolio managers — start their day with The Daily Upside.

Invest better. Read The Daily Upside.

Get the Edge Most Retail Traders Don’t Have

Become a paying subscriber of Sandman Research to get this post and all subscriber-only insights, trade setups, and macro intelligence used by top crypto traders.

Upgrade Now → Get Full AccessA subscription gets you:

- Clear Trade Setups for BTC & Altcoins: Step-by-step guidance with entry, stop, and take-profit levels so you can act confidently during market swings.

- Macro & Market Intelligence: Understand which macro events and liquidity shifts are moving crypto, so you’re never caught off guard by volatility.

- Exclusive ETF & On-Chain Flow Analysis: See capital movements and liquidation clusters before the crowd, giving you an edge in timing entries and exits.

- Altcoin & Sector Insights: Identify early rotation opportunities in high-potential sectors like AI-focused altcoins, without wasting time on dead projects.

- Actionable, Risk-Aware Playbooks: Convert research into actual trades with structured setups, technical breakdowns, and scenario-based strategies.