Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Hello and happy Monday!

As we enter the final weeks of 2025, markets are showing a markedly different tone than just a week ago. Bitcoin and leading altcoins are attempting to stabilize after recent volatility, but liquidity-sensitive assets remain highly reactive to macro shifts. How the Fed signals the path of policy and how markets respond to year-end flows will likely dictate whether BTC and high-cap altcoins can extend gains or face renewed pressure.

Here’s what we’ll cover today:

📈 Market Review: Equities continue to trade near record highs, mega-cap tech valuations remain reasonable, and institutional sentiment supports further risk appetite. Treasury yields jumped last week, making Fed guidance critical.

🔍 Current Market Conditions: Crypto Fear & Greed remains in low territory, ETF flows mixed, and price action shows tentative stabilization. Micro bullish trends suggest early support, but major levels like 102,000 for BTC still need to be reclaimed.

👀 Key Events Ahead: The week’s focus is Wednesday’s FOMC meeting. Investors will watch Powell for clues on the pace of easing and financial conditions. Other catalysts include Tuesday’s JOLTS report, Thursday’s OPEC report, Initial Jobless Claims, and the U.S. 30-year bond auction.

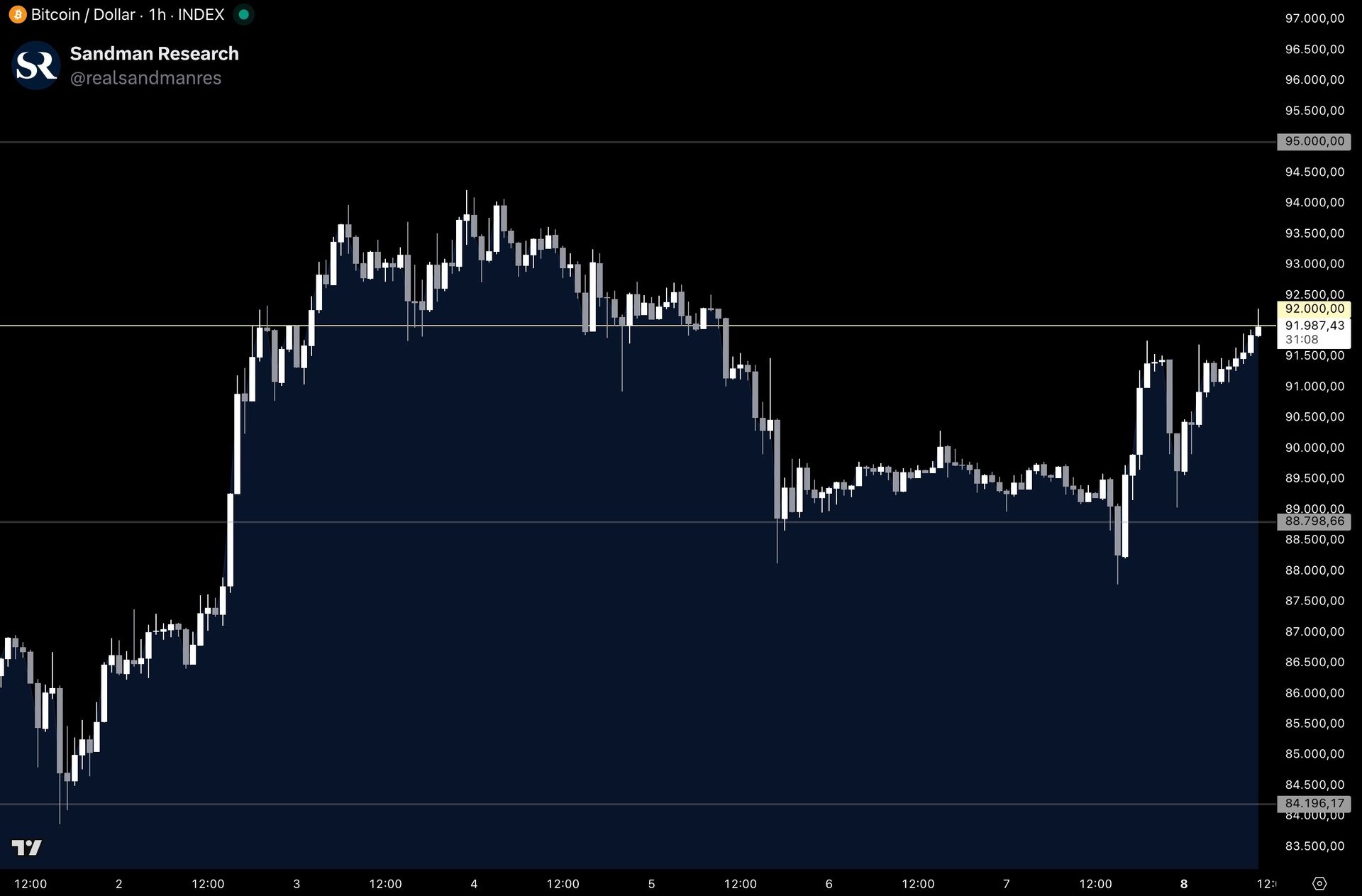

📊 Technical Analysis: BTC retested 88,800 and bounced back to 92,000 over the weekend, forming a potential micro higher low. The two-week liquidation heatmap hints at upside toward 95,000 while downside clusters remain near 83,600.

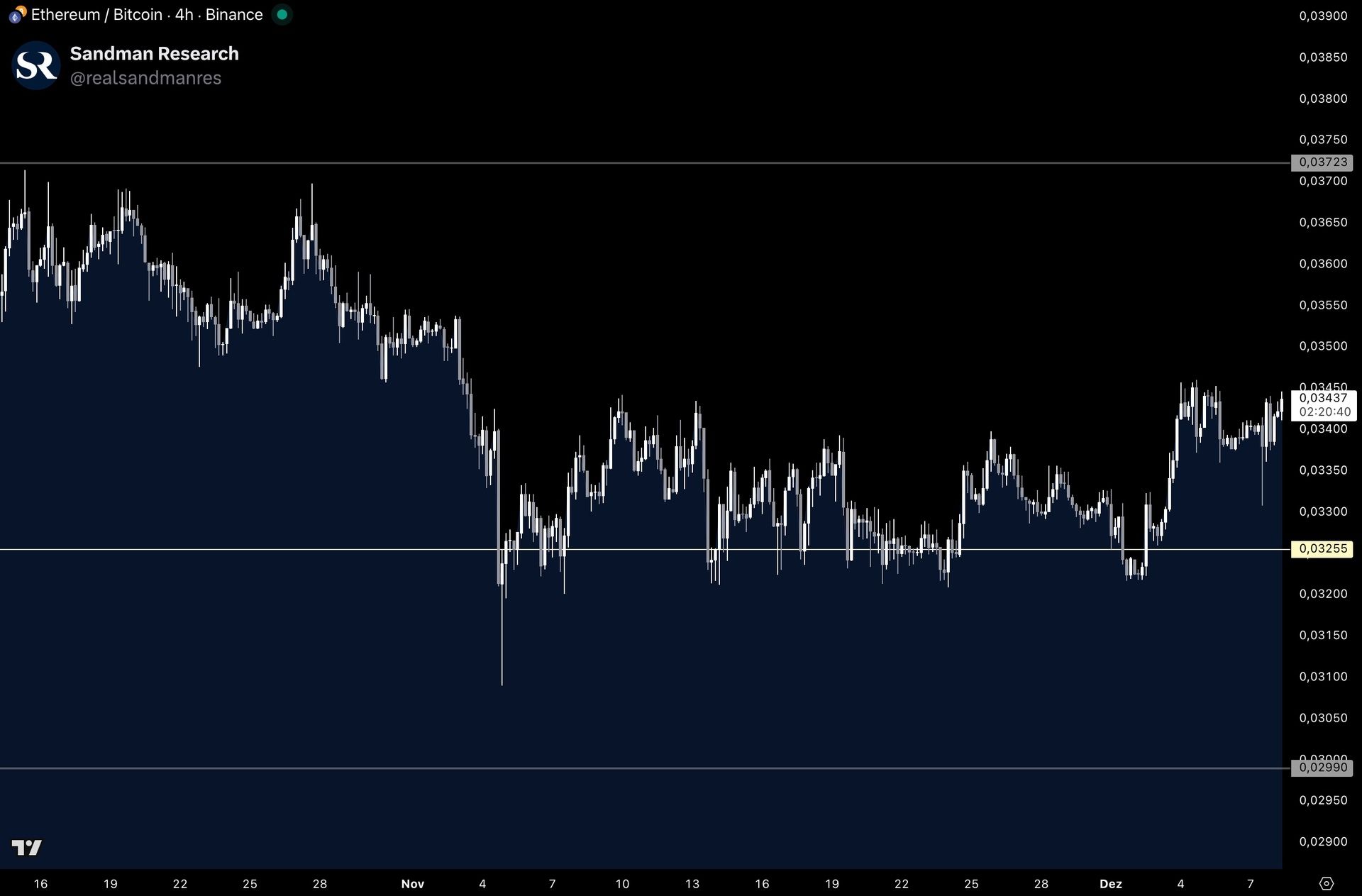

🚀 Altcoin Insights: TOTAL3 bounced from 847B to 879B. ETH/BTC holds above 0.03255 and faces resistance at 0.0346. Portfolio focus remains on BTC and top-cap altcoins, letting upcoming Fed guidance and year-end flows guide further allocation.

Let’s dive in 👇

⚠️ Notice: Brief Pause in Publication

Dear readers, Please note that Sandman Research will take a short break from publishing during the week of December 15–19, 2025. No new reports will be released during this period.

We will resume our regular schedule on Monday, December 22, 2025, with the usual in-depth market coverage, analysis, and insights you rely on.

Thank you for your understanding, and we look forward to continuing to support your crypto and market research needs.

📈 Market Review:

Equities continued their impressive run last week, with global stocks trading near the record highs set in October. The MSCI All-Country World Index has rebounded strongly since mid-November, reclaiming the 1,010 level and signaling renewed confidence across international markets. This strength comes despite lingering concerns around monetary policy and geopolitics, suggesting investors are increasingly pricing in a more supportive economic outlook heading into the new year.

Global Stocks Trade Near Record High Notched in October (Source: Bloomberg)

The bond market, however, painted a notably different picture. U.S. 10-year Treasury yields posted their largest weekly increase since April, climbing more than 10 basis points. Rising yields typically act as a headwind for equities, especially high-growth sectors, making this move an important development to monitor as we progress through December.

US 10-Year Yield Rises Most Since April Last Week (Source: Bloomberg)

Valuations in Big Tech, meanwhile, appear relatively reasonable by historical standards. The Bloomberg Magnificent Seven Index is trading around 30x earnings, only slightly above its 10-year average. This contrasts sharply with the stretched valuations seen at the pandemic-era peak in late 2021, when multiples neared 40x. Despite this year’s strong rally, the current valuation backdrop suggests there may still be room for further upside if earnings growth continues to hold firm.

Big Tech Valuations Are Below a Historical Peak (Source: Bloomberg)

Institutional sentiment heading into 2026 remains distinctly bullish, adding another layer of support for risk assets. Bloomberg’s latest survey of investment managers across the U.S., Europe, and Asia found that 30 of 41 respondents described themselves as “risk-on” for the coming year. Only three were defensive, while four held mixed views. This broad optimism signals that, despite elevated yields and policy uncertainty, institutional investors still see meaningful opportunity in equities as economic growth proves resilient and corporate earnings remain stable.

Investors Are Broadly Optimistic About Stocks in 2026 (Source: Bloomberg)

The combination of reasonable mega-cap valuations and strong institutional risk appetite provides a constructive backdrop as we close out 2025. With a rate cut expected at this week’s FOMC meeting, financial conditions are anticipated to ease further rather than tighten, offering additional support for risk assets heading into 2026. Still, investors should remain attentive to how yields react post-decision, as any unexpected shift in tone could influence valuations and broader market sentiment. We cover this in more detail later in the report.

🔍 Current Market Conditions:

The Crypto Fear & Greed Index remains in extreme fear territory at 19, still well below neutral. Price has not yet managed a decisive reversal, keeping both retail and institutional participants uncertain about whether markets can extend the rally into year-end or slip into a deeper correction across equities and crypto. We continue to follow our framework of a constructive year-end and a strong start to 2026, while staying fully data-driven and objective.

Crypto Fear and Greed Index (Source: Coinglass)

ETF flows last week were mixed, with three positive and two negative sessions. Bitcoin ETF products saw inflows on Monday, Tuesday, and Friday, while Wednesday and Thursday recorded outflows. Overall volume remained exceptionally low and failed to meaningfully influence price, contributing to the slow, range-bound market conditions.

Total Bitcoin Spot ETF Net Inflow (Source: Coinglass)

On lower timeframes, a micro bullish trend is forming, potentially signaling early stabilization that could support stronger rebounds soon. However, we do not expect broader market sentiment to turn decisively bullish until major levels such as 102,000 and 109,300 are reclaimed.

Wall Street’s Morning Edge.

Investing isn’t about chasing headlines — it’s about clarity. In a world of hype and hot takes, The Daily Upside delivers real value: sharp, trustworthy insights on markets, business, and the economy, written by former bankers and seasoned financial journalists.

That’s why over 1 million investors — from Wall Street pros to Main Street portfolio managers — start their day with The Daily Upside.

Invest better. Read The Daily Upside.

👀 Key Events Ahead:

This week’s U.S. macro calendar is relatively light in terms of data releases but heavy in significance, with Wednesday’s FOMC meeting dominating the landscape. As Bitcoin and the broader crypto market attempt to regain footing after recent volatility, the tone set by the Federal Reserve will serve as the primary catalyst for liquidity conditions and directional momentum.

The week begins with Tuesday’s JOLTS Job Openings report, which will provide a fresh read on labor demand. Any notable change in job openings could influence how markets interpret the Fed’s confidence in the soft-landing narrative, especially regarding whether disinflation remains intact and whether the labor market is cooling at a pace consistent with further monetary easing.

Market attention then shifts fully to Wednesday. The Federal Reserve is widely expected to deliver a 25bps rate cut, but the true inflection point will come from Powell’s press conference. Traders will be parsing every signal about the path of policy into 2026. A dovish message, one highlighting softening inflation, easing labor pressures, and the need to support growth, would validate current market pricing for continued cuts and likely boost liquidity-sensitive assets like BTC and altcoins. A more hawkish or cautious tone, however, could unsettle markets. If Powell emphasizes data dependency, questions the durability of disinflation, or suggests discomfort with the market’s aggressive easing expectations, yields could rise sharply, tightening financial conditions and pressuring crypto during an already fragile period.

Thursday adds another important layer with the OPEC Monthly Report, Initial Jobless Claims, and the U.S. 30-year bond auction. Oil supply projections and weekly labor data may influence inflation expectations, while the long-bond auction will offer a live gauge of demand for U.S. duration at a time when the Treasury market is highly sensitive to shifts in Fed communication. Weak demand and higher yields would reinforce tightening liquidity, while strong demand would ease conditions and support risk appetite across digital assets.

With global monetary policy diverging and U.S. policy sitting at a pivotal turning point, this week’s events will shape market sentiment heading into the final stretch of 2025. Even modest surprises, whether in data, forward guidance, or Treasury market dynamics, have the potential to drive outsized reactions in Bitcoin, Ethereum, and high-beta altcoins as traders recalibrate liquidity expectations.

🚨 Each week, we produce multiple in-depth reports, the Monday Market Report is currently the only free piece of content, and it won’t stay that way. With growing investor demand, it will go private in the future.

Full Research Access gives you complete market coverage, deep-dive analysis, and exclusive insights trusted by top investors, for the best price currently.

Make smarter trades, improve portfolio decisions, and stay ahead of the crowd. Upgrade now, your future self will thank you.

📊 Technical Analysis:

Bitcoin crawled back up to the 92,000 key technical level over the weekend after falling below it again early Friday morning. Over the weekend, price fully retested the lower support at 88,800 twice and bounced, potentially forming a micro-trend higher low and providing the support needed for a push into fresh highs.

Bitcoin Price Chart (Source: Tradingview)

The two-week Bitcoin liquidation heatmap further supports this narrative. Notable clusters of leveraged liquidations appear on the upside of current price and above last week’s high, with a significant concentration around 95,000, aligning with a key technical level on the chart and acting as both a price target and a hint at further upside. There is also liquidation interest on the downside, though smaller in size, below last week’s lows at 83,600.

Bitcoin Liquidation Heatmap (Source: Coinglass)

Bullish Scenario:

In the bullish case, Bitcoin starts the week with strength and continues pushing higher, reclaiming the 92,000 technical level and reopening the path toward 100,000. Long setups become attractive once 92,000 is convincingly reclaimed, with 95,000 as the first upside target and invalidation if price falls back below the entry. If Bitcoin first pulls back to retest 88,800 again, additional long opportunities emerge on a confirmed bullish retest of that zone, with 92,000 acting as the initial target before any higher extension.

Bearish Scenario:

In the bearish case, Bitcoin fails to reclaim 92,000 and gets rejected from that level. Short setups may form on a confirmed bearish retest, targeting 88,800, with invalidation if price reclaims the entry. Should 88,800 break and flip into resistance, further short opportunities open on a bearish retest of that level, targeting 84,200 as the next major downside area.

All the news that matters to your career & life

Hyper-relevant news. Bite-sized stories. Written with personality. And games that’ll keep you coming back.

Morning Brew is the go-to newsletter for anyone who wants to stay on top of the world’s most pressing stories — in a quick, witty, and actually enjoyable way. If it impacts your career or life, you can bet it’s covered in the Brew — with a few puns sprinkled in to keep things interesting.

Join over 4 million people who read Morning Brew every day, and start your mornings with the news that matters most — minus the boring stuff.

🚀 Altcoin Insights:

Altcoins retested the next lower support level as well, with TOTAL3 falling over the weekend and retesting the 847B technical level perfectly once again on Sunday afternoon. From there we saw a bullish reaction with total3 instantly bouncing and moving higher to now 879B. Next higher zone of interest and a crucial level to reclaim in order to shift trend on higher timeframes is the 950B level.

TOTAL3 (Source: Tradingview)

Ethereum/Bitcoin wicked lower as well on late Sunday but it did not retest any major technical levels, as it did not come close to the next lower support at 0.03255 and still moved higher, looking to extend the current extension. ETH BTC is for now encountering resistance around 0.0346 and needs to flip this zone for a chance of closing in at the next higher major target at 0.03723.

Ethereum / Bitcoin (Source: Tradingview)

With the FOMC meeting and the final major data releases of the year approaching, we’re sticking to a measured, data-driven approach. Our positions remain focused on Bitcoin and the strongest altcoins from our Q4 Watchlist, still avoiding low-cap projects. Market conditions are signaling caution, and BTC plus the top large caps already provide sufficient exposure and volatility. We’ll let the upcoming Fed signals and year-end flows guide any portfolio adjustments, expanding into mid- and lower-tier assets only when risk-reward is clearly favorable and trends become reliable.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.