No MEV. No Gas

CoW Swap blocks MEV so bots can’t front-run your trades. Keep more of every swap.

Hello and happy Monday!

This week marks a critical turning point as the Federal Reserve prepares to announce its latest interest rate decision. With inflation still above target, equities near all-time highs, and Bitcoin rebounding from mid-October lows, investors are navigating a week where every statement, number, and trade flow could dictate market direction. Risk and opportunity are balanced on a knife’s edge.

Here’s what we’ll cover today:

📉 Market Review: Global equities reach fresh all-time highs amid optimism over a potential U.S.-China trade deal. Volatility remains elevated, highlighted by the October 16th spike, the second-most extreme in two decades.

🔍 Current Market Conditions: ETF flows are mixed but show renewed interest, while sentiment improves as the Fear & Greed Index moves back to neutral territory.

👀 Key Events Ahead: Wednesday’s Fed decision is the week’s focal point, with the market expecting a 25bps rate cut to 3.75%–4.00%. Trump–Xi discussions and MegaCap tech earnings also create conditions for rapid sentiment shifts and potential volatility across markets.

📊 Technical Analysis: Bitcoin reclaims $115,300, technically invalidating the bearish trend, opening the door for sustained upside. Bullish and bearish scenarios are outlined with key entry and exit levels for traders.

🚀 Altcoin Insights: Altcoins rebounded from mid-October lows, with TOTAL3 reclaiming $1T. ETH/BTC consolidates just below 0.03723.

Let’s dive in 👇

📈 Market Review:

We’re entering a critical week for global markets as the Federal Reserve prepares to announce its latest policy decision on Wednesday. With inflation still above target and U.S. equities sitting at record highs, investors are closely watching for signals on the pace of future rate cuts and the Fed’s confidence in the economy’s trajectory.

Global Stocks Rise as US-China Trade Deal Nears (Source: Bloomberg)

The MSCI All Country World Index has recently pushed to fresh all-time highs above 1,000, with the latest leg of the rally fueled by renewed optimism over a potential U.S.-China trade deal. This trade-driven surge has helped the index break through major resistance levels as markets price in reduced geopolitical risks and stronger business confidence. However, such concentrated optimism also introduces vulnerability, as any setback in trade negotiations could quickly unwind recent gains.

Oct. 16 VIX Move Was Extreme Given S&P 500 Blip (Source: Bloomberg)

The October 16th volatility spike stands out sharply in historical context. The VIX jumped to nearly eight times the S&P 500’s modest percentage decline, marking the second-most extreme volatility reaction of the past two decades, exceeding even the levels seen during COVID-19 and the Lehman Brothers collapse. This disconnect between moderate equity losses and explosive implied volatility underscores how fragile current market structures can be. While stocks have since recovered, the event serves as a reminder that beneath the surface of steady markets, instability can erupt suddenly when sentiment or positioning shifts.

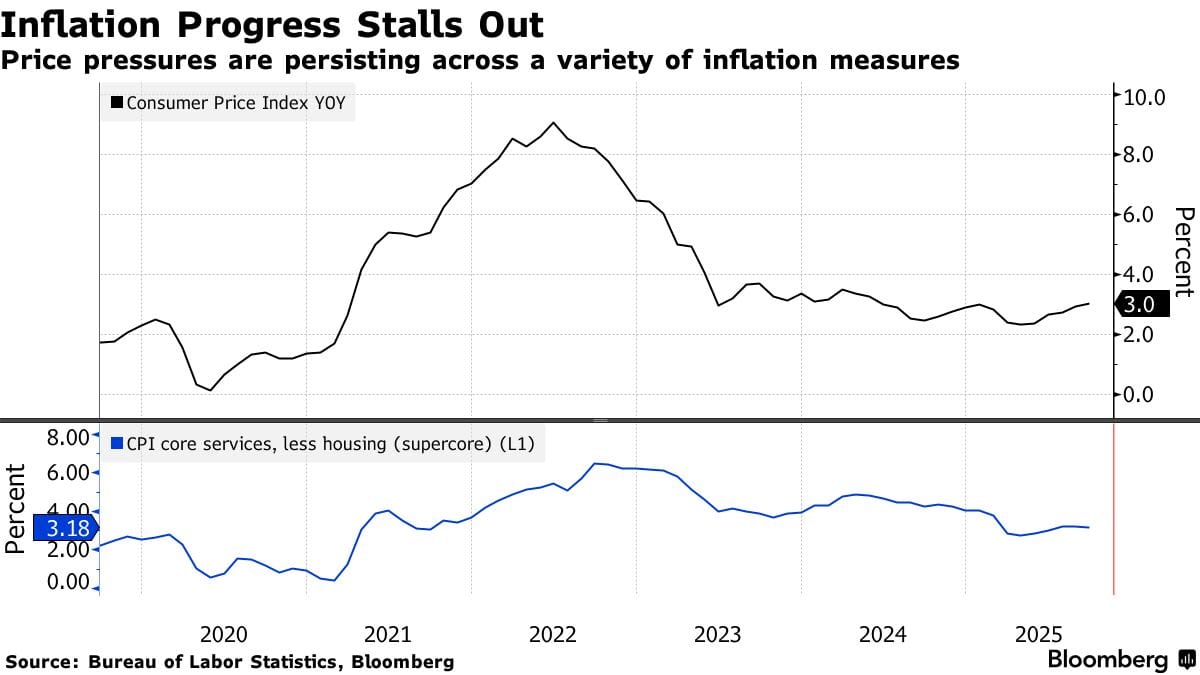

Inflation Progress Stalls Out (Source: Bloomberg)

Headline inflation currently sits at 3.0% year-over-year, while core services inflation excluding housing remains elevated at 3.18%, proof that the Fed’s fight against inflation is far from over. The prolonged plateau around 3% throughout 2024 and 2025 shows that the final push toward the 2% target will be the most difficult. This persistence explains why policymakers remain cautious about declaring victory, even as they begin to ease monetary policy in response to labor market softening.

Central Bank Rate Decisions This Week (Source: Bloomberg)

The Federal Reserve is widely expected to deliver another 25 basis point rate cut this week, which would lower the target range to 3.75%-4.00%. However, divisions remain within the committee, Governor Stephen Miran has argued for larger half-point cuts, while Governor Christopher Waller supports the more gradual, consensus approach. This divergence reflects the Fed’s delicate balancing act: supporting a slowing labor market while ensuring inflation continues its descent. Notably, this Fed meeting won’t include updated economic projections or a press conference, meaning investors will parse the policy statement word-for-word for any hints about the committee’s forward guidance. The direct market implications and trading scenarios tied to this week’s rate decision will be covered in detail in the “Key Events Ahead” section later in this report.

🔍 Current Market Conditions:

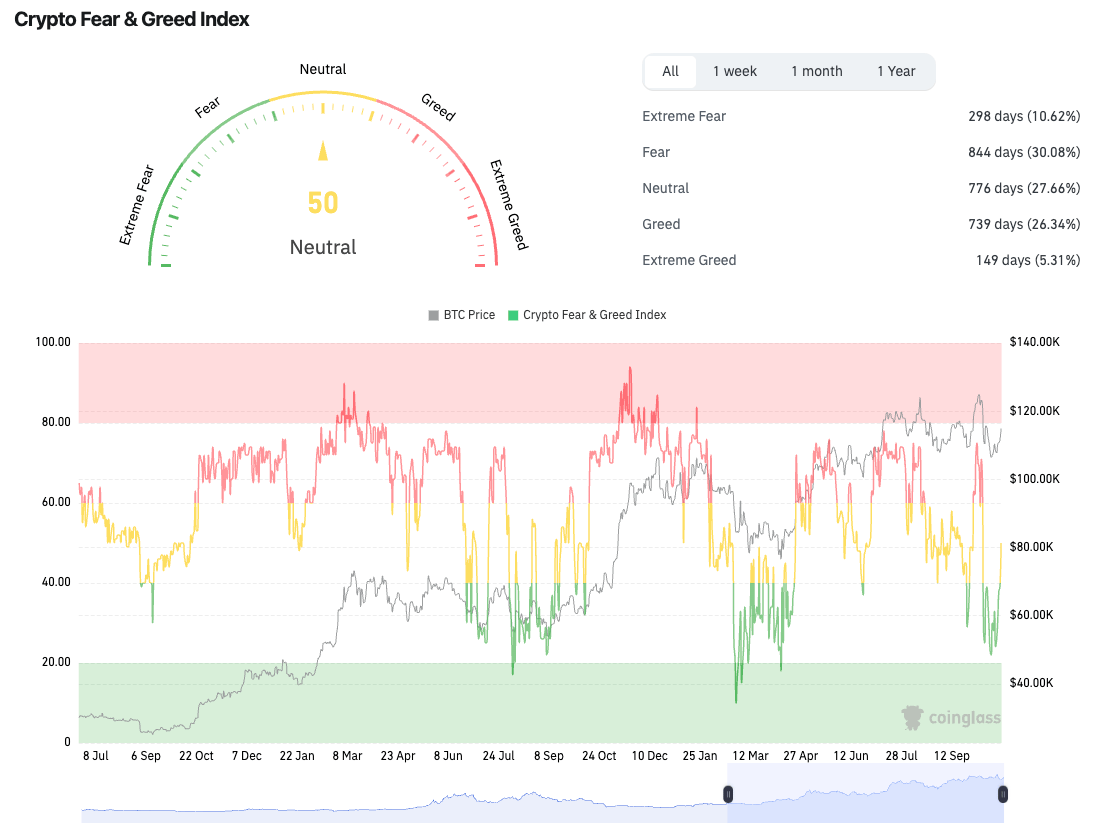

With Bitcoin recovering more than 12% since reaching new lows on October 17th, market sentiment has improved notably. The Fear and Greed Index has moved out of fear territory and returned to a perfectly neutral reading of 50. While it never entered extreme fear, this recent pullback appears to have served as a sentiment reset, a pattern that has historically preceded the next leg higher, similar to what we saw in March this year and August last year.

Crypto Fear and Greed Index (Source: Coinglass)

In August 2024, Bitcoin bottomed around 49,000, with the Fear and Greed Index briefly hitting extreme fear, right before Bitcoin rallied over 122%, breaking above 100,000 for the first time in history. Likewise, in April 2025, Bitcoin retraced from new highs and bottomed near 74,000, after the index reached extreme greed twice, before rallying 69% to new all-time highs of 126,200.

Total Bitcoin Spot ETF Net Inflow (Source: Coinglass)

Bitcoin Spot ETF flows were mixed last week. However, notable inflows on Thursday and Friday may have contributed to the price strength observed over the weekend. As we head into a crucial week with a Federal Reserve policy meeting and interest rate decision, ETF flows are expected to remain volatile and unpredictable in the short term. Rather than anticipating moves ahead of the decision, the focus should remain on post-meeting flows, as sustained, positive inflows over multiple weeks remain essential for Bitcoin to trend higher and ultimately push into new all-time high territory.

👀 Key Events Ahead:

This week’s Federal Reserve interest rate decision stands as the most closely watched event for global markets, likely setting the tone for the remainder of October. With inflation still hovering above target and risk assets trading near record highs, investors are laser-focused on the Fed interest rate decision, FOMC statement and Chair Powell’s press conference on Wednesday for clues on how far the central bank is willing to go with rate cuts in the months ahead.

The Fed is widely expected to deliver a 25 basis point rate cut, bringing the target range down to 3.75%–4.00%, but the real market driver will be the tone of Powell’s comments and the language in the policy statement.

If Powell strikes a dovish tone, emphasizing slowing growth and the need to support the labor market, markets could interpret this as a green light for continued risk-taking, with equities, gold, and crypto likely to benefit.

Conversely, a more cautious or data-dependent stance could temper expectations for additional cuts this year, boosting the dollar and pressuring risk assets in the short term.

Adding to the week’s macro importance, Thursday’s Trump–Xi meeting will draw intense attention from global investors. Optimism around potential progress in trade relations has supported the latest leg of the global equity rally, and any signs of tension or policy divergence could trigger short-term volatility, particularly in Asia-Pacific and commodities markets.

Beyond macro, this week also marks a critical stretch in the U.S. corporate earnings season, with several MegaCap tech firms (MAG7) reporting results. Strong performance from these names could reinforce market confidence in the ongoing rally, while any disappointment, especially around forward guidance, may weigh heavily on sentiment given their outsized influence on major indices.

🚨 Each week, we produce multiple in-depth reports, the Monday Market Report is currently the only free piece of content, and it won’t stay that way. With growing investor demand, it will go private in the future.

Full Research Access gives you complete market coverage, deep-dive analysis, and exclusive insights trusted by top investors, for the best price currently.

Make smarter trades, improve portfolio decisions, and stay ahead of the crowd. Upgrade now, your future self will thank you.

Don’t let limited data limit your decisions. ⏳

📊 Technical Analysis:

Bitcoin continued its recovery from the post-liquidation event bottom on October 17th at $103,600 and has moved higher decisively since, gaining over 12% and reclaiming multiple technical levels. Most importantly, price managed to break above the previous lower high at $116,000, thereby technically invalidating a bearish mid-timeframe trend that had been in place since reaching fresh all-time highs above $126,000.

Bitcoin Price Chart (Source: Tradingview)

The one-week Bitcoin liquidation heatmap currently shows leverage positioned on both sides of the market, with clusters on the upside being taken out consistently as price has moved higher. Notably, the most significant cluster in volume lies at $106,200, just below this week’s lows, while leverage on the upside continues to build.

Bitcoin Liquidation Heatmap (Source: Coinglass)

Bullish Scenario:

In the bullish case, Bitcoin reclaims $115,300 and continues higher, maintaining momentum and extending its uptrend. Long setups appear on a confirmed reclaim of this level, targeting $116,900, with invalidation if price drops back below entry. If price retests $113,400 first, additional long opportunities appear on a confirmed bullish retest targeting $115,300. Given the significance of $111,900, a retest of that level would also offer long opportunities, targeting $113,400, $115,300, and $116,900.

Bearish Scenario:

In the bearish case, Bitcoin fails to reclaim $115,300 and faces rejection. Short setups may develop on a confirmed bearish retest, targeting $113,400 and $111,900, with invalidation if price reclaims entry. If $111,900 fails to hold, further short setups emerge on a bearish retest of that level, targeting $109,300 again.

🚀 Altcoin Insights:

Altcoins managed to rebound from their October 17th lows as well, with TOTAL3 gaining over 11% and reclaiming the $1T mark. Notably, altcoins just this morning faced rejection at the $1.05T technical key level. Contrary to Bitcoin, TOTAL3 has not yet managed to invalidate bearish structure; to do so, it would first need to reclaim the $1.09T technical level.

TOTAL3 (Source: Tradingview)

Ethereum/Bitcoin (ETH/BTC) also moved higher after its liquidation wick perfectly retested the 0.03255 key technical level. However, upon reaching the next higher technical resistance at 0.03723 just three days later, ETH/BTC has been trading sideways just below this level and is now potentially moving toward it again after finding support around 0.035.

Ethereum / Bitcoin (Source: Tradingview)

We continue to focus on a crypto portfolio centered on Bitcoin and top-tier altcoins from our Q4 Watchlist, avoiding smaller-cap and higher-risk tokens for now. With the Fed continuing its rate-cutting cycle and a potential US-China trade deal on the horizon, we could be entering a period of reduced geopolitical stress and market uncertainty that historically provides fertile ground for risk asset rallies.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

If you want to stay ahead of the curve with in-depth analysis and real-time updates, make sure to subscribe to Full Research Access for even more insights - you won’t want to miss what’s coming next!

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.