UN-Limited Limit Orders in DeFi

CoW Swap limit orders offer:

Unlimited order management: Limit orders on CoW Swap are completely FREE to place or cancel. Yes, really!

Unlimited order placement: Use one crypto balance to place multiple orders at once, even if you don’t have the full amount yet. That’s useful!

Unlimited order surplus: All upside captured after a price is hit goes to you and not to order takers. As it should be!

Plus everything else you know and love about CoW Swap, like gasless trading and MEV protection.

Hello and happy Monday!

As we enter November, markets are showing clear signs of transition. Gold’s rally has lost momentum, equity gains are now concentrated in a handful of tech giants, and bond yields are rising again as investors reassess the path of rate cuts. For Bitcoin and crypto, this tightening liquidity backdrop means volatility ahead, with both risks and opportunities emerging as we approach the next macro inflection point.

Here’s what we’ll cover today:

📈 Market Review: Gold pulls back from record highs as China’s tax reforms hit demand, while equity gains remain narrowly driven by mega-cap tech stocks. Treasury yields rise above 4% again as optimism for December rate cuts fades.

🔍 Current Market Conditions: Bitcoin sentiment softens as the Fear & Greed Index slips from 50 to 43. ETF flows stay negative into week’s end, inflows needed for renewed bullish momentum.

👀 Key Events Ahead: ISM Manufacturing and Services PMI, ADP Employment Report, and Consumer Sentiment data take center stage. Traders watch closely for clues on U.S. growth and Fed policy as the market digests mixed signals.

📊 Technical Analysis: Bitcoin remains above key structural support, forming potential higher lows. Heatmap data highlights clustered liquidations above 111,800, the area to watch for a possible bullish reversal.

🚀 Altcoin Insights: TOTAL3 loses the $1T level, retesting $950B support as ETH/BTC grinds toward 0.03255. Portfolio strategy stays focused on Bitcoin, high-cap altcoins, and selective exposure to AI narratives.

Let’s dive in 👇

📈 Market Review:

Spot gold has pulled back from its October peak near $4,500 per ounce, settling around $4,000 as we enter November. The sharp summer rally continues to unwind, exactly as anticipated, with China’s new tax reforms on gold purchases weighing on demand from the world’s largest consumer market. Historically, gold topping and retracing has been a positive signal for Bitcoin, as capital often rotates into digital assets once momentum in precious metals fades.

Gold Eases as China Tax Reform Hits Buying (Source: Bloomberg)

The performance gap across major equity indices this year is striking. Technology stocks have powered much of the market’s advance, driving the Nasdaq 100 up nearly 30% and the S&P 500 about 17% since last November, while the equal-weighted S&P 500 has remained largely flat throughout 2025. This divergence shows that the majority of stocks have been left behind, with gains concentrated in a handful of mega-cap technology leaders. For investors, it raises important questions about the sustainability of the rally and whether broader market participation will eventually emerge, or if we are seeing a structural shift toward narrower market leadership.

Tech Driving US Stock Market Gains (Source: Bloomberg)

The concentration risk in U.S. equities has now reached historic proportions. Nvidia alone commands a larger weighting in the S&P 500 than six entire sectors combined, including Healthcare, Industrials, and Consumer Staples. Such dominance underscores how heavily current market performance depends on a small number of companies. The narrow leadership makes equity markets increasingly sensitive to any pullback in tech sentiment, highlighting the importance of diversification and disciplined risk management at this stage of the cycle.

Nvidia’s S&P 500 Weighting Tops Six Other Sectors (Source: Bloomberg)

Meanwhile, the 10-year Treasury yield has climbed back above 4% after briefly dipping to 3.9% in October, signaling fading enthusiasm for imminent Federal Reserve rate cuts. After easing from highs above 4.6% earlier this year, yields have stabilized within a narrow range as investors reassess the path of monetary policy. The latest uptick suggests growing skepticism that a December rate cut remains likely.

Ten-Year Treasury Yield Extends Rise Above 4% Mark (Source: Bloomberg)

Together, these four charts capture markets in transition: traditional safe havens are cooling, equity gains are increasingly concentrated, and fixed income markets are recalibrating expectations. The macro backdrop points to a late-cycle environment, defined by tightening breadth, shifting capital flows, and an approaching inflection point for risk assets.

🔍 Current Market Conditions:

With Bitcoin pulling back over the past week and opening red this morning after a brief weekend recovery, market sentiment has softened as well. The Fear and Greed Index dropped from a perfectly neutral 50 last Monday to 43 today. While still within the neutral zone, a continued decline in price could quickly push sentiment back into fear territory.

Crypto Fear and Greed Index (Source: Coinglass)

For context, major cycle tops typically occur when the index enters extreme greed levels above 80, something we haven’t seen since January 2025, when Bitcoin hit $106,000 before correcting to $76,000, entering extreme fear, and then rallying to new highs of $124,000. The Fear and Greed Index remains a valuable tool for putting current price action into perspective and comparing sentiment shifts across market cycles.

Total Bitcoin Spot ETF Net Inflow (Source: Coinglass)

Bitcoin spot ETF flows closed last week in negative territory, with consecutive outflows on Wednesday, Thursday, and Friday. Momentum has yet to turn decisively positive, which will be key for a sustainable reversal. As we open the new week, positive inflows would help restore bullish sentiment and stabilize price action.

👀 Key Events Ahead:

This week’s U.S. macro calendar is lighter in terms of headline events but remains highly relevant for gauging the economy’s momentum as markets transition into November. With risk assets consolidating after last week’s volatility, investors will focus on incoming data to assess whether soft-landing expectations remain justified or if growth headwinds are starting to build.

The week begins with Monday’s ISM Manufacturing PMI, a key indicator for industrial activity and overall economic health. Recent prints have shown persistent contraction in manufacturing, and another weak reading could reinforce the view that growth is slowing, a potential tailwind for rate-cut expectations but a warning sign for earnings and equities.

United States ISM Purchasing Managers Index (Source: Tradingview)

Attention then shifts to Wednesday’s ADP Employment Report and ISM Services PMI, both crucial for assessing labor market strength and the broader services-driven economy. A strong ADP print or resilient services data would challenge the dovish narrative forming in bond markets, possibly lifting yields and the dollar while pressuring risk assets like Bitcoin and equities. Conversely, soft data could fuel renewed rate-cut bets and a short-term relief rally in crypto.

The week concludes with Friday’s University of Michigan Consumer Sentiment survey, offering insights into household confidence and inflation expectations. With consumption still a key driver of U.S. GDP, a deterioration in sentiment could amplify concerns about slowing demand into year-end.

🚨 Each week, we produce multiple in-depth reports, the Monday Market Report is currently the only free piece of content, and it won’t stay that way. With growing investor demand, it will go private in the future.

Full Research Access gives you complete market coverage, deep-dive analysis, and exclusive insights trusted by top investors, for the best price currently.

Make smarter trades, improve portfolio decisions, and stay ahead of the crowd. Upgrade now, your future self will thank you.

📊 Technical Analysis:

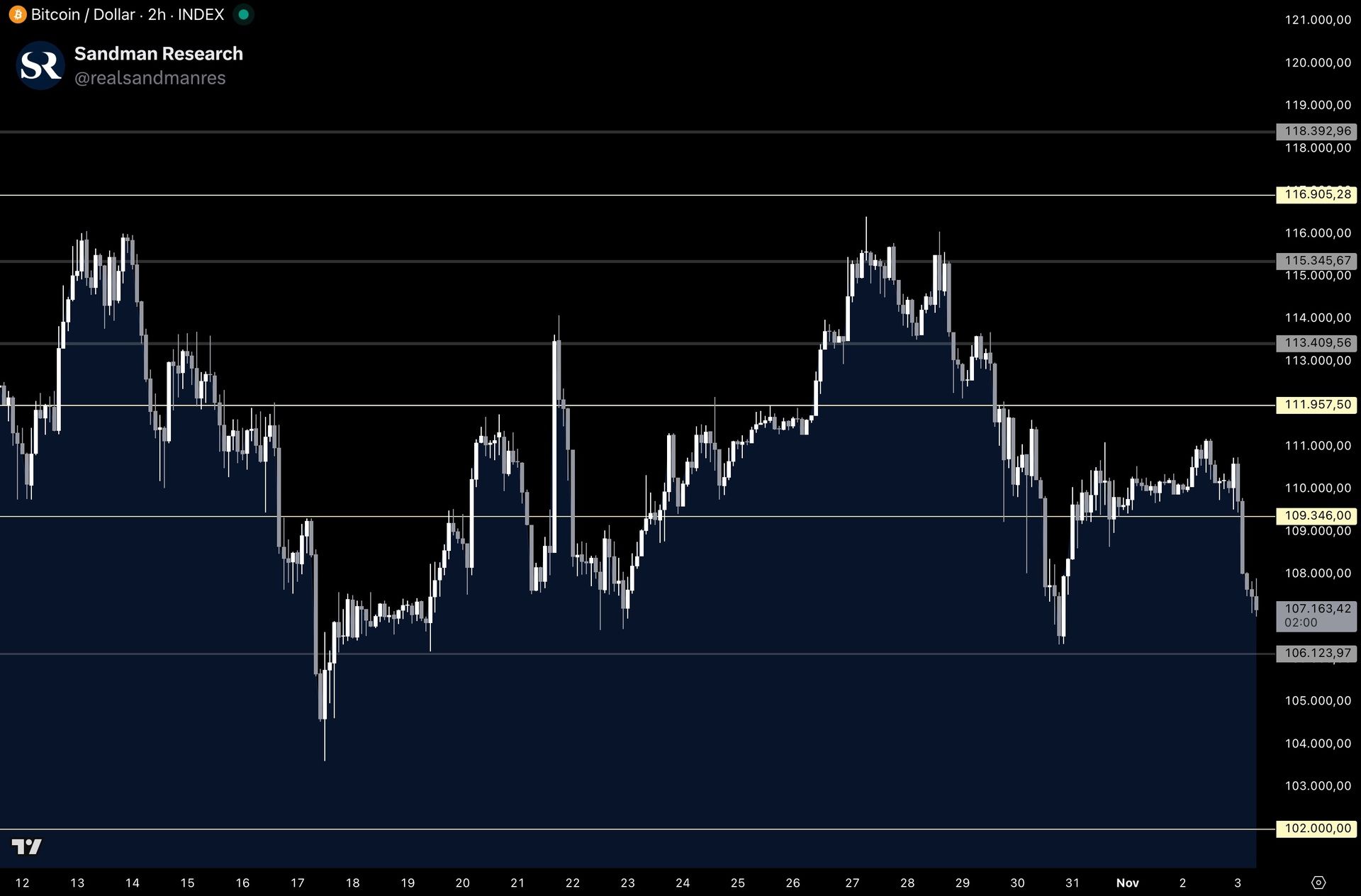

Since forming a higher technical extreme at 116,000 on October 27th, Bitcoin has pulled back sharply and is now looking to retest the key technical level at 106,100 once more. As long as BTC holds above the October 17th lows at 103,600, the broader technical structure remains potentially bullish, with confirmation coming only if price reclaims the recent higher extreme at 116,400.

Bitcoin Price Chart (Source: Tradingview)

The one-week Bitcoin liquidation heatmap shows leverage concentrated primarily above current price, with notable liquidation clusters just above the recent weekend swing high at 111,800 and extending up to 116,500, the key zone to reclaim for trend confirmation. Combined with the current technical structure, this setup could hint at a potential bullish continuation if price successfully holds above the October 17th lows.

Bitcoin Liquidation Heatmap (Source: Coinglass)

Bullish Scenario:

In the bullish case, Bitcoin reclaims $109,300 and continues higher, regaining upward momentum. Long setups appear on a confirmed reclaim of this level, targeting $111,900, with invalidation if price drops back below entry. If price first retests $106,100, additional long opportunities arise on a confirmed bullish retest, targeting $109,300.

Bearish Scenario:

In the bearish case, Bitcoin fails to reclaim $109,300 and faces rejection. Short setups may develop on a confirmed bearish retest, targeting $106,100, with invalidation if price reclaims entry. If $106,100 breaks, further short setups open on a bearish retest of that level, targeting $102,000 once again.

🚀 Altcoin Insights:

Altcoins moved lower as well, with TOTAL3 clearly losing the $1T mark, both a technical and psychological level for the chart. The metric is now approaching the next lower support at $950B, where ideally it finds stability and bounces higher. Notably, TOTAL3 has remained in a defined range since the mid-October liquidation event, oscillating between range lows at $950B and highs at $1.05T, with $1T serving as the midpoint.

TOTAL3 (Source: Tradingview)

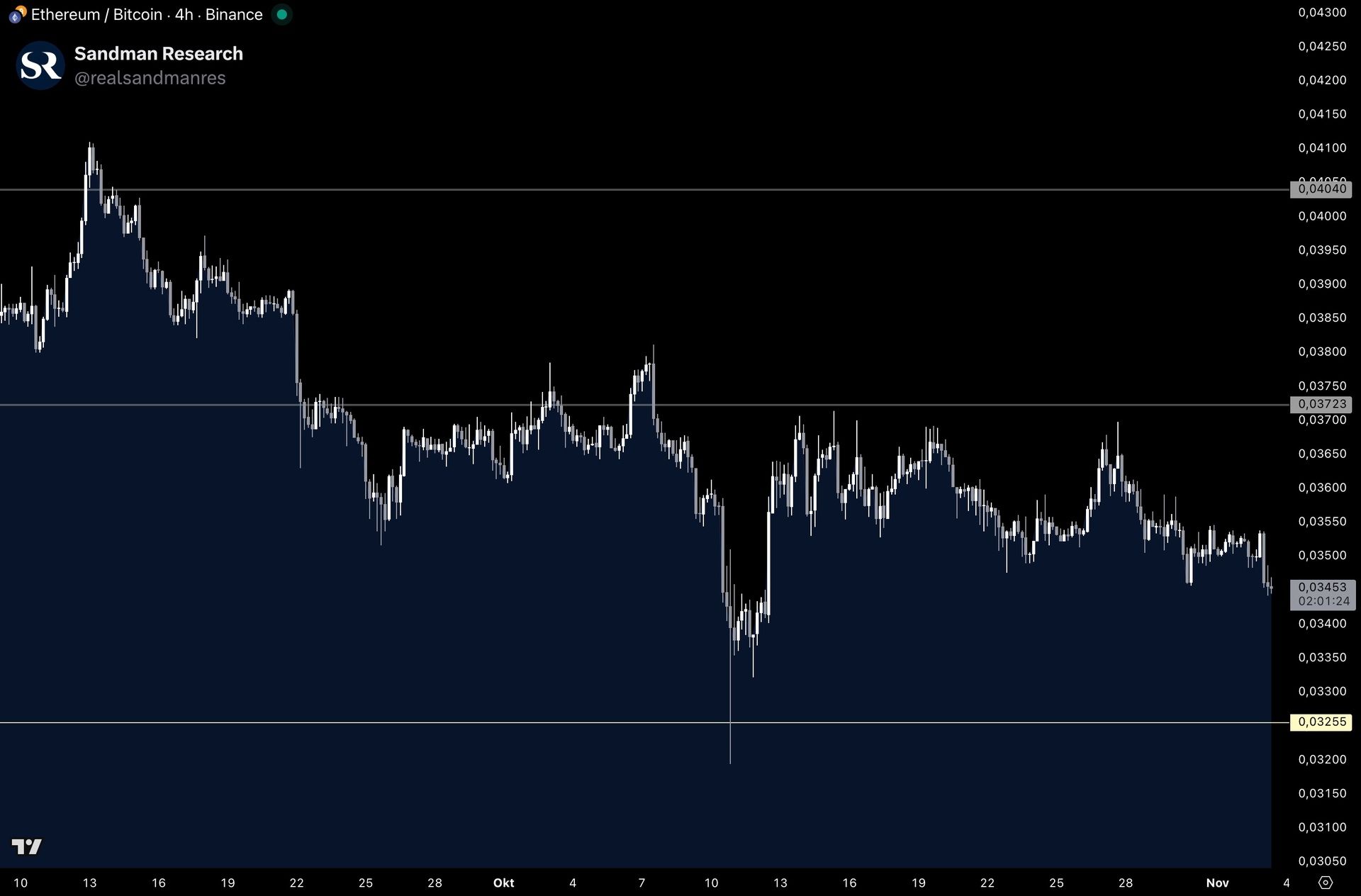

Ethereum/Bitcoin (ETH/BTC) continues to grind lower after repeated rejections at 0.03723 throughout October, failing to reclaim this technical level and establish upward momentum. The pair is now approaching the next key level at 0.03255, which was retested during the October liquidation event.

Ethereum / Bitcoin (Source: Tradingview)

We maintain a focus on a crypto portfolio anchored in Bitcoin and top-tier altcoins from our Q4 Watchlist, while keeping an eye on AI-focused tokens and avoiding smaller-cap, higher-risk names for now. Our outlook remains constructive into year-end for risk and digital assets, but our approach stays data-driven and selective, maintaining a defensive tilt toward high-cap altcoins.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

If you want to stay ahead of the curve with in-depth analysis and real-time updates, make sure to subscribe to Full Research Access for even more insights - you won’t want to miss what’s coming next!

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.