No MEV. No Gas

CoW Swap blocks MEV so bots can’t front-run your trades. Keep more of every swap.

Good morning and welcome to this week’s altcoin market update.

Markets are flashing warning signs as we move deeper into autumn, with volatility rippling across crypto, equities, and funding markets. Bitcoin’s sharp reversal, weakening altcoins, and rising friction in money markets reflect increasing investor caution. Treasuries are finding support as stocks stumble, highlighting a classic risk-off rotation.

This week, we’ll break down how liquidity stress, ETF flows, and macro developments are shaping Bitcoin and altcoin trends, and highlight key technical levels traders should monitor heading into Q4.

Here’s what we’ll cover today:

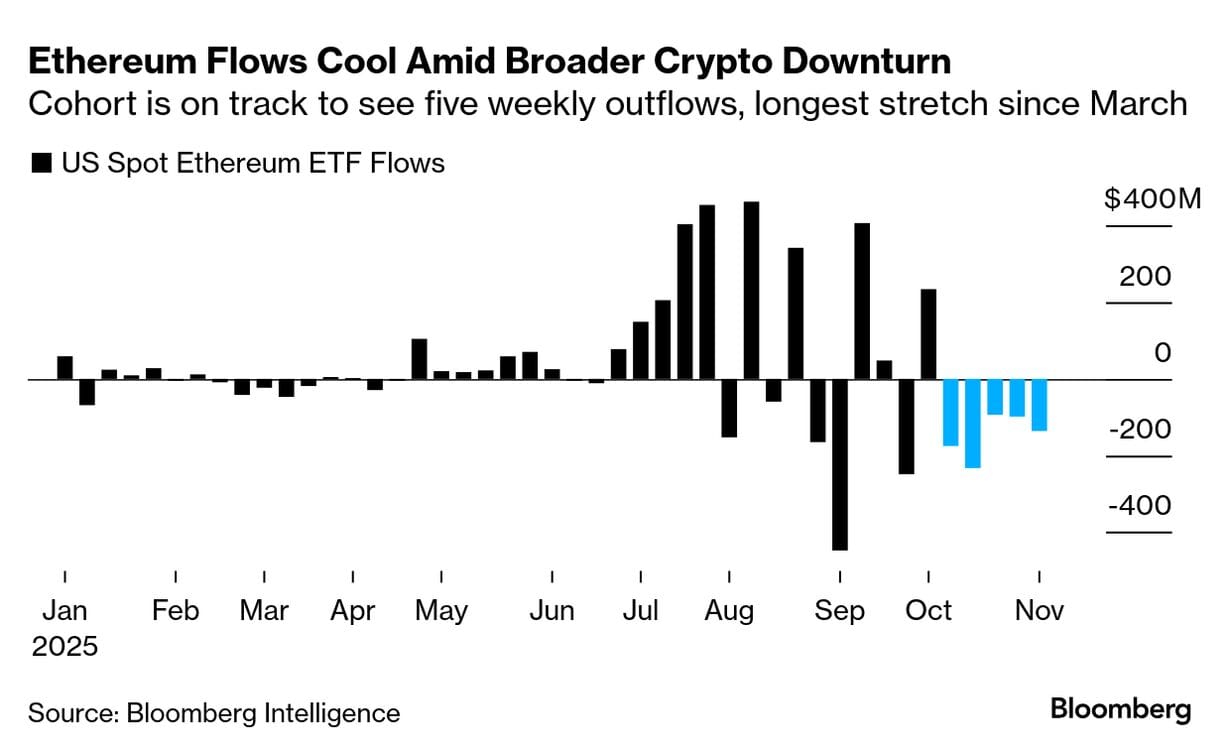

📅 Macro Review: Liquidity tightens as repo rates rise, Treasury yields pull back amid equity volatility, and Bitcoin gives back summer gains, hovering near $100K. ETH outflows continue for a fifth consecutive week, highlighting institutional sentiment shifts.

📊 Crypto Market Overview: Bitcoin attempts to reclaim $102K after breaking below key levels at $106.1K and $100K. TOTAL3 trades between $847B–$950B, OTHERS between $230B–$240B, with bullish and bearish scenarios defined.

🔍 Bitcoin vs. Altcoins: BTC.D climbs to 61.3% before settling near 60.7%, OTHERS.D dips to 6.56% and trades below 6.93%. Potential altcoin rotation exists if BTC.D falls below resistance and OTHERS.D reclaims its range.

📈 Key Reversal Signals: OTHERS/BTC approaches previous lows near 2M, ETH/BTC consolidates below 0.03723, key levels must be reclaimed to signal potential altcoin strength.

🚀 Chart of the Week: ??? remains in a structural bullish trend with technical support offering a favorable entry. Long and short setups defined, defensive higher-timeframe trades recommended.

Let’s dive in! 🚀

📅 Macro Review:

Markets are flashing warning signs as we move deeper into autumn, with volatility spreading across crypto, traditional finance, and funding markets. Bitcoin’s sharp reversal, shifting sentiment in digital assets, and rising friction in money markets all point to growing investor caution. Meanwhile, Treasuries are finding renewed support as equities stumble.

Bitcoin Wipes Out Summer Rally (Source: Bloomberg)

Bitcoin has surrendered much of its impressive summer gains, retreating from highs above $120,000 to hover around the psychologically important $100,000 level. After peaking in early October, the digital asset entered a steep correction that erased months of appreciation within weeks. This pullback mirrors broader weakness across the crypto market, reflecting declining risk appetite among investors. Despite the selloff, Bitcoin remains in a high-timeframe uptrend, with structural support still intact.

Ethereum Flows Cool Amid Broader Crypto Downturn (Source: Bloomberg)

Ethereum is undergoing its most sustained period of selling pressure since March, as spot ETF flows have turned decisively negative throughout November. After strong inflows during the summer, some weeks exceeding $400 million, the asset has now seen five consecutive weeks of outflows. This reversal marks a meaningful shift in institutional sentiment toward ETH. As noted in previous reports, Ethereum’s performance at this stage depends heavily on consistent ETF inflows; unlike Bitcoin, which is increasingly viewed as digital gold, ETH continues to trade more like a high-beta tech stock, even more sensitive to liquidity cycles and investor risk appetite.

Treasuries Gain, Stocks Slip in Risk-Off Trade (Source: Bloomberg)

Treasury yields have fallen notably in recent days as investors seek safety amid equity volatility. The 10-year yield has pulled back from recent highs, with the shaded area on the chart illustrating a clear move lower coinciding with rising market uncertainty. This bond rally, falling yields and rising prices, signals a classic risk-off shift as investors prioritize capital preservation over returns.

Repo Rates Have Trended Higher Over Past Month (Source: Bloomberg)

A recent chart from the Federal Reserve Bank of New York highlights that repo rates have climbed steadily over the past month, reflecting higher funding costs and mounting stress in short-term liquidity markets. The widening gap between the Secured Overnight Financing Rate (SOFR) and the effective federal funds rate indicates tightening liquidity conditions, with institutions paying more to borrow cash overnight. These frictions often point to reduced system-wide liquidity and can force leveraged participants to scale back exposure, pressuring both equities and crypto. This liquidity squeeze helps explain Bitcoin’s sharp correction from all-time highs back toward $100K, as well as the recent broad selloff across altcoins. While it may not signal a full trend reversal, it underscores how sensitive digital assets remain to shifts in global liquidity, a dynamic that continues to dictate short-term market behavior.

Gain Full Research Access to read the rest.

Become a paying subscriber of Sandman Research to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Institutional-Grade Market Analysis: Deep-dive reports on Bitcoin and Altcoins, delivering expert insights multiple times per week.

- Macro Coverage: Stay informed with global macroeconomic trends and key economic events that impact the crypto market.

- Exclusive Data & Research: Access proprietary insights and in-depth market intelligence used by top traders and institutions.

- Actionable Intelligence: Identify key technical levels, trade setups, and high-probability scenarios before the market reacts.