🚨 MACRO ALERT:

China's inflation is set to collapse to 0.3% while the US yield curve steepened to 100bps spread, the exact conditions that historically sent Bitcoin parabolic. We're tracking the deeper currents that drive trillion-dollar asset rotations.

Chinese deflation is forcing coordinated central bank easing globally, creating the liquidity tsunami that smart money is already positioning for. Our analysis shows why this setup rivals 2020's monetary expansion, but this time, crypto is a $3.3T asset class with institutional backing.

Here’s what we’ll cover today:

📈 Market Review: How Chinese deflationary collapse creates the perfect crypto catalyst, plus why the Magnificent Seven convergence signals broader risk-on rotation

🔍 Current Market Conditions: Real-time analysis of the deflation-to-liquidity pipeline as Powell prepares to address weakening economic data

👀 Key Events Ahead: This week's packed economic calendar could accelerate dovish Fed expectations, the exact trigger crypto needs for its next leg higher

📊 Technical Analysis: Why Bitcoin’s current consolidation confirms our bullish thesis, and the key levels where institutional money is accumulating

🚀 Altcoin Insights: The hidden rotation as smart money positions for the next liquidity cycle, plus: When are our proprietary signals flashing major opportunity?

Ready to capitalize on the macro-to-crypto convergence?

Let’s dive in!

📈 Market Review:

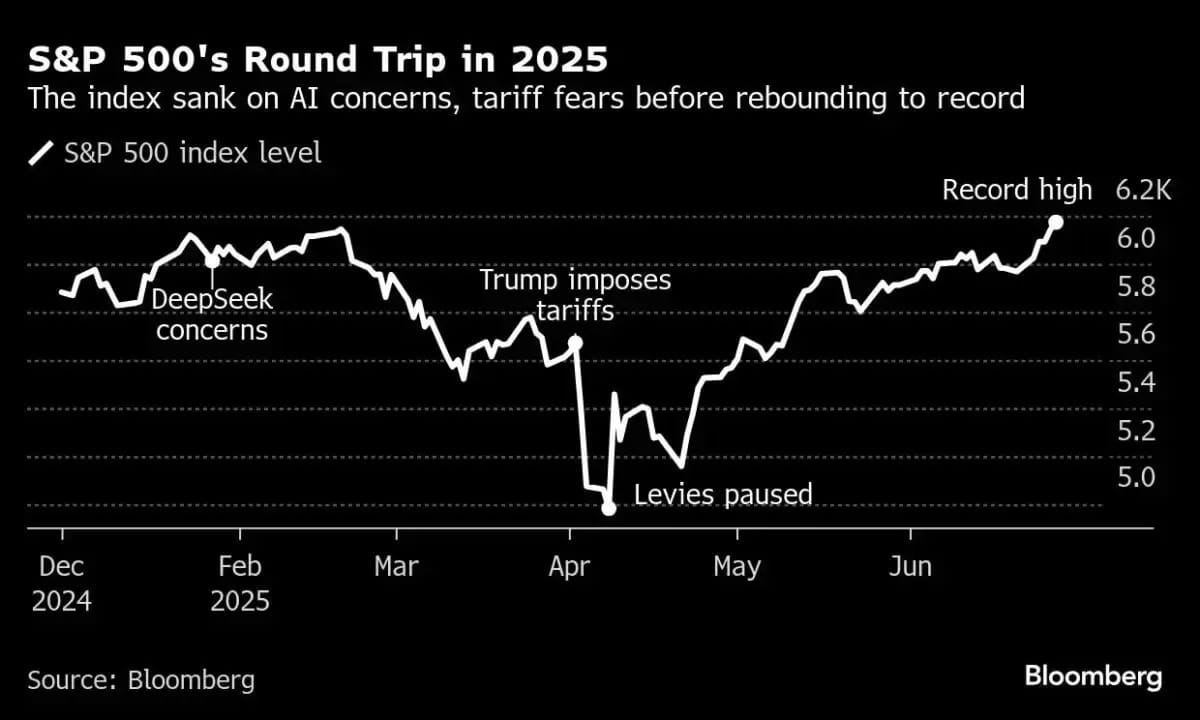

The S&P 500’s performance in 2025 shows how strong and adaptable the market can be, even during major disruptions. Early in the year, a breakthrough in artificial intelligence by DeepSeek shook investor confidence about U.S. tech leadership.

Soon after, Trump’s renewed trade tariffs added more uncertainty. But once those tensions eased, the market bounced back strongly, pushing the S&P 500 to new highs above 6,100. This pattern, volatility followed by recovery, suggests that while policy shifts can shake markets, they often create opportunities instead of long-term damage.

S&P 500’s Round Trip in 2025 (Source: Bloomberg)

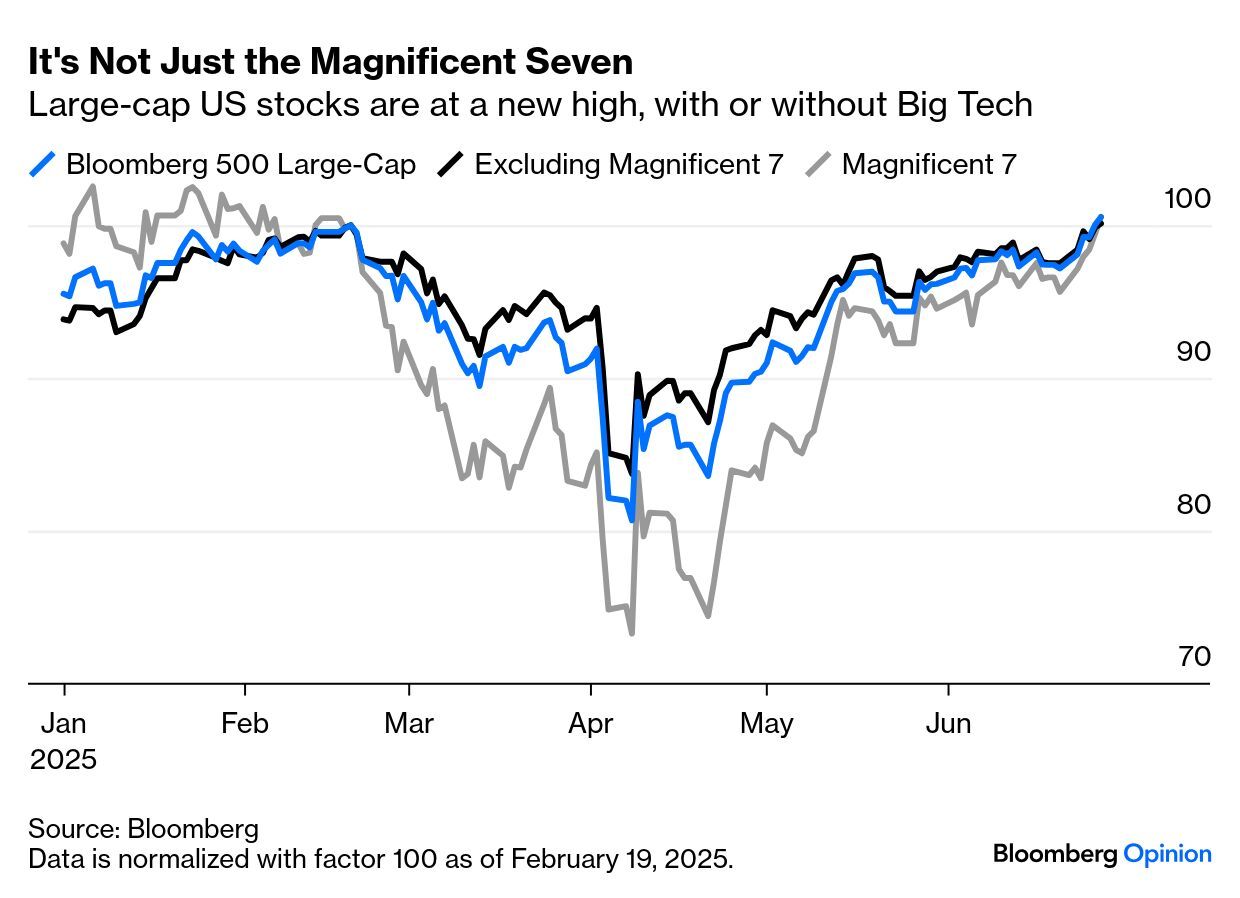

We’re also seeing a positive shift beneath the surface. Until recently, most gains were driven by a few giant tech stocks (the “Magnificent Seven”). Now, strength is spreading across other large companies in different sectors.

This broader participation is a healthy sign. It usually means the bull market is maturing and more companies are creating real value, not just the biggest tech names. For investors, it supports the idea of a balanced stock portfolio, because both growth and value stocks are contributing.

It’s Not Just the Magnificent Seven (Source: Bloomberg)

Gold, after rising through most of 2024, saw its first monthly drop in 2025. But that’s not a bad sign. It’s a normal pullback after a strong run, and the big picture hasn’t changed. Central banks are still printing money, geopolitical risks are still high, and people still want alternatives to traditional currencies, all of which support gold in the long run.

Gold Heads for First Monthly Loss in 2025 (Source: Bloomberg)

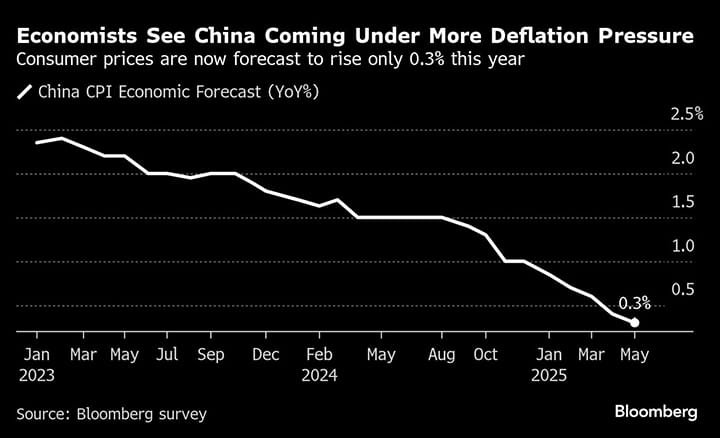

In China, the situation is more serious. Prices are falling faster than expected, with inflation now projected at just 0.3% for the year, down from over 2% in 2023. This sharp drop is more than just a red flag; it could reshape global markets. To fight deflation, China is likely to loosen its monetary policy significantly. At the same time, other central banks may also respond to prevent the situation from spreading.

What does this mean for crypto? In short: a wave of global liquidity. Whenever central banks around the world start printing money to support the economy, assets like Bitcoin tend to benefit. Crypto has historically done well in exactly this kind of environment, when there's lots of cheap money looking for higher returns.

Economists See China Coming Under More Deflation Pressure (Source: Bloomberg)

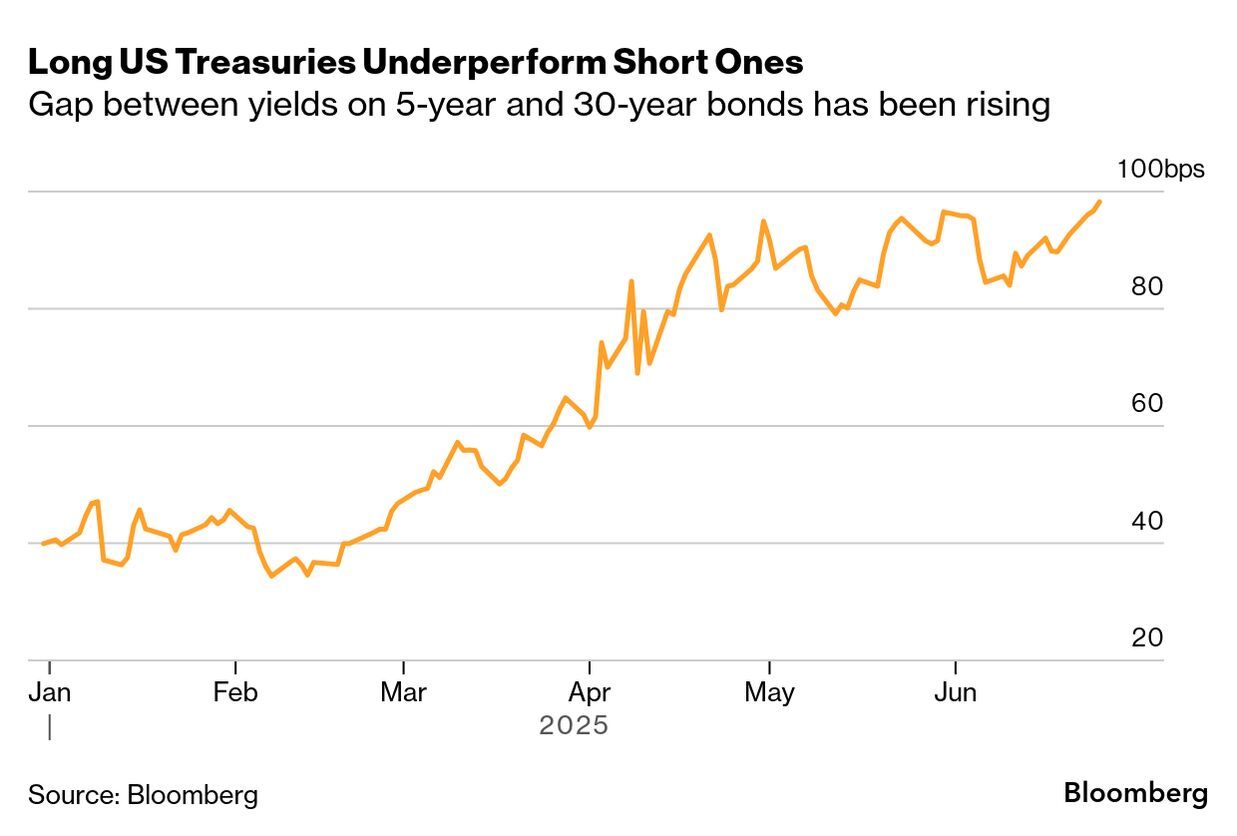

Another key signal is coming from the U.S. bond market. The difference between short-term and long-term Treasury yields (known as the yield curve) has widened sharply. This often happens when investors worry about inflation or government debt in the future.

That’s a big deal for crypto. When people start to question the value of traditional currencies or worry about fiscal problems, they often turn to digital assets like Bitcoin as a hedge.

Long US Treasuries Underperform Short Ones (Source: Bloomberg)

Yes, volatility in crypto is always part of the game. But behind the price swings, the big picture is becoming clearer: central banks are loosening policy, inflation concerns are rising, and the financial system is changing.

These forces are all pushing more investors toward crypto, not just as a bet, but as part of a serious long-term strategy.

🔍 Current Market Conditions:

While it was recently in fear territory with a reading of 37, the Crypto Fear and Greed Index has recovered from deeper levels and moved back into neutral, currently sitting at 52, indicating no significant signs of market stress.

With price action still confined to the same range as last week, we view this development as a healthy reset rather than a cause for concern. Resets like these are essential, allowing the market to recalibrate, especially during bull markets, before fresh expansion moves can unfold.

Crypto Fear and Greed Index (Source: Coinglass)

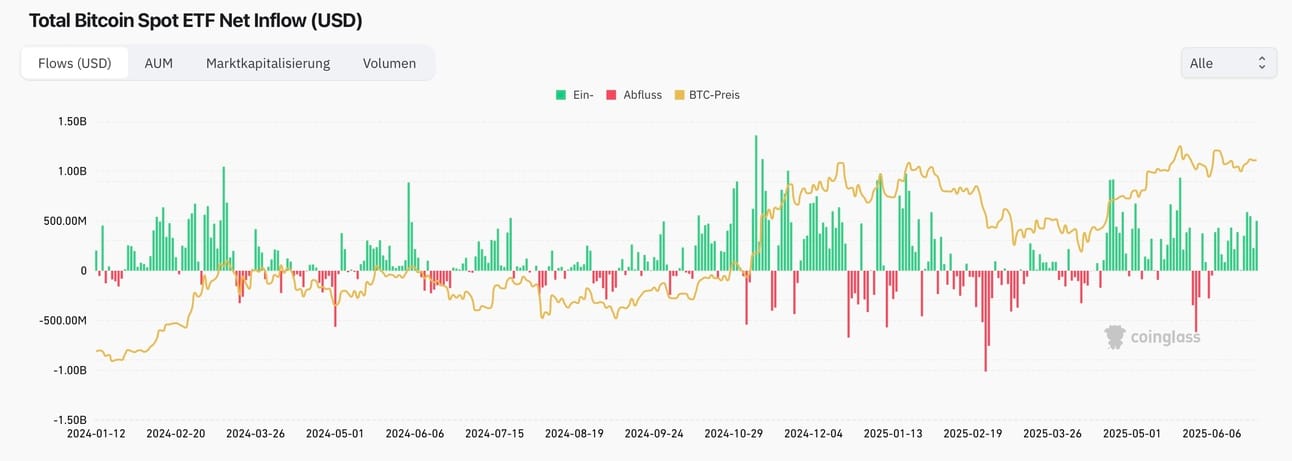

At the same time, total net inflows into Bitcoin spot ETFs have maintained a strong and steady pace, with no net outflows recorded since June 6th. Over the past week alone, daily inflows averaged $442 million.

While this buying pressure hasn’t yet resulted in a major price breakout, it is a clear indicator of bullish sentiment and aligns with the macro narrative we've outlined: investors are growing more confident and are beginning to rotate into higher-yielding alternative assets, fueled by expectations of improving global liquidity conditions.

Total Bitcoin Spot ETF Net Inflow (Source: Coinglass)

We continue to monitor our Bitcoin-to-Global M2 Liquidity correlation model closely, as it has provided strong confluence since early 2024. According to this framework, we’re once again entering a pivotal phase. It proved highly accurate during the peak of Israel-Iran tensions, particularly when the U.S. struck Iran’s nuclear facilities, but it remains to be seen whether the market will react in a similar way as it did during October–November of last year, when Bitcoin surged sharply after geopolitical stress peaked.

Bitcoin and M2 Global Liquidity (10-week lead) Correlation (Source: Tradingview)

If the model holds true, it suggests a strong continuation to the upside through July and August, potentially even extending into September. This would be fully in line with our broader macro thesis, reinforcing our outlook and the strategic approach we are following.

🇺🇸 INDEPENDENCE DAY SPECIAL - 7-DAY FREE TRIAL 🇺🇸

⚠️ If you’re reading this, you’re serious about gaining a real crypto edge , but the free tier only scratches the surface:

The real power lies in Full Access, where you get complete market coverage and exclusive insights trusted by top investors.

For better portfolio decisions and smarter trades, upgrade now, your future self will thank you.

Don’t let limited data limit your decisions. ⏳

👀 Key Events Ahead:

This week is packed with key economic events that could impact market sentiment. It kicks off on Monday with the Chicago PMI. On Tuesday, all eyes will be on the ISM Manufacturing PMI, JOLTS Job Openings, and a speech from Fed Chair Powell. Wednesday brings the ADP Nonfarm Payrolls report, offering early insight into the labor market. Thursday is particularly important, featuring Jobless Claims, Nonfarm Payrolls, the Unemployment Rate, Average Hourly Earnings, and the ISM Services PMI, with markets closing early at 13:00. On Friday, U.S. markets will be closed in observance of Independence Day.

Any signs of labor market softening or manufacturing weakness could trigger dovish Fed expectations, potentially catalyzing the next leg higher in risk assets and crypto. Powell's commentary on policy outlook will be particularly crucial given current macro crosscurrents.

Now let’s dive into the part you’re really here for: the charts, key levels, trade scenarios and what’s next for Bitcoin and Altcoins. 🔥

Unlock smarter trades and better portfolio decisions, join now and keep reading!

📊 Technical Analysis:

Bitcoin continues to trade between two major levels, ranging sideways without any significant spikes in either direction. The key upside target remains at 109,300, while potential support is seen at 106,100. At the time of writing, Bitcoin is trading around 107,600.

Bitcoin Price Chart (Source: Tradingview)

The Bitcoin two-week liquidation heatmap still highlights a notable cluster of leveraged liquidations just above the current price, slightly below $109,000. Although price tapped into this area yesterday, it didn’t fully clear the cluster, potentially hinting at further upside in the short term until that liquidity is taken.

Bitcoin Liquidation Heatmap (Source: Coinglass)

Bullish Scenario:

In a bullish case, we’d like to see Bitcoin push higher, targeting the key technical level at 109,300 and clearing the remaining upside liquidations. Since price is currently between major levels, long opportunities arise either on a successful retest of the 106,100 support, targeting 109,300, or after a clean breakout and retest of 109,300, with upside potential toward previous highs near 111,900. In both setups, the trade would be invalidated if price fails to hold above the respective entry level.

Bearish Scenario:

In a bearish scenario, Bitcoin fails to break above current levels or gets rejected after taking out the upside liquidations but stalls below 109,300. Short opportunities would emerge on a bearish retest of 109,300, assuming price shows clear signs of rejection and begins trending lower. In this case, 106,100 becomes the downside target, with the trade invalidated if price reclaims and holds above 109,300.

🚀 Altcoin Insights:

While Bitcoin continued to trade sideways and was unable to reach the higher key level at 109,300, the TOTAL3 altcoin market cap index successfully climbed into the next key area at 840B on Sunday. Since then, it has seen a minor pullback over the past hours, now sitting at 831B.

TOTAL3 Altcoin Market Cap (Source: Tradingview)

TOTAL3 remains in a major downtrend after hitting strong resistance at 940B twice in May, forming a double top and retracing since. For further upside potential and a possible shift into a bullish trend, we’d like to see the previous swing high at 864B reclaimed. A higher low forming around 840B could then turn this key area from resistance into support, helping to establish a stronger uptrend.

While this would be the ideal scenario, we must stay objective: given the ongoing bearish trend and the fact that price is currently sitting at key resistance, further downside in the short term appears likely. Altcoin holders need to exercise further patience as the market continues to consolidate and key confirmations are still pending.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

If you want to stay ahead of the curve with in-depth analysis and real-time updates, make sure to subscribe to Full Research Access for even more insights - you won’t want to miss what’s coming next!

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.