⚠️ This week, Bitcoin surged past $123,000 to new all-time highs, driven by strong institutional demand amid a calmer macro backdrop. With the US dollar weakening and volatility in traditional markets easing, crypto is capturing renewed investor focus.

However, key economic data and corporate earnings releases this week could test Bitcoin’s resilience and set the tone for risk assets. Today’s deep dive explores the complex interaction between macroeconomic forces and crypto trends to help you navigate what’s next.

Here’s what we’ll cover today:

📈 Market Review: Could record ETF inflows and plummeting bond volatility signal a deeper shift in risk appetite, or are we missing a hidden risk beneath the surface?

🔍 Current Market Conditions: Bitcoin moves into the “greed” zone, but why isn’t market sentiment soaring as high as the price?

👀 Key Events Ahead: This week’s flood of US economic data and earnings could be a game-changer, but which reports will truly move the needle, and how might they reshape the crypto landscape?

📊 Technical Analysis: Bitcoin stands near critical levels, will it hold firm and continue its ascent, or will cracks appear beneath the surface? What price zones are quietly shaping the next big move?

🚀 Altcoin Insights: Altcoins trail Bitcoin’s surge, but a key milestone has been reclaimed. Is this the calm before a fresh breakout, or a warning to stay cautious? When and how might the altcoin cycle really ignite?

Ready to capitalize on the macro-to-crypto convergence?

📈 Market Review:

Bitcoin's explosive rally to new all-time highs above $123,000 represents a decisive breakout from months of consolidation. What's particularly striking is how this rally has been driven by genuine institutional demand rather than speculative retail fever.

Record spot Bitcoin ETF inflows signal that sophisticated investors are positioning aggressively for the next phase of cryptocurrency adoption.

Bitcoin Hits Fresh Record High on Long Bets (Source: Bloomberg)

The ICE BofA MOVE Index, which tracks bond market volatility, has dropped to 80, marking its lowest level in over three years. This decline from highs of 200 in 2022 and 140 in early 2025 suggests growing investor confidence in the Fed’s rate trajectory and a more stable macro environment.

Treasuries Volatility Sinks to Lowest in More Than Three Years (Source: Bloomberg)

For Bitcoin, now trading above $120,000 and entering fresh all-time highs, this calm backdrop is highly supportive. Lower Treasury volatility often translates to improved liquidity and risk appetite, creating favorable conditions for continued upside in crypto and other risk assets.

Market Expectations of Fed Cut by September Wane (Source: Bloomberg)

Market expectations for aggressive Federal Reserve rate cuts have cooled considerably, with futures now pricing in approximately one rate cut by September rather than the multiple cuts anticipated earlier. This shift reflects a more realistic assessment of the Fed's likely policy path.

Powell’s Chances of Survival (Source: Bloomberg)

Federal Reserve Chair Jerome Powell appears to have weathered the storm of political pressure, with prediction markets now pricing in an 80% probability that he will complete his current term. The dramatic volatility in these betting odds throughout 2025 reflects how intense political pressure surrounding monetary policy decisions has subsided from the peaks seen in April and May.

🔍 Current Market Conditions:

As Bitcoin has entered fresh all-time highs repeatedly over the past days, the CoinGlass Fear and Greed Index has also risen, now sitting at 75 and in the “greed” zone. Notably, last Monday, when BTC was still trading at $107,000, the index was at 72, meaning sentiment has increased only modestly compared to the significant price rise.

Crypto Fear and Greed Index (Source: Coinglass)

For comparison, when Bitcoin first crossed $100,000 in November 2024, the Fear and Greed Index hit the “extreme greed” zone with a reading of 94. This suggests the current market environment is far healthier and that Bitcoin's strength could very well continue.

“Bitcoin” Interest Over Time (Source: Google Trends)

Another metric reinforcing this outlook is Google search interest for Bitcoin. While this metric surged to 100 during the 2021 bull market peak, it currently sits at just 30 and has only recently begun to trend higher, indicating we still have significant room to grow.

Total Bitcoin Spot ETF Net Inflow (Source: Coinglass)

Meanwhile, total net inflows into Bitcoin spot ETFs remain consistently positive, with the last outflow recorded on July 1st. Not only have flows stayed green since then, but they have also surged to record levels over the past two trading days, which together brought in $2.21 billion in inflows, the highest since November 7th of last year.

👀 Key Events Ahead:

This week is packed with critical events for markets, with several high-impact U.S. economic data releases and a flurry of corporate earnings reports that could set the tone for risk assets heading into the second half of July.

On Tuesday, markets will be watching closely as CPI inflation data is released, alongside the New York Fed Manufacturing Index. CPI remains one of the most important indicators for the Federal Reserve’s rate path, and any surprise here, especially a hotter-than-expected print, could move markets significantly. Wednesday brings another round of key data with the release of PPI inflation and U.S. industrial production numbers. While PPI often flies under the radar compared to CPI, it provides deeper insight into upstream pricing pressures that can later filter into consumer inflation. Thursday is perhaps the busiest day of the week, with U.S. retail sales, jobless claims, and the Philadelphia Fed Manufacturing Index all hitting the tape. These data points will help paint a clearer picture of U.S. consumer strength and labor market resilience, both of which are crucial as the Fed looks for signs of either overheating or economic slowdown. The week wraps up on Friday with the University of Michigan's Consumer Sentiment survey and updated inflation expectations, two metrics that offer a glimpse into how households view the economy and where they believe inflation is heading in the months ahead.

In addition to these economic data points, this week also marks the start of Q2 earnings season. Major U.S. banks are beginning to report, with JPMorgan, Wells Fargo, and Citigroup kicking things off. As earnings roll in from various sectors, they’ll provide a more granular look at corporate health, margins, and forward guidance, all of which are likely to feed into broader market sentiment.

⚠️ If you’re reading this, you’re serious about gaining a real crypto edge , but the free tier only scratches the surface:

The real power lies in Full Access, where you get complete market coverage and exclusive insights trusted by top investors.

For better portfolio decisions and smarter trades, upgrade now, your future self will thank you.

Don’t let limited data limit your decisions. ⏳

📊 Technical Analysis:

Following last Monday’s market report, Bitcoin finally reclaimed the crucial $109,300 level and then surged. It first hit the prior all‑time highs, paused briefly, and then rallied straight to a fresh all-time high at $123,171. Price now hovers near $122,500, trying to hold these elevated levels ahead of a week packed with earnings and key economic data.

Bitcoin Price Chart (Source: Tradingview)

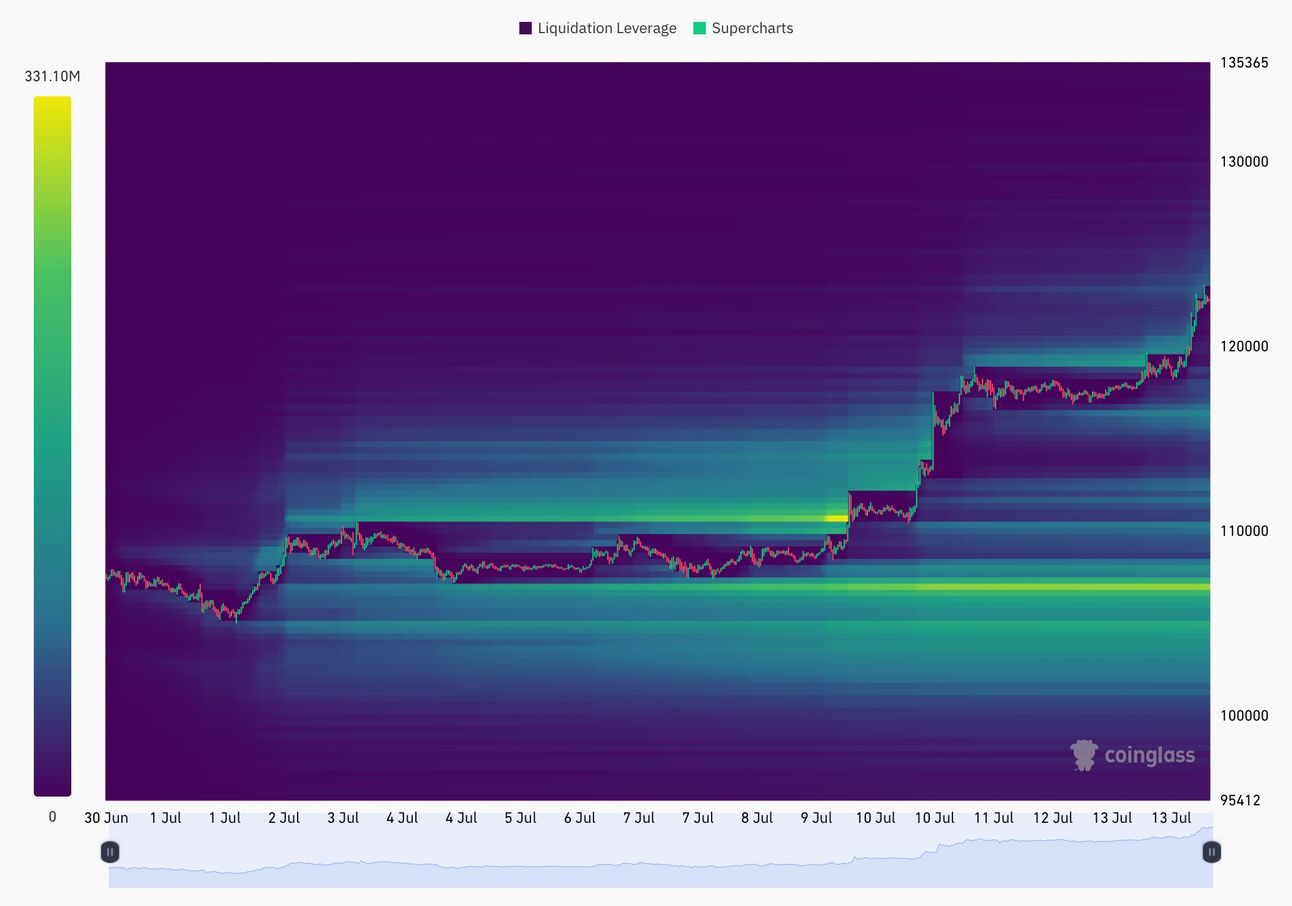

The two‑week Bitcoin liquidation heatmap shows the last major cluster at $110,000 was wiped out on July 8, triggering the rapid rally that followed. With Bitcoin above $120,000, liquidation clusters sit only below the market, the largest being around $106,000. That hints pullbacks are possible, even though price doesn’t have to revisit that level.

Bitcoin Two Week Liquidation Heatmap (Source: Coinglass)

Bullish scenario:

In a bullish case, we’d want to see Bitcoin establish itself at elevated levels and ideally form a range with clear support, allowing for healthy price action and trend continuation to follow. An area to offer support is the short consolidation zone between $118,100 and $116,900, where Bitcoin consolidated before moving higher on Sunday. Long opportunities could arise on a successful bullish retest of that zone, if price confirms it is holding above. Invalidation occurs if price falls below that zone. We remain careful and rather defensive with opening fresh positions here, as we have positioned ourselves well before these spikes, at lower entry prices.

Bearish scenario:

In a bearish case, Bitcoin sees a clear rejection at current levels, failing to hold elevated prices or trend higher. In that case, sharp pullbacks could follow. A trigger for potential short opportunities would be price falling below the support zone at $116,900. This could lead to short opportunities on a successful bearish retest, targeting $111,900 again. Keep risk managed tightly and consider using smaller position size until we have favorable price action that allows for high-quality, high-probability opportunities again.

🚀 Altcoin Insights:

As Bitcoin shoots into fresh highs, altcoins are seeing some demand as well, but notably, there is still a significant lag, as expected. The TOTAL3 chart has just reclaimed the crucial key area at $940B, currently sitting at $960B and approaching the next key area at $1 trillion.

This is a bullish development, as with this recent spike, TOTAL3 was able to put in a fresh higher high, confirming the bullish trend and market structure shift. This makes us think a pullback could form next, ideally resulting in a higher low, validating the bullish trend and allowing those still sidelined to build altcoin positions.

TOTAL3 (Source: Tradingview)

As we remained Bitcoin-heavy and focused only on higher-cap altcoins in the past months, with Bitcoin reaching fresh higher highs, it can now be considered locking in some partial profits and rotating them into altcoins on a pullback, as they are expected to provide higher percentage returns entering the latter stages of the cycle. This applies especially if you are not positioned yet.

Remember, it never hurts to reward yourself whenever the market makes it possible.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

If you want to stay ahead of the curve with in-depth analysis and real-time updates, make sure to subscribe to Full Research Access for even more insights - you won’t want to miss what’s coming next!

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.