Best Price. Every Trade.

Built for active crypto traders. CoW Swap always searches across every major DEX and delivers the best execution price on every swap you make. Smarter routes. Better trades. No wasted value. Find your best price today. So why trade on any one DEX when you can use them all?

Hey there, and happy Friday!

This week’s focus turns to Bitcoin’s sharp pullback to its lowest levels since May, a move that has rattled sentiment.

While BTC corrects from October’s highs, macro conditions are shifting as expectations for a December Fed rate cut decline sharply, tightening short-term liquidity. Equities have also pulled back from recent highs, and with global valuations diverging, investors are reassessing risk as we move deeper into Q4.

Here’s what we’ll cover today:

🌍 Market Recap & Macro Overview: Bitcoin drops to its lowest levels since May as broader markets correct. Fed rate-cut expectations fall from nearly 25 bps to just ~10 bps. S&P 500 pulls back under 6,800, while U.S.–international equity valuations diverge sharply. What this means for global risk assets and crypto positioning.

📈 Bitcoin (BTC) Breakdown: BTC breaks below $98,900 and sweeps down to $95,980, fully closing a long-open CME gap. ETF flows show heavy mid-week outflows with $866M exiting on Thursday alone. Key levels, gaps, and actionable setups covered.

📊 Ethereum (ETH) Outlook: ETH approaches its key $3,059 support again after bouncing earlier in the week. ETF flows remain decisively negative. Heatmap positioning shows liquidation clusters building above $3,672, keeping a potential reversal scenario in play.

🚀 Solana (SOL) Analysis: SOL loses both $160 and $143 support and trades near $140. SOL/BTC prints a new technical extreme, confirming continued underperformance. Heatmap shows major liquidation interest above 170.

Let’s dive in 👇

🌍 Market Recap & Macro Overview:

Bitcoin has retreated to its lowest levels since May, trading around $97,000 after reaching highs near $126,000 in October. While the decline has been sharp, it's important to remember that BTC remains significantly higher than earlier in the year, and corrections of this size are typical within broader bull cycles. For investors who have been underallocated or waiting for more favorable entry points, this pullback may present an opportunity to begin building exposure through dollar-cost averaging or initial allocation, especially given Bitcoin’s historical pattern of recovering strongly from similar drawdowns.

Bitcoin Drops to Lowest Since May (Source: Bloomberg)

Market expectations for a December Federal Reserve rate cut have also shifted, moving from nearly a fully priced 25 bps cut to barely 10 bps anticipated as of Thursday. While this reduction in easing expectations removes some of the near-term macro tailwinds, it also signals that economic conditions remain solid enough for the Fed to adjust policy gradually rather than resorting to emergency measures. In other words, the broader macro backdrop remains stable, even if markets temporarily recalibrate.

Bets on a December Fed Rate Cut Waver (Source: Bloomberg)

The S&P 500 has pulled back below 6,800 after reaching highs above 6,900, raising short-term technical concerns for momentum traders. However, zooming out tells a different story: the index remains far above the April panic lows near 5,000, and pullbacks of this magnitude are normal within a long-term uptrend. Periods like this often improve the risk-reward profile for quality companies with strong fundamentals, making selective accumulation more attractive.

S&P 500 Tumbles Below 6,800 (Source: Bloomberg)

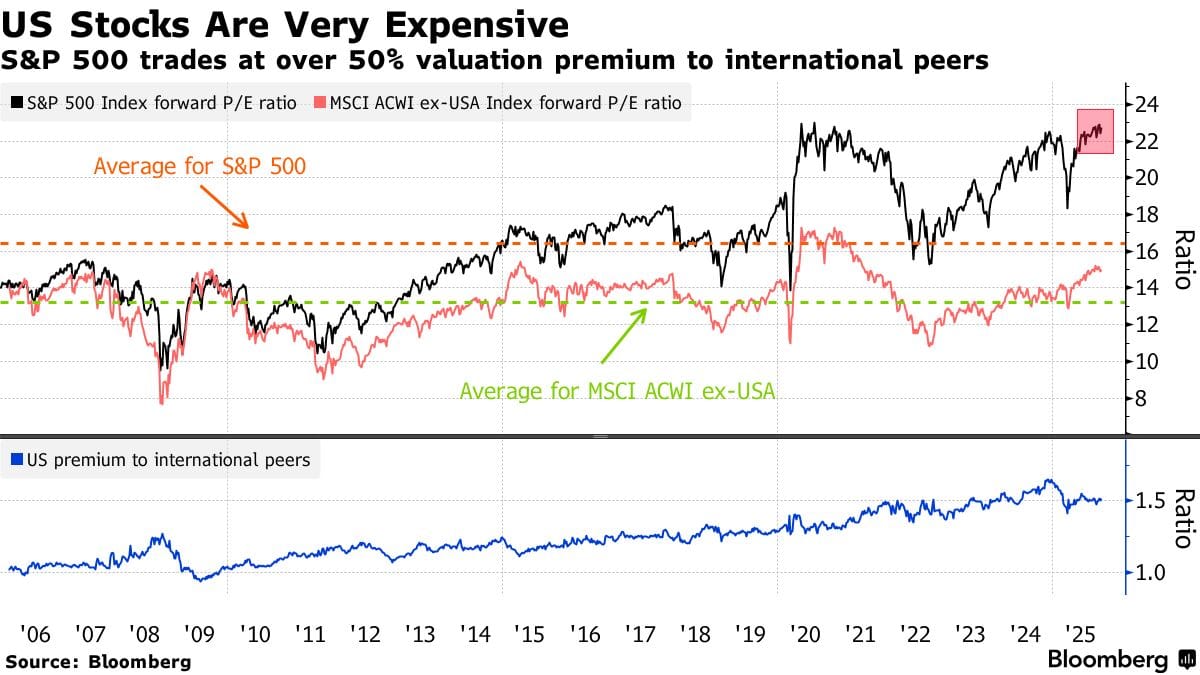

U.S. equities continue to trade at a substantial premium to international markets, with the S&P 500 valued at roughly 23x forward earnings compared to about 15x for the MSCI ex-USA index. This nearly 50% valuation gap highlights the importance of geographic diversification and selective positioning. While U.S. markets have delivered outstanding returns, the current spread suggests that incremental capital may find better risk-adjusted opportunities in international equities or alternative assets, especially for investors already heavily concentrated in U.S. exposure.

US Stocks Are Very Expensive (Source: Bloomberg)

The Bottom Line:

While current market weakness may feel uncomfortable, corrections are a healthy and necessary part of broader market cycles and they often set the stage for strong future performance. For investors considering Bitcoin exposure, this pullback offers a materially more attractive entry than the recent highs. Importantly, the market environment does not resemble a cycle peak: we are still far from the euphoric sentiment that typically marks macro tops. As discussed in our previous frameworks, liquidity was expected to tighten into late October and early November, and our data continues to support the thesis for stronger performance into year-end as these seasonal headwinds begin to ease.

Gain Full Research Access to read the rest.

Become a paying subscriber of Sandman Research to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Institutional-Grade Market Analysis: Deep-dive reports on Bitcoin and Altcoins, delivering expert insights multiple times per week.

- Macro Coverage: Stay informed with global macroeconomic trends and key economic events that impact the crypto market.

- Exclusive Data & Research: Access proprietary insights and in-depth market intelligence used by top traders and institutions.

- Actionable Intelligence: Identify key technical levels, trade setups, and high-probability scenarios before the market reacts.