Stop Drowning In AI Information Overload

Your inbox is flooded with newsletters. Your feed is chaos. Somewhere in that noise are the insights that could transform your work—but who has time to find them?

The Deep View solves this. We read everything, analyze what matters, and deliver only the intelligence you need. No duplicate stories, no filler content, no wasted time. Just the essential AI developments that impact your industry, explained clearly and concisely.

Replace hours of scattered reading with five focused minutes. While others scramble to keep up, you'll stay ahead of developments that matter. 600,000+ professionals at top companies have already made this switch.

Hello and happy Monday!

We’re entering the final month of the year with markets facing a very different tone than just a week ago. After hovering above $90,000 for days, Bitcoin sold off sharply as a sudden spike in Japanese government bond yields triggered a global risk-off move. Liquidity conditions tightened fast, the yen strengthened, and high-beta assets, crypto first among them, reacted immediately. At the same time, global equities have paused after months of strength, while emerging markets are showing early signs of resilience.

Here’s what we’ll cover today:

📈 Market Review: Bitcoin drops nearly $5,000 to start December as a spike in Japanese bond yields triggers a global risk-off move. Equities cool after a seven-month rally, while emerging markets continue to firm.

🔍 Current Market Conditions: Fear & Greed rises slightly but remains in fear at 23. ETF flows stay positive but weak, with no meaningful buying pressure behind the move. Liquidity remains thin.

👀 Key Events Ahead: A data-heavy macro week: ISM Manufacturing, JOLTS, ADP, Services PMIs, Jobless Claims, PCE, and Consumer Sentiment. Liquidity-sensitive markets like BTC could react sharply.

📊 Technical Analysis: BTC rejects 92,000, breaks 88,800, and trades above 84,200. The higher-timeframe structure remains bearish, with both upside and downside scenarios active depending on how price interacts with key levels.

🚀 Altcoin Insights: TOTAL3 breaks below 847B and turns lower. ETH/BTC holds above 0.03255 support. Altcoin structure remains bearish, keeping our allocation focused on BTC and high-cap leaders.

📈 Market Review:

Markets entered December with a distinctly risk-off tone as Bitcoin's sharp selloff underscored a broader shift in investor sentiment. After hovering comfortably above $90,000 at the end of November, BTC plunged nearly 5% to around $85,981 on the first trading day of the month, erasing over $5,000 in value. This move was largely triggered by a sudden spike in Japanese government bond yields that rippled through global markets. Higher Japanese yields imply a more hawkish Bank of Japan, strengthening the yen and tightening global liquidity conditions. As liquidity tightens, high-beta assets such as Bitcoin are typically hit first, explaining why BTC reacted with such speed and intensity.

Bitcoin Falls in Risk-Off Start to December (Source: Bloomberg)

The 2-year JGB yield touched 1.01%, its first move above the 1% mark since 2008 and the culmination of a rapid climb from negative yields just a few years ago. This shift underscores the Bank of Japan’s ongoing retreat from ultra-loose policy as domestic inflation becomes more persistent. A spike in JGB yields effectively signals the end of free money from Japan, a key global liquidity source for decades. Because Japanese investors are among the world’s largest holders of foreign bonds and equities, rising local yields encourage repatriation flows and reduce demand for global risk assets. The result: a liquidity shock that contributed directly to BTC’s selloff and broader risk-off behavior across markets.

2-Year JGB Yield Hits 1% for First Time Since 2008 (Source: Bloomberg)

The global equity rally that powered markets higher for seven consecutive months finally ran out of steam in November, snapping an impressive winning streak. Daily percentage changes in the MSCI All Country World Index flattened into month-end after strong gains earlier in the year, particularly in May and June. This cooling reflects a natural consolidation phase as investors reassess valuations and adjust exposures heading into year-end. While this pause does not imply a broader downturn, it indicates that upward momentum is no longer linear and that markets may become more sensitive to macro catalysts and liquidity developments, such as the shift in Japan.

Global Stocks Halted a 7-Month Winning Run in November (Source: Bloomberg)

Emerging market equities, however, defied the broader malaise with a modest uptick as traders maintained expectations for Federal Reserve rate cuts despite mixed economic signals. The MSCI Emerging Markets Index recovered from November lows at 1,335 to close at 1,368, extending its rebound from autumn drawdowns. Lower U.S. rates would weaken the dollar and reduce global funding stress, both of which typically benefit EM assets. The relative strength in developing markets highlights an ongoing divergence in risk appetite, with investors still seeking opportunities in regions offering better valuations and potentially earlier monetary easing.

EM Stocks Rise as Traders Keep Fed Rate Cut Bets Alive (Source: Bloomberg)

The start of December illustrates a market caught between conflicting forces, Bitcoin reacting sharply to sudden liquidity tightening from Japan, global equities pausing after months of strength, and emerging markets showing resilience. As year-end approaches, expect elevated volatility, sharper cross-asset divergences, and greater sensitivity to central bank policy signals as portfolios are repositioned and global liquidity dynamics evolve.

Consider this our entire pitch:

Morning Brew isn’t your typical business newsletter — mostly because we actually want you to enjoy reading it.

Each morning, we break down the biggest stories in business, tech, and finance with wit, clarity, and just enough personality to make you forget you’re reading the news. Plus, our crosswords and quizzes are a dangerously fun bonus — a little brain boost to go with your morning coffee.

Join over 4 million readers who think staying informed doesn’t have to feel like work.

🔍 Current Market Conditions:

The Crypto Fear & Greed Index has climbed higher from previous readings and is now back in fear territory with a reading of 23, hinting at sentiment potentially calming again. While this is a positive development, price needs to gain strength decisively here to rule out any dead-cat bounce and continuation lower, especially after yesterday’s sell-off.

Crypto Fear and Greed Index (Source: Coinglass)

ETF flows last week were mainly positive, with outflows only on Monday, where $151 million left the ETFs. Notably, the positive inflows in the following days and throughout the rest of the week were minor, unable to meaningfully shift investor confidence or signal significant demand, and they did not push price higher decisively.

Total Bitcoin Spot ETF Net Inflow (Source: Coinglass)

While price could be forming a bottom here on higher timeframes, and the potential for a bullish reversal and overall trend continuation remains, it is important to remain careful and observe the data. If momentum fades, the situation could turn quickly. Hence, this week needs to see ETF flows that are not only positive but actually of significant volume, capable of shifting price action and fueling any bullish movements.

👀 Key Events Ahead:

This week’s U.S. macro calendar is packed with high-impact releases, offering crucial insights into growth, labor market conditions, and inflation heading into the final month of 2025.

The week kicks off with Monday’s November ISM Manufacturing PMI, which will provide insight into the health of the industrial sector and supply chain pressures. A stronger-than-expected reading could boost yields and weigh on risk assets, while a softer print may support easing expectations.

Tuesday brings September JOLTS Job Openings, shedding light on labor demand and potential wage pressures. This data can influence market expectations for Fed policy, with implications for liquidity conditions in crypto and equities.

Wednesday is the most event-heavy day, featuring November ADP Nonfarm Employment, November S&P Global Services PMI, and November ISM Services PMI. ADP offers a preview of broader employment trends, while the two PMI readings provide a real-time pulse on service-sector activity.

Thursday delivers Initial Jobless Claims, providing an early indicator of labor market resilience. Market reactions tend to be quick, particularly if the data deviates from expectations, amplifying short-term volatility in crypto markets.

Friday concludes the week with September PCE Inflation and December MI Consumer Sentiment. PCE remains the Fed’s preferred inflation gauge, with hot prints likely to lift yields and weigh on risk assets, while soft readings support easing narratives. Consumer sentiment will round out the week, offering insight into household confidence and potential spending trends as the year closes.

Overall, the combination of labor, service-sector, and inflation data makes this week pivotal. With year-end positioning underway, even minor deviations could trigger meaningful moves in Bitcoin, Ethereum, and high-beta altcoins.

🚨 Each week, we produce multiple in-depth reports, the Monday Market Report is currently the only free piece of content, and it won’t stay that way. With growing investor demand, it will go private in the future.

Full Research Access gives you complete market coverage, deep-dive analysis, and exclusive insights trusted by top investors, for the best price currently.

Make smarter trades, improve portfolio decisions, and stay ahead of the crowd. Upgrade now, your future self will thank you.

📊 Technical Analysis:

Despite trending higher throughout most of the past week, Bitcoin faced rejection at the 92,000 key technical level after hovering just below it for four days and sold off sharply late Sunday. This decline pushed price back below the 88,800 technical level, and BTC is now trading above 84,200. The broader higher-timeframe structure remains bearish, with consecutive lower highs and lower lows intact until price reclaims 107,400, the previous bearish extreme within the structure. If price continues lower and forms fresh lower lows, turning last week’s push toward 92,000 into just another lower high, BTC could potentially be targeting the 74,400 area.

Bitcoin Price Chart (Source: Tradingview)

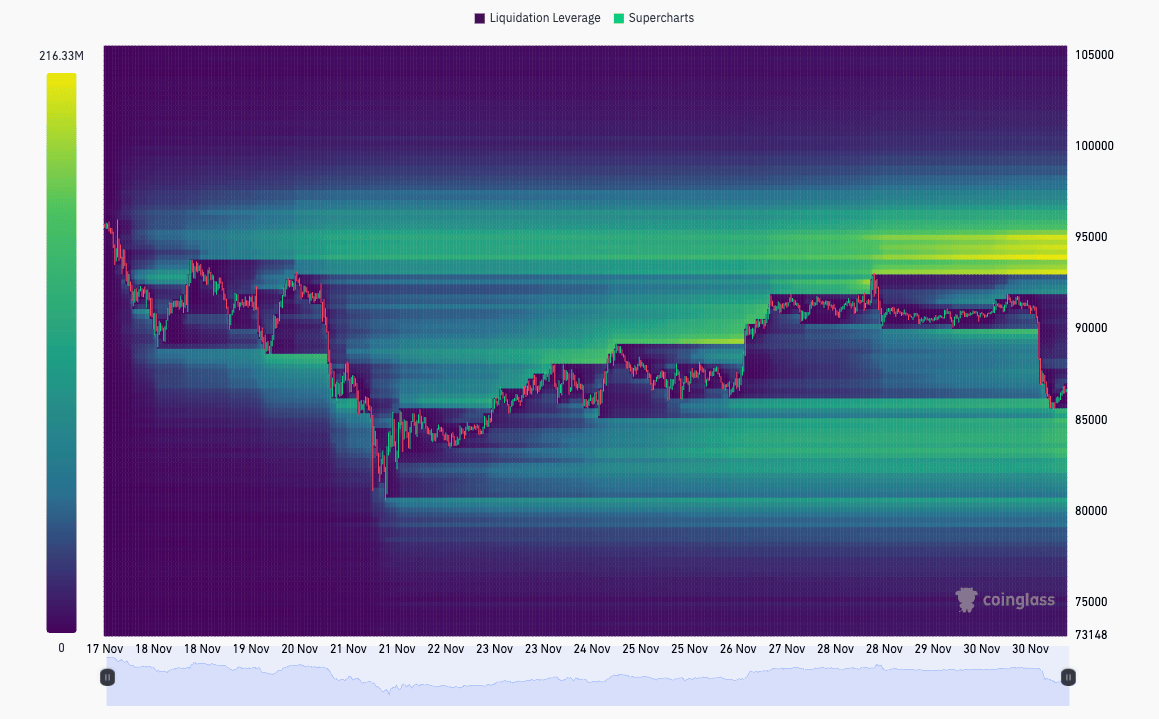

The two-week Bitcoin liquidation heatmap adds further context. It shows heavy liquidity stacking above the 92,000 key level, keeping it an important area to reclaim if bulls regain strength. Notably, leveraged liquidations have also been building on the downside, spread from 85,000 toward 80,000. This suggests that significant volatility remains possible in both directions, hinting at a potentially turbulent week ahead.

Bitcoin Liquidation Heatmap (Source: Coinglass)

Bullish Scenario:

In the bullish case, Bitcoin starts the week with strength and continues pushing higher, reclaiming the 88,800 technical level and reopening the path toward 92,000. Long setups become attractive once 88,800 is convincingly reclaimed, with 92,000 as the primary upside target and invalidation if price falls back below the entry. If Bitcoin first pulls back to retest 84,200, additional long opportunities emerge on a confirmed bullish retest of that zone, with 88,800 acting as the initial target before any higher extension.

Bearish Scenario:

In the bearish case, Bitcoin fails to reclaim 88,800 and gets rejected from that level. Short setups may form on a confirmed bearish retest, targeting 84,200, with invalidation if price reclaims the entry. Should 84,200 break and flip into resistance, further short opportunities open on a bearish retest of that level, targeting 78,300 as the next major downside area.

🚀 Altcoin Insights:

Altcoins sold off as well, with TOTAL3 dropping sharply and losing over 5% within just six hours. Importantly, TOTAL3 also broke below the previously strong support at 847B, and is now hovering just beneath it at 840B. The chart continues to show a clearly bearish market structure, and the probability remains high that TOTAL3 eventually forms a fresh lower low, with the recent extension toward 900B likely representing nothing more than another lower high within the broader trend. In environments like this, it’s crucial to stay objective and trade the market you have, not the one you want.

TOTAL3 (Source: Tradingview)

While Ethereum/Bitcoin (ETH/BTC) headed lower as well, it notably held above its next key technical level. ETH/BTC continues to remain above 0.03255 support, a level that has been tested repeatedly since early November. Although brief deviations below occurred, we have yet to see a clean, decisive break that would confirm renewed Ethereum underperformance relative to Bitcoin.

Ethereum / Bitcoin (Source: Tradingview)

For now, our strategy stays disciplined and unchanged: the core of the portfolio remains built around Bitcoin and the highest-quality altcoins on our Q4 Watchlist. Market conditions simply do not justify taking on unnecessary exposure in weaker assets, BTC and leading large caps already provide enough volatility on their own. We continue to hold a constructive medium-term outlook for crypto and broader risk assets into year-end, but we’re letting the data guide our allocation. That means staying concentrated in strength until the market provides a clear, reliable opening to rotate further down the risk curve. When that shift arrives and the reward-to-risk profile improves meaningfully for mid- and low-caps, we’ll highlight it early and decisively.

We hope this report provided you with valuable insights into the latest market developments and geopolitical shifts.

If you want to stay ahead of the curve with in-depth analysis and real-time updates, make sure to subscribe to Full Research Access for even more insights - you won’t want to miss what’s coming next!

As always, stay informed, stay prepared, and have a fantastic week ahead! 🚀

Stay ahead of the curve with Sandman Research.