Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Hello and happy Friday!

Liquidity conditions are no longer tightening, but they aren’t meaningfully expanding either, leaving risk assets in a transition phase.

Today’s report cuts through the macro noise with 14 charts, delivering a clear, actionable outlook on what actually matters for trading.

The crypto section dives deep into Bitcoin, Ethereum, and Solana, outlining precise long and short setups for each asset to help you navigate the weekend ahead.

Here’s what we’ll cover today:

🌍 Market Recap & Macro Overview: Fed liquidity conditions, rising hawkish signals, and Japan’s influence on global capital flows, framing the macro backdrop that drives risk appetite into the weekend.

📈 Bitcoin (BTC) Breakdown: Key technical levels, ETF flow momentum, liquidation zones, and clearly defined bullish and bearish trading scenarios to position for BTC’s next move.

📊 Ethereum (ETH) Outlook: ETH/USD and ETH/BTC structure, institutional demand via ETF flows, major resistance levels, and scenario-based trade setups as Ether tests higher-timeframe trends.

🚀 Solana (SOL) Analysis: Relative strength signals, reclaim attempts at pivotal levels, SOL/BTC reactions, and liquidation-driven targets defining upside continuation or downside risk.

Let’s dive in 👇

Daily News for Curious Minds

Be the smartest person in the room by reading 1440! Dive into 1440, where 4 million Americans find their daily, fact-based news fix. We navigate through 100+ sources to deliver a comprehensive roundup from every corner of the internet – politics, global events, business, and culture, all in a quick, 5-minute newsletter. It's completely free and devoid of bias or political influence, ensuring you get the facts straight. Subscribe to 1440 today.

🌍 Market Recap & Macro Overview:

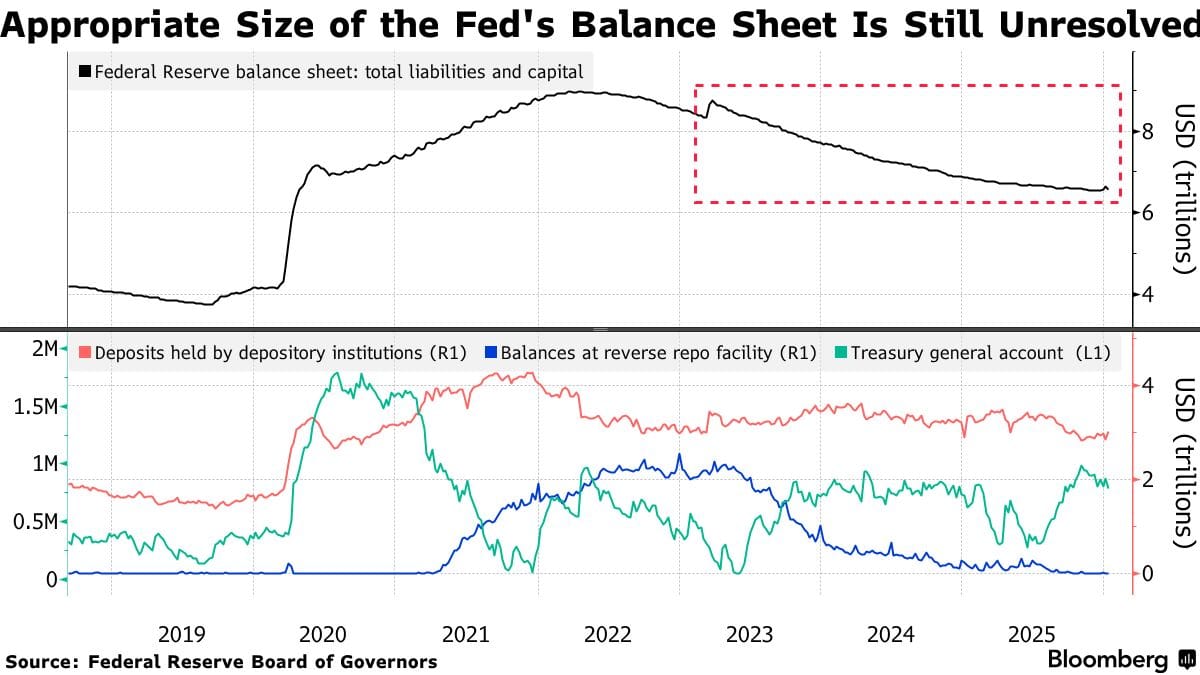

The Fed’s balance sheet has stabilized around $6.6 trillion after shrinking from pandemic peaks above $8 trillion, signaling the end of quantitative tightening, but not yet a return to expansion. This matters for crypto because balance sheet growth is liquidity fuel: when the Fed buys bonds, fresh money enters the system and tends to flow into risk assets, including cryptocurrencies. The shift from active drainage to maintenance removes a key headwind, but crypto bulls still need to see the balance sheet turn higher for true tailwinds to return.

Appropriate Size of the Fed’s Balance Sheet Is Still Unresolved (Source: Bloomberg)

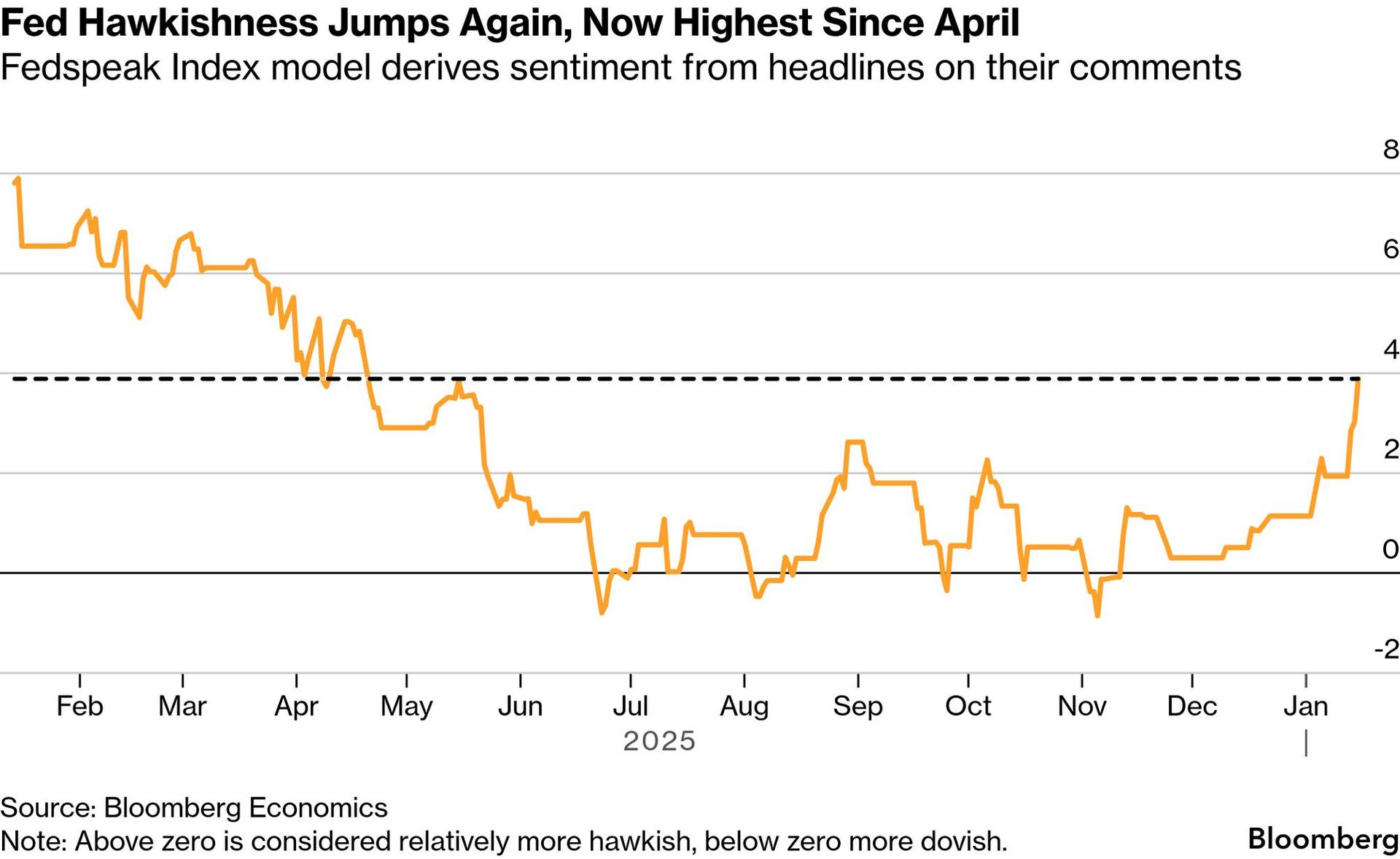

At the same time, Fed hawkishness has jumped to its highest level since April. That creates short-term headwinds for capital flows, supporting the dollar and pressuring assets that benefit from easy money. Bitcoin and altcoins perform best when real rates fall and liquidity expands. Conditions are moving in that direction, but not there yet, which helps explain why crypto has struggled to sustain strength.

Fed Hawkishness Jumps Again (Source: Bloomberg)

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

Japan adds another layer of complexity. A Bloomberg survey shows 48% of economists expect the Bank of Japan to raise rates in July, a scenario we covered closely in recent weeks. BOJ hikes strengthen the yen and unwind carry trades funded in cheap yen. The six-month runway gives markets time to adjust, but any acceleration toward April or surprise hikes could trigger global stress, similar to what we saw in August 2024.

July Is Most Popular Timing for BOJ’s Next Rate Hike (Source: Bloomberg)

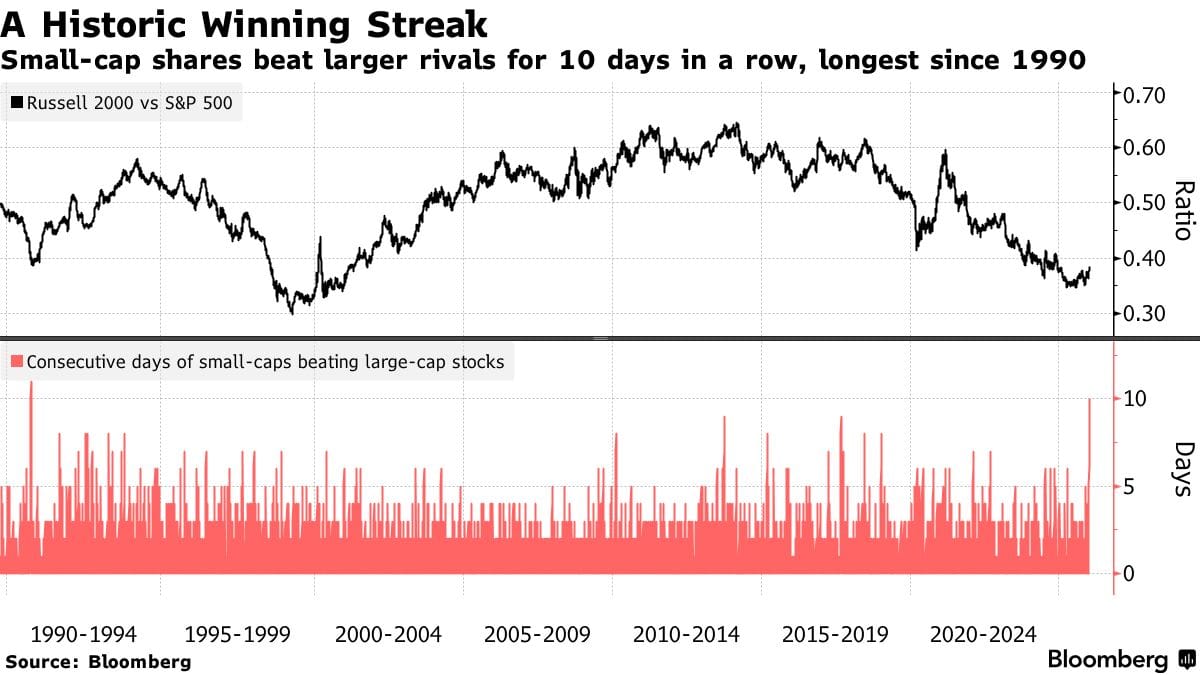

Yet risk appetite is clearly stirring. Small-caps just logged a historic 10-day winning streak versus large-caps, the longest since 2008. Rotations from blue-chip safety into volatile small-caps signal aggressive risk-taking, behavior that often spills over into crypto as investors search for asymmetric upside. This suggests capital could soon look beyond equities toward Bitcoin and digital assets, despite Fed hawkishness and developments in Japan.

A Historic Winning Streak (Source: Bloomberg)

The macro picture is mixed: liquidity has stopped draining but isn’t meaningfully expanding, central banks remain cautious, yet risk appetite is re-emerging.

Navigating this environment as a retail investor requires precise data and structure, which sets the stage for the crypto section, covering Bitcoin, Ethereum, and Solana with key charts, metrics, and actionable long and short setups for each asset for the weekend ahead.

Get the Edge Most Retail Traders Don’t Have

Become a paying subscriber of Sandman Research to get this post and all subscriber-only insights, trade setups, and macro intelligence used by top crypto traders.

Upgrade Now → Get Full AccessA subscription gets you:

- Clear Trade Setups for BTC & Altcoins: Step-by-step guidance with entry, stop, and take-profit levels so you can act confidently during market swings.

- Macro & Market Intelligence: Understand which macro events and liquidity shifts are moving crypto, so you’re never caught off guard by volatility.

- Exclusive ETF & On-Chain Flow Analysis: See capital movements and liquidation clusters before the crowd, giving you an edge in timing entries and exits.

- Altcoin & Sector Insights: Identify early rotation opportunities in high-potential sectors like AI-focused altcoins, without wasting time on dead projects.

- Actionable, Risk-Aware Playbooks: Convert research into actual trades with structured setups, technical breakdowns, and scenario-based strategies.